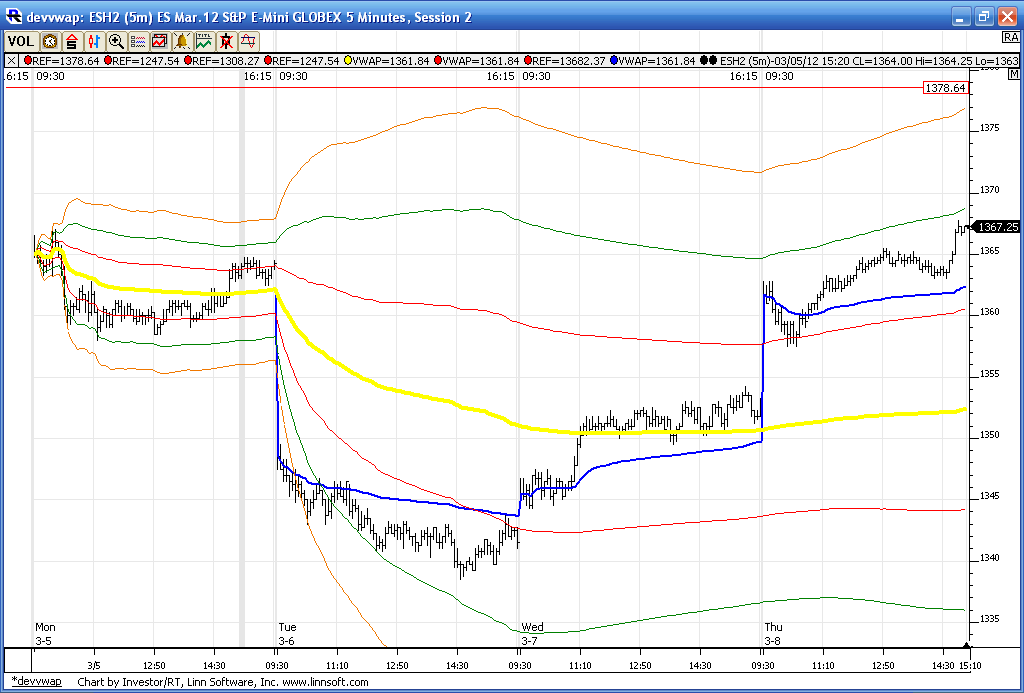

ES Thursday 3-8-12

here is how my low volume numbers look on the down side. Above these I would be using 72 and 77 . Not shown. most interesting area is the BAND of low volume at 53.50 - 57.50.

We have a weekly open and weekly pivot at 1366. We have a daily r1 level at 56. Virgin VWAP at 69.25, 62.25, 50 and 44 ! Using March at least until noon

Once we get the 8:30 reports out of the way we can dial it down and as RTH opens we will have the completed O/N range to verify our numbers.

We have a weekly open and weekly pivot at 1366. We have a daily r1 level at 56. Virgin VWAP at 69.25, 62.25, 50 and 44 ! Using March at least until noon

Once we get the 8:30 reports out of the way we can dial it down and as RTH opens we will have the completed O/N range to verify our numbers.

I don't think anyone should give anybody grief as long as explanation come at some point in time. We all want to be grateful for any postings made by our forum members as long as they help us become better traders. Nuff said

Price should keep advancing from here as traders are again shorting/selling into this and price is holding- if this don't go down, price will advance.

here is the developing weekly vwap. I will admit that I am a bit challenged by longer term use of the vwap bands. Their greatest utility to me is using the previous days bands and the developing on the day session as it unfolds.

But.......my thinking is that if I like to watch the previous week and the developing weeks volume profile then I should at least watch the same on the vwap bands

But.......my thinking is that if I like to watch the previous week and the developing weeks volume profile then I should at least watch the same on the vwap bands

Although that short from 65 did generate 2pts down to IB, the better trade was to the long side given the way traders were "positioned" heavily to the short side. I assume shorting but it could just be selling.. When their positions arrives at a level like IB/HV, that's when decisions are made.. It was dangerous for the shorts there because it was short heavy at a level..

Looking back, I can't help but notice that to get 4-5 pts on ES is often hard work and requires patience.. which is equivalent to a 20-25 ticks in CL which is often nothing, but it cuts both ways..

shorting into 68.50 and small...71.25 will most likely have me bail

I don't have any levels till 70-75 so that's where I will assume its going.. If I was in this trade, I would take partial profits at 70 and let some aim for 75.. the stop loss would be moved to the swing low @ 66.25

target is 66 air pocket and we know this is late for fades so I consider this aggressive but the high volume price of last week and this months volume profile is 68.50....not my favorite place to do business but often it at least slows price...will see how much steam this train has now !!

jedi, but the problem with Cl is that it is very choppy and moves in every direction.

Originally posted by vasuki

jedi, but the problem with Cl is that it is very choppy and moves in every direction.

CL is almost always choppy but like anything else, its how you read it.. today, most of my profits came from 20 tick scalps - other days, I try to hold for more.. That's a whole different topic but the concepts are ALMOST exactly the same.. With CL, I rely less on vol and more on ATR as guideposts...

Thanks Jedi.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.