ES Wednesday 9-16-15

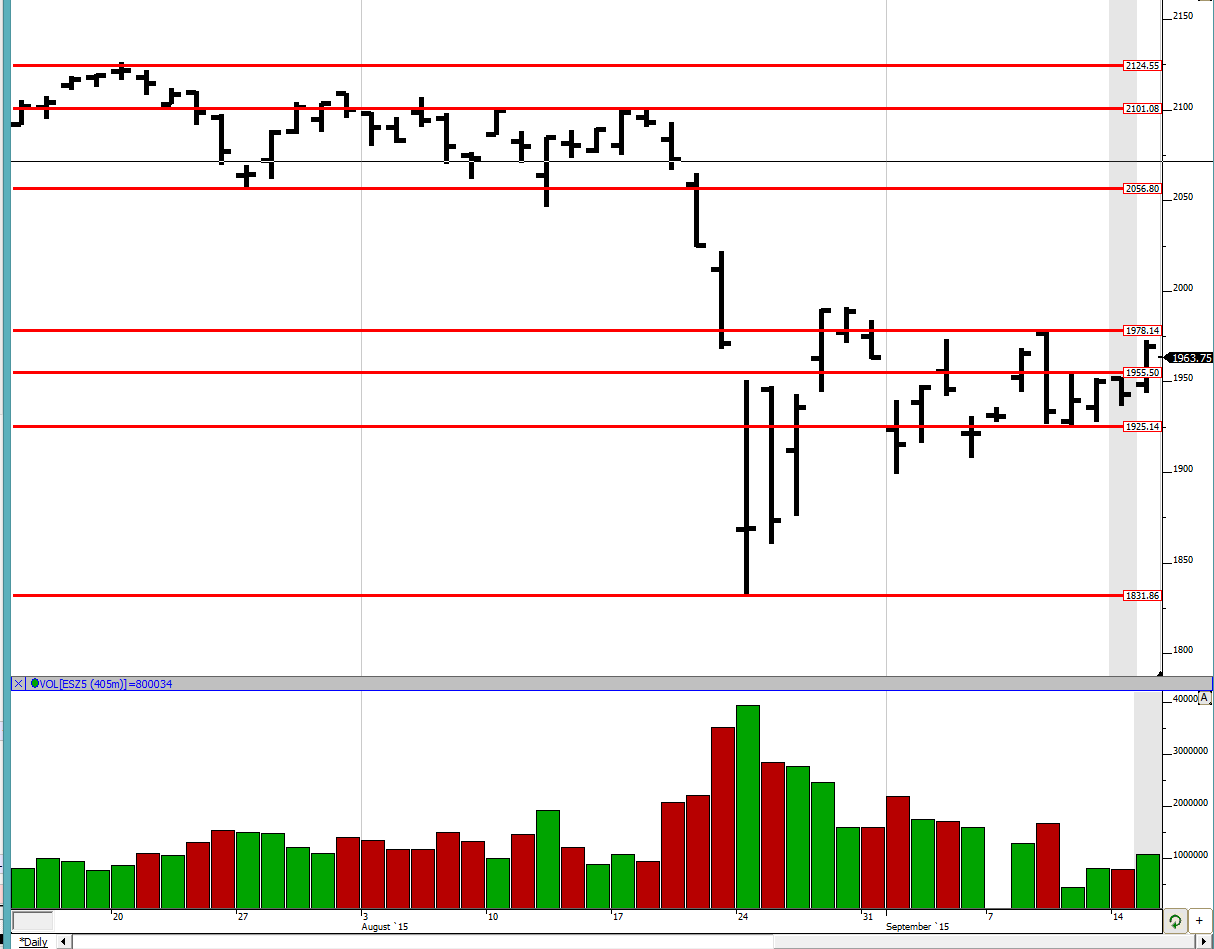

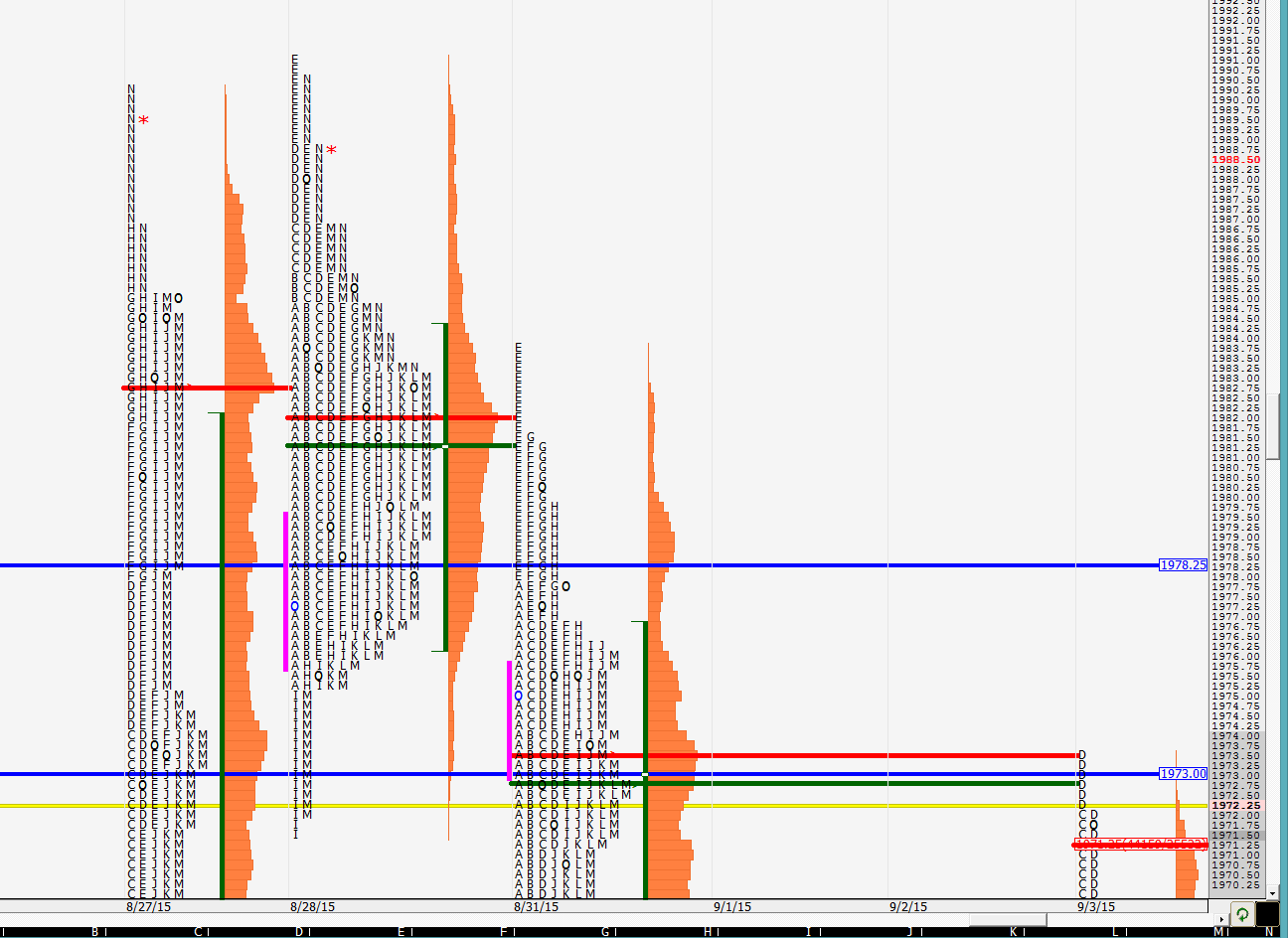

Good evening to all. Today we broke out the previous 3 day balance area (9/10, 9/11 and 9/14) and are approaching the 4 day balance area high (from 9/9) of 1978.25. We saw a breakout of the 3 day balance and we closed above it. We did not quite reach 1978.25 today but that along with the 1992 high from 8/28 are the next reference points if we are to break out of this larger balance. We have so many balance areas inside one another that sometimes we can get lost but it is imperative to keep them in mind from a larger point of view. If we do get above 1992, which I do not think can happen before FOMC, then there is a lot of place for it to move above. On the other hand, if things break down from here, then 1925, 1898.25 and 1831 are in sight. Stay flexible.

Greenies: 1923, 1934.25, 1940.5, 1943, 1947.25, 1959.25, 1968.5, 1977, 1995, 2012.5, 2053

Profile:

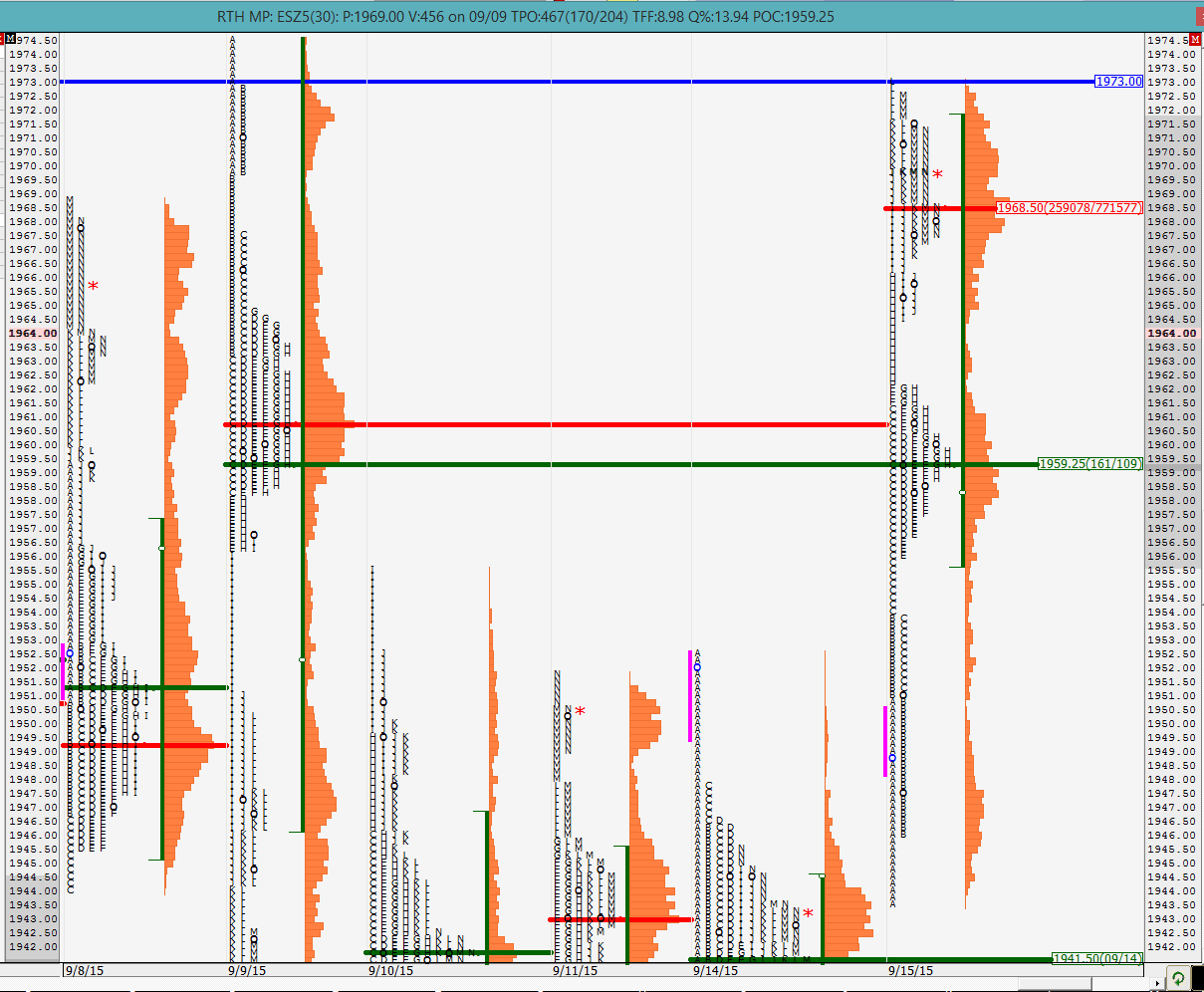

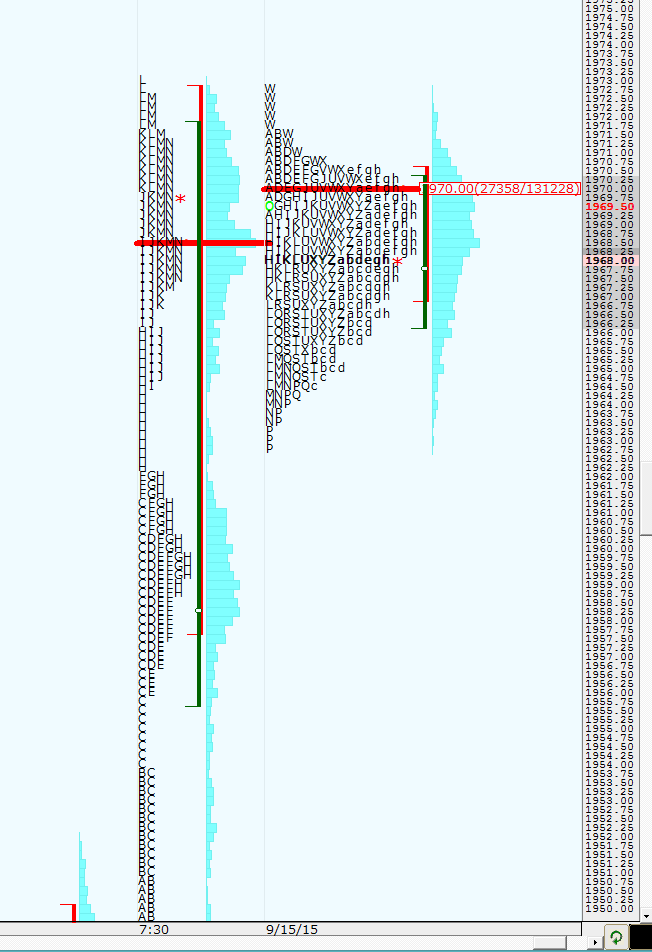

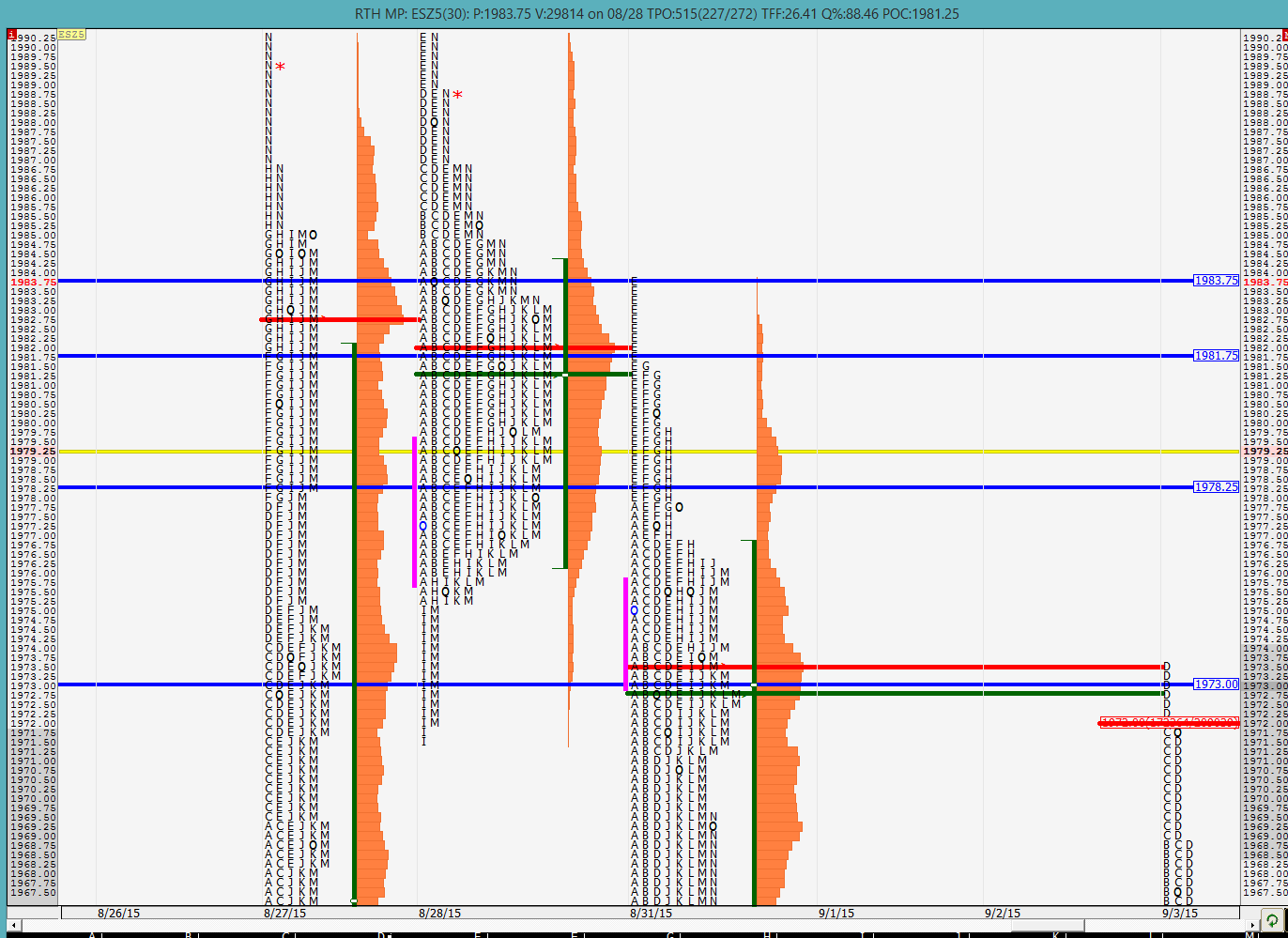

Today was a 3-distribution day as can be seen in the chart below. The POC was in the center distribution and the VPOC in the top one. Again, these tend to get cleaned up over time and not necessarily right away. Look where the high of the day is: right to the tick of the selling tail from 9/9. The market closed all the remaining distributions from 9/9 perfectly and sold off. This is another indication that it is primarily the day time traders playing right now which also means that such references work very well. We shall see in which distribution do we open RTH tomorrow and if we can sustain today's momentum into FOMC or if there is liquidation prior to that.

The split profile simply shows how today was a trend day up.

We shall come up with a plan in the morning depending on how the O/N plays out and where we open. Remember, that tomorrow is the last full day before FOMC. Good luck to all.

Greenies: 1923, 1934.25, 1940.5, 1943, 1947.25, 1959.25, 1968.5, 1977, 1995, 2012.5, 2053

Profile:

Today was a 3-distribution day as can be seen in the chart below. The POC was in the center distribution and the VPOC in the top one. Again, these tend to get cleaned up over time and not necessarily right away. Look where the high of the day is: right to the tick of the selling tail from 9/9. The market closed all the remaining distributions from 9/9 perfectly and sold off. This is another indication that it is primarily the day time traders playing right now which also means that such references work very well. We shall see in which distribution do we open RTH tomorrow and if we can sustain today's momentum into FOMC or if there is liquidation prior to that.

The split profile simply shows how today was a trend day up.

We shall come up with a plan in the morning depending on how the O/N plays out and where we open. Remember, that tomorrow is the last full day before FOMC. Good luck to all.

The O/N action so far is pretty balanced with it being more short than long but I am not putting much into it. Of more interest is the fact that the O/N high could not exceed YD's RTH high as well as that the low could not get out of the top distribution. All the O/N action was in the top distribution which should bode well for the buyers but we shall see. Keep an eye on the references and trade off of them. Good luck to all.

breaking out of YD's and O/N highs. target would be 9/9's high at 78.25 if the breakout is sustained. we could just look above and fail as well. need to monitor closely

VWAP is 69.25 and as long as we stay above it, it should be fine but not much lift so far is concerning

In case we get to 78.25 (looking shaky right now), then this is what lies above it. i cant see the market breaking out too far out of 1992 before tomorrow so possibly some fade opportunities might lie above there

looked above ONH and failed. likely going to ONL now? who knows, I am running cold right now!

30 min VPOC at 70 already tested

its been more of a play the edges kind of a day rather than look for breakouts. i should have known better considering tomorrow is FOMC

we are spending more time and building volume inside YD's top most distribution. this all bodes well for the buyers so far

we have now reached 78.25. i was just too early on it in the morning :)

i dont think my charts have transitioned well. we are at the VPOC from 8/21 on the Sept contract. I need to look into my charts. I hate rollovers

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.