ES Thursday 10-13-16

Sick kid in room next door...ah...school season is in full bloom...no video but some charts may help confirm your numbers...I plan to take OR trades today on breakouts...will trade a bit smaller as we may need to stop and reverse

Confluent numbers

2129 - 2131 - buying tail and VA low from Wednesday

Daily S2 and Monthly S1 - 2118 - 2119.50 POC of overnight is at 2119 as I am making this.

Yd's low and S1 2125.26 - 2126.26 ( see final note on this area below)

The overnight low currently at 2113.50 is the real close to the split between S2 at 2119.25 and S3 at 2106

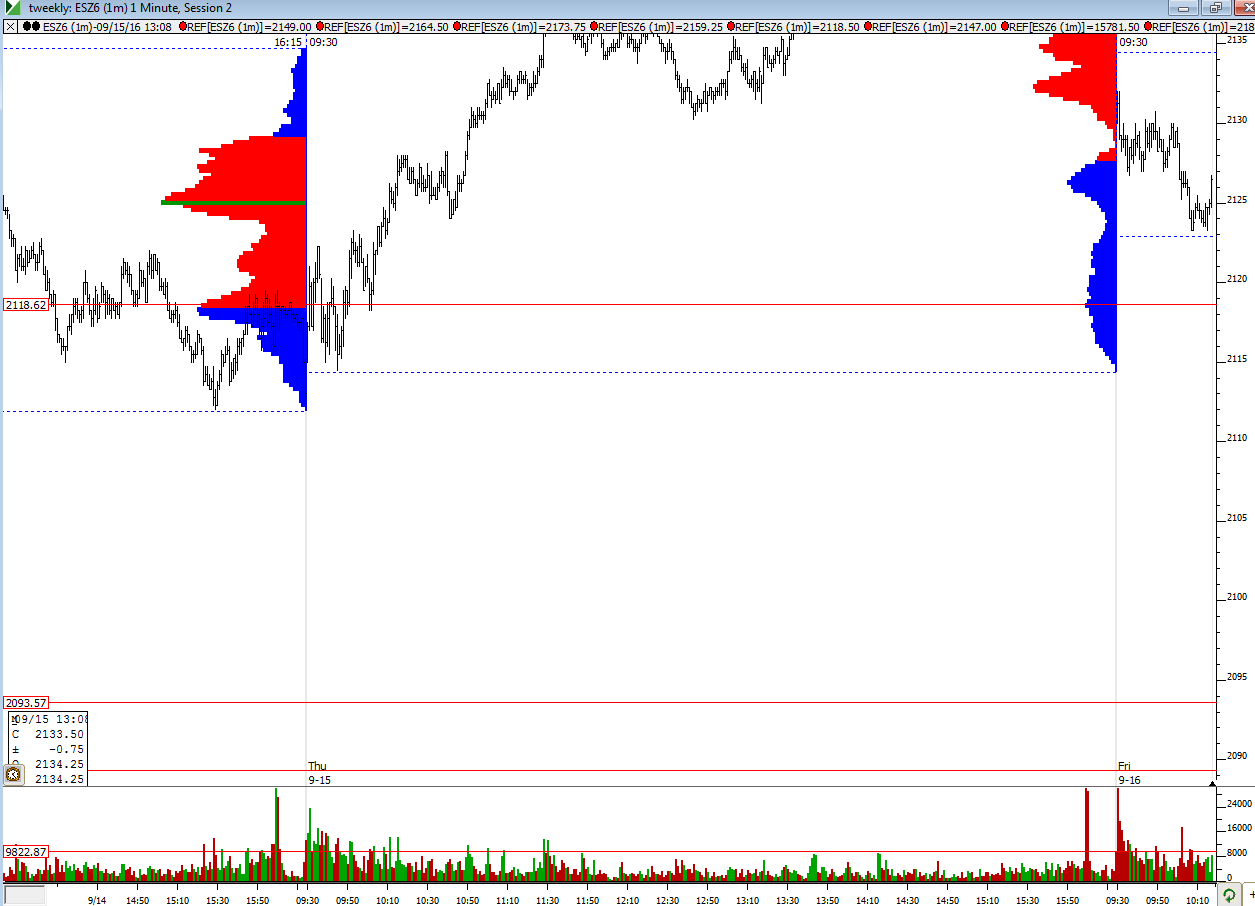

a few charts: Here is sept 14 and 15th...not all of the chart is shown but look at the bell curve from the 14th and then look at subtle bell curve on the 15th but look at the price action at the 2119 level on the 15th...I think this is the key bull/bear line today in general...will edit and add a few more charts

and look at all these multiple bracket lows from the 13, 14, 15th of September

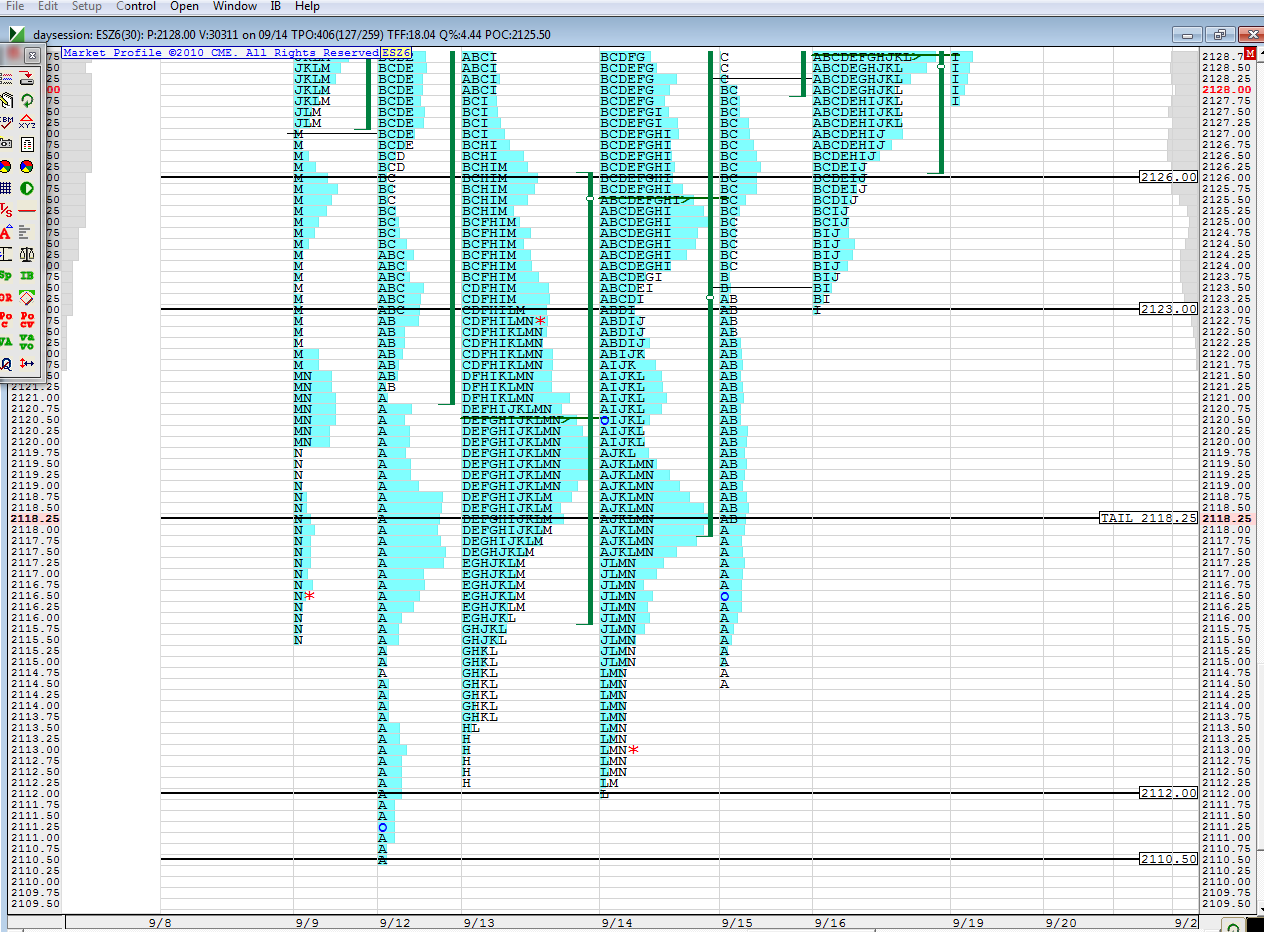

a better visual of key ranges, buying tail from the 15th and value areas on my MP chart...note the buying tail edge ( place where we go from single prints to double prints)...right at the 2118- 2119 number

so even if we break that Overnight low which is essentially the low from the 15th then they still have to try and break it down and out from those lows in the 2110 - 2112 area...markets don't often close below the S2 level but that needs a statistic to that...I prefer the long side in general so will be heavier on long side OR breaks and lighter on short side breaks....all this will depend on exactly where we open too.........I'll formulate a better trade plan for myself the closer we get to the open

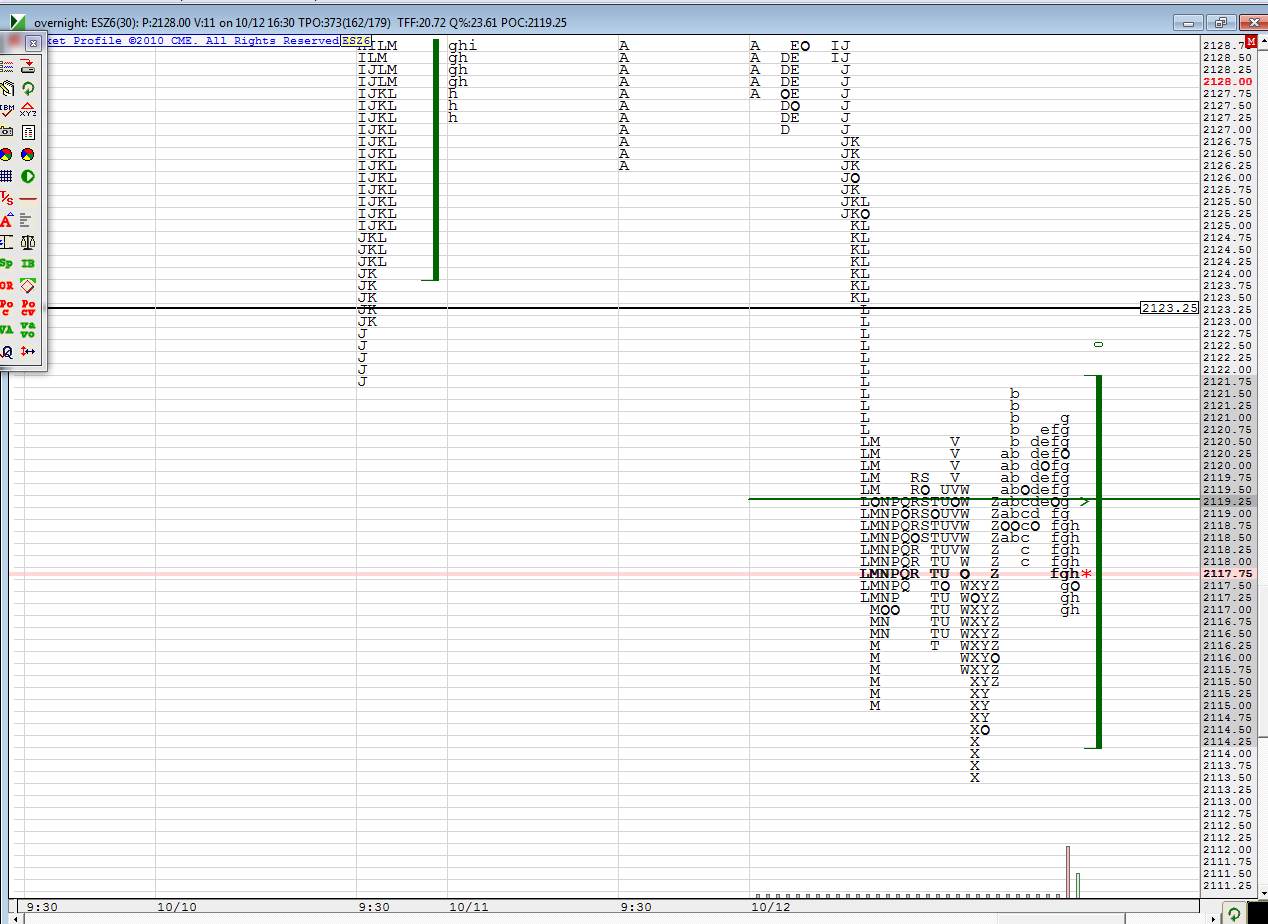

and here is current overnight action and the FINAL NOTE.....the overnight has single prints at 22 - 23 area so that is more important to me then the 25 - 26 area mentioned above and I can't have numbers so close together so I am using the 22- 23 over the 25 - 26.....the 22 - 23 includes the overnight singles , the low from the 16th and the low from Tuesday

Confluent numbers

2129 - 2131 - buying tail and VA low from Wednesday

Daily S2 and Monthly S1 - 2118 - 2119.50 POC of overnight is at 2119 as I am making this.

Yd's low and S1 2125.26 - 2126.26 ( see final note on this area below)

The overnight low currently at 2113.50 is the real close to the split between S2 at 2119.25 and S3 at 2106

a few charts: Here is sept 14 and 15th...not all of the chart is shown but look at the bell curve from the 14th and then look at subtle bell curve on the 15th but look at the price action at the 2119 level on the 15th...I think this is the key bull/bear line today in general...will edit and add a few more charts

and look at all these multiple bracket lows from the 13, 14, 15th of September

a better visual of key ranges, buying tail from the 15th and value areas on my MP chart...note the buying tail edge ( place where we go from single prints to double prints)...right at the 2118- 2119 number

so even if we break that Overnight low which is essentially the low from the 15th then they still have to try and break it down and out from those lows in the 2110 - 2112 area...markets don't often close below the S2 level but that needs a statistic to that...I prefer the long side in general so will be heavier on long side OR breaks and lighter on short side breaks....all this will depend on exactly where we open too.........I'll formulate a better trade plan for myself the closer we get to the open

and here is current overnight action and the FINAL NOTE.....the overnight has single prints at 22 - 23 area so that is more important to me then the 25 - 26 area mentioned above and I can't have numbers so close together so I am using the 22- 23 over the 25 - 26.....the 22 - 23 includes the overnight singles , the low from the 16th and the low from Tuesday

there was no point in taking OR long trades because of WHERE we opened....look at OR high ( u can look at standard one minute).....would you want to buy knowing you have a key number right at that high ???...the OR high was 18.25 and we knew 18.25 - 19.25 was a key area...just one point away..no room for any profit...

scaling heavy at the 10.50...that's two points off entry and I don't like 2110 - 2112 as per my charts above......not sure what may happen here...is this a failed breakdown of a range? too early to tell

scaling again at print of 2112....only one left to try for newkids 14.50...this a low time spot now

stop is at 08.75

revising target to 2114

bonus fill at 14.75 and missed my stop by one tic on last runner.when they probed down ........that's it for me....cool day........that 14.50 was also at one time the peak price on the developing day......ranges and value hard at work today........that 14.50 is critical if bulls can do any more work on upside....look at charts above...trade well if ya stay and play....wife has chores for me........but at least it's not painting

and don't forget the ft71 webinar on bookmap....later today...not sure where u sign up...I got an email sign up and I think it's at big mikes forum

Thanks Bruce

I am not going to be able to attend the webinar live but plan on watching the recording and comparing notes later

Originally posted by BruceM

and don't forget the ft71 webinar on bookmap....later today...not sure where u sign up...I got an email sign up and I think it's at big mikes forum

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.