How are Fibonacci Retracements and Extensions calculated?

Hi,

I was wondering if someone would be able to tell me what the formula is for the Fibonacci Retracement / Extensions, in the Daily Notes? I use these levels and I'm curious about how they are derived... thanks.

/W

I was wondering if someone would be able to tell me what the formula is for the Fibonacci Retracement / Extensions, in the Daily Notes? I use these levels and I'm curious about how they are derived... thanks.

/W

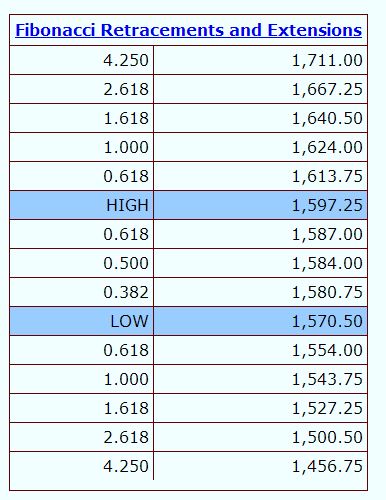

Above is an example of what it looks like in the Daily Notes from today's ES: http://www.mypivots.com/dailynotes/symbol/688/-1/e-mini-sp500-september-2013 (If you look at this page after 6/24/2013 the values will have changed.)

The High and Low are the values from the previous trading session. The ratios between these two values are multiplied against the range (High - Low) and then added to the Low. If the High was 1,000 and the Low was 900 then the range would be 100 and the 0.382 ratio would be 100 * 0.382 + 900 = 938.2

For the ratios above and below the Highs and Lows you also multiply the ratio against the range but above the High you will add it to the High value and below the Low you will subtract it from the Low value.

The numbers have been rounded to 0.25 increments because that is what the ES trades in.

If you have your own ratios then you can plug those into the Fibonacci Calculator.

Hope that helps.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.