Depth Of Market Execution DOME DOM

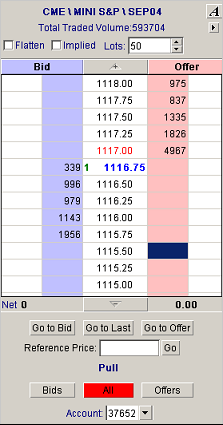

The Depth of Market (DOM) and Depth of Market Execution (DOME) screens on trading platforms usually look something like this image:

The difference between a DOM and a DOME is that you can execute trades directly in a DOME (which is what the extra E stands for =Execution) while in a DOM is just for viewing the Depth of the Market.

In the middle column you will see a list of prices available. These are almost always arranged from lowest at the bottom to highest at the top and change in increments of the minimum tick size. For example, if you were looking at the DOME for the Emini S&P 500 then the prices would change in increments of 0.25. If you were looking at the DOME for the Big S&P 500 pit traded contract then the prices would be changing in increments of 0.1.

The right hand column shows the total number of contracts that sellers (offer or ask side) are offering at each price. The left hand column shows the total number of contracts that buyers (bid side) are bidding at each price.