The Ichimoku Dragon Pattern

The following provided by gio5959:

The Ichimoku Dragon Pattern

First , let me say that I was not the one who first spotted this pattern using the Ichi and if could remember where I first saw it mentioned I would gladly give that person the credit

Nonetheless, this pattern is merely a W pattern or can be a M pattern if turned upside down. This pattern can happen in all time frames. What it attempts to do is identify a short term reversal in the trend (or, what I like to call a 'shock and awe').

The tail will usually, but not always, be a high of the day and then makes a double bottom where it creates the legs. The back part of the pattern tends to retrace and test the bottom of the tail-hook (support/resistance).

After the second leg is in place (double bottom) you might anticipate the breakout of the back.

Now, what I've noticed is that when the 'Ichi' gives a buy sig (a cross of the Tenkan Sen and Kijun Sen) as outlined in light blue color, after the legs are formed (double bottom) the price tends to go to fib levels 1.13/ fib 1.27 from the HOD and LOD where it forms the head of the Dragon. (whew, that was a long sentence)

One more thing to consider is - If the bottom of the head does not come down and violate the top of the tail or go as low as the back of the pattern we may then have a continuation of price. (the Dragon rears it head and breathes fire). If price does come back down to violate the tail or back part of the pattern then Tarragon the Dragon Slayer has killed the Dragon and no continuation of price - okay, I had fun with that analogy :)

This happens to be a 3min chart but if a trader would use BruceM's 'triple bar theory' in a 5min chart you will notice something very special in the formation of this pattern.

Good luck and I hope this 'very simple chart pattern' helps in your trading. The Ichi just makes it easier to spot and therefore plan your trade and may even provide some humor and thus relieve some stress while trading.

The Ichimoku Dragon Pattern

First , let me say that I was not the one who first spotted this pattern using the Ichi and if could remember where I first saw it mentioned I would gladly give that person the credit

Nonetheless, this pattern is merely a W pattern or can be a M pattern if turned upside down. This pattern can happen in all time frames. What it attempts to do is identify a short term reversal in the trend (or, what I like to call a 'shock and awe').

The tail will usually, but not always, be a high of the day and then makes a double bottom where it creates the legs. The back part of the pattern tends to retrace and test the bottom of the tail-hook (support/resistance).

After the second leg is in place (double bottom) you might anticipate the breakout of the back.

Now, what I've noticed is that when the 'Ichi' gives a buy sig (a cross of the Tenkan Sen and Kijun Sen) as outlined in light blue color, after the legs are formed (double bottom) the price tends to go to fib levels 1.13/ fib 1.27 from the HOD and LOD where it forms the head of the Dragon. (whew, that was a long sentence)

One more thing to consider is - If the bottom of the head does not come down and violate the top of the tail or go as low as the back of the pattern we may then have a continuation of price. (the Dragon rears it head and breathes fire). If price does come back down to violate the tail or back part of the pattern then Tarragon the Dragon Slayer has killed the Dragon and no continuation of price - okay, I had fun with that analogy :)

This happens to be a 3min chart but if a trader would use BruceM's 'triple bar theory' in a 5min chart you will notice something very special in the formation of this pattern.

Good luck and I hope this 'very simple chart pattern' helps in your trading. The Ichi just makes it easier to spot and therefore plan your trade and may even provide some humor and thus relieve some stress while trading.

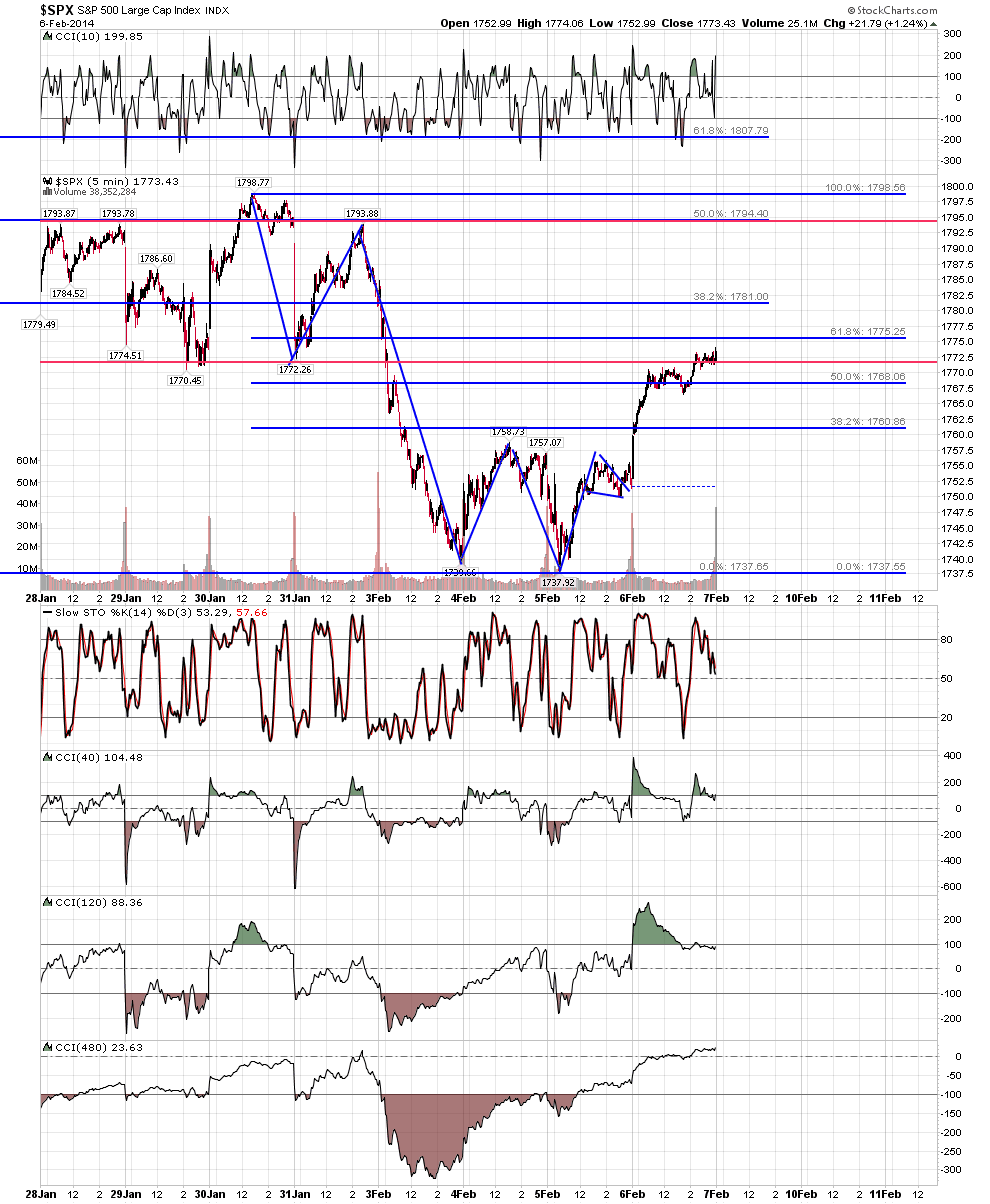

I think this Dragon setup falls into the catagory of

'those that we want to test and find out if they work'

Because of the bullish island gap on the Daily ES we may not make a futher low but who knows for sure, right?

If nothing else, it'll be fun to watch how close we get to the Dragon succeeding or failing.

[file]Has_half_of_the_Dragon_taken_shape_already.jpg,126,,0[/file]

'those that we want to test and find out if they work'

Because of the bullish island gap on the Daily ES we may not make a futher low but who knows for sure, right?

If nothing else, it'll be fun to watch how close we get to the Dragon succeeding or failing.

[file]Has_half_of_the_Dragon_taken_shape_already.jpg,126,,0[/file]

That pattern is an expansion bar down and then two small range bars and then the taking out of the inside small range bar.

All patterns shadows of what is happening in higher time frames, generally 6-8 times longer. For example. A flag or pennant on the 5 min is an inside bar on the 40 min. This can be used to determine if you wish to play the setup.

Basically any consolidation pattern tends to be inside bars on higher time frames.

John

All patterns shadows of what is happening in higher time frames, generally 6-8 times longer. For example. A flag or pennant on the 5 min is an inside bar on the 40 min. This can be used to determine if you wish to play the setup.

Basically any consolidation pattern tends to be inside bars on higher time frames.

John

Cool, it's using my 1.128 (I called it the 1.13 in Advanced Fibonacci Trading Concepts, then reverted back to calling it 1.128 after that). It's the reciprocal of my .886, for those that wonder where it comes from. Amazing how widespread my numbers have become.

Sorry, that's a lot of 'my's' in that post. The point was, I am amazed to see some things that I came up with that were considered very esoteric on a very mainstream forum that has little to no emphasis on Fibs. Makes me feel like I made a decent contribution to the literature.

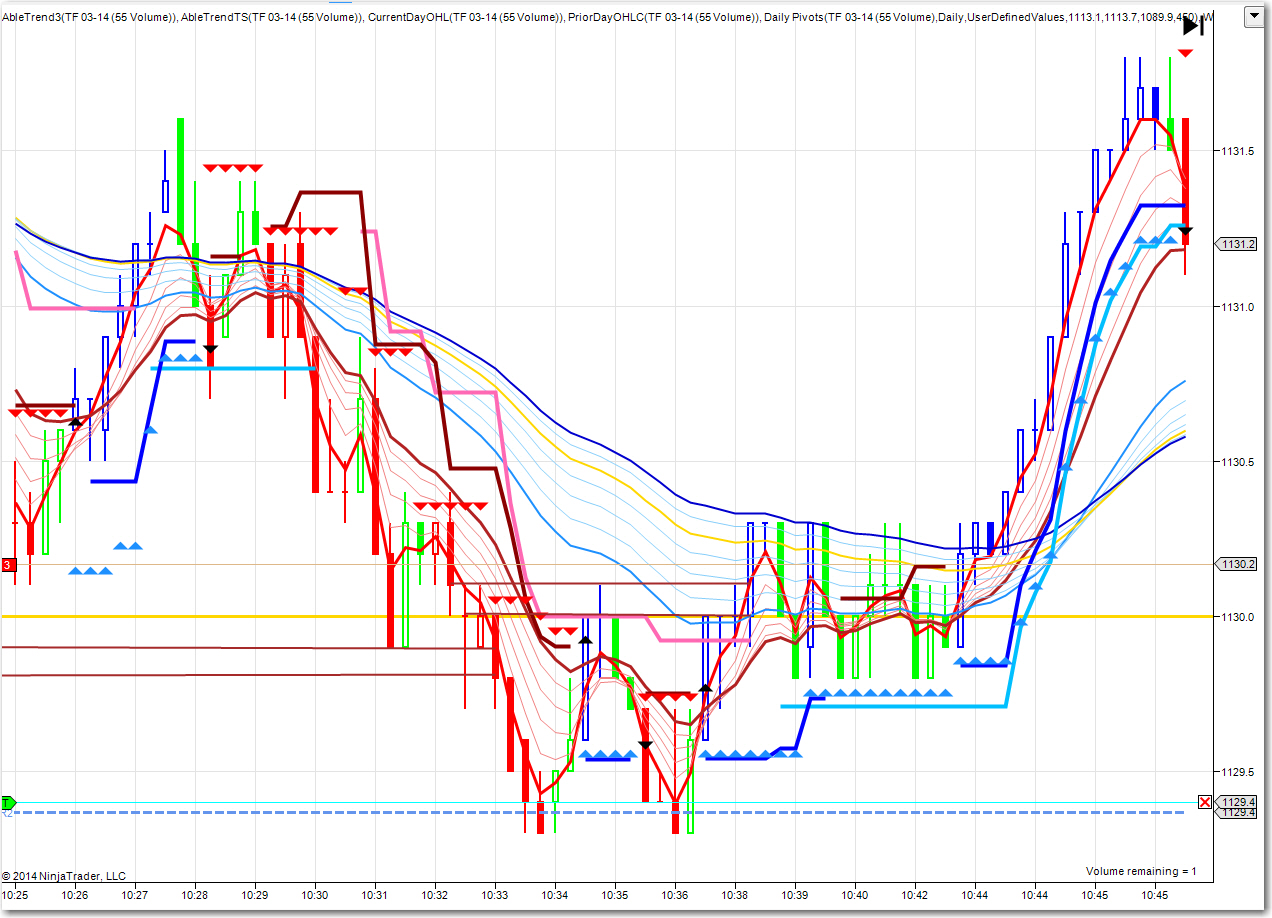

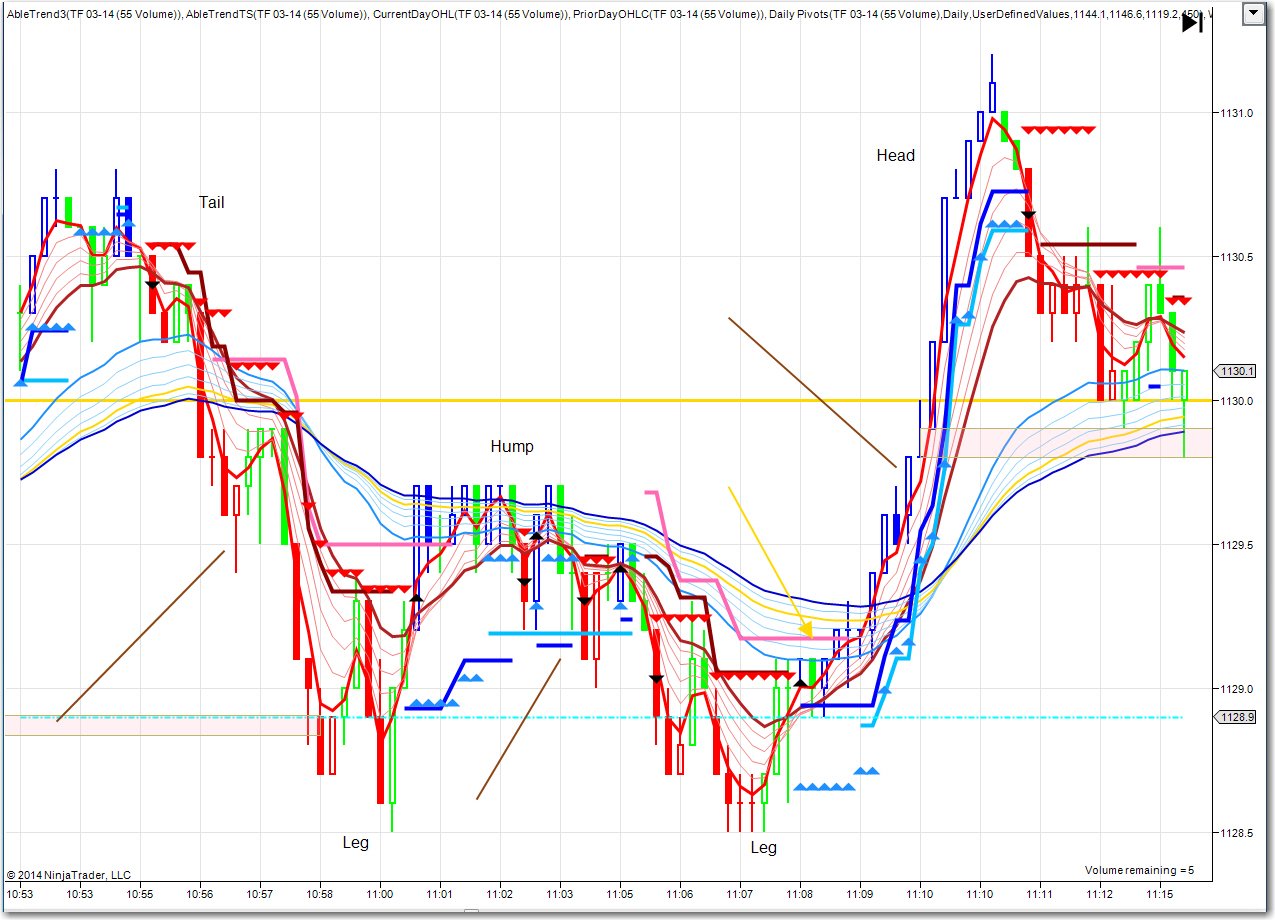

Russell Dragon in todays 55 Volume chart

Here is the Dragon Pattern found on 55 volume chart 2-13-14 around 10:34 EST

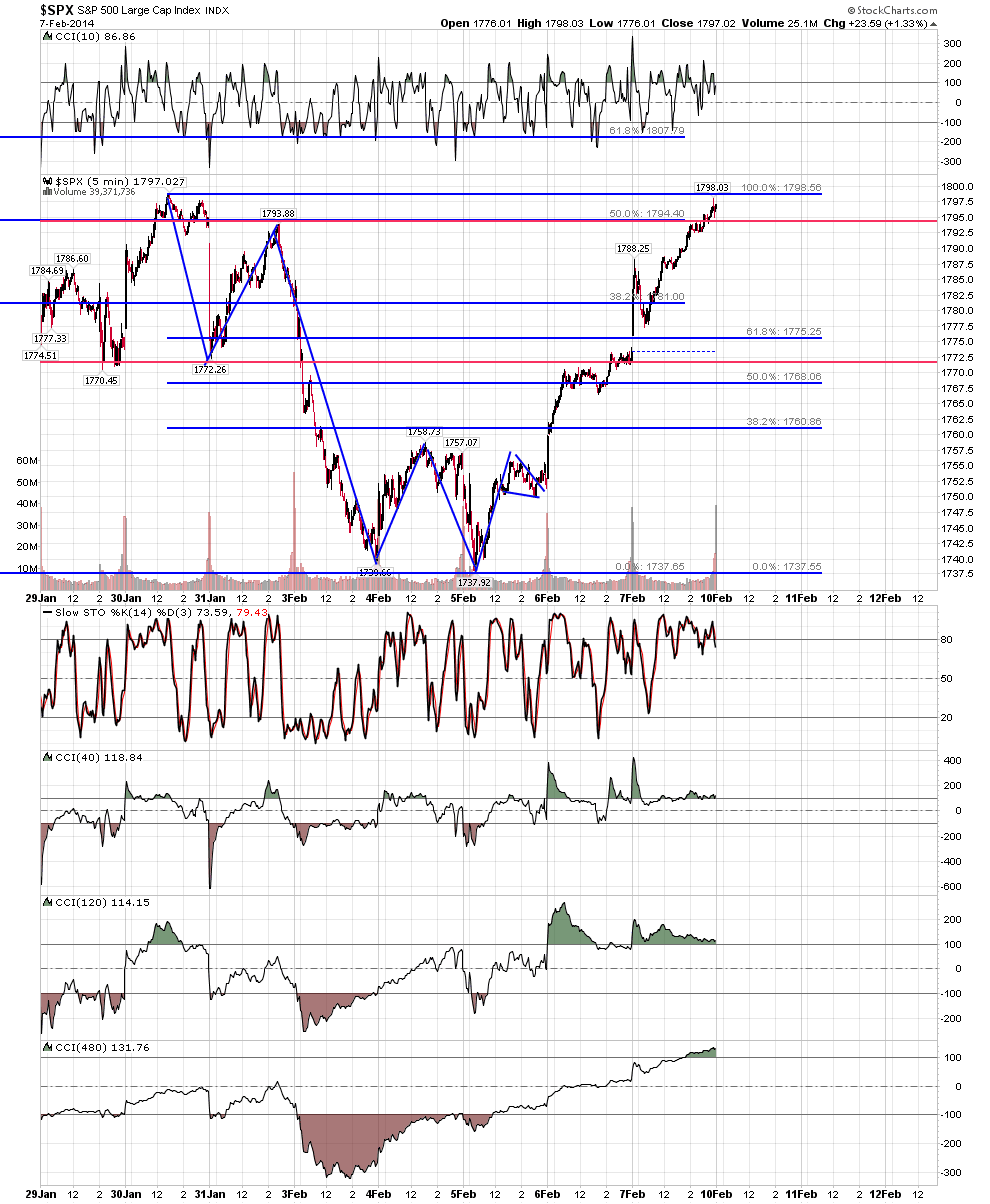

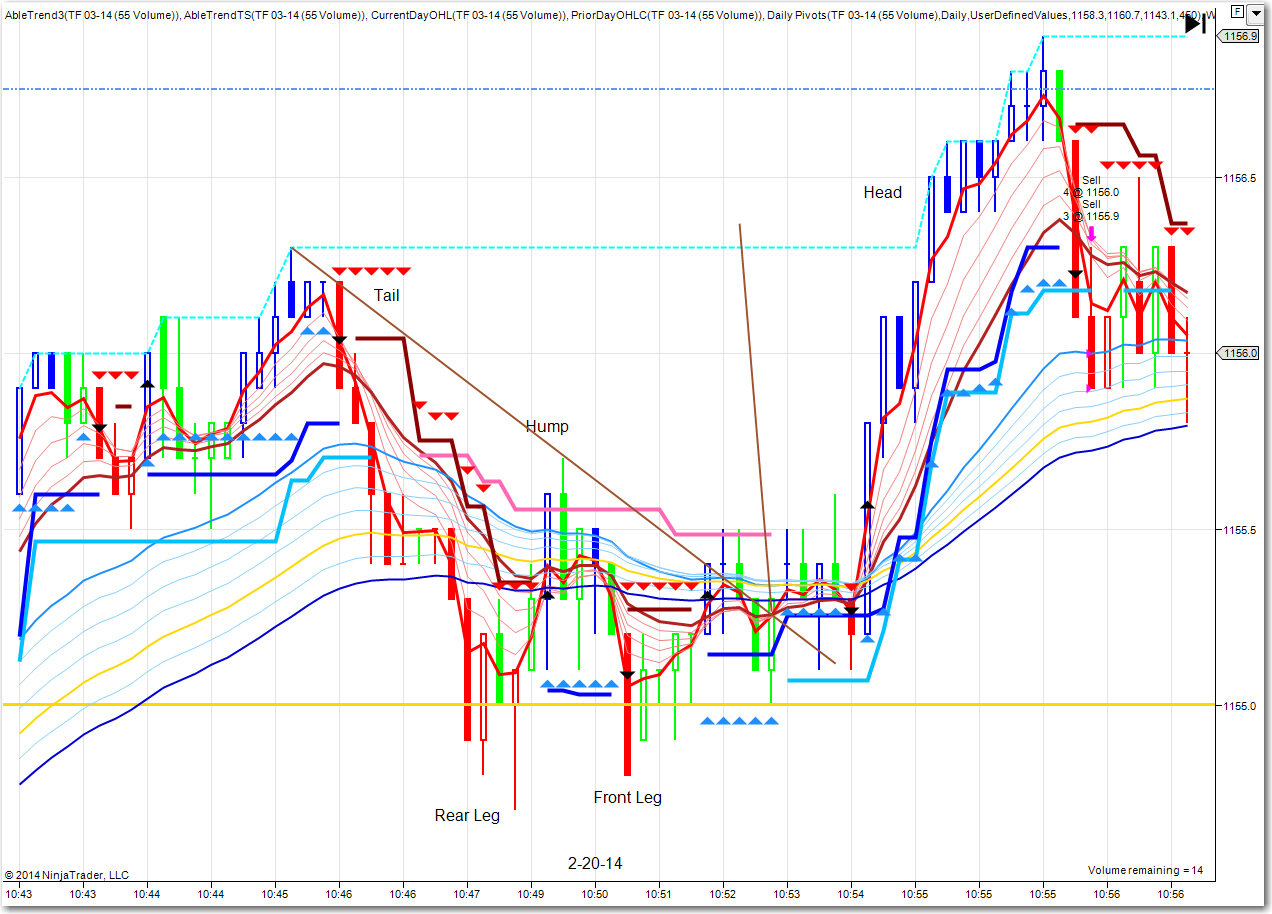

Here is another good example of Dragon from Russell 55 volume chart from 2-12-14

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.