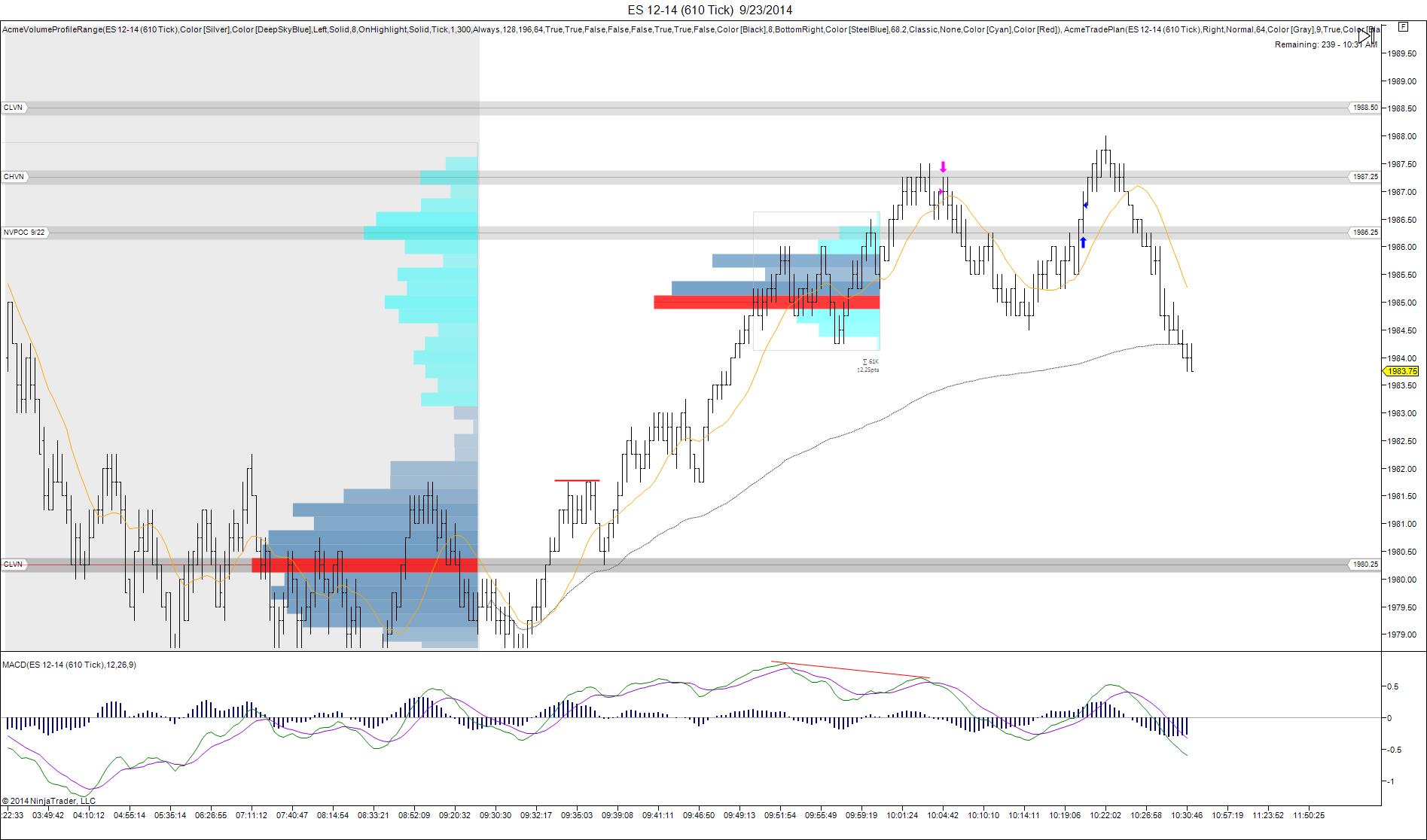

ES Tuesday 9-23-14

i won't be trading on Tuesday morning but here are the numbers as I see them...Good luck and hope it is a profitable session ! Today formed the "b" pattern which can sometimes mean that this was just longs liquidating and not true selling. Dalton sometimes looks at this as more patient buyers entering the market and it doesn't mean we go back up right away....with the all time high being an overnight high it seems to imply that maybe the longs will still be able to make all time highs in the day session

I have the monthly SPX range coming in at 66 points as a full projection ..so I take 80% of that range as a minimum...so we need to still see 52 points of range on spx for this month

I have the monthly SPX range coming in at 66 points as a full projection ..so I take 80% of that range as a minimum...so we need to still see 52 points of range on spx for this month

awesome thanks Bruce

thanks Bruce

Really great assessment Bruce..

Question:

Since the O/N was another "b" shaped curve with the volume around 79.25 to 81.25, should we have bought when the market tried going low and then was rejected back into the bell of the O/N? So the market touched 78.25 and so should we have been buyers around 79.5 to get the bell filled again?

Also there was another low volume area between 83.5 to 81.25 therefore we would have expected that to get filled as well?

Since the O/N was another "b" shaped curve with the volume around 79.25 to 81.25, should we have bought when the market tried going low and then was rejected back into the bell of the O/N? So the market touched 78.25 and so should we have been buyers around 79.5 to get the bell filled again?

Also there was another low volume area between 83.5 to 81.25 therefore we would have expected that to get filled as well?

so far the run up has been to almost the POC from yesterday so I am guessing we should have been looking for Longs after the rejection of the move to the downside?

Trying a short up here @ 1987.25 area High Volume node on a longer term Volume Profile chart

Fill @ 87.00.

Out on a retrace should have taken profit @ 85.00..

Sharks,

what was there at 85 that you say now you should have taken profits there?

what was there at 85 that you say now you should have taken profits there?

Not sure there is to much left, already a 10 point range almost.

Gonna go hit some golf balls, I need the practice.

Gonna go hit some golf balls, I need the practice.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.