The Quality of Divergence

Four measures

If you don't know what divergence is then read about it here: Divergence

Divergence is a subjective decision. When is it divergence and when is it not divergence? Is it slight divergence or strong divergence? Because divergence is so subjective it makes it very difficult to write a computer program to isolate and detect divergence.

In order to help with the practical application of divergence in trading I've come up with the following observations for measuring the quality of divergence. The more each of these criteria are met in any divergence signal the better the probability of success in trading the divergence will be.

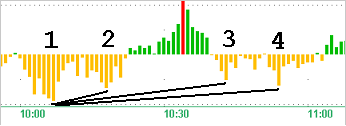

The mini-chart below shows the oscillator which in this case is the DeltaT indicator. It is assumed that the price from which this oscillator is derived is making lower lows at the marked points.

1. Time proximity

Did the 2 points in the divergence happen within a short or long time period? Short/long time is of course in itself subjective and this depends on the time frame in which you are trading. In the figure shown above the divergence from point 1 to 2 has a higher quality reading than the divergence from 1 to 3 or from 2 to 3 because of the shorter time period.

2. Clarity/distinction

Is the divergence clear or messy? In the divergence example above from point 1 to 2 we have a couple bars sticking down in the middle so this is NOT a clear divergence.

3. Difference size

Is the second point much greater or smaller than the first point? Is it double or half the size of the first point? Generally - the greater the difference the better the divergence.

4. Volume

Although this is not a quality reading of the divergence itself we use it as a criteria in our trading. As such: Does the second point have a distinct and isolated volume spike. A single sharp volume spike adds quality to the divergence.