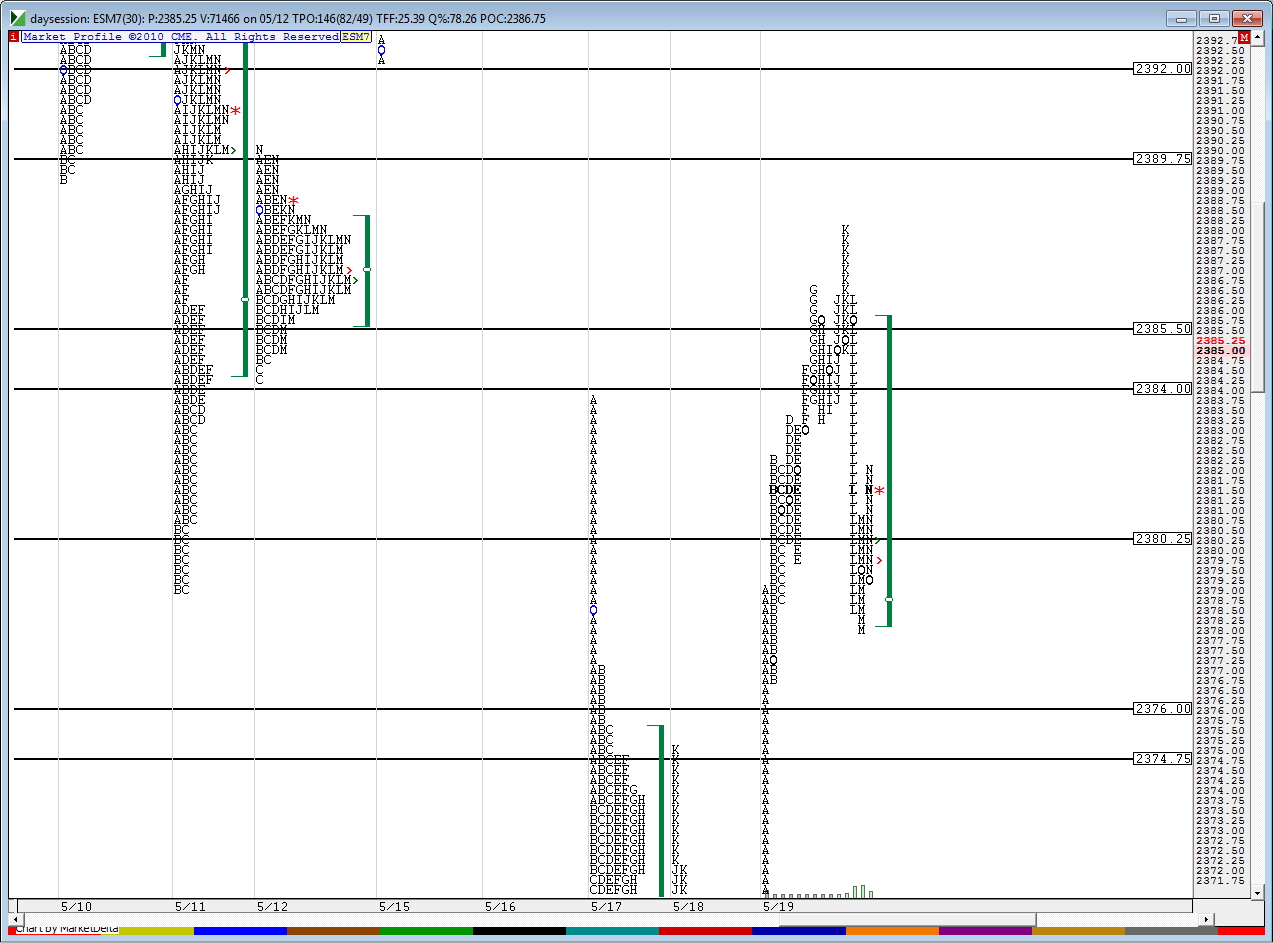

ES 5-22-19

In the process of making a second video.....options are only pricing in a 7.5 pt move as one standard deviation this morning....here are basic areas so far and my plan...starting small shorts in overnight at 84 even....looking to get back to 80 - 82 zone

some repetition but the bottom line for me is I will not be long this market early on if the midpoint of the overnight hasn't been tested. ....the best short areas to sell frm will be the 84 - 85 and then the 89.75 - 91 area...and watch the 74 - 75 on the downside if / when we retest that

here is hard copy...not much to say on weekly so didn't expand...remember options have 2388 area as a one SD move today so that adds some confluence to that zone up there

some repetition but the bottom line for me is I will not be long this market early on if the midpoint of the overnight hasn't been tested. ....the best short areas to sell frm will be the 84 - 85 and then the 89.75 - 91 area...and watch the 74 - 75 on the downside if / when we retest that

here is hard copy...not much to say on weekly so didn't expand...remember options have 2388 area as a one SD move today so that adds some confluence to that zone up there

filled the gap at 8725!

Originally posted by BruceM

upper gap in data filled...now how about they go get that 87.25 !!

yeah that was cool.....I hoping this market got too long.......I also know that the IB high or low will get broken today ...hoping it's the lows

t

t

Originally posted by stocksster

filled the gap at 8725!

Originally posted by BruceM

upper gap in data filled...now how about they go get that 87.25 !!

next target for me is the open print if they will give it

Ym is trying to lead the way out higher today and I never like longside when it does that...just doesn't make sense to me that 30 stocks are going to be more powerful then 500 but it does happen..Ym has not had a retest of the breakout from fridays high yet so I'm still sticking with short bias and haven't covered runners even with that poor high up there

I took one more off at 85.75....that is overnight high and just below open print and now we need to get under that and break that Ib low in order to have a shot at my final two targets which are 2383.50 and 2382 !...

at least the current POC is forming under Fridays highs.....we still have a shot for further downside even as the value area is now overlapping higher but is smaller than fridays so far.......still seems to me like they need to clean up Fridays profile more........I also said that about thursdays.....LOL......but Volume is way off today so this drive higher has to be looked at as suspicious anyway...I'm selling calls now on spy

Gap at 90.25

gap in the data at 90.25 short from 92.25

oopps...sorry stockster...didn't see your post

thes markets are out of synch....es makes new low and ym doesn't then es makes new highs without ym

I'm abandoning my plan to get short if/ when all these tops get broken.....for two reasons 1) it's too late in the day and 2 ) we had a selloff friday afternoon so I don't look for many things to repeat in the market....so expecting another selloff this late would go against probabilities for me....My calls sold are under water and will evaluate them tomorrow

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.