Single Prints Forward Test - July 2005

This test is a continuation of the June strategy which lost just under 12% in that month. Here is a link to the June 2005 strategy.

The same rules will apply to this month as for June.

The same rules will apply to this month as for June.

1 July 2005: Update

Market opened on a single print but this was above where the limit order would have been for a short so no trade.

Market opened on a single print but this was above where the limit order would have been for a short so no trade.

5 July 2005: Update

5 single prints were created today which is the most I've ever seen created in a market. It lead me to the question: What is the maximum number of single prints that can be created in a single session? I believe that the answer is 1 less than the number of brackets in the session because you need at least 2 brackets to create the first single and then each bracket after that could create a single. So in the case of the ER2, we trade from 09:30 to 16:15 EST which gives us 14 brackets (if my math is correct) and so a maximum of 13 single prints could be created in one day.

Of those 5 single prints created one of them triggered a trade which was stopped out at a loss of $210.

The Single Print spreadsheet has been updated.

Cumulative loss: $210

5 single prints were created today which is the most I've ever seen created in a market. It lead me to the question: What is the maximum number of single prints that can be created in a single session? I believe that the answer is 1 less than the number of brackets in the session because you need at least 2 brackets to create the first single and then each bracket after that could create a single. So in the case of the ER2, we trade from 09:30 to 16:15 EST which gives us 14 brackets (if my math is correct) and so a maximum of 13 single prints could be created in one day.

Of those 5 single prints created one of them triggered a trade which was stopped out at a loss of $210.

The Single Print spreadsheet has been updated.

Cumulative loss: $210

6 July 2005: Update

One new single print which was filled and triggered a trade.

2 single prints from previous session also trigered trades so 3 single print trades in total today: 2 partial winners and 1 loser.

What is interesting to note is the the 2 partial winners moved to at least 2 points in profit for a total gain of 4 points while the loser closed out at a loss of 1 point. These are the sort of results we can work with. The $ profitability is not good because we only take off 1 contract at the first (2 point profit target).

Total profit for the day was $170.

The Single Print spreadsheet has been updated.

Cumulative monthly loss: $40

(Loss is pure commission at this point.)

One new single print which was filled and triggered a trade.

2 single prints from previous session also trigered trades so 3 single print trades in total today: 2 partial winners and 1 loser.

What is interesting to note is the the 2 partial winners moved to at least 2 points in profit for a total gain of 4 points while the loser closed out at a loss of 1 point. These are the sort of results we can work with. The $ profitability is not good because we only take off 1 contract at the first (2 point profit target).

Total profit for the day was $170.

The Single Print spreadsheet has been updated.

Cumulative monthly loss: $40

(Loss is pure commission at this point.)

7 July 2005: Update

Market opened below singles removing them from the equation.

Market created 2 new singles which both triggered long trades. Both trades closed profitably.

Total profit for the day was $610.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $570

Market opened below singles removing them from the equation.

Market created 2 new singles which both triggered long trades. Both trades closed profitably.

Total profit for the day was $610.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $570

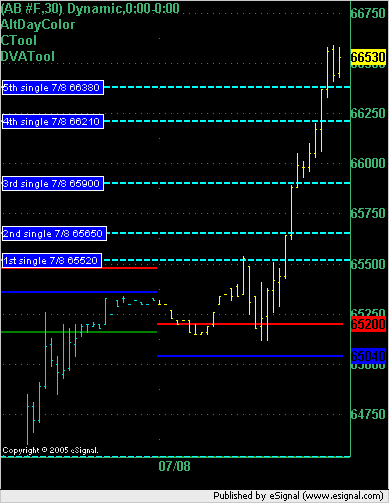

8 July 2005: Update

5 new single prints created. No single print trades triggered.

Today's Market Profile Graphic

5 new single prints created. No single print trades triggered.

Today's Market Profile Graphic

11 July 2005: Update

Market created 2 new singles which both triggered long trades. One winner (1st single created) and one loser (2nd single created). This is classic Single Print theory. The first single to be created (if more than 1 is created during the day) is the one that is most likely to hold.

Total profit for the day was $340.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $910

Market created 2 new singles which both triggered long trades. One winner (1st single created) and one loser (2nd single created). This is classic Single Print theory. The first single to be created (if more than 1 is created during the day) is the one that is most likely to hold.

Total profit for the day was $340.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $910

12 July 2005: Update

Market created 1 new single print which triggered a long trades which was stopped out.

Total loss for the day was $210.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $700

Market created 1 new single print which triggered a long trades which was stopped out.

Total loss for the day was $210.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $700

13 July 2005: Update

Market created 1 new single print which triggered a short trade.

Total profit for the day was $390.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $1,090

Market created 1 new single print which triggered a short trade.

Total profit for the day was $390.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $1,090

14 July 2005: Update

[*EDIT*] Correction: This posting has been correct and another (previously missed) single traded added.[*EDIT*]

Market created 2 new single prints. One of those single prints triggered a short and the other will carry forward to tomorrow as the only single print above us. A long single print trade was also triggered today and ran in parallel with the short single. Both were profitable.

Total profit for the day was $770.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $1,860

[*EDIT*] Correction: This posting has been correct and another (previously missed) single traded added.[*EDIT*]

Market created 2 new single prints. One of those single prints triggered a short and the other will carry forward to tomorrow as the only single print above us. A long single print trade was also triggered today and ran in parallel with the short single. Both were profitable.

Total profit for the day was $770.

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $1,860

15 July 2005: Update

1 single print trade gets stopped out at loss of $210

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $1,650

1 single print trade gets stopped out at loss of $210

The Single Print spreadsheet has been updated.

Cumulative monthly profit: $1,650

As mentioned 3 days ago, I'm not going to pursue this forward testing journal anymore. It is my opinion that Single Prints do indeed give you enough of an edge to make them a viable strategy.

I believe that this strategy can be improved by adding filters and improving the money management once a trade has been entered. I think that the money management has a lot of room for improvement.

I will be working with my Back Tester program to try and optimize what filters need to be used with Single Prints to make this strategy most effective as well as improved money management techniques.

Good luck to anybody else following this strategy and keep me posted on any results that you think might be interesting to follow up on.

Regards,

Guy Ellis

I believe that this strategy can be improved by adding filters and improving the money management once a trade has been entered. I think that the money management has a lot of room for improvement.

I will be working with my Back Tester program to try and optimize what filters need to be used with Single Prints to make this strategy most effective as well as improved money management techniques.

Good luck to anybody else following this strategy and keep me posted on any results that you think might be interesting to follow up on.

Regards,

Guy Ellis

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.