Wolfe Wave

Search Dictionary

Definition of 'Wolfe Wave'

A Wolfe Wave is a predictive pattern used in technical analysis. It is said to be present in all securities markets and all time frames. Because Wolfe Waves rely on time as one component it may not be as reliable when using it on a non-time based chart, such as a tick, volume, or range chart.

The Wolfe Wave is named after Bill Wolfe and Brian Wolfe who say that they "discovered it, and did not invent it."

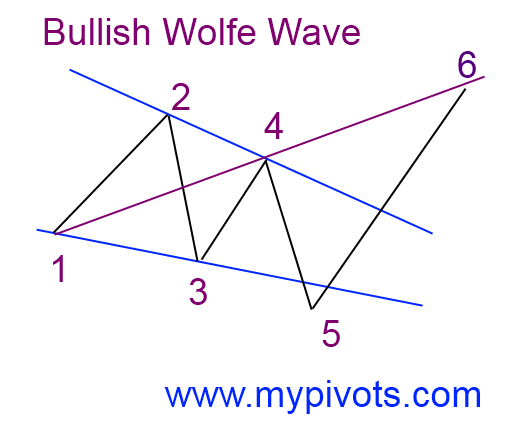

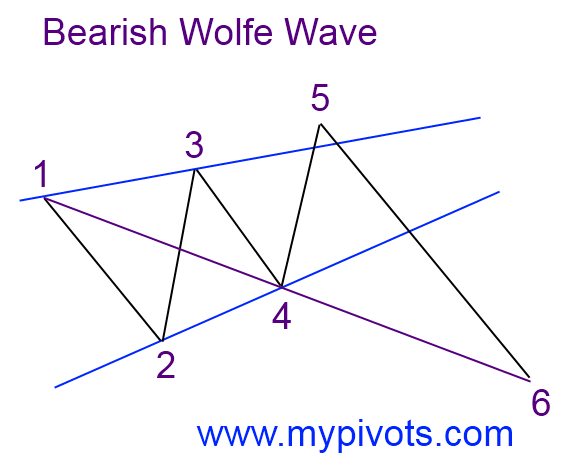

In its most simplistic terms the Wolfe Wave pattern consists of five waves with the fifth wave extending beyond the equilibrium line. Traders will then extrapolate a line from wave 1 to beyond wave 4 in order to ascertain a predictive price at point 6.

Wolfe Waves have the following characteristics.

The Wolfe Wave is named after Bill Wolfe and Brian Wolfe who say that they "discovered it, and did not invent it."

In its most simplistic terms the Wolfe Wave pattern consists of five waves with the fifth wave extending beyond the equilibrium line. Traders will then extrapolate a line from wave 1 to beyond wave 4 in order to ascertain a predictive price at point 6.

Wolfe Waves have the following characteristics.

- Points three and four should stay within the channel created by one and two.

- The symmetry of waves one to two is the same as waves three to four.

- Wave (point) four is within the channel created by waves one to two. There is regular time between all waves. (This is why tick, volume and range charts may not produce accurate Wolfe Waves.)

- Wave five goes pass the channel created by waves one and three and is the trade entry signal.

Do you have a trading or investing definition for our dictionary? Click the Create Definition link to add your own definition. You will earn 150 bonus reputation points for each definition that is accepted.

Is this definition wrong? Let us know by posting to the forum and we will correct it.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.