ES 7-31-17

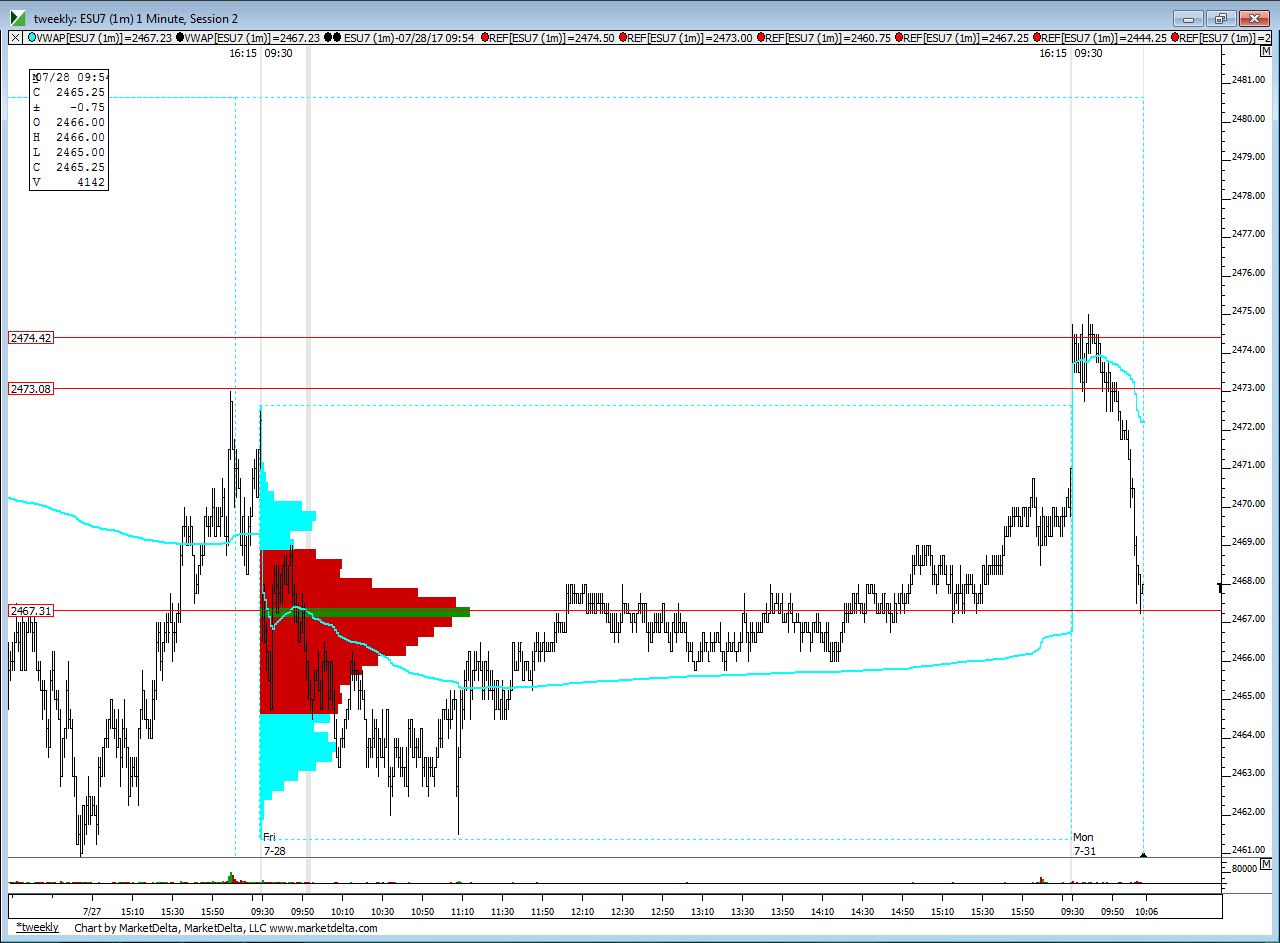

Confluence with Daily R1 at 73 - 74 area and then R2 at 77 - 78 this morning if you are trading early...will edit and post a video soon for those interested..keep in mind that friday was an inside balancing day so if breakout traders are going to show up then these are the type of days they like to run breakouts from.

edit : Lines I am working from today

what happened in the overnight and a weekly probability concept you shouldn't miss

as long as 2468 holds today then I am trading for trade that goes 5 points above the open print but will take something off at 2475.75..ideal day session longs will come from either the 70 - 71 area or that 67-68 ...aggressive traders can just get long in the overnight as long as we are two points or less under that 2475 target

edit : Lines I am working from today

what happened in the overnight and a weekly probability concept you shouldn't miss

as long as 2468 holds today then I am trading for trade that goes 5 points above the open print but will take something off at 2475.75..ideal day session longs will come from either the 70 - 71 area or that 67-68 ...aggressive traders can just get long in the overnight as long as we are two points or less under that 2475 target

I'm hoping we open and drop down first today...then I will sell put credit spreads with the expectation that we will try to drive at least 5 points above the weekly open before weeks end which will allow the option to decay

long bias on Es day trades this morning

I'm gonna have to be flexible and can't let the probabilities off weekly throw off price action/ order flow read...selling Spy put spread on dips down if they come and looking for longs in ES at 72 - 73 but keeping it small as this is NOT a fade trade and I am a fader !!!

if the weekly probability is going to work then we know at some point this week they will tag the POC from last week as it is within the 5 point range....meaning that 5 points above the open contains the POC .......so we may be delayed but I don't think we will be denied.....that is why the options are probably a better vehicle to use this idea with

I just sold the 246.5 puts....4 days to expiry on spy ...took a loser on ES as I was waiting for that 75.75 but price rolled over and stopped me out an OR low...missed short side completely ....will look for one more long in the 67 - 68 area..to target the 2470 and if lucky higher

how my favorite chart looks......this includes the Low Volume zone ( see Thursdays chart posted in Fridays thread ) and also the high time ( bell curve center ) from Friday's trade

revising target to 69.50

best fill is 70.50...trying to hold runners but not much ammo left as I came out heavy to make up for that first trade that was a small loser...

a bit unusual to just fall through a previous high like they did at Fridays high so far without coming back up for a retest...so I would be expecting 2471 to reprint today even if they push out the overnight low........i'd still be watching this 67 - 68 for clues .......and I'm hoping to find one more long trade......FWIW my options trade is so far a loser ..any long trade would first target 69.50 again and then try for Fridays highs......

starting small longs under overnight low at 66 even....first target if I can get something going will be 68.50 print......this is also a weekly VA low area so we need to be careful....daily players see the one time framing down

day trades are done for the day.. a bit of overtime today...we'll see where options are at at days end....still think Fridays high should get tested but as usual I want to get out sooner then later and don't want to be here all day...that 2470 print filled in single prints for those who were closely watching and wondering why that made a good target

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.