ES Thursday 7-30-15

Well, Wednesday was a very unexpected day for me. I came into the trading day having already made up my mind on what the market "should" do, and boy was I wrong!

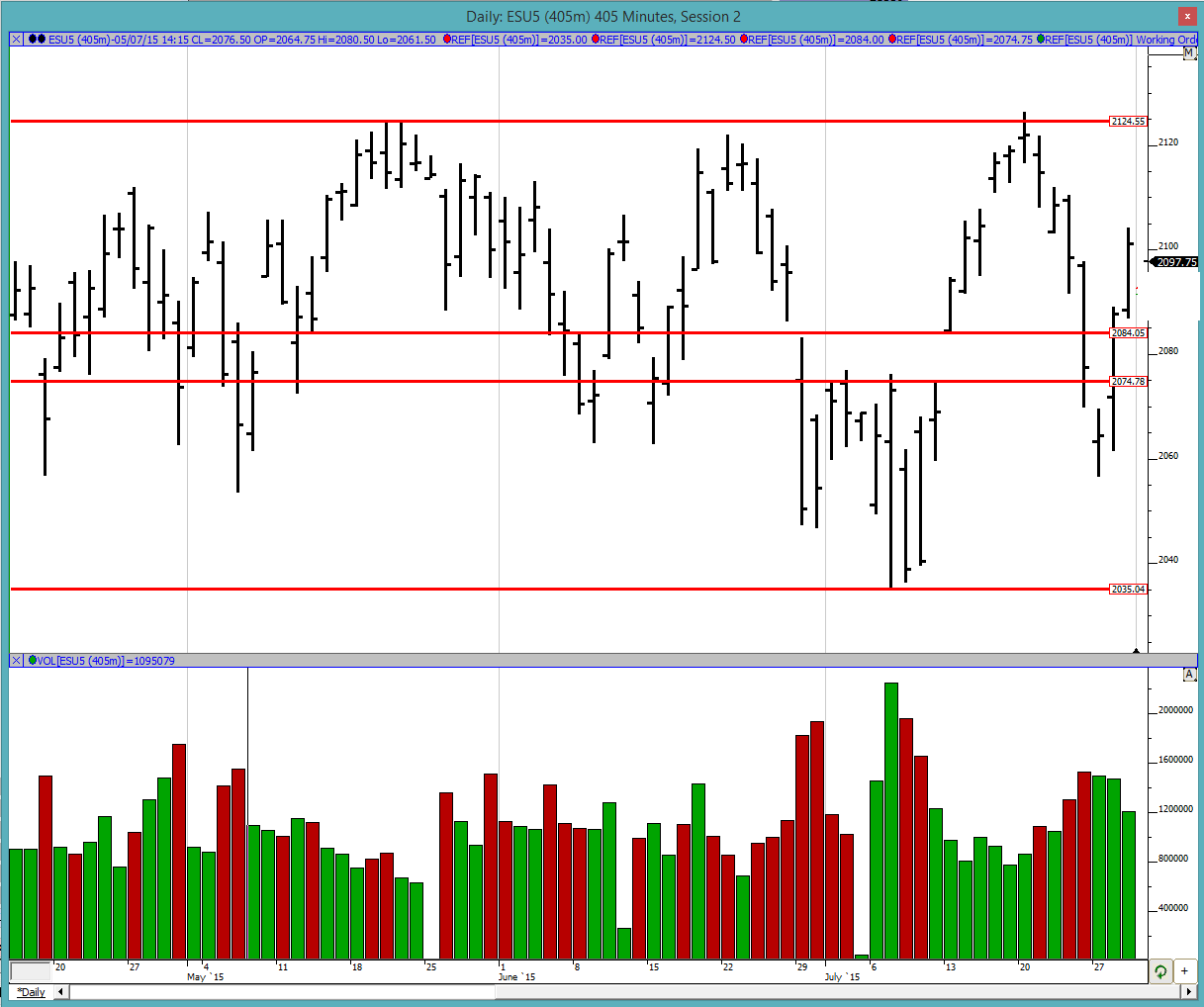

Let us start with the daily chart seen below. After YD's ugly structure and seemingly short squeeze we had another up day today. The markets are kind of in the middle of last week's range. We continue to be in the trading range with no respite in sight. A lot of today's gain happened before the Fed announcement and after some post-announcement oscillations the climb continued before a late small liquidation.

Greenie: On the downside we have greenies at 2096, 2089 and 2066.75. On the upside we have them at 2108.25, 2112.75 and 2118.75

Profile:

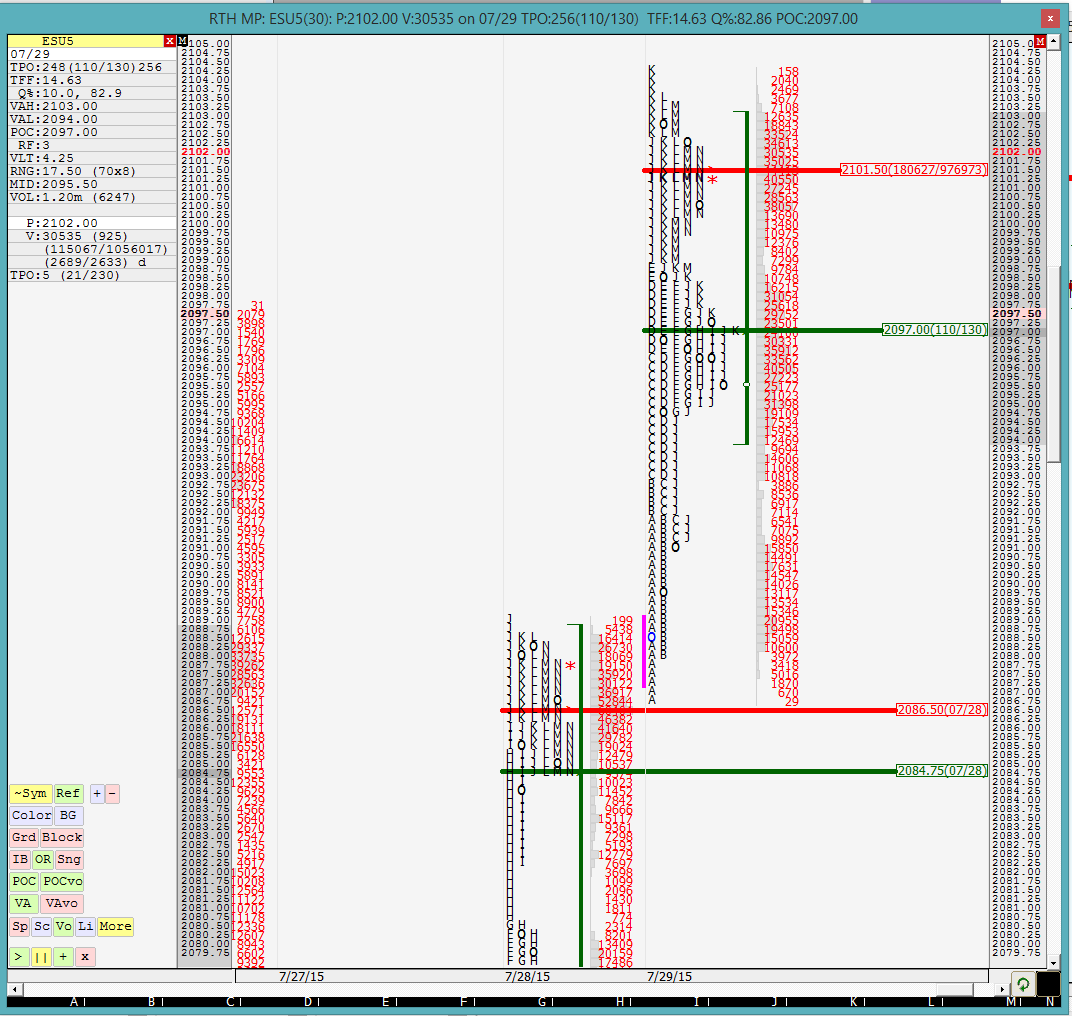

Wednesday again the profile was jagged but did not have multiple distributions. There was excess on both the top and bottom as seen in the K and A periods respectively. The POC ended up being close to the middle of the range after the aforementioned late liquidation break. Value was clearly higher and it paid to stay with the value on this trading day. The VPOC for the day though stayed towards the upper extreme of the range.

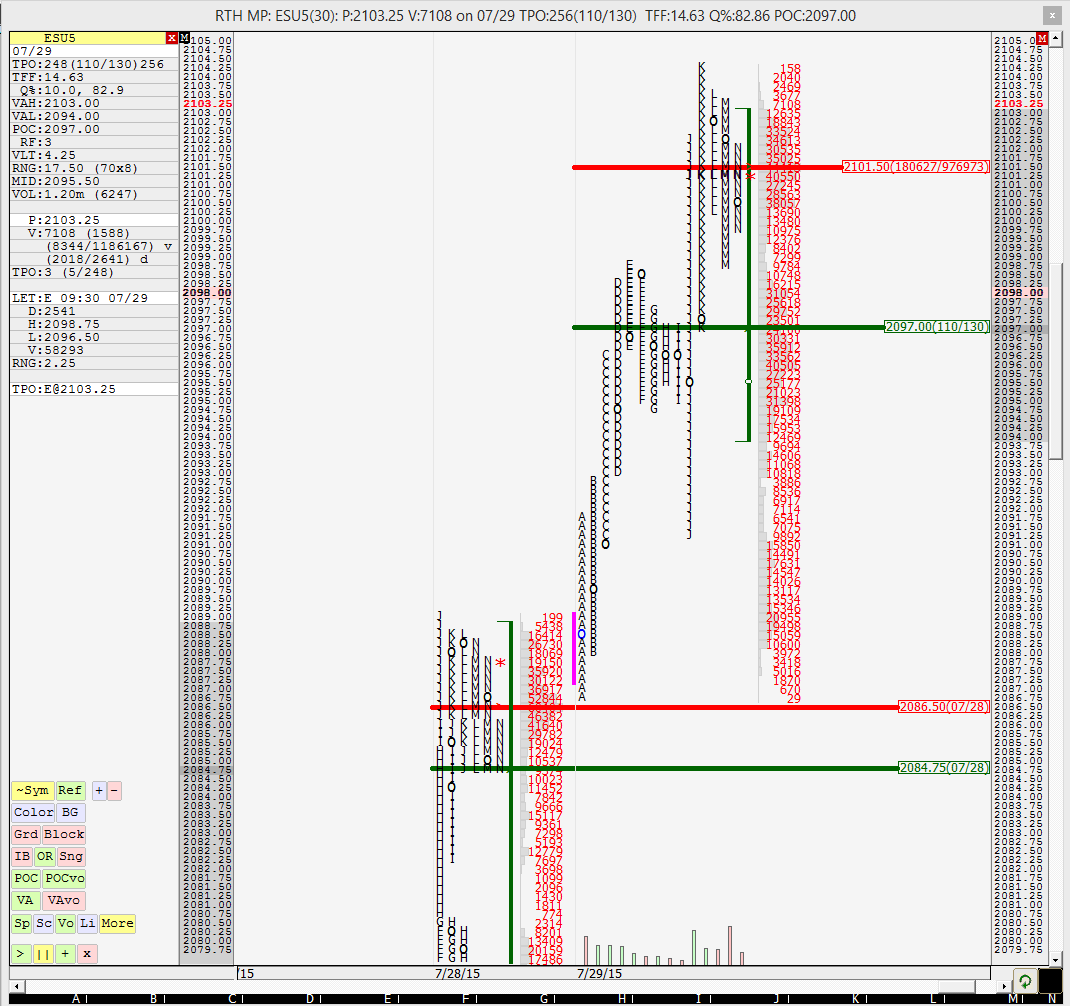

The split profile for Wednesday is the most revealing of the charts. Notice where the A period low is? Right on 7/28 's VPOC. Works like magic. The little pink bar that is seen on the left of the profile is the first 1-min IB of RTH. We can see that after the RTH open and after the 1st minute of trading, the market tried probing lower into Tuesday's range but was rejected right at Tuesday's VPOC and A period was kicked out of the prior day's range. That was the first likely opportunity to go long. B period opened and the 30-min VPOC was at 2089 i.e. right on 7/28's high. B period opened and the market again probed lower to see if there was anything in 7/28's range. B period was again defended at 7/28 close and market was kicked out of 7/28's range. This was again an opportunity to go long on a Range breakout trade on the pullback. This kind of trade is not my strongest attribute and I did not see this trade develop in real time and by the time I realized what was going on, it was too late. This is something I personally need to work on because these trades can be fairly lucrative. Wednesday being a Fed day blinded me to this trade but I will continue to focus on improving at it. The market one time framed higher till the E period and then it kind of balanced until the Fed announcement.

I find the 2097 number to be of interest because not only is it the POC but it was also the pullback low in K period and the market could not probe lower. So I am curious to see how it plays out on Thursday.

2106 is last week's VPOC and this week's developing VPOC is way down at 2062.25

We shall see how the O/N plays out and come up with a plan in the AM.

Good luck to all.

Let us start with the daily chart seen below. After YD's ugly structure and seemingly short squeeze we had another up day today. The markets are kind of in the middle of last week's range. We continue to be in the trading range with no respite in sight. A lot of today's gain happened before the Fed announcement and after some post-announcement oscillations the climb continued before a late small liquidation.

Greenie: On the downside we have greenies at 2096, 2089 and 2066.75. On the upside we have them at 2108.25, 2112.75 and 2118.75

Profile:

Wednesday again the profile was jagged but did not have multiple distributions. There was excess on both the top and bottom as seen in the K and A periods respectively. The POC ended up being close to the middle of the range after the aforementioned late liquidation break. Value was clearly higher and it paid to stay with the value on this trading day. The VPOC for the day though stayed towards the upper extreme of the range.

The split profile for Wednesday is the most revealing of the charts. Notice where the A period low is? Right on 7/28 's VPOC. Works like magic. The little pink bar that is seen on the left of the profile is the first 1-min IB of RTH. We can see that after the RTH open and after the 1st minute of trading, the market tried probing lower into Tuesday's range but was rejected right at Tuesday's VPOC and A period was kicked out of the prior day's range. That was the first likely opportunity to go long. B period opened and the 30-min VPOC was at 2089 i.e. right on 7/28's high. B period opened and the market again probed lower to see if there was anything in 7/28's range. B period was again defended at 7/28 close and market was kicked out of 7/28's range. This was again an opportunity to go long on a Range breakout trade on the pullback. This kind of trade is not my strongest attribute and I did not see this trade develop in real time and by the time I realized what was going on, it was too late. This is something I personally need to work on because these trades can be fairly lucrative. Wednesday being a Fed day blinded me to this trade but I will continue to focus on improving at it. The market one time framed higher till the E period and then it kind of balanced until the Fed announcement.

I find the 2097 number to be of interest because not only is it the POC but it was also the pullback low in K period and the market could not probe lower. So I am curious to see how it plays out on Thursday.

2106 is last week's VPOC and this week's developing VPOC is way down at 2062.25

We shall see how the O/N plays out and come up with a plan in the AM.

Good luck to all.

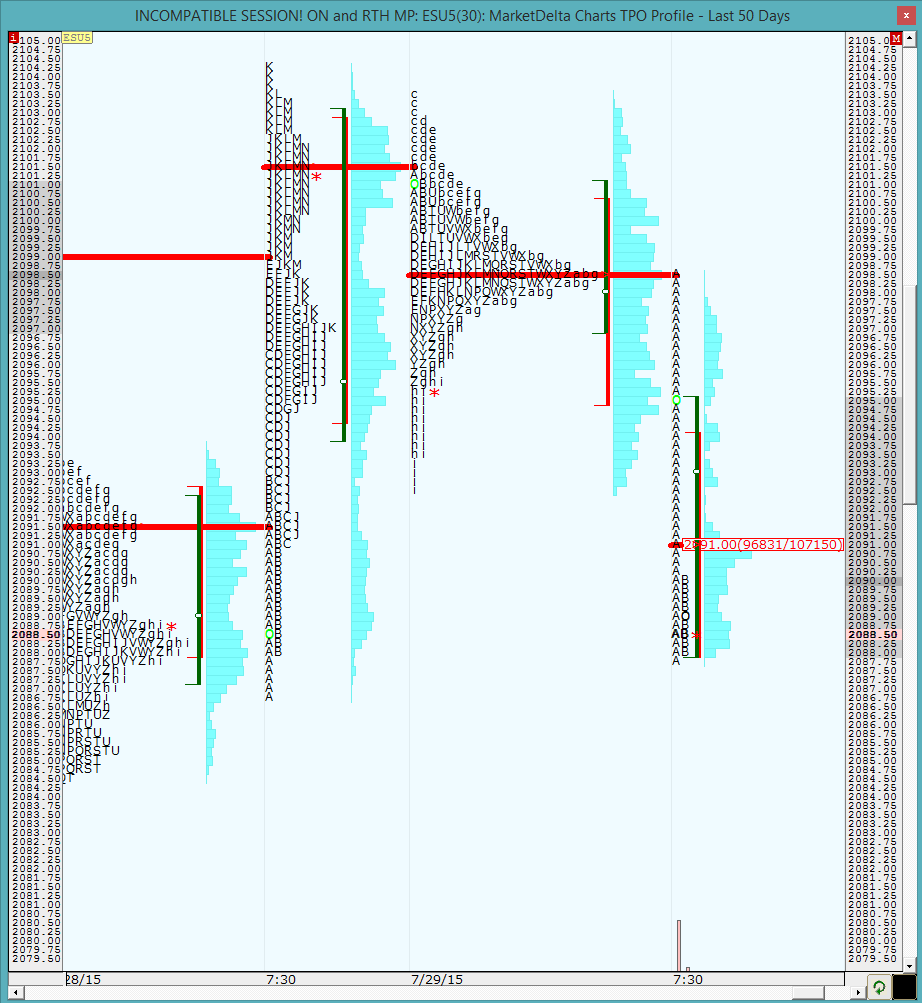

The O/N action has been completely within YD's RTH range. The inventory is almost 100% short but not quite there. The prices are currently hovering around YD's VA so at the open I will be watching to see if the market can stay within VA or reject it and move lower. Remember, the next greenie down is at 2089. Good luck to all.

opened within YD's VA. will have to wait and find an opportunity to trade

remember that there is a greenie at 2089 and there is a ledge at 2084.75, which was the POC from 7/28

that is a lot of single prints in the A period so far and expect some to be taken out at some point today

it might not be the smartest idea to go long when the selling so far has been this strong. i would rather wait for a bounce and then take a short on another pull back

30 min VPOC @ 2091

Notice where the A period high of the day is..... right on the O/N VPOC/POC (red horizontal line at the top). That is all the sellers were willing to let go to before they stepped in... I tell you, this stuff works so often that it is mind boggling..

if we wanted to take a short here on a potential pull back, where would we initiate it? where we would we put a stop on it? all i can think is the low of the 1-min IB which is 2094.5 but i would still struggle with it because then is the low a poor low because of weak buyers or are the sellers already exhausted? contradiction abounds

well, the singles are being taken out.. the 2089 greenie provided quite a bounce... if i wasnt so chicken it would have been fairly profitable... oh well..

also in case you are wondering, the current low is 2087.75 and so i consider the greenie held... you have to give it some wiggle room to work and it will never be exact to the tick

also in case you are wondering, the current low is 2087.75 and so i consider the greenie held... you have to give it some wiggle room to work and it will never be exact to the tick

Great roadpath again today NewKid ! Bravo!!! question: Since today's low is weak (no tail) and we are testing the open, isn't it a good idea to short somewhere here?

that is quite long term thinking. my field of vision is pretty narrow although I do keep an eye on the big picture

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.