ES 11-10-16

key area for me will be 2173.75 in early premarket trade...would like to find a short in 73.5 - 75 area to try and get back to YD's rth highs......looking to get some charts up and will edit this post with those

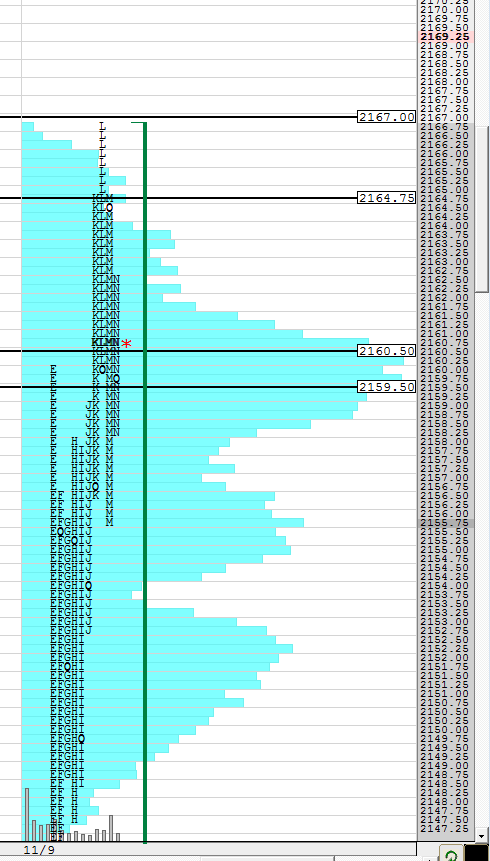

edit...first the upper portion of Wednesdays trade with key areas from that.....let me say this..... HUGE VOLUME yesterday with only the nq slightly behind but AD line is also still diverging...so we've had three higher highs in price but three lower lows in ad line.....

edit 2 ...a view of the profile from 9-6 thru 9-8 ..note the perfect bell center on 9-8 and that is why I took premarket short

statistically we will hit either the R1 or the pivot number today and get that right over 96% of the time.....today's pivot is way down at 2148.75 and R1 is up at 2178.75...59 will be the deciding factor to determine which one of those we get....so far price will be opening much closer to the 78.75 so anyone buying will be using that 73.75 - 75 area as a caution area on the way to the R1 if price happens to go that way.....no midpoint test yesterday too

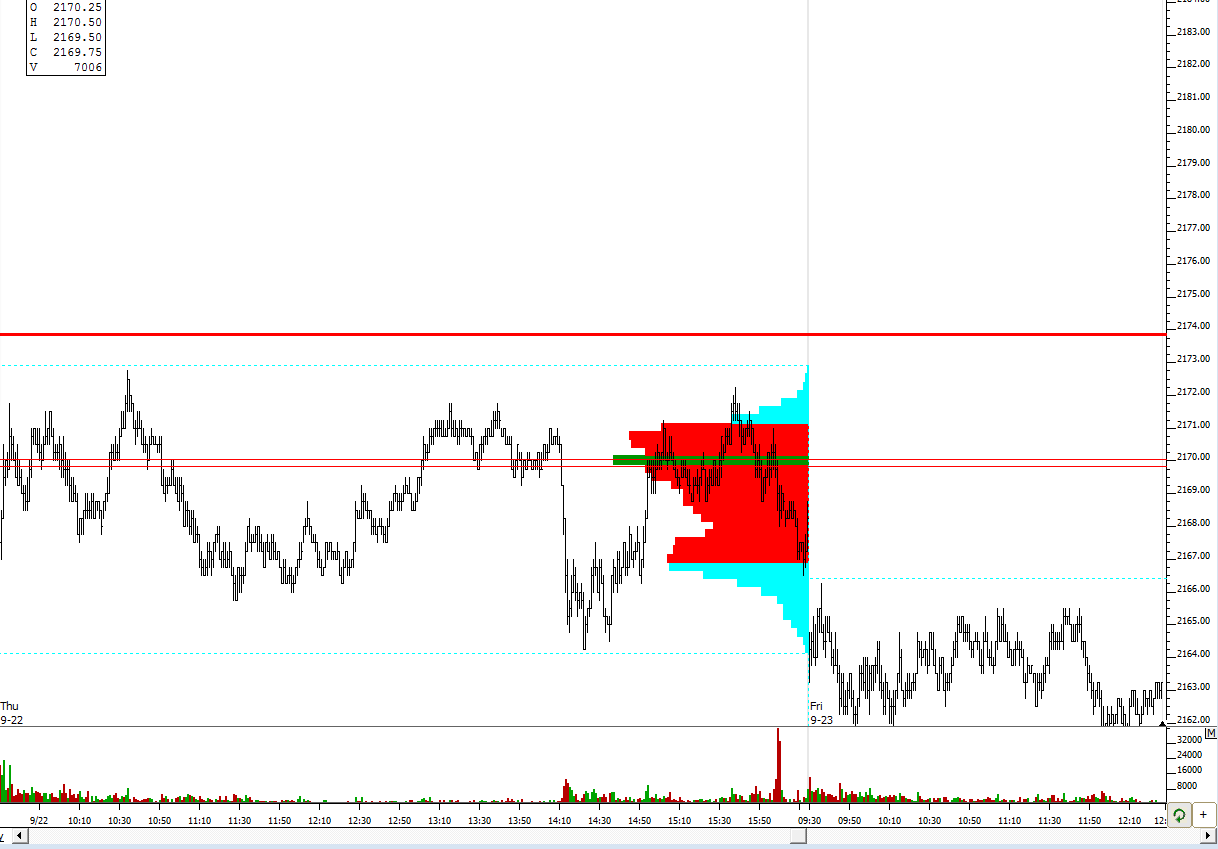

edit 3 : if you are looking to add another line to watch it would be this one at 69.75 from 9-22 trade

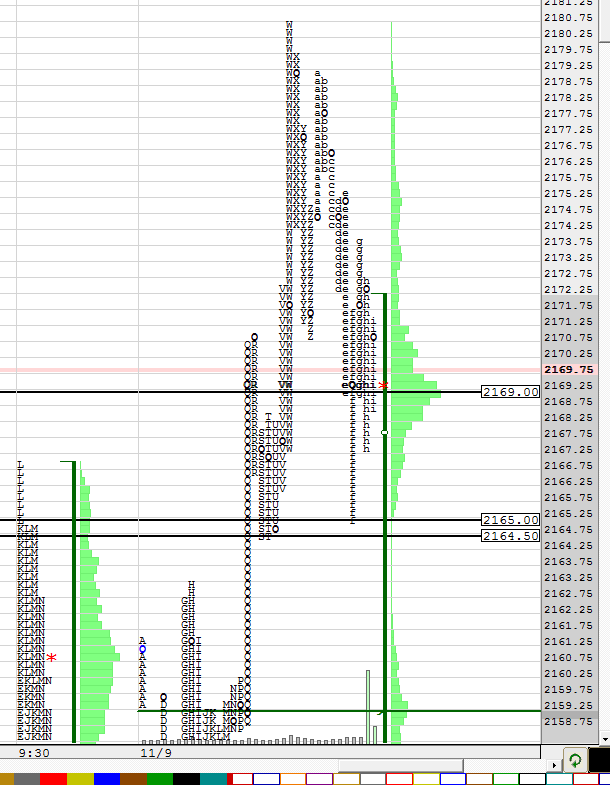

edit 4 ..and finally look at the 69 in the overnight...all the volume ( green horizontal histogram) is building there

and last but not least is some context

edit...first the upper portion of Wednesdays trade with key areas from that.....let me say this..... HUGE VOLUME yesterday with only the nq slightly behind but AD line is also still diverging...so we've had three higher highs in price but three lower lows in ad line.....

edit 2 ...a view of the profile from 9-6 thru 9-8 ..note the perfect bell center on 9-8 and that is why I took premarket short

statistically we will hit either the R1 or the pivot number today and get that right over 96% of the time.....today's pivot is way down at 2148.75 and R1 is up at 2178.75...59 will be the deciding factor to determine which one of those we get....so far price will be opening much closer to the 78.75 so anyone buying will be using that 73.75 - 75 area as a caution area on the way to the R1 if price happens to go that way.....no midpoint test yesterday too

edit 3 : if you are looking to add another line to watch it would be this one at 69.75 from 9-22 trade

edit 4 ..and finally look at the 69 in the overnight...all the volume ( green horizontal histogram) is building there

and last but not least is some context

starting new shorts at 70.25 but plan is to work that 73.75 - 75 area if they push it up quick in RTH so keeping second O/N trade small just in case..... ...expecting midpoint to print of overnight in rth today and YD's highs to be retested.....I'm letting all longs go....if we opened lower that I would have rethought long ideas

plan is to try for 66.75 as a first target as long as we don't end up trading to the 73-75 zone before that hits...

starting RTH core at 72.75 and will target OR high at 70.25...

what I don't want to see as we approach that 73 - 75 is a bigger VOLUME one minute bar then first bar of the day...that would decrease odds of OR high test

took loser at 74.25.....will try again at 78 - 80 zone and then if wrong on that one too I'll realize that today is a clunker and I'm on the wrong side..target on shorts will be 75...amazing how usually my exit on failed trades becomes target on additional trades...or at least in that area...so starting again at 78 but small and will add above 80 on this campaign...overnight high goes well with R1 today

revising first target to 75.25

coming out heavy at 75.25 to get clean on the day with other RTH loser......I keep track of On trades differently than day session...trying to hold 2 contracts but realize that it seems more likely to go get R1 and the O/N high...so if I can see something I may reverse to long side with a small position and the low volume area at 74 would be the place to see something happen if it is going to......basically can they hold trade above the center of the bell curve from 9-8 trade ?

see that was a blow through trade..they broke right through that 73.75 as if it wasn't there...so they needed to come back to test it.....so this is a big area now and will decide if they get the O/N high and R1 or back to OR and YD highs...gotta focus here..If i read it right then day session will go green on the day...I hope NOT to get the long signal in here and hope we can get back to OR high

scaling one at 70.25..that is OR high...need 73.75 to hold back rallies now in order to have a chance at YD's highs

a quick video of what I was seeing on the short up there

for those holding...in order for floor number stats to fulfill they actually have to trade at the price on the chart ...so far we missed the R1 ....so if you can and you think it's wise then try to hold for the offical pivot print...........good luck...c ay all on monday....cool day but tricky

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.