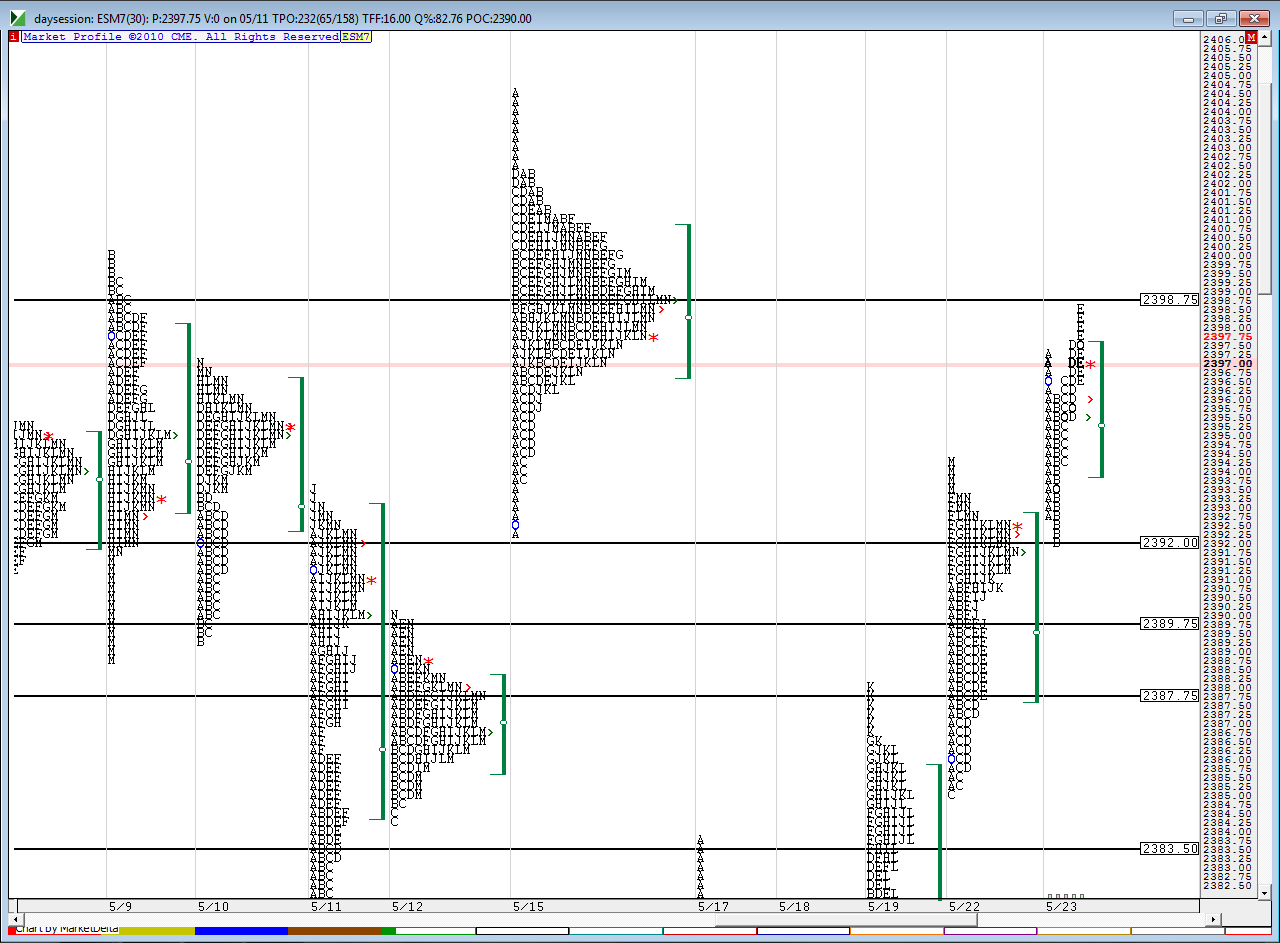

ES 5-23-17

my thoughts and that damn midpoint idea....will today be the third day in a row ??

vid 2 to expand on daily breakout points and how we tend to cluster around them...we also can see the good breakout from the 2374 area

another question to ask is how often do we fail at returning to the previous days close in a row ? This will be the third day in a row if we don't get back to it today

vid 2 to expand on daily breakout points and how we tend to cluster around them...we also can see the good breakout from the 2374 area

another question to ask is how often do we fail at returning to the previous days close in a row ? This will be the third day in a row if we don't get back to it today

came out on all runners at 92.75 print..that is one tic above settlement and just so close to midpoint too

there is official midpoint...congrats to any who held for that test....now we know that 95 % of the time they will get an overnight high or low so the midpoint is the dividing line. I think if we pop up from here and get out of yesterdays RTH high then the overnight high is in play but what I would like to see is continued selling for the overnight low so I can exit some calls that I sold yesterday.

not that you would need to have done this but for those who like to combine profiles here is 5 - 15 and 5 -16 and look at "E" period high so far today...once again volume is even lower then yesterday and I feel there are many legging into the short side

these well defined POC's usually do one of two things they get rejected and come back out of that days low so in this case it would actually be the lows of 5 - 16 or they tend to dawdle near the POC without much rejection, build tpo's and then pop out the highs....if that is the case then we would see new all time highs and soon....like today or tomorrow

edit: This should really have read one of three things and the third thing is that they blow through it as if it isn't there and then come back down to test them...in this case if we had blow through from below then I would have expected an attempted retest back down from the next resistance point above and then you would see if it would have held as support depending on what target was achieved during the blow through phase of the drive. Hope to explain more tomorrow

edit: This should really have read one of three things and the third thing is that they blow through it as if it isn't there and then come back down to test them...in this case if we had blow through from below then I would have expected an attempted retest back down from the next resistance point above and then you would see if it would have held as support depending on what target was achieved during the blow through phase of the drive. Hope to explain more tomorrow

I'm heading out and won't be checking on the market as I periodically do many days. I just want to draw your attention to the lows that formed on this current drive up at prices of 95.25 and 95.50...in general those weak intraday lows get tested...anyway for me I wouldn't get too bullish up here with those lows sitting in the market

Originally posted by BruceM

I'm heading out and won't be checking on the market as I periodically do many days. I just want to draw your attention to the lows that formed on this current drive up at prices of 95.25 and 95.50...in general those weak intraday lows get tested...anyway for me I wouldn't get too bullish up here with those lows sitting in the market

what do you mean weak intraday lows? what qulifies a weak or strong? thanks for your answer

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.