Potential options strategy

Hi

Can you please tell me why this strategy sounds to good to be true? A person with two different trading accounts goes long and short a contract, at the same time, writes a covered call and a covered put. Then places a long order at the strike price (or just above) of the covered call option to protect loss against the short position. And place an order to go short at the strike price (or just below) of the covered put to protect against the long position. And if ever BOTH options get exercised, close out position completely.

It seems like a trader can just collect the money for the premiums with little to no risk to him/her. It appears to be a no lose situation. Can you tell me what I'm missing? Because if this were possible, it seems like everyone would be doing it. Thank you for your time.

Grasshopper

Can you please tell me why this strategy sounds to good to be true? A person with two different trading accounts goes long and short a contract, at the same time, writes a covered call and a covered put. Then places a long order at the strike price (or just above) of the covered call option to protect loss against the short position. And place an order to go short at the strike price (or just below) of the covered put to protect against the long position. And if ever BOTH options get exercised, close out position completely.

It seems like a trader can just collect the money for the premiums with little to no risk to him/her. It appears to be a no lose situation. Can you tell me what I'm missing? Because if this were possible, it seems like everyone would be doing it. Thank you for your time.

Grasshopper

GH,

Yes, with the exception of the 1800 and 1836.

The last two weeks were easy as the the previous 4 were straight down.

The system has to move so much because the cost of options is so high.

You can do it with SPY weeklys as well where atm is like $200 bucks.

QQQs (=NQ)are really cheap....like 80-100.

IWM (=RUT)

Anyway they all have the about the same probability (about 70%). I just use ES because it trades 24 hours and I don't miss any opportunities because the market is CLOSED? I wish it were open on Saturday!

People think making money in the market has to be complicated....its better to be simple.....

Each of the indices is at or near resistance for next week. But do it on paper and see for yourself.......Don't trust anyone, but don't be afraid either. Keep the risk fixed. Protection is built into a call......I think the capital required per call is like $300 bucks?

And have fun!

Yes, with the exception of the 1800 and 1836.

The last two weeks were easy as the the previous 4 were straight down.

The system has to move so much because the cost of options is so high.

You can do it with SPY weeklys as well where atm is like $200 bucks.

QQQs (=NQ)are really cheap....like 80-100.

IWM (=RUT)

Anyway they all have the about the same probability (about 70%). I just use ES because it trades 24 hours and I don't miss any opportunities because the market is CLOSED? I wish it were open on Saturday!

People think making money in the market has to be complicated....its better to be simple.....

Each of the indices is at or near resistance for next week. But do it on paper and see for yourself.......Don't trust anyone, but don't be afraid either. Keep the risk fixed. Protection is built into a call......I think the capital required per call is like $300 bucks?

And have fun!

Grednfer has described this type of option trade a little while back. There's more info on how he trades it and additional variations presented. Hope this is helpful. And Grednfer, you obviously can add to the whole of the info here (and the linked postings) and expand on what you think needs expanding or honing into ... when it comes to deliniating earlier what/how you'd approached getting out of a position and reestablishing it etc. for better understanding.

Here's the link: http://www.mypivots.com/board/topic/6646/2/what-to-choose-itm-options-or-direct-the-future#80359

I know that throughout the thread, the key emphasis was that "you know your risk" (what you paid for the options). But there's obviously more to it ... any potential variations on exiting position or reestablishing ... put on at Friday's close or wait until Monday or Tuesday to initiate the position ... "trading around it" with the futures contract etc.

Good discussion here!

MM

Here's the link: http://www.mypivots.com/board/topic/6646/2/what-to-choose-itm-options-or-direct-the-future#80359

I know that throughout the thread, the key emphasis was that "you know your risk" (what you paid for the options). But there's obviously more to it ... any potential variations on exiting position or reestablishing ... put on at Friday's close or wait until Monday or Tuesday to initiate the position ... "trading around it" with the futures contract etc.

Good discussion here!

MM

Thanks everyone. Just one more question on writing options. I thought that when you write an option, you get to keep the price of the premium you received no matter what? So if I write a call option and get a premium of $800 for it, don't I get to keep that entire $800 no matter what happens?

Grasshopper

Grasshopper

GH,

Yes that is true. Writing an option is the same as shorting the option. And yes you keep the cash no matter what.......your profit is fixed but your downside is not. Its the opposite when you buy the option.....downside is fixed but the profit is not.

Yes that is true. Writing an option is the same as shorting the option. And yes you keep the cash no matter what.......your profit is fixed but your downside is not. Its the opposite when you buy the option.....downside is fixed but the profit is not.

Thanks grednfer! So as far as the covered call goes, my profit and my risk are fixed?

Grasshopper

Grasshopper

GH,

A covered call: buy Something and sell ATM or ITM call against it....right?

Profit is fixed but risk or downside is not.

If you buy a call outright, risk is fixed (to premium owned) and profit is variable.

You may want to work with SPY until you feel more comfortable.

Next week ATM is about 180-200 for 1.

I may have to use them as well as they haven't released the ES weeklys for next week yet......which means the MMs are afraid....which means we could be going down large......

A covered call: buy Something and sell ATM or ITM call against it....right?

Profit is fixed but risk or downside is not.

If you buy a call outright, risk is fixed (to premium owned) and profit is variable.

You may want to work with SPY until you feel more comfortable.

Next week ATM is about 180-200 for 1.

I may have to use them as well as they haven't released the ES weeklys for next week yet......which means the MMs are afraid....which means we could be going down large......

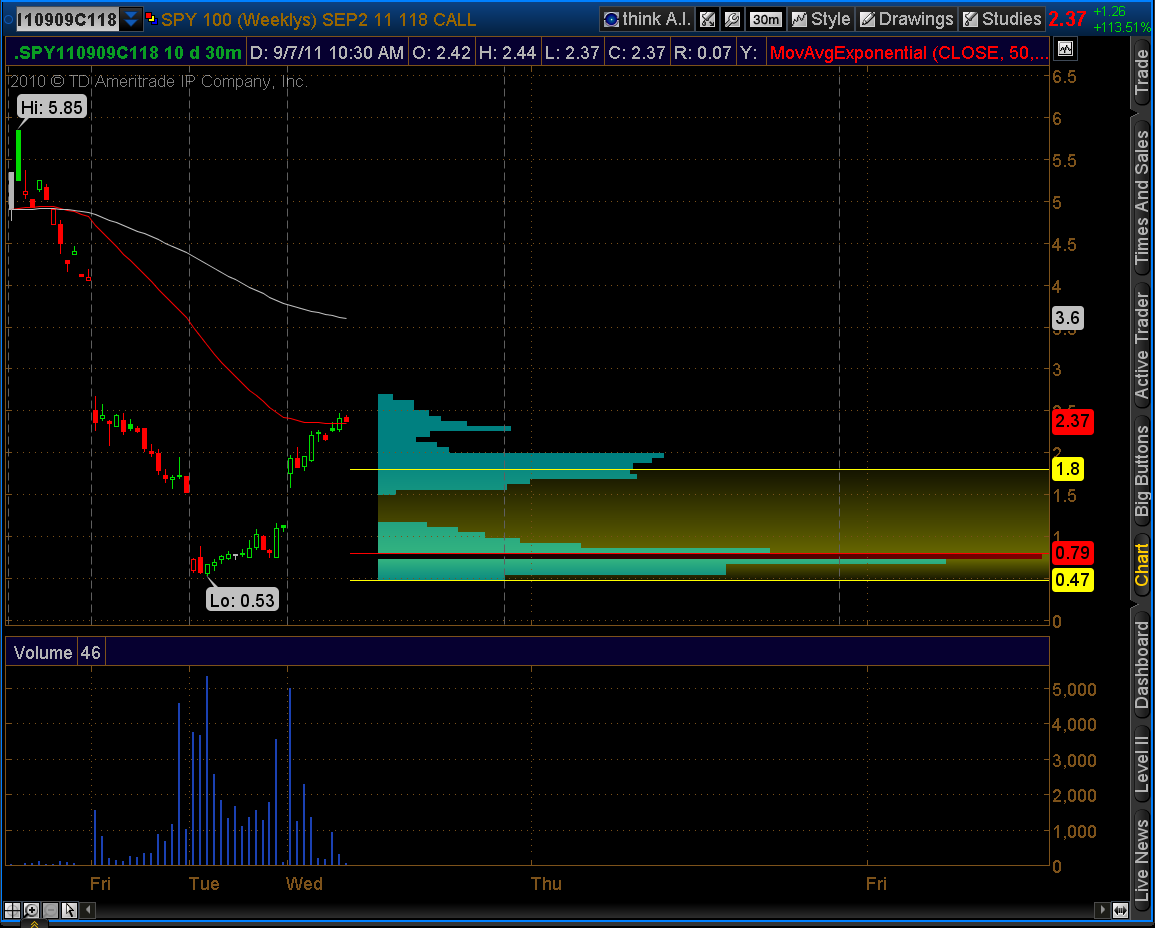

Wanted to show last week on SPY....

The 118 calls were bought at the close for 1.55

Although they got hammered at the open from Tuesday, they rebounded and sold em off for 2.5 today.....I would normally hold em but I'm seeing something and not worth the risk.

Bought the 114 calls yesterday for 2.4......sold em today for 5.8

Weird how this always catches a double.

I don't know why this weekly thing works, maybe its the simplicity......but it does well. And the efficiency ratio is very high since you don't have to monitor the squwiggles.

I hate the spy calls......equivalent to es is 5-6 contracts which is just more commissions.......ES ones are already there for next week....good! And good luck!

The 118 calls were bought at the close for 1.55

Although they got hammered at the open from Tuesday, they rebounded and sold em off for 2.5 today.....I would normally hold em but I'm seeing something and not worth the risk.

Bought the 114 calls yesterday for 2.4......sold em today for 5.8

Weird how this always catches a double.

I don't know why this weekly thing works, maybe its the simplicity......but it does well. And the efficiency ratio is very high since you don't have to monitor the squwiggles.

I hate the spy calls......equivalent to es is 5-6 contracts which is just more commissions.......ES ones are already there for next week....good! And good luck!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.