Collective2 - Six Sigma Trading

Original title for this thread: Zero losses year to date - eminis

Our trade system has produced only positive trades year to date with an estimated 14% return. Data guaranteed.

sixsigmatrading.com (site currently not available)

Our trade system has produced only positive trades year to date with an estimated 14% return. Data guaranteed.

sixsigmatrading.com (site currently not available)

sst: Your system is showing impressive returns but is a high risk high reward system. It is what I would call a wipe-out system. At some point it is going to wipe itself out. This is because the stops appear to be excessively large - in fact I still cannot ascertain the size of the stops by looking at the historical trades.

The collective2 system shows that the drawdown and risk on one of your trades was extreme and on 2 of the trades was very high and on another 2 trades was high. These are 5 trades with drawdown and risk of high or worse out of 18 trades so over 25% of the trades have this high, very high, or extreme risk profile.

You are averaging down your positions and with systems such as this it is usually just a matter of time until you've averaged in all of your allowable margin and the market just continues to go against you and that's the end of your account and system.

I would love to hear pt_emini's comment on your equity profile because he often has some very astute observations about this sort of thing.

Of course I may be wrong and the risk is not as high as I think it is and I welcome your comments to explain why this is so or why this system has a better risk/reward profile than I perceive it to have. No matter what I wish you the best of luck with it and please keep us posted and up-to-date with its progress.

The collective2 system shows that the drawdown and risk on one of your trades was extreme and on 2 of the trades was very high and on another 2 trades was high. These are 5 trades with drawdown and risk of high or worse out of 18 trades so over 25% of the trades have this high, very high, or extreme risk profile.

You are averaging down your positions and with systems such as this it is usually just a matter of time until you've averaged in all of your allowable margin and the market just continues to go against you and that's the end of your account and system.

I would love to hear pt_emini's comment on your equity profile because he often has some very astute observations about this sort of thing.

Of course I may be wrong and the risk is not as high as I think it is and I welcome your comments to explain why this is so or why this system has a better risk/reward profile than I perceive it to have. No matter what I wish you the best of luck with it and please keep us posted and up-to-date with its progress.

It is incorrect to assume that a particular method will ultimately lead to failure. The key to any successful method is the ability to manage a trade appropriately by using any method available. Just because one uses stops does not mean you cannot ding yourself to death with a number of small losses that accumulate. Likewise, the use of averaging does not always lead to a wipe out. Systems fail because because the management technique is ineffective.

Six Sigma does not have that problem. It is a system that breathes with the market as it rises and falls and is thus able to adapt to changing conditions. Sometimes it uses stops, and sometimes it does not. Even when it does use stops, they are not a rigid standard but rather can vary in size. Sometimes it averages in and sometimes it does not. With every passing moment, the market changes character and because of this, there are right times and wrong times to use each type of safety method. Six Sigma is able to identify each scenario and move with the market to optimize each trade. The end result is a highly successful system. The goal is positive growth and how that happens in between is irrelevent as long as the trade is managed effectively and with a limited risk factor to the account overall.

I noticed the risk factor collective 2 associated with a few of the trades, however, you will also note that each of those trades still produced a profit and in two of those cases, the profit was high. The account has never experienced a drawdown greater than just over 5%. C2 applies a rigid code of statistics to assess risk factor but it cannot assess the risk factor of a strategy within a system which is not known nor can it assess risk associated on a time scale or by trade management.

I guarantee you will find no other system like Six Sigma and I also guarantee it will never wipe itself out. The current pattern of successs should hold given the high quality control of trading that is used within the system.

It certainly sounds fascinating and I hope that it succeeds. I noticed one of your comments "Sometimes it uses stops, and sometimes it does not." which is not strictly accurate. All systems use stops, the ultimate stop is the size of the account. Even Warren Buffett and Bill Gates don't have enough money to trade without stops - granted that it will take a long time for them to wipe out an account but there is always a stop - whether you want it or not.

I was just looking at the trades for August and notice that one of your trades was entered at 3:15 in the morning:

BTO 5 @ESU6 1268.00 8/10/06 3:17 STC 5 1268.50 8/10/06 11:42

...and then closed out at 11:42 on the same morning with a $1,375 drawdown and a $125 profit.

What is the practicality of this system? How many people following and using the system can get signals at that time of the morning and act on them? Sure, if you live in Europe you can get them but then you're going to miss out on other signals if they're issued on a twenty-four hour basis.

This is not a criticism of the system because if that's a requirement then that is what you have to do. But if you're selling the signals on Collective2 as you are then you cannot target the average stay at home day trader who would usually just trade the liquid part of the day from 09:30 to 16:15 EST because they would not be able to get those signals. At this point you need to target larger trading organizations or teams of traders who are watching for signals 24 hours a day. With your system this can be expensive if you are only issuing 4 signals a month like there have been this month.

This would also lend itself to a broker based and automated subscription service where you dump your cash with a broker and they execute the signals for you. Have you thought about that?

How many subscribers do you have on Collective2 for Sigma Six?

BTO 5 @ESU6 1268.00 8/10/06 3:17 STC 5 1268.50 8/10/06 11:42

...and then closed out at 11:42 on the same morning with a $1,375 drawdown and a $125 profit.

What is the practicality of this system? How many people following and using the system can get signals at that time of the morning and act on them? Sure, if you live in Europe you can get them but then you're going to miss out on other signals if they're issued on a twenty-four hour basis.

This is not a criticism of the system because if that's a requirement then that is what you have to do. But if you're selling the signals on Collective2 as you are then you cannot target the average stay at home day trader who would usually just trade the liquid part of the day from 09:30 to 16:15 EST because they would not be able to get those signals. At this point you need to target larger trading organizations or teams of traders who are watching for signals 24 hours a day. With your system this can be expensive if you are only issuing 4 signals a month like there have been this month.

This would also lend itself to a broker based and automated subscription service where you dump your cash with a broker and they execute the signals for you. Have you thought about that?

How many subscribers do you have on Collective2 for Sigma Six?

There must be some error in the timing reported because I am not even awake at 3am in the morning. All trades are generally posted during the trading day, but might extend to maybe an hour before to maybe 2 hours after market close. Some signals are GTC though which means they can be executed in the morning hours if that's when targets are met, but the signal itself is released much earlier. Almost all (with only a few exceptions) executions are during normal trading hours as well though.

The system should work with either an automated plan or manually and there is no need to watch 24 hours a day. I have been contacted by several institutions with interest. Subscriber numbers are private, but they are slowly coming in with only 1 cancelation so far and that was because they wanted something more intraday based whereas I do both intraday and extended hold.

The system should work with either an automated plan or manually and there is no need to watch 24 hours a day. I have been contacted by several institutions with interest. Subscriber numbers are private, but they are slowly coming in with only 1 cancelation so far and that was because they wanted something more intraday based whereas I do both intraday and extended hold.

quote:

Originally posted by day trading

I was just looking at the trades for August and notice that one of your trades was entered at 3:15 in the morning:

BTO 5 @ESU6 1268.00 8/10/06 3:17 STC 5 1268.50 8/10/06 11:42

...and then closed out at 11:42 on the same morning with a $1,375 drawdown and a $125 profit.

What is the practicality of this system? How many people following and using the system can get signals at that time of the morning and act on them? Sure, if you live in Europe you can get them but then you're going to miss out on other signals if they're issued on a twenty-four hour basis.

This is not a criticism of the system because if that's a requirement then that is what you have to do. But if you're selling the signals on Collective2 as you are then you cannot target the average stay at home day trader who would usually just trade the liquid part of the day from 09:30 to 16:15 EST because they would not be able to get those signals. At this point you need to target larger trading organizations or teams of traders who are watching for signals 24 hours a day. With your system this can be expensive if you are only issuing 4 signals a month like there have been this month.

This would also lend itself to a broker based and automated subscription service where you dump your cash with a broker and they execute the signals for you. Have you thought about that?

How many subscribers do you have on Collective2 for Sigma Six?

When you say that the system should work an automatic plan, how is it automated?

For example, say I was at work every day and could only check the system in the evenings. Could I still trade the system? If so, how would I do it?

For example, say I was at work every day and could only check the system in the evenings. Could I still trade the system? If so, how would I do it?

If you sign up for the system signals through www.collective2.com, they have software written that works with select brokers which automatically trades the signals. Thus, if you choose to have it automated, when Six Sigma releases a trade signal, it will go straight to your broker account and get executed or go GTC if it is waiting for a target price.

You can read more about the automated system at the collective2 site and how it works. I only release the signals.

You can read more about the automated system at the collective2 site and how it works. I only release the signals.

quote:

Originally posted by day trading

When you say that the system should work an automatic plan, how is it automated?

For example, say I was at work every day and could only check the system in the evenings. Could I still trade the system? If so, how would I do it?

Thanks sst!

Since I last looked at this system I see that they have had 7 losses out of 52 trades for a win percent of 86.5%. This is an impressive win percent but I still think that this is an exceptionally dangerous system that is just waiting to blow up because of the size of the stops that they allow the system to take.

For example, the average win is $2,894 while the average loss is $8,240.

Looking at the trades there is one in particular that stands out which is their biggest loss from 9/12/06 10:19 to 12/14/06 10:31 the draw down was $32,315 which represented 16.8% of the account.

The annualized return on this system is 93.45% which is phenomenally good but I can't see that lasting.

100% / 16.8% is 5.95. In other words it only takes 6 extreme losing trades in a row to wipe out the account. All systems have their winning and losing streaks and if this one hits a losing streak and has 6 losers in a row and each is allowed to lose $32,315 then the account is no longer there.

pt_emini: I consider you a good judge of the sustainability of a system. Would you agree with my analysis or am I going over the top? I'm interested in anybody's comments about my opinion. Am I being overly risk averse with my outlook here or reasonable?

For example, the average win is $2,894 while the average loss is $8,240.

Looking at the trades there is one in particular that stands out which is their biggest loss from 9/12/06 10:19 to 12/14/06 10:31 the draw down was $32,315 which represented 16.8% of the account.

The annualized return on this system is 93.45% which is phenomenally good but I can't see that lasting.

100% / 16.8% is 5.95. In other words it only takes 6 extreme losing trades in a row to wipe out the account. All systems have their winning and losing streaks and if this one hits a losing streak and has 6 losers in a row and each is allowed to lose $32,315 then the account is no longer there.

pt_emini: I consider you a good judge of the sustainability of a system. Would you agree with my analysis or am I going over the top? I'm interested in anybody's comments about my opinion. Am I being overly risk averse with my outlook here or reasonable?

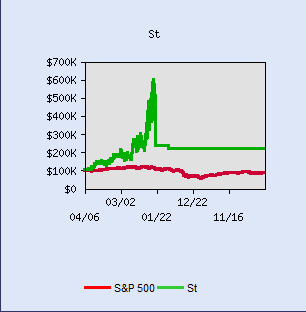

Been awhile since I have been here. Just posting an update. Six Sigma has been monitored at www.collective2.com for almost a year now.

http://www.collective2.com/cgi-perl/systems.mpl?session=16869265732880569377771735041267292&want=publicdetails&systemid=19460736

All trades are posted and recorded. Saw someone made a comment about a large drawdown from last year. One has to understand that this is a dynamic system that plays both sides of the market. During the course of that particular drawdown, there were a number of opposing trades made as well. When the large drawdown position in question was closed, the equity curve was actually making new highs at the time, thus erasing any negatives from the drawdown trade. There is a lot more than meets the eye to this system so be sure to examine all past trades for a better guide as often, a single trade won't tell the whole story.

Thanks for looking. Feedback welcome.

http://www.collective2.com/cgi-perl/systems.mpl?session=16869265732880569377771735041267292&want=publicdetails&systemid=19460736

All trades are posted and recorded. Saw someone made a comment about a large drawdown from last year. One has to understand that this is a dynamic system that plays both sides of the market. During the course of that particular drawdown, there were a number of opposing trades made as well. When the large drawdown position in question was closed, the equity curve was actually making new highs at the time, thus erasing any negatives from the drawdown trade. There is a lot more than meets the eye to this system so be sure to examine all past trades for a better guide as often, a single trade won't tell the whole story.

Thanks for looking. Feedback welcome.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.