ES 8-2-17

not much to look at...just trying to still get out of my 46.5's and now my 46 puts ...video covers the rest which is not much..!

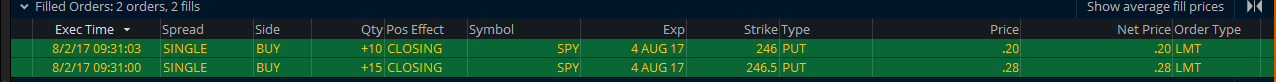

hard copy of the options as Jing cut off time stamp

hard copy of the options as Jing cut off time stamp

sure seems like 2475 is gonna be the big kahunna for today to watch

I closed my options on open...the time decay was significant enough to reach my profit objectives....so even though they haven't hit that weekly POC...yet , the trades made money...the 246.5 were sold for .48 just in case anyone forgets from Monday

a video on the Potential POC options trading system....full rules disclosed for $5,000 ( It's always 5 k) and optional signal service room for......."wait for it " , 5 k per year......don't wait order now....send cash , money order or Bitcoin to

Ron Co Options

5K Rip me off drive

EZ-Town, VT 50000

but wait here is a special bonus to help you look your best

and here is a review of the options POC on the weekly and the real point of this post

Ron Co Options

5K Rip me off drive

EZ-Town, VT 50000

but wait here is a special bonus to help you look your best

and here is a review of the options POC on the weekly and the real point of this post

Great vid Bruce, I am trading something similar as well, using weekly SPY pivot point instead of POC.

I notice you are using /ES data to trade SPX or SPY?

Any particular reason?

Thanks,

Mike

I notice you are using /ES data to trade SPX or SPY?

Any particular reason?

Thanks,

Mike

no particular reason except I like the fills on SPY and I have very limited experience with ES options. Spx is a bit scary and fills don't come in as well..so don't trade them too often....I'm also too frugal to subscribe to more data on my IB data that feeds my Market Delta program....otherwise I would probably just use SPY......perhaps when I have more time I will use TOS and see what kind of weekly POC's it kicks off on SPY data....the problem there is they use continuous contract data but maybe that will turn out to be a good thing

Originally posted by Big Mike

Great vid Bruce, I am trading something similar as well, using weekly SPY pivot point instead of POC.

I notice you are using /ES data to trade SPX or SPY?

Any particular reason?

Thanks,

Mike

Thanks

Originally posted by BruceM

no particular reason except I like the fills on SPY and I have very limited experience with ES options. Spx is a bit scary and fills don't come in as well..so don't trade them too often....I'm also too frugal to subscribe to more data on my IB data that feeds my Market Delta program....otherwise I would probably just use SPY......perhaps when I have more time I will use TOS and see what kind of weekly POC's it kicks off on SPY data....the problem there is they use continuous contract data but maybe that will turn out to be a good thingOriginally posted by Big Mike

Great vid Bruce, I am trading something similar as well, using weekly SPY pivot point instead of POC.

I notice you are using /ES data to trade SPX or SPY?

Any particular reason?

Thanks,

Mike

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.