ES Friday 11-14-14

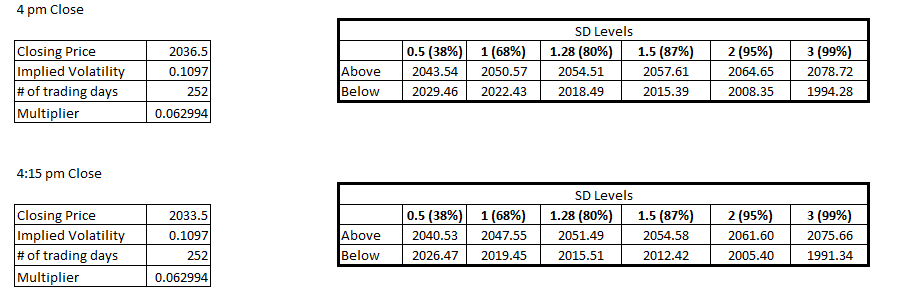

YD we hit both the upper and lower 1/2 bands using both the 4pm and 4:15pm close. As a matter of fact, the high and low of the day were ~1 point away from the bands.

Today we have the 4pm and 4:15pm bands 3 points apart so I will be focusing more on the 4pm bands just because they are tighter.

Today we have the 4pm and 4:15pm bands 3 points apart so I will be focusing more on the 4pm bands just because they are tighter.

coming out at 37.25,,,holding one contract as I kept everything smaller today....watching opening range high closely...this will be only RTh trade for me today

notice how we opened in Value and blew right through VA high from YD....all those that are taught to sell at VA high when we open inside value get stopped out 2points ( a common stop point I assume for smaller traders) ...so they buy back up there at the 39 area but only to cover failed shorts and that so far is telling us that it isn't new buyers up there...at least not yet......now many will want to see a IB close back under the va high from YD...that's what I would like to see for my one measly runner but I am impatient...

Bruce, since you fade so much as part of your trading, I had a question for you.

How do you (emotionally/mentally) manage to convince yourself that entering the trade is the right thing to do?

For example, today in RTH you took a short at 39.75. How did you do that? I find myself second guessing because so far I have only seen all the momentum and feel like I am stepping in front of a freight train and then back off.

This is something that I am really missing and I think is the most critical aspect. Any insight would be much appreciated. TIA

How do you (emotionally/mentally) manage to convince yourself that entering the trade is the right thing to do?

For example, today in RTH you took a short at 39.75. How did you do that? I find myself second guessing because so far I have only seen all the momentum and feel like I am stepping in front of a freight train and then back off.

This is something that I am really missing and I think is the most critical aspect. Any insight would be much appreciated. TIA

Are you talking time or volume VA? The volume VA was at 39.25 and the time was at 37.5.

Originally posted by BruceM

notice how we opened in Value and blew right through VA high from YD....all those that are taught to sell at VA high when we open inside value get stopped out 2points ( a common stop point I assume for smaller traders) ...so they buy back up there at the 39 area but only to cover failed shorts and that so far is telling us that it isn't new buyers up there...at least not yet......now many will want to see a IB close back under the va high from YD...that's what I would like to see for my one measly runner but I am impatient...

done at 34.75...perhaps they will run to the otherside of value but we are back into that big weekly bell and I have no clue from here.....I sell above value or buy below expecting price to make an attempt to get back into value....which we have done......hope all have a great weekend.....

I'm not a hunter but respect those who do hunt....been up here in VT for 7 years and this morning was the first time I have ever seen a buck ........they are always so elusive.....so tomorrow starts hunting season.........a shame that I probably won't see that one again............I want to tell him to "RUN" and keep going...make it a challenge for those dedicated enough to be out in the freezing cold tomorrow...........it was a real beauty...luckily most hunters I talk to up here have a deep respect for the animals, follow the rules and eat what they kill............

I'm not a hunter but respect those who do hunt....been up here in VT for 7 years and this morning was the first time I have ever seen a buck ........they are always so elusive.....so tomorrow starts hunting season.........a shame that I probably won't see that one again............I want to tell him to "RUN" and keep going...make it a challenge for those dedicated enough to be out in the freezing cold tomorrow...........it was a real beauty...luckily most hunters I talk to up here have a deep respect for the animals, follow the rules and eat what they kill............

most times I am talking about time va's as my IB data doesn't paint volume VA's as well as other data feeds...but look at sharks chart and that nice center bell of volume...many will have stops 2 points outside of VA highs and lows as per time.....at least that is what I believe

Originally posted by NewKid

Are you talking time or volume VA? The volume VA was at 39.25 and the time was at 37.5.

Originally posted by BruceM

notice how we opened in Value and blew right through VA high from YD....all those that are taught to sell at VA high when we open inside value get stopped out 2points ( a common stop point I assume for smaller traders) ...so they buy back up there at the 39 area but only to cover failed shorts and that so far is telling us that it isn't new buyers up there...at least not yet......now many will want to see a IB close back under the va high from YD...that's what I would like to see for my one measly runner but I am impatient...

Bumping up in case you missed my question earlier.

Bruce, since you fade so much as part of your trading, I had a question for you.

How do you (emotionally/mentally) manage to convince yourself that entering the trade is the right thing to do?

For example, today in RTH you took a short at 39.75. How did you do that? I find myself second guessing because so far I have only seen all the momentum and feel like I am stepping in front of a freight train and then back off.

This is something that I am really missing and I think is the most critical aspect. Any insight would be much appreciated. TIA

Bruce, since you fade so much as part of your trading, I had a question for you.

How do you (emotionally/mentally) manage to convince yourself that entering the trade is the right thing to do?

For example, today in RTH you took a short at 39.75. How did you do that? I find myself second guessing because so far I have only seen all the momentum and feel like I am stepping in front of a freight train and then back off.

This is something that I am really missing and I think is the most critical aspect. Any insight would be much appreciated. TIA

Originally posted by BruceM

done at 34.75...perhaps they will run to the otherside of value but we are back into that big weekly bell and I have no clue from here.....I sell above value or buy below expecting price to make an attempt to get back into value....which we have done......hope all have a great weekend.....

I'm not a hunter but respect those who do hunt....been up here in VT for 7 years and this morning was the first time I have ever seen a buck ........they are always so elusive.....so tomorrow starts hunting season.........a shame that I probably won't see that one again............I want to tell him to "RUN" and keep going...make it a challenge for those dedicated enough to be out in the freezing cold tomorrow...........it was a real beauty...luckily most hunters I talk to up here have a deep respect for the animals, follow the rules and eat what they kill............

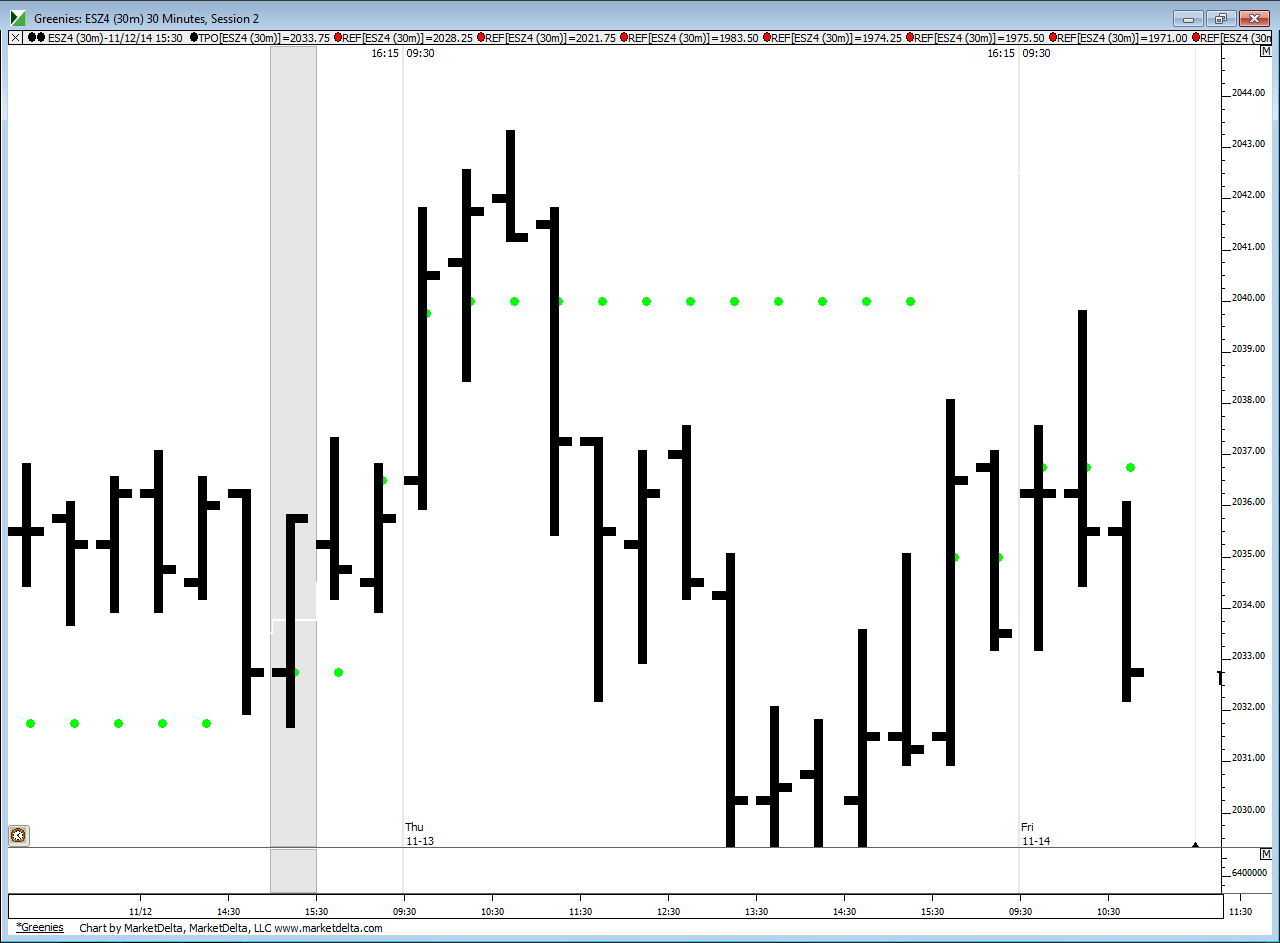

I have zones predefined as u know....look at my Greenies chart and sharks chart...note the bulk in volume on his chart at the 39 - 40 area..now I work off of probabilities and the structure of the market........we had single prints ( as I took the short there where single prints left behind from the 30 minute breakout) but they got filled in.....I think a lot is experience and also knowing that over a large sample of trades and watching the first 90 minutes each day that they do not trend this ES market much in that time frame........the biggest part is to be a good loser on the rare trend days that start from the open print and say " oh, they got me today but I will be back tomorrow or I may try after the 90 minutes are up to get some money back"..........

\

as I ramble further....If they trend in the first 90 minutes then I sometimes look for the inverse to happen after 90 minutes is up ....it's the old trend idea that trend leads to consolidation and consolidation goes to trend......so as a fader I always think that there may be higher odds to trend after the first 90 minutes especially if we had back and forth trade within that first 90 minutes....is that clear ??? Consolidation leads to trend which leads back to consolidation....but the basic premise is that for me the first 90 minutes they like to go test ranges, va's and volume area....they like to take a peak nearby.....

I also believe strongly in the bell curves and hopefully there is a thread somewhere on that.......the bell is the consolidation and the LVns are the transition points that separate different bell curves.....so if we are moving up then I will take a trade at or near an LVN ...the 37.50 for today and also the center of the upper bell...that 39 - 40 area.....I also know that when they just blow through bells and don't stop at all and get right to the other side then they like to come back to retest the center.....so that gives me a chance to make up for a loss on a wrong trade....if we blew right though the 39- 40 and went up into the 42 - 43 then I would expect them to TRY at least for the 39 - 40 retest to see if that would hold as support.....

so I guess I never really know what will happen...who does ? but I have strong references based on past trading days, 17 years ( next year) of ES screen time...YIKES) and I believe in the bell curves....I also try to look at the bigger picture and that is that this is only one day of hundreds or thousands for me......and while it still hurts the ego ( especially when you post to a forum and get it wrong...LOL) it's really just one day....nothing more....so I look at the bigger sample of trades...

a suggestion might be to wait until you see an area and then let it drop back by 1.25 or 1.5 points...then enter......and try multiple times like that off of a potential swing high or low that LINES up with a pre- defined zone........sometimes your entry will be close to a target...in that case use 1 - 1.25 points of a swing high or low and be prepared to take 3- 4 tries in your zone......sure wish I could be more helpful with the mental side of this game.........u need to have faith in your abilities , be satisfed and not be afriad to try more than once in a zone......

there are times when I need to try more than once but I cannot due to time type in every try I take at a zone...so I don't always get it right the first time so sorry if it may look like I do....I usually will take three tries in a zone......if I get it wrong three times then I need to regroup......statistically I don't get it right the first time enough...it seems the second time is my best entry ...in the old days I kept wider stops but getting smacked around has evolved me into taking a few tries with smaller stops....there is something liberating with being out of the market and trying again...

here is greenies...note where green dots are from YD

.

\

as I ramble further....If they trend in the first 90 minutes then I sometimes look for the inverse to happen after 90 minutes is up ....it's the old trend idea that trend leads to consolidation and consolidation goes to trend......so as a fader I always think that there may be higher odds to trend after the first 90 minutes especially if we had back and forth trade within that first 90 minutes....is that clear ??? Consolidation leads to trend which leads back to consolidation....but the basic premise is that for me the first 90 minutes they like to go test ranges, va's and volume area....they like to take a peak nearby.....

I also believe strongly in the bell curves and hopefully there is a thread somewhere on that.......the bell is the consolidation and the LVns are the transition points that separate different bell curves.....so if we are moving up then I will take a trade at or near an LVN ...the 37.50 for today and also the center of the upper bell...that 39 - 40 area.....I also know that when they just blow through bells and don't stop at all and get right to the other side then they like to come back to retest the center.....so that gives me a chance to make up for a loss on a wrong trade....if we blew right though the 39- 40 and went up into the 42 - 43 then I would expect them to TRY at least for the 39 - 40 retest to see if that would hold as support.....

so I guess I never really know what will happen...who does ? but I have strong references based on past trading days, 17 years ( next year) of ES screen time...YIKES) and I believe in the bell curves....I also try to look at the bigger picture and that is that this is only one day of hundreds or thousands for me......and while it still hurts the ego ( especially when you post to a forum and get it wrong...LOL) it's really just one day....nothing more....so I look at the bigger sample of trades...

a suggestion might be to wait until you see an area and then let it drop back by 1.25 or 1.5 points...then enter......and try multiple times like that off of a potential swing high or low that LINES up with a pre- defined zone........sometimes your entry will be close to a target...in that case use 1 - 1.25 points of a swing high or low and be prepared to take 3- 4 tries in your zone......sure wish I could be more helpful with the mental side of this game.........u need to have faith in your abilities , be satisfed and not be afriad to try more than once in a zone......

there are times when I need to try more than once but I cannot due to time type in every try I take at a zone...so I don't always get it right the first time so sorry if it may look like I do....I usually will take three tries in a zone......if I get it wrong three times then I need to regroup......statistically I don't get it right the first time enough...it seems the second time is my best entry ...in the old days I kept wider stops but getting smacked around has evolved me into taking a few tries with smaller stops....there is something liberating with being out of the market and trying again...

here is greenies...note where green dots are from YD

.

Originally posted by NewKid

Bruce, since you fade so much as part of your trading, I had a question for you.

How do you (emotionally/mentally) manage to convince yourself that entering the trade is the right thing to do?

For example, today in RTH you took a short at 39.75. How did you do that? I find myself second guessing because so far I have only seen all the momentum and feel like I am stepping in front of a freight train and then back off.

This is something that I am really missing and I think is the most critical aspect. Any insight would be much appreciated. TIA

I get the entry points and all that. I have almost the same zones marked on my chart as you do. I think the most telling thing was this quote from you

".u need to have faith in your abilities , be satisfed and not be afriad to try more than once in a zone......"

I guess that is what I am lacking and I am hoping that I get that with more time and experience. Thanks again for the answer.

".u need to have faith in your abilities , be satisfed and not be afriad to try more than once in a zone......"

I guess that is what I am lacking and I am hoping that I get that with more time and experience. Thanks again for the answer.

Originally posted by BruceM

I have zones predefined as u know....look at my Greenies chart and sharks chart...note the bulk in volume on his chart at the 39 - 40 area..now I work off of probabilities and the structure of the market........we had single prints ( as I took the short there where single prints left behind from the 30 minute breakout) but they got filled in.....I think a lot is experience and also knowing that over a large sample of trades and watching the first 90 minutes each day that they do not trend this ES market much in that time frame........the biggest part is to be a good loser on the rare trend days that start from the open print and say " oh, they got me today but I will be back tomorrow or I may try after the 90 minutes are up to get some money back"..........

\

as I ramble further....If they trend in the first 90 minutes then I sometimes look for the inverse to happen after 90 minutes is up ....it's the old trend idea that trend leads to consolidation and consolidation goes to trend......so as a fader I always think that there may be higher odds to trend after the first 90 minutes especially if we had back and forth trade within that first 90 minutes....is that clear ??? Consolidation leads to trend which leads back to consolidation....but the basic premise is that for me the first 90 minutes they like to go test ranges, va's and volume area....they like to take a peak nearby.....

I also believe strongly in the bell curves and hopefully there is a thread somewhere on that.......the bell is the consolidation and the LVns are the transition points that separate different bell curves.....so if we are moving up then I will take a trade at or near an LVN ...the 37.50 for today and also the center of the upper bell...that 39 - 40 area.....I also know that when they just blow through bells and don't stop at all and get right to the other side then they like to come back to retest the center.....so that gives me a chance to make up for a loss on a wrong trade....if we blew right though the 39- 40 and went up into the 42 - 43 then I would expect them to TRY at least for the 39 - 40 retest to see if that would hold as support.....

so I guess I never really know what will happen...who does ? but I have strong references based on past trading days, 17 years ( next year) of ES screen time...YIKES) and I believe in the bell curves....I also try to look at the bigger picture and that is that this is only one day of hundreds or thousands for me......and while it still hurts the ego ( especially when you post to a forum and get it wrong...LOL) it's really just one day....nothing more....so I look at the bigger sample of trades...

a suggestion might be to wait until you see an area and then let it drop back by 1.25 or 1.5 points...then enter......and try multiple times like that off of a potential swing high or low that LINES up with a pre- defined zone........sometimes your entry will be close to a target...in that case use 1 - 1.25 points of a swing high or low and be prepared to take 3- 4 tries in your zone......sure wish I could be more helpful with the mental side of this game.........u need to have faith in your abilities , be satisfed and not be afriad to try more than once in a zone......

there are times when I need to try more than once but I cannot due to time type in every try I take at a zone...so I don't always get it right the first time so sorry if it may look like I do....I usually will take three tries in a zone......if I get it wrong three times then I need to regroup......statistically I don't get it right the first time enough...it seems the second time is my best entry ...in the old days I kept wider stops but getting smacked around has evolved me into taking a few tries with smaller stops....there is something liberating with being out of the market and trying again...

here is greenies...note where green dots are from YD

.Originally posted by NewKid

Bruce, since you fade so much as part of your trading, I had a question for you.

How do you (emotionally/mentally) manage to convince yourself that entering the trade is the right thing to do?

For example, today in RTH you took a short at 39.75. How did you do that? I find myself second guessing because so far I have only seen all the momentum and feel like I am stepping in front of a freight train and then back off.

This is something that I am really missing and I think is the most critical aspect. Any insight would be much appreciated. TIA

a quick video and thanks for the kind words said here today....I appreciate the feedback....

Bruce i know u were asking abt what was going on with 32 that stopped the market many times...i had (and still have) the developing weekly midpoint at 32.5 (24hrd chart)...i usually look at both rth and 24hr when looking at weekly stats since many times we make a siginificant low or high in a week during o/n that skews things a bit wrt to the rth chart..here the link tot he chart fwiw

http://www.charthub.com/charts/2014/11/14/es_main_15m_141114121732

http://www.charthub.com/charts/2014/11/14/es_main_15m_141114121732

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.