how does futures work?

Hi in my beginning class my teacher explained that futures are something like this: for an future: a buyer and a sellers agree on the market price of the future,if the price rises the buyer earns money if it goes lower the seller earn money. so the market value is fixed and sometime in the future the seller the exchange of the stock and the money takes place? then the exchange product(commodities etc is liquidated)

i can;t visualize what this means can somone explain

commodities futres are liquidated at the end of the contract(does that mean the commodities are not atcually delivered but the buyer or the seller just pays the difference?)

i can;t visualize what this means can somone explain

commodities futres are liquidated at the end of the contract(does that mean the commodities are not atcually delivered but the buyer or the seller just pays the difference?)

Think of buying a house. What are your options? You can pay cash now and lock in the price. Simple. But say that you won't have the money to buy the house for two years but you want to lock in the price. You enter into a contract with the seller and establish a price today that you will pay in two years time. During those two years the price of the house will (1) remain the same, (2) go up, (3) go down. If (1) happens then you have have not benefited from entering into the contract. If (2) happens then you've gained because you locked in the house price and now that it's worth more you can buy it at the originally agreed upon price and if you wish sell it to make a profit. If (3) happens then you have lost out and need to pay more for a house that's worth less.

Remember these are contracts that you cannot back out of...

Now imagine that you didn't actually want to take possession of the house and you were doing this as a speculative venture to make money with the anticipation that the market will rise. At the end of the two years, instead of buying the house, you sell the contract to someone else who does want to buy the house. If the house price has risen then you've made a cash gain without ever having to own the house, just the future.

Remember these are contracts that you cannot back out of...

Now imagine that you didn't actually want to take possession of the house and you were doing this as a speculative venture to make money with the anticipation that the market will rise. At the end of the two years, instead of buying the house, you sell the contract to someone else who does want to buy the house. If the house price has risen then you've made a cash gain without ever having to own the house, just the future.

can you short sell futures?

i think there are laws that short selling stocks are not allowed

why?

i think there are laws that short selling stocks are not allowed

why?

Yes, but it's not called short selling it's just called selling. You either sell or buy a future. I have never heard of any restrictions about selling futures. Both the long and short side of futures have the same regulations/laws/rules afaik.

You can reverse the house analogy above and imagine that you're selling a house and enter into a contract with the buyer to sell it in 2 years time.

You can reverse the house analogy above and imagine that you're selling a house and enter into a contract with the buyer to sell it in 2 years time.

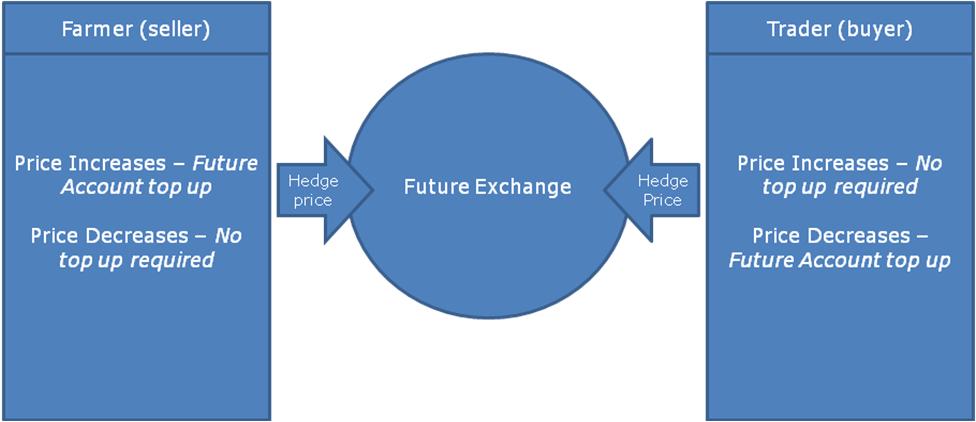

A futures contract is a financial contract obligating the purchaser to buy an asset or the seller to sell an asset at a predetermined future date. These are commonly used for commodities like farming goods (corn, wheat even pork bellies), precious metals, bonds and share price indices. Futures contracts were created so the buyer or seller of the asset can hedge against price fluctuations in the market over the period of the contract. This means the farmer can give business certainty to the buyer and have security in locking in estimated profit. The up side is, if price decreases the seller is protected but if the price increases the seller is out of pocket the for the difference in price and vice versa for the buyer; if price increases the buyer is protected and if the price decreases they are responsible for paying the variation in margin. However there are also ways to hedged if price moves in the wrong direction.

What are index futures? They are the same as futures for commodities however these are used by Stock Portfolio Managers to hedge risk over the term of the contract. For instance, the S&P 500 contract period is three months. The managers can hedge against downside price movement in equities investment by shorting the futures contract on index which the shares are placed. They can also have additional gains by increasing exposure in index futures if the direction is favourable.

What are index futures? They are the same as futures for commodities however these are used by Stock Portfolio Managers to hedge risk over the term of the contract. For instance, the S&P 500 contract period is three months. The managers can hedge against downside price movement in equities investment by shorting the futures contract on index which the shares are placed. They can also have additional gains by increasing exposure in index futures if the direction is favourable.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.