the gap

Thanks for your article, Guy. Thought-provoking as ever. Here's something I've noticed: If price fails to retrace into the IB by 11:00 or so, the gap doesn't close. Now, by "retrace" I mean something significant, not a four-candle-on-the-one-minute-chart overthrow. Now, I haven't quantified this, so perhaps, under the harsh light of hard data analysis, this anecdotal obeservation isn't terribly useful. But there is a conceptual logic behind the observation, and does suggest possible time-stop techniques for the gap-fill strategy. Such an approach would have kept you safe (I believe)from the lion's share of the losses on those three big-loss days. The question is, how many small-win days would have turned into moderate-loss days, and would this have worsened the overall result? Sigh. I don't know.

Thanks for your kind words poster.

That's an interesting observation and a strategy in itself or even a method of enhancing the profits from a gap fade strategy. i.e. reverse at 11am if we have not traced back into IB - or something similar to that.

I will keep an eye on this and see if I notice something usable. Thanks for the insight.

That's an interesting observation and a strategy in itself or even a method of enhancing the profits from a gap fade strategy. i.e. reverse at 11am if we have not traced back into IB - or something similar to that.

I will keep an eye on this and see if I notice something usable. Thanks for the insight.

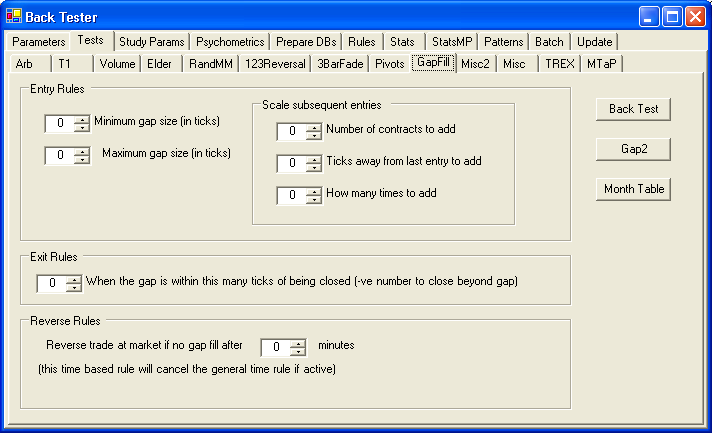

I was just looking back at the Back Tester that I developed to see if I'd incorporated some sort of "time out" for the Gap Fade and in fact I had. Have a look at the interface for testing the Gap Fade strategy:

So the idea of reversing the trade after X number of minutes if the gap hadn't filled had obviously already crossed my mind and I have obviously tested that. The one thing that I have not tested is incorporating the "trade kill" with a relationship to the IB + time combo.

So the idea of reversing the trade after X number of minutes if the gap hadn't filled had obviously already crossed my mind and I have obviously tested that. The one thing that I have not tested is incorporating the "trade kill" with a relationship to the IB + time combo.

Hey, this is interesting. How does your backtester work exactly? Can this concept (IB + timestop) be tested through your protocol?

The back tester takes historical data (1 minute bars) and runs them through the system as if were a live simulation. The reason that I set it up this way was so that I could also run live data through it to generate the same signals in real-time - but that's another story.

Yes, the IB and MP concepts can be wired up to the back tester to test that idea but unfortunately I'm snowed under with work at the moment and it would take some time to do that - time which at the moment I don't have. However, if I manage to find the time I'll do it - but don't hold your breath - I have to finish several other projects first.

Yes, the IB and MP concepts can be wired up to the back tester to test that idea but unfortunately I'm snowed under with work at the moment and it would take some time to do that - time which at the moment I don't have. However, if I manage to find the time I'll do it - but don't hold your breath - I have to finish several other projects first.

is the backtester commercially available?

no trade2win - it hasn't been commercialized - and I currently have too much on my plate to do that.

Are you saying that you lost $2,000 in 3 months using the Equity Dream system? How did their hypothetical results compare to your actual results over that period?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.