ES Monday 7-14-14

Well the strength from Fridays inside bar up close has carried over in the overnight so far. I was hoping for long trades inside of Fridays range but that doesn't seem to be part of the plan this morning.

I have the following price points to work from today

74.50 price action from a day session

71.75 price action from a day session and near current O/N high

68.50 - 69.50 this is price action and R2 today

64.75 - 65.75 this is price action and R1 today

59.50 - 60 this is pivot and the VA high

55.25 - 56.75 this is S1, poc and VA low

My plan is to look for an inventory adjustment as per Dalton as all O/N trade has happened above the close of Friday. So I prefer sells after 9 a.m. above the 69.50 edge but ideal sells will come in RTH up near 71.50 and possibly 74.50 if they can push that far. Keep in mind that Friday was an inside day and a gap open higher implies a POSSIBLE breakout.....I only will try buys near 64.50 - 65.50 and at 59.50- 60.50....these would be smaller especially if we open and drive lower quickly......watch where your O/N midpoint is before we open and look to last Mondays Range for confluence points with the overnight

here is how my rth chart looks

I have the following price points to work from today

74.50 price action from a day session

71.75 price action from a day session and near current O/N high

68.50 - 69.50 this is price action and R2 today

64.75 - 65.75 this is price action and R1 today

59.50 - 60 this is pivot and the VA high

55.25 - 56.75 this is S1, poc and VA low

My plan is to look for an inventory adjustment as per Dalton as all O/N trade has happened above the close of Friday. So I prefer sells after 9 a.m. above the 69.50 edge but ideal sells will come in RTH up near 71.50 and possibly 74.50 if they can push that far. Keep in mind that Friday was an inside day and a gap open higher implies a POSSIBLE breakout.....I only will try buys near 64.50 - 65.50 and at 59.50- 60.50....these would be smaller especially if we open and drive lower quickly......watch where your O/N midpoint is before we open and look to last Mondays Range for confluence points with the overnight

here is how my rth chart looks

expecting trade on bear side of the open print

Thanks for the info, Bruce.

With value now building higher, I am starting to think long.

With value now building higher, I am starting to think long.

u may be right aladdin but so early in the session I prefer to just use the levels...look at last Thursday as an example....value started lower from the open but we drove higher so it's a difficult concept at least for me early on....just my big mouthed opinion

As per Bruce: Friday's inside day + gap open = possible break out

As per Dalton: Value building higher + gap trading rules

As per Dalton: Value building higher + gap trading rules

Let's get real confused...

Does anyone looked at S&P500 components A/D line?

I have TradeStation and they have one on there.$AADSPD

The other day when we had a huge break (GApPED DOWN, Thursday) and opened lower, SPX AD line ($AADSPD at Tradestation) was Positive except for first two minutes... Today 7/14/14, with a huge GAP UP... $AADSPD is under -0- but only about -32 right now 10:16:17 AM,

lowest has been like -100, BUT on the other day with huge gap down that bottomed and lifted, the $AADSPD moved up to like +180 whileES lingered a lows before chugging higher.

Can this lack luster SPX AD Line be a tell for no followthrough higher in price today?

Does anyone looked at S&P500 components A/D line?

I have TradeStation and they have one on there.$AADSPD

The other day when we had a huge break (GApPED DOWN, Thursday) and opened lower, SPX AD line ($AADSPD at Tradestation) was Positive except for first two minutes... Today 7/14/14, with a huge GAP UP... $AADSPD is under -0- but only about -32 right now 10:16:17 AM,

lowest has been like -100, BUT on the other day with huge gap down that bottomed and lifted, the $AADSPD moved up to like +180 whileES lingered a lows before chugging higher.

Can this lack luster SPX AD Line be a tell for no followthrough higher in price today?

yes paul it can...LOL...they would need to get a 30 minute close above last Mondays afternoon pull back high to change that for me and the On high....two in a row closes would even be more bullish...

Thanks for insight, Bruce.

But what are you using for a pullback High in Monday's session?

But what are you using for a pullback High in Monday's session?

my spx adv-decl line is at 250...

Originally posted by PAUL9

Let's get real confused...

Does anyone looked at S&P500 components A/D line?

I have TradeStation and they have one on there.$AADSPD

The other day when we had a huge break (GApPED DOWN, Thursday) and opened lower, SPX AD line ($AADSPD at Tradestation) was Positive except for first two minutes... Today 7/14/14, with a huge GAP UP... $AADSPD is under -0- but only about -32 right now 10:16:17 AM,

lowest has been like -100, BUT on the other day with huge gap down that bottomed and lifted, the $AADSPD moved up to like +180 whileES lingered a lows before chugging higher.

Can this lack luster SPX AD Line be a tell for no followthrough higher in price today?

Thanks APK,

I'm going to make sure I have the right ticker...

I'm going to make sure I have the right ticker...

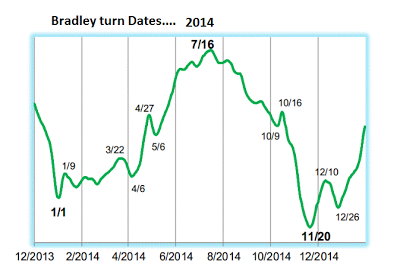

Just some turning dates previously posted by other members. Not sure if market will respect them or not...

TI they do move alike, but at different levels, there is alsways a spread.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.