ES End of the week update .. Friday the 13th !!

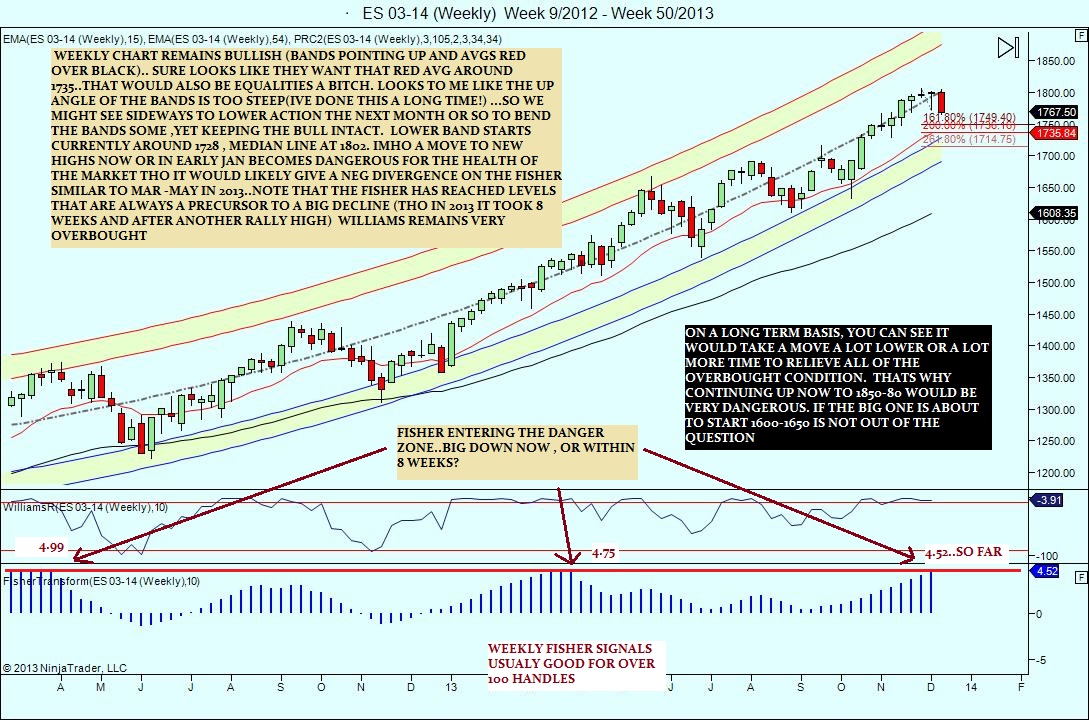

Maybe we go past equality (short term 1765.50) and grab that 1760-62 or try to rally now...no idea but dont get complacent on the late Dec rally , when ever it comes! I think things could potentially get ugly in Jan...just my opinion,fwiw

..

..

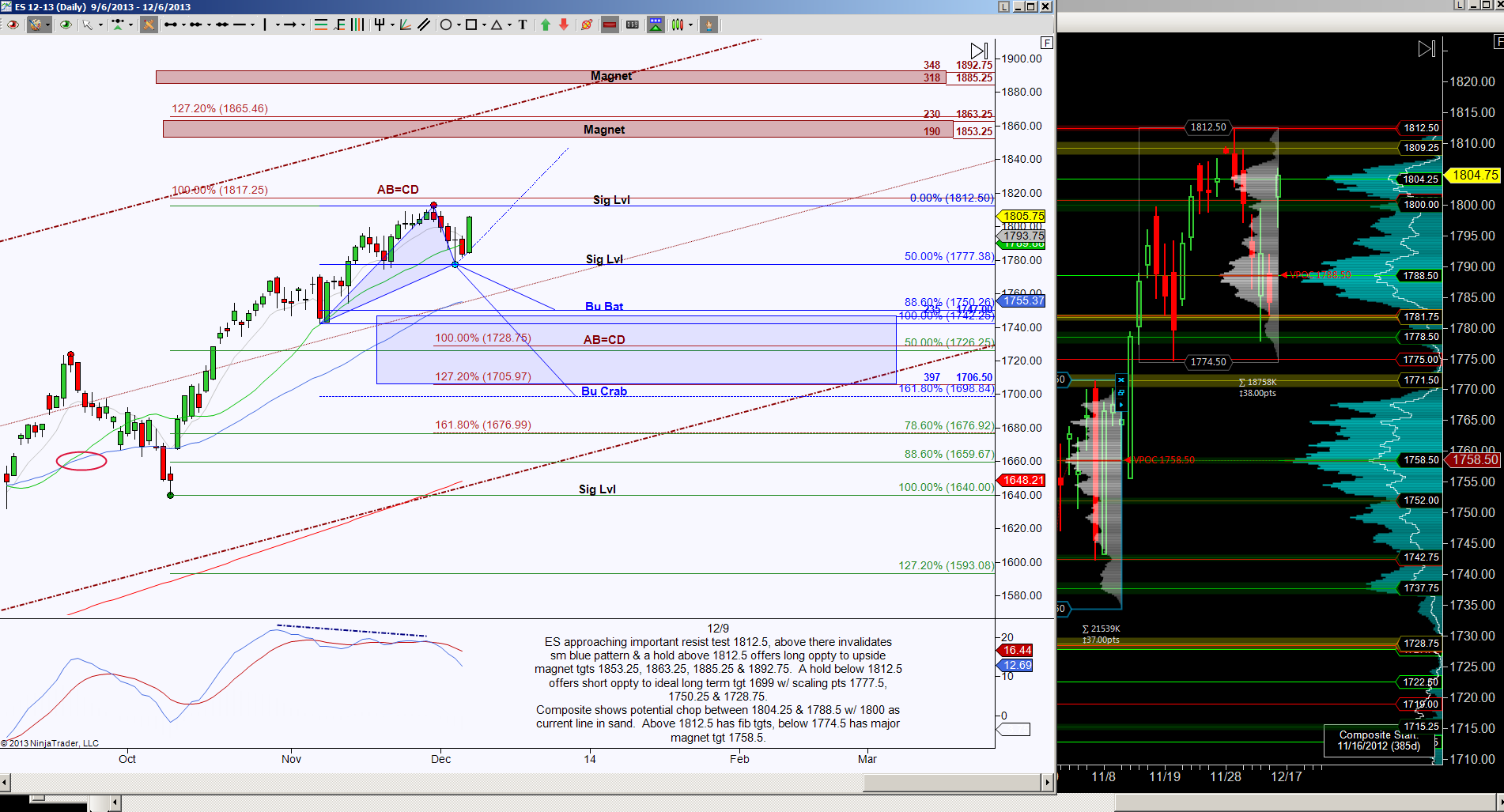

And for my ES friends , an interesting look from a harmonic and vol profile look from Kathy Garner, one of the few analysts i respect..(. be advised its basis the Dec contract, so now it would basically reflect the cash index)

Oops , i meant G arber!.. and from Cobra (for next weeks action)...12/16: OE Monday, SPX up 8 of 12

12/18: FOMC

12/20: OE Friday, SPX up 22 of 30

Dec OE Week, SPX up 22 of 28

12/18: FOMC

12/20: OE Friday, SPX up 22 of 30

Dec OE Week, SPX up 22 of 28

Hey Monkey, check this out.. its a study of just Dec expiration week!..

I have already shown how interpet seasonals in past updates,but here is an interesting study for the week of DEC expiration courtesy of Ned Davis research: Enjoy S&P 500 Cash | NASDAQ Composite

Expiration Study for December:

Average % Changes For S&P 500 Cash

Total Months Tested For Daily Stats: 29

Study Expiration Date Range : 12/21/1984 - 12/21/2012

Overall Expiration Date Range: 1/20/1984 - 11/15/2013

DAILY STATS

Day (Period) Geo Avg Ari Avg Median Num Up Num Dn Total

-------------- -------- -------- -------- ------ ------ ------

PreviousFriday 0.23662 0.23929 0.27353 19 10 29

Monday 0.18411 0.18974 0.22698 17 12 29

Tuesday 0.43144 0.43865 0.25187 17 12 29

Wednesday -0.05486 -0.05226 -0.07654 14 15 29

Thursday -0.11352 -0.10902 -0.14143 13 16 29

Exp. Friday 0.32290 0.32688 0.41702 20 9 29

PrevFri-Mon 0.42116 0.42931 0.50493 21 8 29

Day AfterExp -0.02613 -0.02175 -0.11364 13 16 29

WEEKLY STATS

Period Geo Avg Ari Avg Median Num Up Num Dn Total

-------------- -------- -------- -------- ------ ------ ------

Study Exp Week 0.77134 0.78568 0.70491 23 6 29

All Exp Week 0.29429 0.32281 0.57187 215 144 359

NonExpire 0.11037 0.13679 0.24132 669 529 1198

All Weeks 0.15274 0.17968 0.31185 884 673 1557 8-)

I have already shown how interpet seasonals in past updates,but here is an interesting study for the week of DEC expiration courtesy of Ned Davis research: Enjoy S&P 500 Cash | NASDAQ Composite

Expiration Study for December:

Average % Changes For S&P 500 Cash

Total Months Tested For Daily Stats: 29

Study Expiration Date Range : 12/21/1984 - 12/21/2012

Overall Expiration Date Range: 1/20/1984 - 11/15/2013

DAILY STATS

Day (Period) Geo Avg Ari Avg Median Num Up Num Dn Total

-------------- -------- -------- -------- ------ ------ ------

PreviousFriday 0.23662 0.23929 0.27353 19 10 29

Monday 0.18411 0.18974 0.22698 17 12 29

Tuesday 0.43144 0.43865 0.25187 17 12 29

Wednesday -0.05486 -0.05226 -0.07654 14 15 29

Thursday -0.11352 -0.10902 -0.14143 13 16 29

Exp. Friday 0.32290 0.32688 0.41702 20 9 29

PrevFri-Mon 0.42116 0.42931 0.50493 21 8 29

Day AfterExp -0.02613 -0.02175 -0.11364 13 16 29

WEEKLY STATS

Period Geo Avg Ari Avg Median Num Up Num Dn Total

-------------- -------- -------- -------- ------ ------ ------

Study Exp Week 0.77134 0.78568 0.70491 23 6 29

All Exp Week 0.29429 0.32281 0.57187 215 144 359

NonExpire 0.11037 0.13679 0.24132 669 529 1198

All Weeks 0.15274 0.17968 0.31185 884 673 1557 8-)

Hard to read , but i just look at numbers up and numbers down... ie: Thurs weak cause 13 days up versus 16 days down..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.