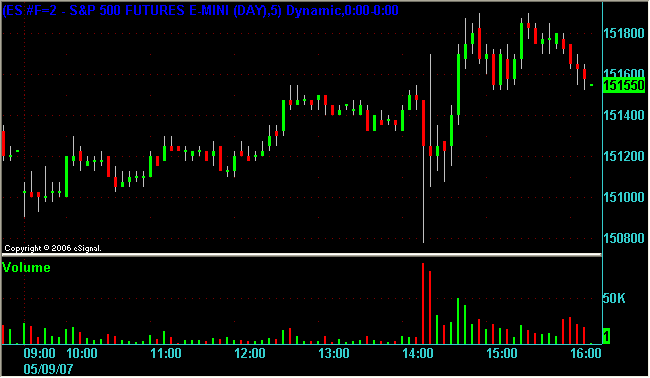

FOMC Fed Day 9 May 2007

The next FOMC interest rate announcement will be on the 9 May 2007.

CBOT Fed Watch:

http://www.cbot.com/cbot/pub/cont_detail/0,3206,991+23425,00.html

http://www.cbot.com/cbot/pub/cont_detail/0,3206,991+23425,00.html

quote:

Based upon the May 4 market close, the CBOT 30-Day Federal Funds futures contract for the May 2007 expiration is currently pricing in a 2 percent probability that the FOMC will decrease the target rate by at least 25 basis points from 5-1/4 percent to 5 percent at the FOMC meeting on May 9 (versus a 98 percent probability of no rate change).

Summary Table

May 2: 97.1% for No Change versus 2.9% for -25 bps.

May 3: 97.8% for No Change versus 2.2% for -25 bps.

May 4: 98.0% for No Change versus 2.0% for -25 bps.

May 7: 98.5% for No Change versus 1.5% for -25 bps.

May 8: 98.7% for No Change versus 1.3% for -25 bps.

May 9: FOMC decision on federal funds target rate.

From the Fed today:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Economic growth slowed in the first part of this year and the adjustment in the housing sector is ongoing. Nevertheless, the economy seems likely to expand at a moderate pace over coming quarters.

Core inflation remains somewhat elevated. Although inflation pressures seem likely to moderate over time, the high level of resource utilization has the potential to sustain those pressures.

In these circumstances, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Economic growth slowed in the first part of this year and the adjustment in the housing sector is ongoing. Nevertheless, the economy seems likely to expand at a moderate pace over coming quarters.

Core inflation remains somewhat elevated. Although inflation pressures seem likely to moderate over time, the high level of resource utilization has the potential to sustain those pressures.

In these circumstances, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.