FOMC Fed Day 17 September 2015

From the CME:

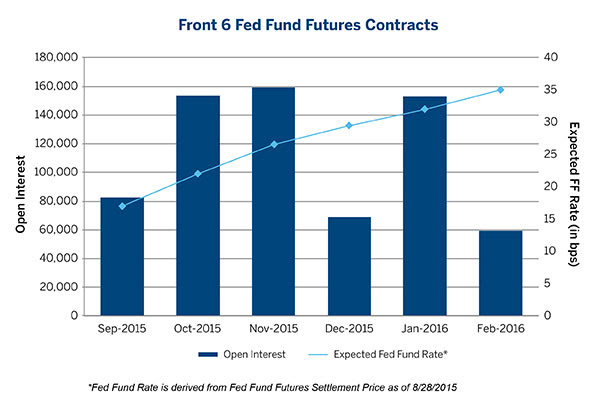

...we still expect the Fed to initiate the first rate-rise in the federal funds rate in over a decade at the September FOMC meeting, although we would put our qualitative probability assessment at only around 55%, with a 30% probability for action later in the year, and 15% probability of the decision being delayed into 2016. The markets, as represented by federal funds futures, have a much lower probability attached to the September FOMC meeting.

When the rate-rise move comes, it is likely to be the first of several. However, the Fed may make it clear that it will go slow and skip meetings in between rate rises.

The Fed may even surprise us by abandoning ranges and reverting back to its old habit of simply setting an explicit point target for the effective federal funds rate. And, to add to the surprise, the Fed might choose 0.25% as the new target for the effective federal funds rate, instead of moving to a 0.25% to 0.50% range.

As a final note of caution, we would point out that the US employment report due for release on 4th September is still a critical data point. We estimate job creation at 225,000 per month or higher. Nevertheless, if for any reason, the jobs data surprises to the downside, say less than 200,000 net new jobs created, then the Fed might delay its rate-rise decision past the September FOMC meeting. The bigger the downward surprise the longer the delay, as more data points will be needed to confirm whether the unexpected downward movement was a blip or a new and weaker trend. For this reason, we feel that if the jobs number is unexpectedly weak, then the October FOMC meeting is off the table, too, since the Fed will want to see more data and will wait for December.

Additionally, because the 4th of September is the Friday before the long US Labor Day weekend, this could make for some very exciting trading, either if (a) as we expect, the data will seal the deal for September, or (b) we are wrong and the data disappoints, suggesting a delay to December or into 2016.

From James Altucher today:

B) INTEREST RATES MIGHT RISE

Are you kidding me?

Let me explain simply please.

The Fed lends money to banks. When the Fed rate is low, savings rates are low.

When savings rates are low, people put money in higher risk stocks than in savings.

When savings rates are high (7%+) people put money in their savings account because its safer (it really is).

That's why people say "when interest rates go up, stocks go down."

Oh my god! (sorry for the repeat).

The Fed Rate is at 0.25% and has been for six years.

They SHOULD raise it to 0.5% or even 2%. Nobody is saying, "Oh, now I should move out of the stock market and get 2% savings rates.

And, by the way, the Fed only raises rates when every indicator suggests that companies are growing at a fast rate.

Let's look at recent times the Fed raised rates. Through most of the 90s (the markets went straight up). 1999, the Nasdaq 100 went up almost 100% over the next year (and value stocks continued to go higher ever after the crash).

From 2002-2007 the Fed raised rates every chance it could get. The market went constantly up.

And none of that was from such a low base of 0.25%.

So newspapers, PLEASE STOP LYING

From the CME:

Fedwatch Tool can be found here: www.cmegroup.com/trading/interest-rates/fed-funds.html

...we still expect the Fed to initiate the first rate-rise in the federal funds rate in over a decade at the September FOMC meeting, although we would put our qualitative probability assessment at only around 55%, with a 30% probability for action later in the year, and 15% probability of the decision being delayed into 2016. The markets, as represented by federal funds futures, have a much lower probability attached to the September FOMC meeting.

When the rate-rise move comes, it is likely to be the first of several. However, the Fed may make it clear that it will go slow and skip meetings in between rate rises.

The Fed may even surprise us by abandoning ranges and reverting back to its old habit of simply setting an explicit point target for the effective federal funds rate. And, to add to the surprise, the Fed might choose 0.25% as the new target for the effective federal funds rate, instead of moving to a 0.25% to 0.50% range.

As a final note of caution, we would point out that the US employment report due for release on 4th September is still a critical data point. We estimate job creation at 225,000 per month or higher. Nevertheless, if for any reason, the jobs data surprises to the downside, say less than 200,000 net new jobs created, then the Fed might delay its rate-rise decision past the September FOMC meeting. The bigger the downward surprise the longer the delay, as more data points will be needed to confirm whether the unexpected downward movement was a blip or a new and weaker trend. For this reason, we feel that if the jobs number is unexpectedly weak, then the October FOMC meeting is off the table, too, since the Fed will want to see more data and will wait for December.

Additionally, because the 4th of September is the Friday before the long US Labor Day weekend, this could make for some very exciting trading, either if (a) as we expect, the data will seal the deal for September, or (b) we are wrong and the data disappoints, suggesting a delay to December or into 2016.

Fedwatch Tool can be found here: www.cmegroup.com/trading/interest-rates/fed-funds.html

The next FOMC interest rate announcement will be on 17 September 2015 at 2pm.

Here's a chart showing the last 25 years of fed rates: Fed Rates Chart

Here's a collection of E-mini S&P500 charts from Fed Days: Fed Day Charts

Article and charts about Fed Days.

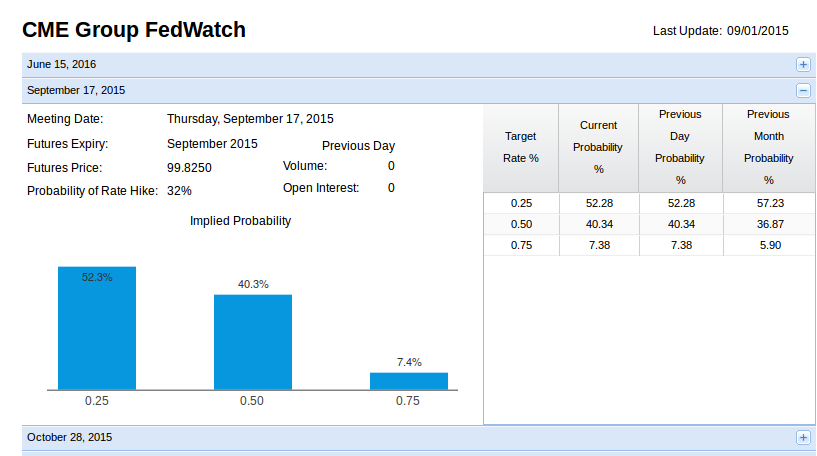

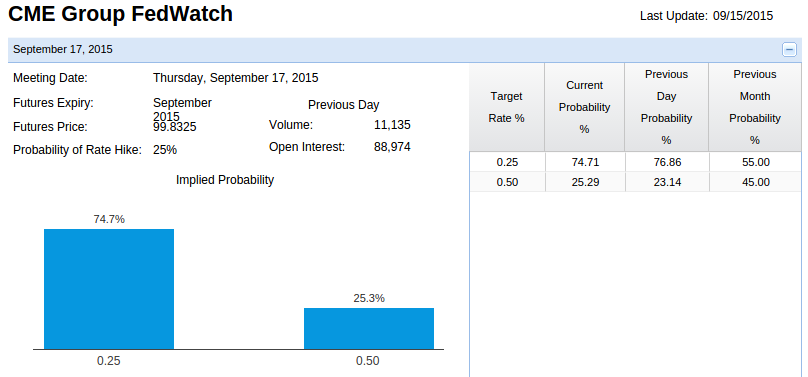

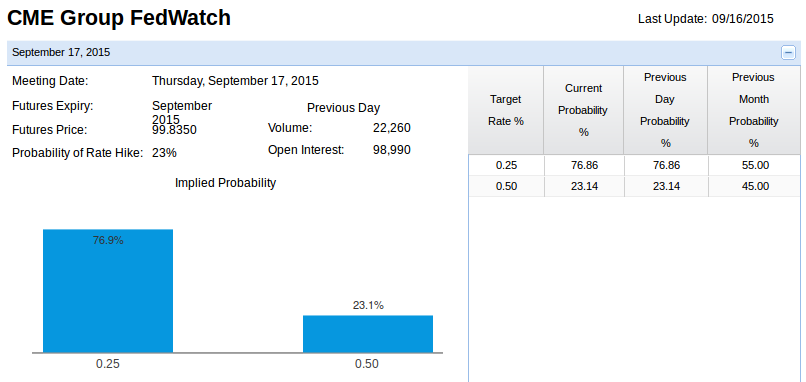

Implied probability of rate at this meeting:

0.00 (23%) (previous meeting: 44%)

0.25 (77%) (previous meeting: 56%)

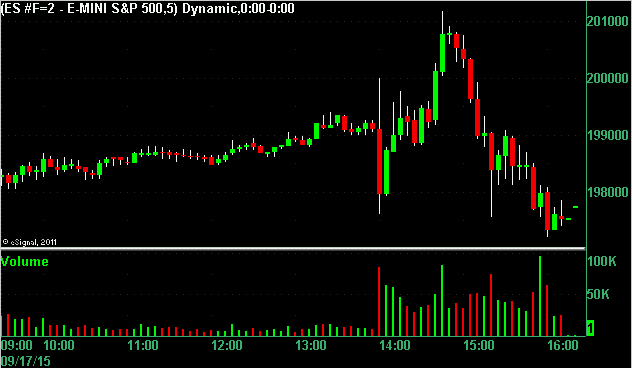

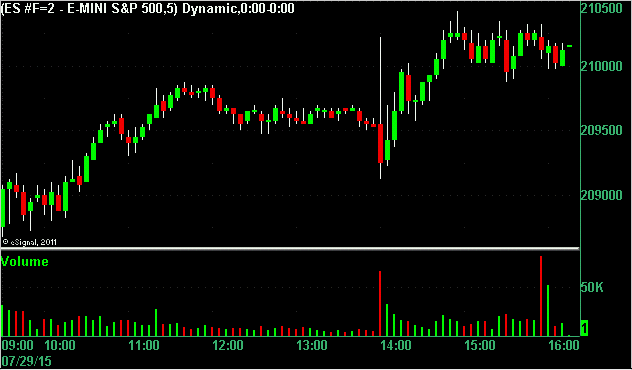

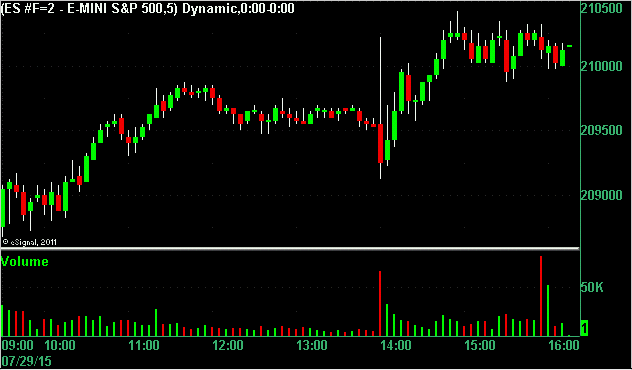

On the last Fed Day on 29/July/2015 this is what the ES did:

Here's a chart showing the last 25 years of fed rates: Fed Rates Chart

Here's a collection of E-mini S&P500 charts from Fed Days: Fed Day Charts

Article and charts about Fed Days.

Implied probability of rate at this meeting:

0.00 (23%) (previous meeting: 44%)

0.25 (77%) (previous meeting: 56%)

On the last Fed Day on 29/July/2015 this is what the ES did:

Release Date: September 17, 2015

Information received since the Federal Open Market Committee met in July suggests that economic activity is expanding at a moderate pace. Household spending and business fixed investment have been increasing moderately, and the housing sector has improved further; however, net exports have been soft. The labor market continued to improve, with solid job gains and declining unemployment. On balance, labor market indicators show that underutilization of labor resources has diminished since early this year. Inflation has continued to run below the Committee's longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation moved lower; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term. Nonetheless, the Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring developments abroad. Inflation is anticipated to remain near its recent low level in the near term but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams. Voting against the action was Jeffrey M. Lacker, who preferred to raise the target range for the federal funds rate by 25 basis points at this meeting.

Information received since the Federal Open Market Committee met in July suggests that economic activity is expanding at a moderate pace. Household spending and business fixed investment have been increasing moderately, and the housing sector has improved further; however, net exports have been soft. The labor market continued to improve, with solid job gains and declining unemployment. On balance, labor market indicators show that underutilization of labor resources has diminished since early this year. Inflation has continued to run below the Committee's longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation moved lower; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term. Nonetheless, the Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring developments abroad. Inflation is anticipated to remain near its recent low level in the near term but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams. Voting against the action was Jeffrey M. Lacker, who preferred to raise the target range for the federal funds rate by 25 basis points at this meeting.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.