ES Tuesday 2-28-12

I wanted to make sure the question I had at the end of the this post got posted so (before my aging mind wandered off and forgot to post my question to Bruce), I thought I better just open the thread

In terms of today's market. I will be focussing on 1377 area for signs of selling and ABC sell pattern in the 5 min bars.

I don't follow the Up volume - Down volume anymore, but I noticed yesterday it was mentioned that even price rose, there was more DVOL than UVOL. After an up day, a drift higher in the overnight can often be a search for stops and a prelude to early RTH profit-taking.

Weekly R2 = 1377.50 (RTH Only)

RE my studies of extensions of Monday ranges, the 618 extension up is 1381.75 (if printed RTH increases odds for a print at full extension 1388.50, especially if retracements attract buyers at MOnday's H (1370.75)

I am looking at this simple observation with renewed interest as I hope the analysis Bruce offers about the vwap and the standard deviations of VWAP might deliver clues as to low risk entries LONG if the 618 extension UP is printed but that event sparks an immediate retracement.

XXXXXXXXXXX

Now, Bruce,

thanks for your terrific videos.

I have questions about the IB generated volume profile (Black Background) you displayed in yesterday's video as "overnight."

>>>>what is the length of the bars used (shouldn't really matter, but I am curious)

AND

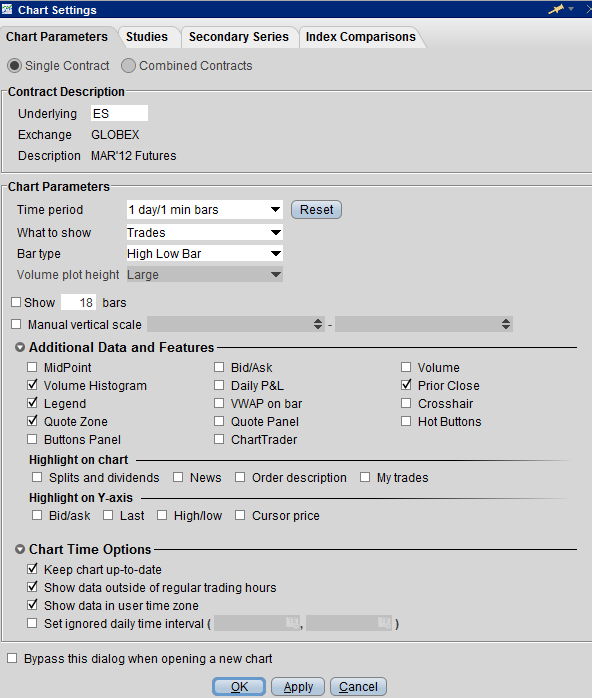

>>>>In the "chart parameters" setting, what time period are you capturing for 'overnight?'

my overnight chart parameters read

time period: "15hrs/5 min bars"

(as of 9:30am ET the volume profile histograms would be displaying a volume profile based on data back to 6:30pm the previous day.

and believe me, my IB volume profile for the overnight looked nothing like yours.

In terms of today's market. I will be focussing on 1377 area for signs of selling and ABC sell pattern in the 5 min bars.

I don't follow the Up volume - Down volume anymore, but I noticed yesterday it was mentioned that even price rose, there was more DVOL than UVOL. After an up day, a drift higher in the overnight can often be a search for stops and a prelude to early RTH profit-taking.

Weekly R2 = 1377.50 (RTH Only)

RE my studies of extensions of Monday ranges, the 618 extension up is 1381.75 (if printed RTH increases odds for a print at full extension 1388.50, especially if retracements attract buyers at MOnday's H (1370.75)

I am looking at this simple observation with renewed interest as I hope the analysis Bruce offers about the vwap and the standard deviations of VWAP might deliver clues as to low risk entries LONG if the 618 extension UP is printed but that event sparks an immediate retracement.

XXXXXXXXXXX

Now, Bruce,

thanks for your terrific videos.

I have questions about the IB generated volume profile (Black Background) you displayed in yesterday's video as "overnight."

>>>>what is the length of the bars used (shouldn't really matter, but I am curious)

AND

>>>>In the "chart parameters" setting, what time period are you capturing for 'overnight?'

my overnight chart parameters read

time period: "15hrs/5 min bars"

(as of 9:30am ET the volume profile histograms would be displaying a volume profile based on data back to 6:30pm the previous day.

and believe me, my IB volume profile for the overnight looked nothing like yours.

buying into 64.50...67 is the magnet still......will get back 2 ya Paul

here is a screen shot of the settings Paul....so I'm only trapping the Sunday night open until the day session begins but once the day session starts then this one day setting combines the overnight and day session into one profile

70 is /was the secondary target and will look for shorts now up here.....using 67.50 as target below...sorry posts are late today...low volumne O/N and yesterdays RTH highs up here..weekly R1 too

Thanks for posting the parameters.

Makes a huge difference.

HUGE

Makes a huge difference.

HUGE

still using the 67 area as a magnet price..so looking for sells again up near 70 - 71..

failures up here will have them push up into 74 - 75 where I will look for new shorts again...

hour range is complete..pauls .618 mathces up with R2 today !

failures up here will have them push up into 74 - 75 where I will look for new shorts again...

hour range is complete..pauls .618 mathces up with R2 today !

abandoning shorts up here now...would need to see new highs

oh man, I am just slightly behind on my posts today...

short on the 71.25....what will it take to break away from the 67.50 volume?

short on the 71.25....what will it take to break away from the 67.50 volume?

great work bruce, question abt your last trade, wasn't it higher risk because volume had started building in the 70 area (peak volume right now) ? granted that combining yesterday and today's profiles 67.5 is still the guy to beat, so i see the logic of repeating that sell back to 67.5....just wanted to know if u did perceive it as a higher risk one

absolutely higher risk especially since we were breaking out of the hour highs too....

you will find though that the trades that really run away from you will be outside of both yesterdays RTH range AND the OVERNIGHT...so it was ok to take with smaller size IMHO

so we haven't resolved the overnight which helps our fades up here

you will find though that the trades that really run away from you will be outside of both yesterdays RTH range AND the OVERNIGHT...so it was ok to take with smaller size IMHO

so we haven't resolved the overnight which helps our fades up here

the tricky thing about peak volume prices is that it isn't always implying that price is being accepted higher ( or lower) ...sometimes it is smart money getting short in this example possibly....

I like peak volume as targets or when we try to break away from it and fail

In this case today it just shows us that a battle is brewing at yesterdays RTH highs, VA high, weekly r1 etc....

I like peak volume as targets or when we try to break away from it and fail

In this case today it just shows us that a battle is brewing at yesterdays RTH highs, VA high, weekly r1 etc....

if we just look at my chart posted you can see which area had more volume.....so in theory which area should be a stronger attractor? The one that has the most volume as more players thought that was fair value

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.