Entries, Entries, Entries

While I find exits to be very personal in nature, and subject to so many variables as to render a "best exit" as undeterminable, I find entries to be just the opposite. I believe there is a "best" entry, and that is the price at the actual turn. This is the ideal, but it is achievable now and again. My hope is to provide some insights on different entry methods, and hopefully receive replies with comments, insights, examples from all of you as well. Im merely opening this up for discussion. So, lets get going...

There are a number of entry methodologies around, some of which follow. Id like to focus upon the last couple as these might be new to some, and perhaps I can provide some insights as I regularly use these.

Breakout entry - to me, this type of entry is entering as price breaks thru a price level, ie a previous peak/low, a temporary price shelf, expecting price to continue the direction of the break thru the level. While these may work for some, they typically give up too much of the price movement for me, and additionally are subject

to negative slippage as price breaks thru. This approach has one many times selling at support, and buying at resistance. Conceptually, this is backwards from what we are taught (buy at support [Low], sell at resistance [High]).

I used these early on, but soon garnered my real-time education on this approach. :-(

Bar Take Out - (also referred to as "price action" entry). An example for me would be entering a pullback in expectation of price resuming the trend direction. For a long, price bars would be making lower highs as the pullback progresses, and

as such we would place our buy stop 1 or 2 ticks above the high of the prior bar, allowing an uptick(s) to stop us into the trade. This basic method is used by many traders. I used this method myself until a few years ago (until the following

entry methods were presented to me). What I found to be frustrating with this premise was:

1. False entries as price would move up just enough to trigger me in, then resume the move down

2. With the common protective stop placement below the last (lowest low), this would often get hit, then price would move up as desired, but leaving me out of the trade.

3. Zigzag pullbacks (ABCs) were a constant fear as I would be stopped in, and then stopped out shortly after.

4. It would not be unusual to be stopped in and out several times trying to get into a pullback for the move back in the trending direction.

At least, this was my experience with them. After being taught the following methods (and practicing in simulation to get used to these as they are much different), Ive found these to be much better (for me at least).

Touch Entry - I learned this from a trader that would enter pullbacks as price touched his bands (bands below for longs, above for shorts). He would then space his stop based upon this entry. He pointed out something related to the popular "price action" entry that I had not considered. The fact the price moves 1 (or 2 ticks) in the direction of the trade (stopping one in) confirms ONLY that price has moved 1 or 2 ticks, nothing more! Confirmation costs money, and it often is no confirmation at all.

Admittedly, having used price action for so long, it was a bit unnerving at first to enter on touches. Price is actually coming AT you rather than moving away from you. It does have a couple distinct advantages in that you wont have many problems getting filled, and you may even see some positive slippage. While I don’t enter from bands, I do use this with well defined wedges and channels given that my RSIs are verifying entry.

A big candle that pushes to reach the touch can be good as it can be an exhaustion bar, giving a really nice entry at the touch. It is a subjective thing for me as to when to use them, so I can provide no objective criteria. Its just something Im used to doing through repitition.

Retest Entry - this method is what really helped me break through on trading turns! I was fortunate to learn this from a trader that provided enough

examples that even I could figure it out! Lol

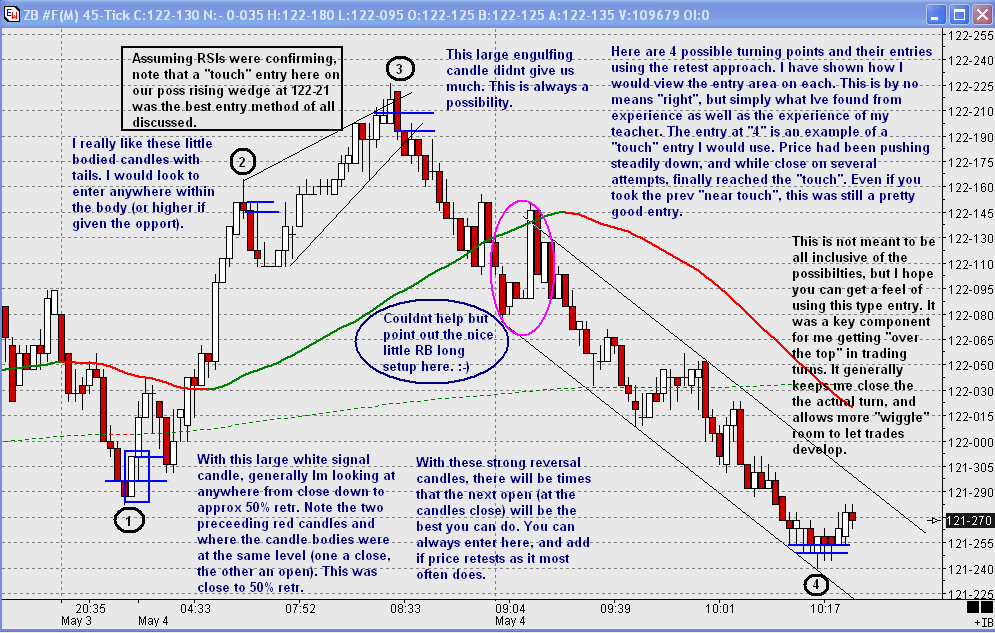

Ive attached a chart to help show this type of entry as a precaution in case my written description is not clear enough. This type of entry works well in "thick" markets (lots of volume) like the ES/Bonds. Price will frequently retest a great deal as price is changing directions. I look for my signal candle that tells me the turn may be starting, then wait for price to retest part/or all of it. Peaks generally spend more time retesting than troughs in my experience. By waiting for retesting of a "signal" candle, we can often get a price within this candle, and this will sometimes put you in the

turn 1 tick from the actual turn. Not bad. Its certainly not always this way, but the possibility does exist. This will NEVER be the case with "price action" entries as we are always giving up a bar (or some movement) for so called "confirmation". I think at this point I'll let my chart jump in and illustrate.

I hope you find this of value, and dont be shy. Jump in with comments, critiques, insights, Michelob Ultras .......

Thanks

There are a number of entry methodologies around, some of which follow. Id like to focus upon the last couple as these might be new to some, and perhaps I can provide some insights as I regularly use these.

Breakout entry - to me, this type of entry is entering as price breaks thru a price level, ie a previous peak/low, a temporary price shelf, expecting price to continue the direction of the break thru the level. While these may work for some, they typically give up too much of the price movement for me, and additionally are subject

to negative slippage as price breaks thru. This approach has one many times selling at support, and buying at resistance. Conceptually, this is backwards from what we are taught (buy at support [Low], sell at resistance [High]).

I used these early on, but soon garnered my real-time education on this approach. :-(

Bar Take Out - (also referred to as "price action" entry). An example for me would be entering a pullback in expectation of price resuming the trend direction. For a long, price bars would be making lower highs as the pullback progresses, and

as such we would place our buy stop 1 or 2 ticks above the high of the prior bar, allowing an uptick(s) to stop us into the trade. This basic method is used by many traders. I used this method myself until a few years ago (until the following

entry methods were presented to me). What I found to be frustrating with this premise was:

1. False entries as price would move up just enough to trigger me in, then resume the move down

2. With the common protective stop placement below the last (lowest low), this would often get hit, then price would move up as desired, but leaving me out of the trade.

3. Zigzag pullbacks (ABCs) were a constant fear as I would be stopped in, and then stopped out shortly after.

4. It would not be unusual to be stopped in and out several times trying to get into a pullback for the move back in the trending direction.

At least, this was my experience with them. After being taught the following methods (and practicing in simulation to get used to these as they are much different), Ive found these to be much better (for me at least).

Touch Entry - I learned this from a trader that would enter pullbacks as price touched his bands (bands below for longs, above for shorts). He would then space his stop based upon this entry. He pointed out something related to the popular "price action" entry that I had not considered. The fact the price moves 1 (or 2 ticks) in the direction of the trade (stopping one in) confirms ONLY that price has moved 1 or 2 ticks, nothing more! Confirmation costs money, and it often is no confirmation at all.

Admittedly, having used price action for so long, it was a bit unnerving at first to enter on touches. Price is actually coming AT you rather than moving away from you. It does have a couple distinct advantages in that you wont have many problems getting filled, and you may even see some positive slippage. While I don’t enter from bands, I do use this with well defined wedges and channels given that my RSIs are verifying entry.

A big candle that pushes to reach the touch can be good as it can be an exhaustion bar, giving a really nice entry at the touch. It is a subjective thing for me as to when to use them, so I can provide no objective criteria. Its just something Im used to doing through repitition.

Retest Entry - this method is what really helped me break through on trading turns! I was fortunate to learn this from a trader that provided enough

examples that even I could figure it out! Lol

Ive attached a chart to help show this type of entry as a precaution in case my written description is not clear enough. This type of entry works well in "thick" markets (lots of volume) like the ES/Bonds. Price will frequently retest a great deal as price is changing directions. I look for my signal candle that tells me the turn may be starting, then wait for price to retest part/or all of it. Peaks generally spend more time retesting than troughs in my experience. By waiting for retesting of a "signal" candle, we can often get a price within this candle, and this will sometimes put you in the

turn 1 tick from the actual turn. Not bad. Its certainly not always this way, but the possibility does exist. This will NEVER be the case with "price action" entries as we are always giving up a bar (or some movement) for so called "confirmation". I think at this point I'll let my chart jump in and illustrate.

I hope you find this of value, and dont be shy. Jump in with comments, critiques, insights, Michelob Ultras .......

Thanks

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.