ES 06-21-11

I thought that if I at least opened a thread about today, that others would post some things.

the gap today has created an island below because price opened inside the gap

Gap is 75.75 to 84.50, it was created by the down open on 6-15-11 and subsequently has never filled,

the open today gapped up, retreated to a low of 77.50, that leaves island style gap 77.50 down to 75.75.

I would expect small moves, and odds favor a fill of the ES lower ghap today.

I consider yesterday a trend day.

today (day following trend day) often has consolidation, intraday zigging and zagging.

Some one else can post something now.

the gap today has created an island below because price opened inside the gap

Gap is 75.75 to 84.50, it was created by the down open on 6-15-11 and subsequently has never filled,

the open today gapped up, retreated to a low of 77.50, that leaves island style gap 77.50 down to 75.75.

I would expect small moves, and odds favor a fill of the ES lower ghap today.

I consider yesterday a trend day.

today (day following trend day) often has consolidation, intraday zigging and zagging.

Some one else can post something now.

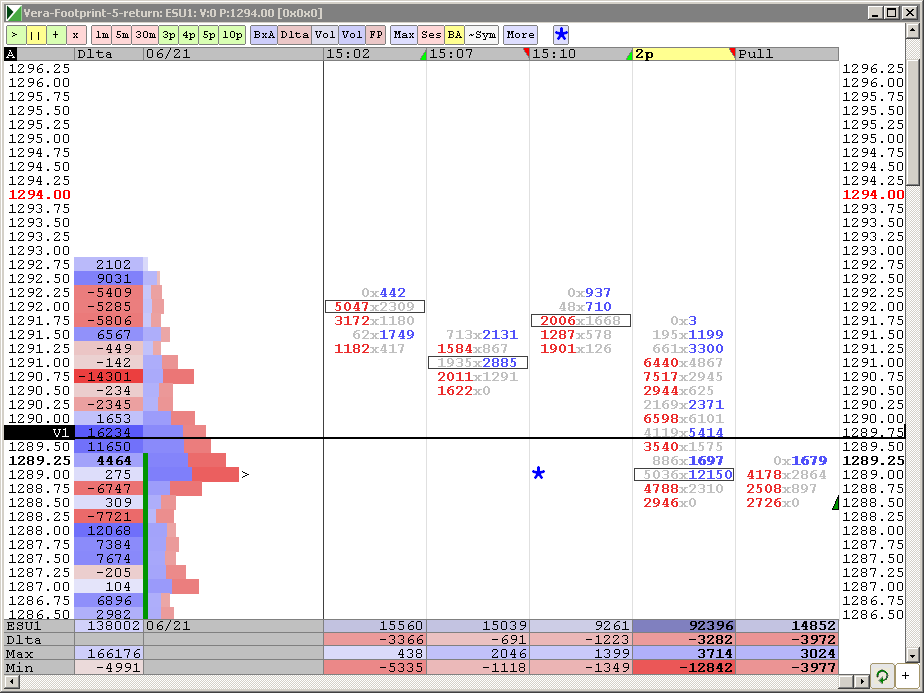

volume has tapered off and market is tryin to create the "p" formation...certainly doesn't mean it won't keep running higher but it will need CONTINUED volume to do that....bonds closing is tricky time...

this needs to work fast...I also don't like how last weeks highs has become support...

keeping this real tight and will not add.....

this needs to work fast...I also don't like how last weeks highs has become support...

keeping this real tight and will not add.....

BTW, volume came at 89.75,see chart above

moving target to 89.50...will not accept new highs now without exiting this trade

went flat at 91 even....just don't like that high..and those quads up there...good chance they will run em out

always frustrating to have a good read on the structure but some small thing shakes u out...still a nice visual on the upper bell pattern..( "P") pattern

look how beautiful that was ...if we use the 89.50 as the middle and the high volume then we have that 86.50 as the lower portion on the bell and 92.50 at the upper end.....3 points away on each side of 89.50..!

look how beautiful that was ...if we use the 89.50 as the middle and the high volume then we have that 86.50 as the lower portion on the bell and 92.50 at the upper end.....3 points away on each side of 89.50..!

looks like 88.5 trying to become key #, was the contract high since Sept became the current contract on Thurs June 9, was the high on that day

as per dalton:

"I’m only looking at the POC for the afternoon rather than the full day; when a market converts from trend to rotational I treat the rotational market as a separate day or auction."

makes sense to me...that's why I attempted those higher sells..

"I’m only looking at the POC for the afternoon rather than the full day; when a market converts from trend to rotational I treat the rotational market as a separate day or auction."

makes sense to me...that's why I attempted those higher sells..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.