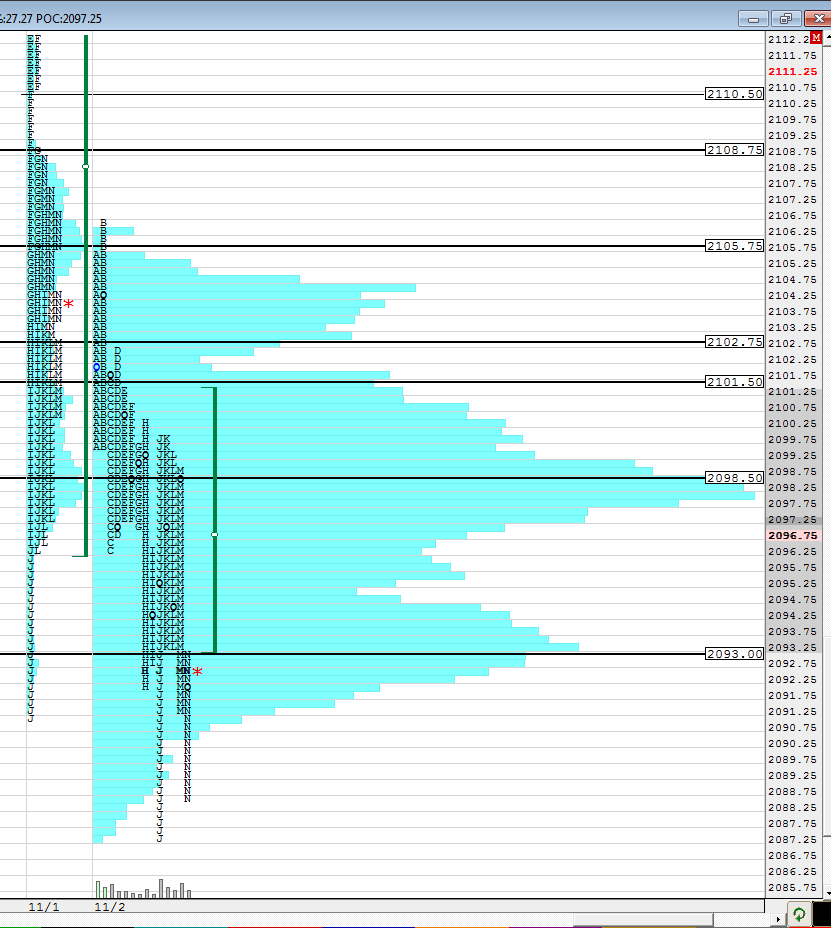

ES Thursday 11-3-16

selling into the 98.75 POC.....96 is target...pivot at 95.75...charts/vid to follow

EDIT : TO include a video...will make screen capture and edit again...taking small trades in On hence the brake up in this post and the edits

EDIT 2: major lines for those who don't want to listen to my banter

I had a data Issue so my comments about ad line and the floor trader PIVOT number is not statistically true....all that is true is that the Ad line will aslo hit one of it's floor trader numbers if you apply the same formula....so they will hit and r1, s1, r2, s2 or the Pivot 96 % of the time of more....

EDIT : TO include a video...will make screen capture and edit again...taking small trades in On hence the brake up in this post and the edits

EDIT 2: major lines for those who don't want to listen to my banter

I had a data Issue so my comments about ad line and the floor trader PIVOT number is not statistically true....all that is true is that the Ad line will aslo hit one of it's floor trader numbers if you apply the same formula....so they will hit and r1, s1, r2, s2 or the Pivot 96 % of the time of more....

thing that surprised me most about yesterday is that we did not fill in any of the three sets of singles from Tuesdays trade.....with that in mind and the ad line divergence I will be selling puts on the open today going out one week.....with the hopes that we get a pop up today or Friday to cover.......expecting trade back up into the 08 - 2110 area to buy the puts back

overnight trade # 2 is flat now at 95 even...will wait for day session...I'd like to see price firm up down near va low and yd's close to look for long trade back to get 98.97 highs but take off something at pivot first....this will depend where we open...that would be ideal trade idea now that we sold off from those highs...since this is a rare event where two O/N trades actually worked , I will be trading smaller in day session and be more selective

ad line opens at 572 so will it rally all the way to 1500 or drop back down to 180 level...I'm thinking the 180 level so we need to find some sells in here for va low test on ES and YD close

small sells at 97.50 as tick/ volume diverged with plan to work the 98.75 if it gets up there..targets will be 95.50 pivot

ad line is now at midpoint of R3 and r2 ....cool spot to roll down

don't have much more a plan for today...here is ad line mumbo jumbo...from a statistical point you need to figure out if ad line is gonna hook back up and go to the plus 1500 or is it more likely for ES price to drop back to YD's close and ad line get down to the 180 ...u can also think about the overnight high or low probability if you like that better

gap fill took off one contact and last is going to try and hold until ad line hits ( if it does the ) 180 level or if ES prints 89.25

ticks range bound an ad line is almost 1/2 to what it was the last time we were up here..poor low too...interesting mix

still suggest to me to hold this last short..we are consolidating under YD's poc which implies lower value...we;ll see if it changes but so far it still looks weak

exited last at 91.25 as Ad line poked through the R2 level

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.