How soon after the close can the value area be computed?

How difficult is it to come up with the vah, poc and val?

How soon after the es market closes can the value area be figured out?

Can the value area be used in trading the es overnight?

From about what time is the best times to use the value area?

Thanks.

How soon after the es market closes can the value area be figured out?

Can the value area be used in trading the es overnight?

From about what time is the best times to use the value area?

Thanks.

many of us use the DEVELOPING value areas so it is unfolding as the market trades.....so it is calculated real time....! No waiting and no fuss.....the software does it all......In general it is best to use Yesterdays VA's for the first 90 minutes or so......then you can see what happens with the current day.....but lines ( Va's) can be used ALL day and some use only that...

Gap days are good to use the developing too

Gap days are good to use the developing too

Thank you Bruce M.

I'm new to all this.

Is the software expensive?

Can anyone tell me where I can get "DEVELOPING value areas" software?

I'm new to all this.

Is the software expensive?

Can anyone tell me where I can get "DEVELOPING value areas" software?

I echo what Bruce just said. In the last hour of trading the Developing Point of Control does not change much.

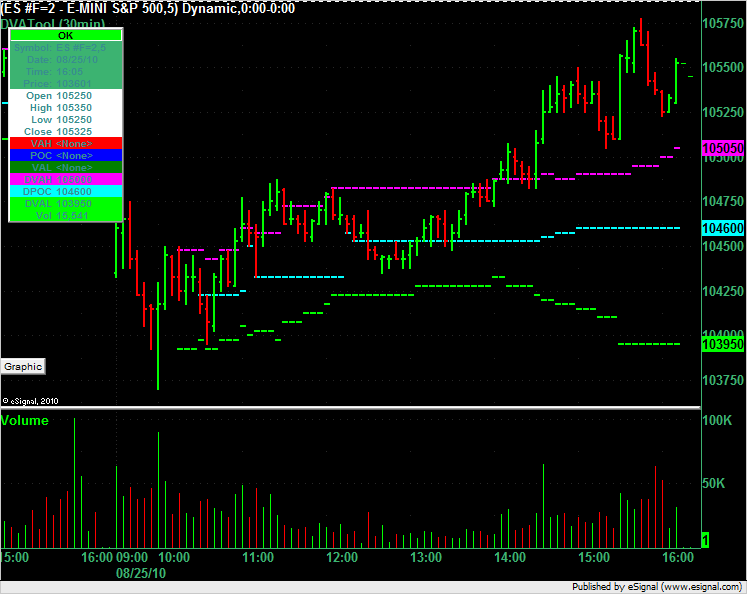

Here is a chart showing the developing value areas and point of control for today in the ES. As you can see, tomorrow's Point of Control of 1046.00 in the ES was set at 3pm this afternoon.

If you are an eSignal user then you can get this indicator (DVATool) and other indicators if you're a premium member of this site.

Here is a chart showing the developing value areas and point of control for today in the ES. As you can see, tomorrow's Point of Control of 1046.00 in the ES was set at 3pm this afternoon.

If you are an eSignal user then you can get this indicator (DVATool) and other indicators if you're a premium member of this site.

I suppose a late response is better than no response.

Regarding when to calculate VAs.....that can be done as soon as the market closes, but as previously pointed out, the POC will not change at the end of the day, EXCEPT, if you track a vol based POC, the vol POC can change if a lot of vol. is traded towards the close. That doesn't happen everyday, but it occurs enough for me to pay attention to it.

Like others here,the first 1-2 hours I pay attention to the previous day VAs and POC (and I tend to give more respect to vol based vs TPO based VAs and POC), after that I pay more attention to the DVAs and DPOC (developing).

One thing to consider is watching a composite profile made up of multiple days. Some traders use a calendar week, other use a rolling week, and there are other ways as well. One of my favorite ways to create a multi day composite is to merge together days that have over-lapping VAs. Such a composite will can have VAs and POC. It can be a great way to get a sense of how the different time frame players are operating and how they see the market (I'm a daytrader and am flat at the close but looking at multiple time frame Market Profiles can be very beneficial).

PopDoc

Regarding when to calculate VAs.....that can be done as soon as the market closes, but as previously pointed out, the POC will not change at the end of the day, EXCEPT, if you track a vol based POC, the vol POC can change if a lot of vol. is traded towards the close. That doesn't happen everyday, but it occurs enough for me to pay attention to it.

Like others here,the first 1-2 hours I pay attention to the previous day VAs and POC (and I tend to give more respect to vol based vs TPO based VAs and POC), after that I pay more attention to the DVAs and DPOC (developing).

One thing to consider is watching a composite profile made up of multiple days. Some traders use a calendar week, other use a rolling week, and there are other ways as well. One of my favorite ways to create a multi day composite is to merge together days that have over-lapping VAs. Such a composite will can have VAs and POC. It can be a great way to get a sense of how the different time frame players are operating and how they see the market (I'm a daytrader and am flat at the close but looking at multiple time frame Market Profiles can be very beneficial).

PopDoc

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.