ES 8-16-17

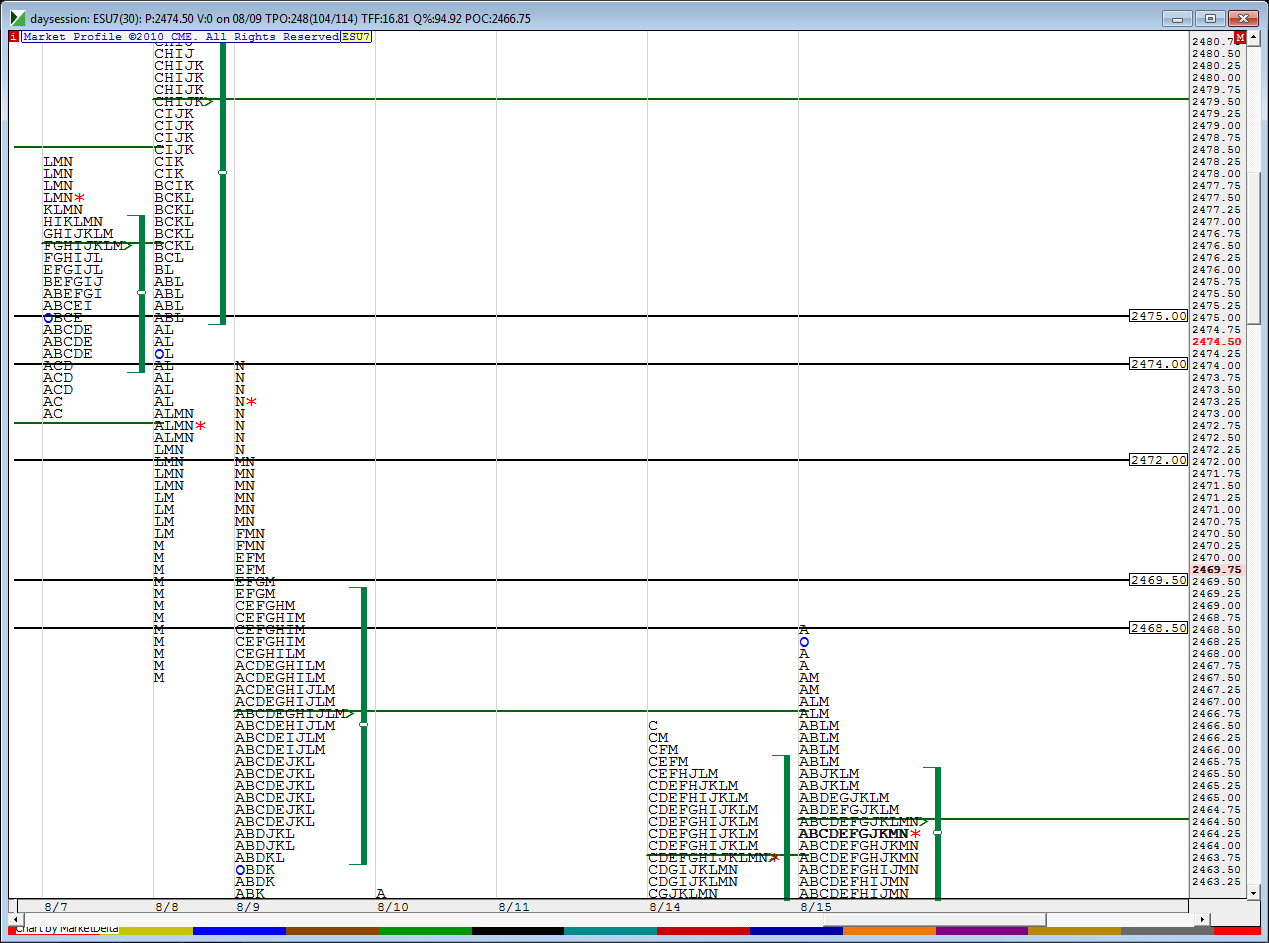

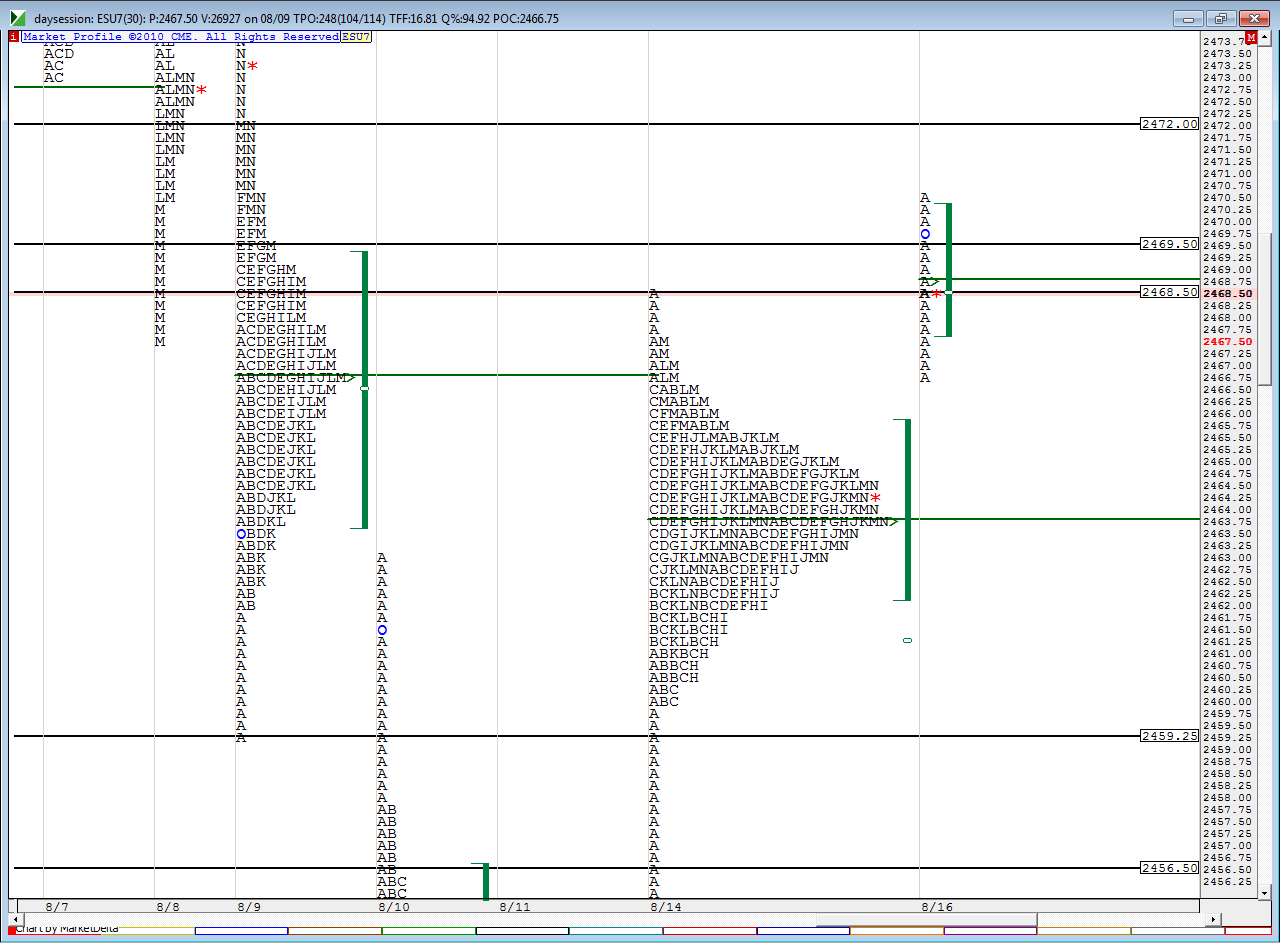

I'm trading for the overnight midpoint again today from 69.50 and higher ...I have broken down and refined my areas a bit from yesterday but in general we have a range of prices that extends from 2472 - 2475 as the key upper zone ( yesterday I think I had it incorrect at 73 - 75 ) with the 69.50 as a value area high...we also have a two day balance so shorts will have to get under that ( 68.50 - 69.50 ) and start pushing towards the 2464 magnet...will start small in On session and will watch O/N high closely today ...here are my lines

an how can we forget the King - 40 years ago today....I was on vacation with my parents in California.......Luckily for me THEY are both still alive and my mom is the same age as Elvis would have been...she reminds me of that and was the one that turned me on to him...

https://www.youtube.com/watch?v=vWVgLLnGaWs

This is a classic !!!!

an how can we forget the King - 40 years ago today....I was on vacation with my parents in California.......Luckily for me THEY are both still alive and my mom is the same age as Elvis would have been...she reminds me of that and was the one that turned me on to him...

https://www.youtube.com/watch?v=vWVgLLnGaWs

This is a classic !!!!

scaling heavy at two points off fill as I added at open

hoping this second dip into yesterday range can get midpoint ...on second short campaign now

.note single prints that are nearby midpoint from overnight...so u need to be careful when we get one or two tics from Overnight midpoint and we have overnight singles at the same spot

for those who like to merge profiles, u can see how well defined Monday and tuesdays trading is and how we have a bell curve with 64 - 65 as the center....so we are battling the upper edge this morning... and If I had to pick one number it would be that 68.50....sellers want it to stay below and build time and buyers want the opposite

everyone may be waiting for 10:30 oil report...ugh!

in terms of structure we have poor lows yesterday and also look at the lows from 8-10 and 8-11....very poor......I'm losing money on calls sold and if we get a bullish close today then I plan to roll these out to next week.....we have yet to trade 4 - 5 points off opening print this week so far...I forgot to mention two things...69.50 is last weeks VA high so now we have two tpo's there and also we have FOMC minutes at 2 pm......

hoping for a pop up post report to look for further sells and then target a retest of 68.50....it's just too perfect how they stopped at that point during this 30 minute period so far...ideally a push out of 71 - 72 would be nice

so far no follow through of the break of the Ib or overnight high...I'm targeting half back at 69 but also mindful of the fact we are one time framing up...so nothing crazy for me up here

monthly developing poc is 2472.75 so that falls right in our 72 - 75 window....this is taking a long time to go nowhere and volume is tapering off as we try to go up...hoping that is good for those calls sold.....eventually......I'm more concerned with those calls then day trades now !

big mike...I left a message for ya on the end of YD's thread...basically wondering how you manage trades done in overnight.....not sure if you are a night owl or use automated contingent orders

Missed your question Bruce sorry. No night owl here that's for sure. I put on a bracket order to get stopped in at my price (59.75). Target was set at 51.75 limit, and stop set at 66.75.

No managing, either I'm a loser, winner or when I wake up it's somewhere in between. IF I get stopped in.LOL I've found there is nearly always a lower low made on the daily chart every week that's good for some $$. If there is no lower low, I don't get picked up. No stats on it, I wish I could have a way to do the numbers easily but I'm more visual.

No managing, either I'm a loser, winner or when I wake up it's somewhere in between. IF I get stopped in.LOL I've found there is nearly always a lower low made on the daily chart every week that's good for some $$. If there is no lower low, I don't get picked up. No stats on it, I wish I could have a way to do the numbers easily but I'm more visual.

Originally posted by BruceM

big mike...I left a message for ya on the end of YD's thread...basically wondering how you manage trades done in overnight.....not sure if you are a night owl or use automated contingent orders

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.