ES Thursday 9-15-16

Looking for tests back down into the 2118 - 2120 area this morning as targets....posting three charts first chart is what is happening on the weekly so far. This has the Value area shaded and the DAILY pivot numbers so 2127.75 - 2129.75 is key upside reference that is weekly VA high and the R1 area for today. Getting above here and consolidating would be very bullish as that will eventually create higher value on the week.

Now the second chart is just the daily and it shows how yesterday was a double distribution day with two prominent POC's at 24.75 and 18

will update this in a minute

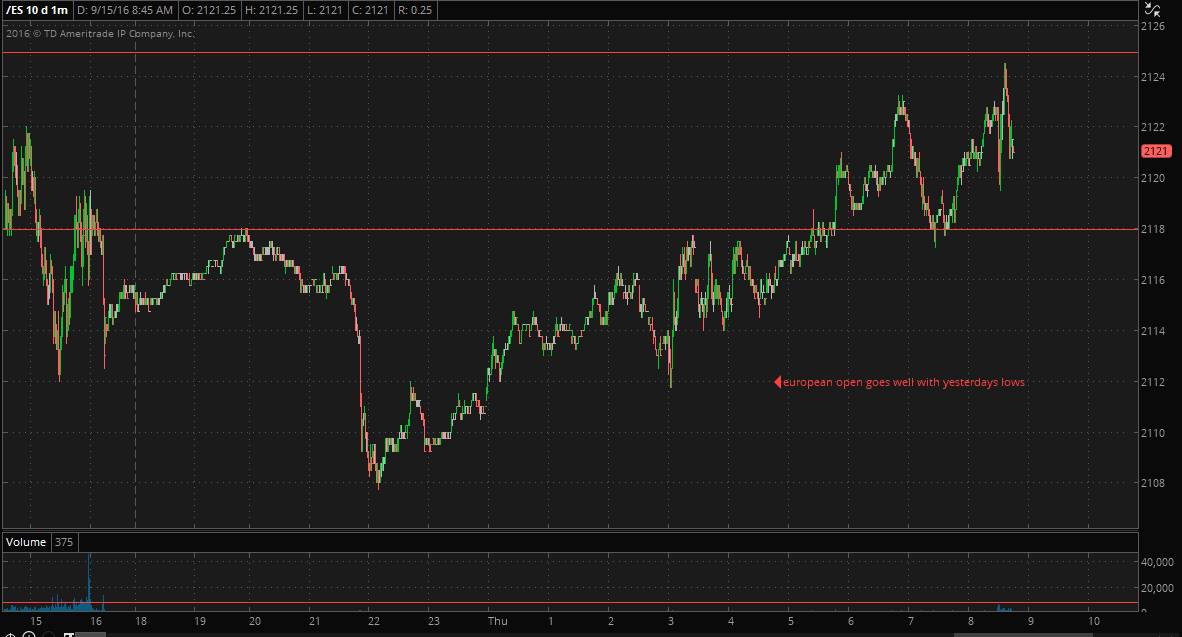

UPDATE....last chart shows the overnight and notice how the 24 area has stopped price so far and also what has happened at the 18 price .so that at least confirms that particular price ...last thing is to notice how the 3 a.m open and swing low goes well with yesterdays lows...so another area of interest for those woho may be trading for that if the 18 - 20 gives way

Now the second chart is just the daily and it shows how yesterday was a double distribution day with two prominent POC's at 24.75 and 18

will update this in a minute

UPDATE....last chart shows the overnight and notice how the 24 area has stopped price so far and also what has happened at the 18 price .so that at least confirms that particular price ...last thing is to notice how the 3 a.m open and swing low goes well with yesterdays lows...so another area of interest for those woho may be trading for that if the 18 - 20 gives way

this is aggressive....but I have noticed that gaps in the data that happen after 3 a.m eastern time get filled in...with that said there are gaps in the data at 20.75 and 21.50 so my bias underneath the 18 number is to the long side......keep floor trader test probabilities in mind this morning

when I made first posts the market was above the 18 - 20 zone and then dropped...now we are under that...just want anyone reading to keep that in perspective

out heavy at first gap fill and magnet price

I'm on second long campaign trying for overnight high.....runners on first campaign get stopped...this dy is basically done for me though...good luck if u stay and play

flat at 24.25 print...cool day .....hope some of this mumbo jumbo helped

I wanted to take a moment to thanks those who vote up the posts and read my ramblings. It means a lot to me. Every once in a while I get asked why I don't hold for bigger moves and my answer is usually the same. It's just not my style and I find it easier to adapt when ranges contract by taking money off the table at key targets when given the chance. So when ranges contract it doesn't change the probabilities that I use to trade, like the pivots, the overnight midpoint or overnight highs or lows.....these are automatically adjusted for me and I don't need to be glued to the screen as I have said quite often. I glance at other forums and I see folks take beatings and have huge 5 or 10 point draw downs and they can not adapt to changes in volatility ( that is really hard to do quickly for anyone).

Lets suppose we have a really big day and then the next day decides to consolidate....well, these folks who are trying to hold on assuming the range is still going to expand ( on the contraction day)get globbered where us probability/target traders take our small pieces and accept what the market offers us early on.....some days it's a bigger piece and some days the targets are closer by but we accept what we are given, get the work done and have a life

this statement applies to day trading only : The longer you are in the market the more money you will give back

Ok that was a big divergent ramble......anyway, thanks to those who read this stuff and those who take the time to vote.....

If the key zone of 27.50 - 29.50 can hold back declines now then I think they may push to 42 by days end......44 begins to define a low time area

Lets suppose we have a really big day and then the next day decides to consolidate....well, these folks who are trying to hold on assuming the range is still going to expand ( on the contraction day)get globbered where us probability/target traders take our small pieces and accept what the market offers us early on.....some days it's a bigger piece and some days the targets are closer by but we accept what we are given, get the work done and have a life

this statement applies to day trading only : The longer you are in the market the more money you will give back

Ok that was a big divergent ramble......anyway, thanks to those who read this stuff and those who take the time to vote.....

If the key zone of 27.50 - 29.50 can hold back declines now then I think they may push to 42 by days end......44 begins to define a low time area

always cool when people start unwinding before a level like the R1 at 42 today....41.25 is high so far.......nuff said.. cya tomorrow...I'd be more concerned with 44 - 46 as we go forward

someone from another forum doesn't like my comments here today...they are actually voting down the posts....too funny...but I'm not gonna let myself get into another debate on mypivots or anywhere for that matter.....I post because it's good karma, it's a way to pay respect to all the people who have helped me on my journey ( the pay it forward concept) and writing stuff down helps you reinforce your own ideas.....so as much as I appreciate the votes up, my detractors won't bring me down. I understand that each have their own way. I'm just a strong advocate of spending LESS time in front of the computer TRADING

Originally posted by BruceM

I wanted to take a moment to thanks those who vote up the posts and read my ramblings. It means a lot to me. Every once in a while I get asked why I don't hold for bigger moves and my answer is usually the same. It's just not my style and I find it easier to adapt when ranges contract by taking money off the table at key targets when given the chance. So when ranges contract it doesn't change the probabilities that I use to trade, like the pivots, the overnight midpoint or overnight highs or lows.....these are automatically adjusted for me and I don't need to be glued to the screen as I have said quite often. I glance at other forums and I see folks take beatings and have huge 5 or 10 point draw downs and they can not adapt to changes in volatility ( that is really hard to do quickly for anyone).

Lets suppose we have a really big day and then the next day decides to consolidate....well, these folks who are trying to hold on assuming the range is still going to expand ( on the contraction day)get globbered where us probability/target traders take our small pieces and accept what the market offers us early on.....some days it's a bigger piece and some days the targets are closer by but we accept what we are given, get the work done and have a life

this statement applies to day trading only : The longer you are in the market the more money you will give back

Ok that was a big divergent ramble......anyway, thanks to those who read this stuff and those who take the time to vote.....

If the key zone of 27.50 - 29.50 can hold back declines now then I think they may push to 42 by days end......44 begins to define a low time area

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.