ES Wednesday 2-11-2015

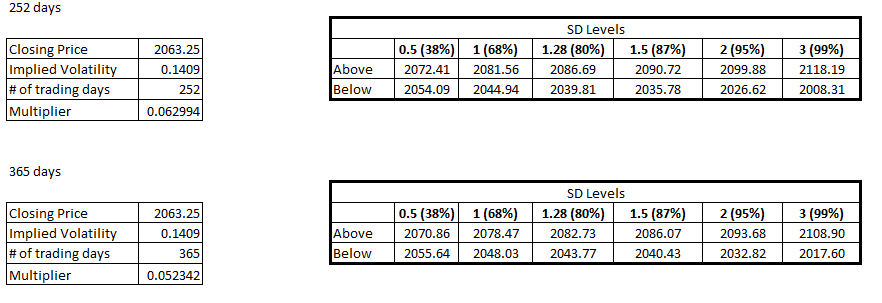

Bands for the day. We also have the weekly 0.5 band at 2071.25 to go with the daily 0.5 band at 2070.75 so we have confluence there. Good luck to all.

here we go..trying to find a short trade...want minimal reaction up to sell into or trade below a low bar swing failure here

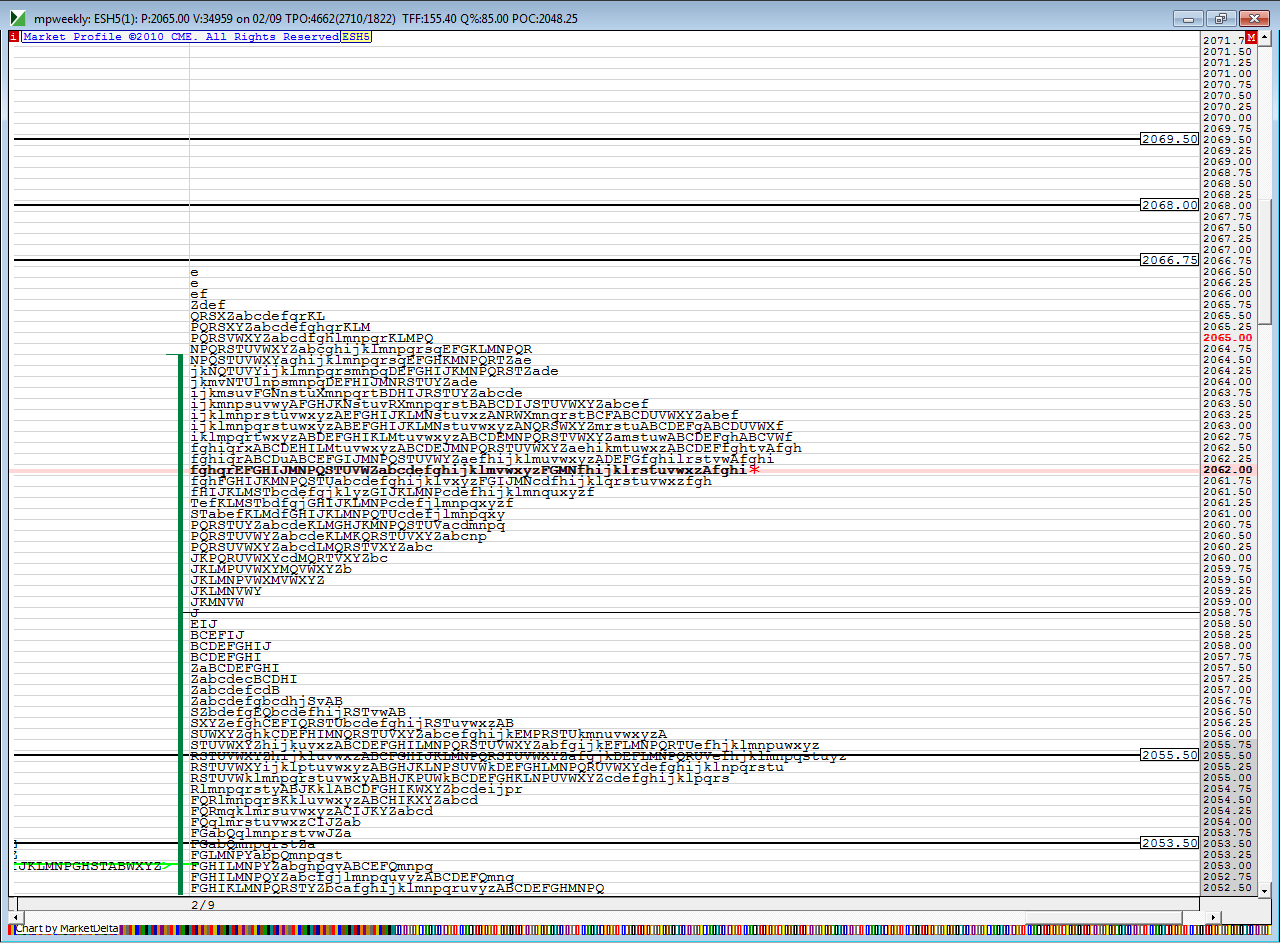

look how "J" period sticks out like a sore thumb.......meaning no time is there ....YET !!

i would have waited for the O/N low/ YD VAL to go long but those singles were a legitimate location as well. would have been a good zone which is what i am thinking you were leaning towards as well

Originally posted by BruceM

thanks.....I was prepared to go in at lower prices too...also keep in mind that I didn't get filled at 59...I just waited for the print....but I also had a bigger plan of action....just want folks to keep that in perspective......those who claim to get in on exact lows or highs are full of baby poo !!!!Originally posted by NewKid

Bruce, that was one heck of an entry going long at 59. that was great analysis

gonna try twice...first try is now at 63.50 short.....keeping stop at 65.....target is 62 then will see if we can get 59 again....a failure here will let me try one more at next swing high assuming they push out over the 65.......this is all small for me and not part of my usual routine .....way past my 11 a.m curfew !!....only trying small here...not big campaigns...too risky in a chop fest

filled on first exit at 62 even....trying to hold last for that new low...really don't want to see much of any reaction up now...if we are to get that new low then it would be more constructive for price to get STUCK down at this 62 area.....that would imply to me that possibly no buyers here this time down...not looking probable ..

Bruce, you had an initial 1.5 point initial target with a 1.5 point stop loss for a R:R of 1:1. Isint that too low? I understand you have your runners to make the reward bigger but still struggling a little with that. Thanks

my initial risk to reward is sometimes way out of whack especially when I am not trading off levels that hit for the first time..........or zones.......the emini swings in 2- 4 point ranges....so I find it often difficult to get good risk to reward ideas going so that is another reason in the first 90 minutes I watch the tape and the slow down...then hope to see trade below lows of high bars etc....so i take multiple small stabs and don't wire in a hard stop....this lunchtime dribble is a different animal to me and not NORMAL.... I think we are just gambling in here....even though I think the 58.75 will get so more time at it we are only on Wednesday...so even if it doesn't happen today it could happen Thurs or Friday...

so yes it is low in this particular case.....

so are we now struggling to go higher or just accepting the breakout from the 59 area yesterday...? it seems nothing will change unless we get above 64 and it turns into support or get below 61.50 and it turns into resistance.....till then it's best to walk away

so yes it is low in this particular case.....

so are we now struggling to go higher or just accepting the breakout from the 59 area yesterday...? it seems nothing will change unless we get above 64 and it turns into support or get below 61.50 and it turns into resistance.....till then it's best to walk away

Originally posted by NewKid

Bruce, you had an initial 1.5 point initial target with a 1.5 point stop loss for a R:R of 1:1. Isint that too low? I understand you have your runners to make the reward bigger but still struggling a little with that. Thanks

man...that was sure Purdy.... and lucky today...I had 5 contracts on at my 63.50 entry ....took three off at the 62 and moved stop on last two to 65.and 63.50 ...got stopped at 63.50 and last one hit that 58.75........it was the only man left standing on the battlefield for me today

I've begun watching John Carters weekly options course found here www.simpleroptions.com I'm really impressed so far and hoping to put up a formal review in a week or so....lots of material to go through and i know many like myself have been interested in the weeklies.

Below is a picture of the 0-hit days. Of the 14 misses, 6 of them are on holidays. So in truth, there are only 8 misses out of 259. I tried looking at range and ATR but there is no good way to filter out these misses. I see some weeks where the range is >2x the ATR and the subsequent week we still hit multiple pivot numbers due to a large range. The misses were just narrow range weeks.

I think after removing the holidays, there is a ~97% chance of hitting at least one weekly pivot number and that is pretty darn good so we shall go with that!

I think after removing the holidays, there is a ~97% chance of hitting at least one weekly pivot number and that is pretty darn good so we shall go with that!

Originally posted by BruceM

great work on the posts today newkid and thanks for updating the weekly pivot point study.....with R1 on weekly up at 90 we really don't even need to think about it unless we get outside of last weeks highs and if it is going to be the 31.50 pivot then we really don't need to think about it until we get below this weeks developing time poc at 48.....

I wonder if the 5% failure happen when the weekly ranges exceed a threshold of weekly average true ranges ? last week had the biggest range in the last 7 weeks......just rambling but there might be a way to filter out that 5 % ....

goods odds they come back up for the 55.50 retest

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.