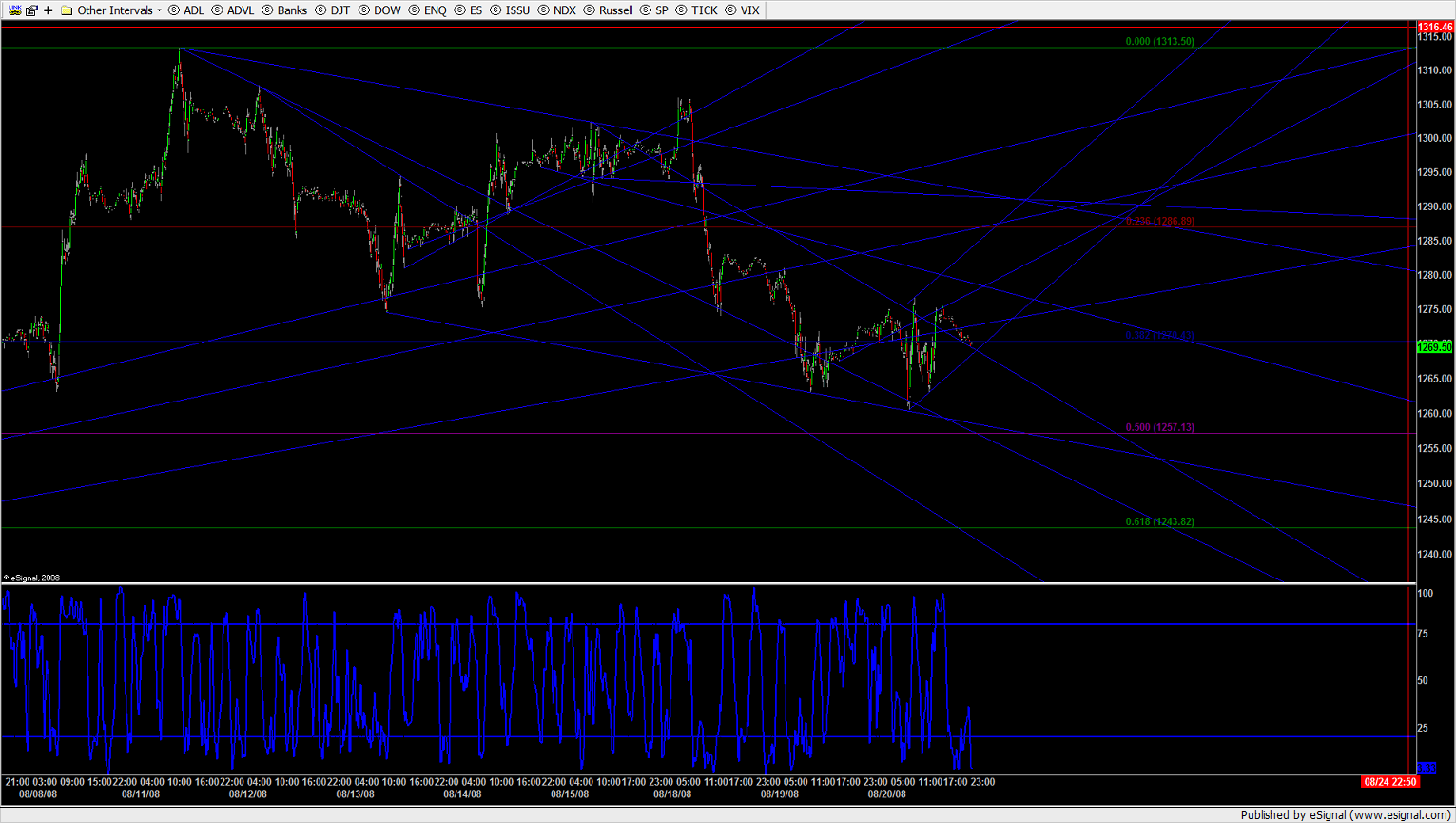

ES 8-21-08

That is no bull 4th wave. I think it's the 5th wave of the bear hell-bent on reaching 54, and winning it. The bull baseline is toast, but they began to form another. I want to see the action at 68 before I make a decision. If 68 is lost there's nothing in the way of bears. In fact I do believe this 5th wave is trying to throw-over 57, its own channel. If so a measured .618 correction of the entire run to 1243 seems likely. Which at the end of it will either be the beginning of a bonifide bull 3rd impulse to correct 1441 or the continuation of the bear market.

Sounds like a plan, Joe; we should do that. That'll be my next windy post. I look forward to your take on MP range type days. It'ld be most appreciated.

What makes this leg hard to anticipate is that both buyers and sellers own it. There isn't a measured move in and among it.

popstocks,

There's never one thing to watch, its Market Profile, Watch first hour, how did the markets open? Has anything changed since 4:00 yesterday? Today we opened within yesterdays value (thats the area where 70% of the markets activity yesterday was)So Popstocks since we opened within value we take the low at 9:30 which was obvious about a half hour later and add yesterdays range 16.75 points putting the high today at 77-79ish give 10%. And looking at the last three days were not going anywhere until new price's are not only traded but accepted. So buy low...sell high, until a breakout...

I have been trading 10 years I started when I was 15, and have just recently found Market Profile charting, It help complment my stlye trading and charting. If your new, which I think I heard you say I strongly recommend getting mind over markets from Dalton, and get some kind of MP charting it'll teach you all you asked about, I wish I had found this out years ago.

There's never one thing to watch, its Market Profile, Watch first hour, how did the markets open? Has anything changed since 4:00 yesterday? Today we opened within yesterdays value (thats the area where 70% of the markets activity yesterday was)So Popstocks since we opened within value we take the low at 9:30 which was obvious about a half hour later and add yesterdays range 16.75 points putting the high today at 77-79ish give 10%. And looking at the last three days were not going anywhere until new price's are not only traded but accepted. So buy low...sell high, until a breakout...

I have been trading 10 years I started when I was 15, and have just recently found Market Profile charting, It help complment my stlye trading and charting. If your new, which I think I heard you say I strongly recommend getting mind over markets from Dalton, and get some kind of MP charting it'll teach you all you asked about, I wish I had found this out years ago.

quote:

Originally posted by BruceM

don't like the shorts up here today..all markets above high volume bars....no trade under first minute lows today so that is first sign for me that two sided traded is not happening as much as it should.....trying to fiqure out when they will get 82 area

Bruce; We have an untested value area above us @ 80.25 to 1302.75

& naked POC @ 1293.25 correct or am I behind the ?

Thanks for the advice CharterJoe, I am in the middle of Mind Over Markets still absorbing all of it. BruceM mentioned about the lack of trading below the lows of the first few minutes from open as a clue that there was not as much liquidity as usual, interesting point.

When and if we get to 80 I'm fading it GTC. I'm not on this train. It could reverse any second.

Volume just dried up a bunch...

I've a GTC limit in at 80.75. If I'm not filled, I'm not filled. If filled, 7 point stop. Targeting 68.

selling 1282.50 4 point stop

Filled.

Thanks RED..you are on top of it........we have some single near 90 too....93.75 is last months high so that is a good zone up top,,,,,

quote:

Originally posted by redsixspeed

quote:

Originally posted by BruceM

don't like the shorts up here today..all markets above high volume bars....no trade under first minute lows today so that is first sign for me that two sided traded is not happening as much as it should.....trying to fiqure out when they will get 82 area

Bruce; We have an untested value area above us @ 80.25 to 1302.75

& naked POC @ 1293.25 correct or am I behind the ?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.