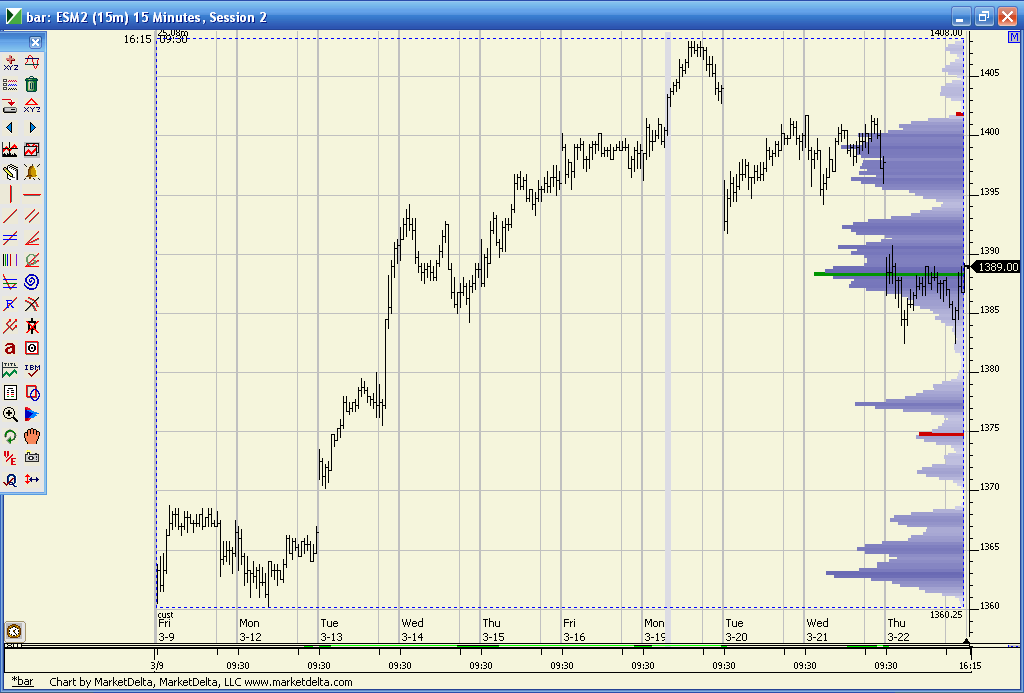

ES Friday 3-23-12

old school price chart read

right now, as the ES sort of retraces, if it fails to get to the LOD and exceeds 84.50 (1 tick above recent swing H) intraday bears will be trapped, ould produce a run to 86.00 (86.25 is the open of the bar that broke price down at 10:05am

right now, as the ES sort of retraces, if it fails to get to the LOD and exceeds 84.50 (1 tick above recent swing H) intraday bears will be trapped, ould produce a run to 86.00 (86.25 is the open of the bar that broke price down at 10:05am

yes I did and it was also pushing out the second air pocket into that low volume zone..but yes the footprints give me some needed hand holding sometimes on these fades. They aren't perfect though

Originally posted by Sangeo

Hey Bruce what was your "better signal" at 80.75's? Did you see something in the footprints?

Thanks!

I'll be surprised if they don't give me that 04.50..midrange is there now too..

just went flat on all but one contract at 04.75. trying to hold this for 1390 ! Stop is at 1380 even and not initiating any new trades anymore today

for this trade to work I really need to see price start to hold or at least consolidate above that VA low and O/N low. Internals are even steven so this has no real edge except the bounce off that longer term LV zone

old school chart read

for confidence in long positions to stay in place, 1384.75 has to act like support if tested.

1384.75 was the Low of the 5 minute bar that completed at 10:50am, so that proved to the point in the price retracement where bulls were willing to take longs to squeeze their bearish brethren.

1384.75 is also the 50% of today's RTH Range, so if that acts like support, next natural expectation would be an attempt to test the HOD (RTH, 1389.00).

for confidence in long positions to stay in place, 1384.75 has to act like support if tested.

1384.75 was the Low of the 5 minute bar that completed at 10:50am, so that proved to the point in the price retracement where bulls were willing to take longs to squeeze their bearish brethren.

1384.75 is also the 50% of today's RTH Range, so if that acts like support, next natural expectation would be an attempt to test the HOD (RTH, 1389.00).

Thanks for the encouragement and recommendations Bruce. I think a lot of us are still around - we just aren't regular posters for whatever reason, but always follow along to learn and glean insight and support each other.

Who'd a thunk 1389.00 could print? Unreal.

Have a great weekend, this old school chartist is starting his weekend right now.

Have a great weekend, this old school chartist is starting his weekend right now.

I have a short@1390 aiming for VWAP@1386 - will add@91/92/93(gap close) and stop out behind 4.50.. Going into lunch, will have to sit..

Edge of bell curve, yesterday's H

Edge of bell curve, yesterday's H

just went flat at 90.25. biggest trade in 4 years too in terms of getting a price swing..not boasting just pointing out that there are still opportunities in these markets. hope all have a great weekend

Originally posted by BruceM

just went flat at 90.25. biggest trade in 4 years too in terms of getting a price swing..not boasting just pointing out that there are still opportunities in these markets. hope all have a great weekend

Congrats Bruce on that trade!

You're right, there are still a lot of opportunities in ES and the volatility will likely pick up in the future.

I missed the buy at 1380.50 which did fit my set ups and here are some reasons:

- An identified level at 1380.50

- Price expanded to 3-4 pts outside of 20min OR/Outer extremity of ATR

- VOLD was not consistent to the downside. If it was, I may have still taken it but would have exited at a closer level like lower OR/VWAP and etc.. In this particular trade, had I taken it, I would have looked to exit at HV@87ish, which was your set from LV to HV..

Question: What made you aim for the other side of the bell curve?

thx

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.