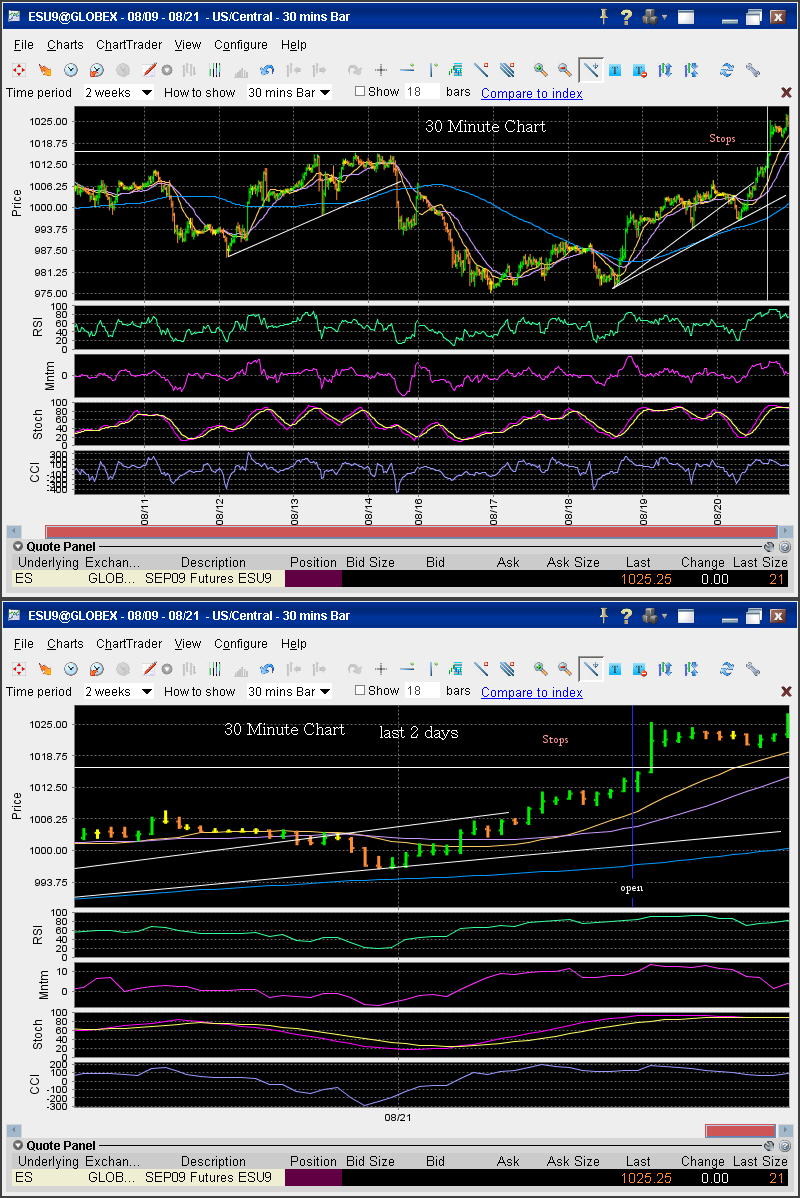

anybody selling above 1022 today?

I'm trying.....higher risk.....gap at 1115.50 on the one minute and lots of "air"........plus 8 - 10 zone on a gap....

Hi Bruce,

This week I took off to recharge my batteries, so I woke up late and the move had already been to the high of 1027.

One thing I noticed was that if, at open, I realized the day would be an "upslash" day that is the low was at the open or close to it, then if one adjusts the Fib numbers by +6, you get 1027.25 at 100% {versus 1027 which was the actual high}.

I computed the +6 by:

12.75-6.75 where,

12.75 = Yest Mid- Today's open {i.e Yest Mid=1001.00, Open=1013.75}

6.75 = 1/2 yesterday's range

Yesterday's numbers before adjustment were:

(see http://www.mypivots.com/dn/?symbol=189)

Fibonacci Retracements and Extensions

425% 1065.25

262% 1043.00

162% 1029.50

100% 1021.25

62% 1016.00

HIGH 1007.75

62% 1002.50

50% 1001.00

38% 999.50

LOW 994.25

62% 986.00

100% 980.75

162% 972.50

262% 959.00

425% 937.00

-----

After adjustment of +6:

Fibonacci Retracements and Extensions

425% 1071.25

262% 1049.00

162% 1035.50

100% 1027.25

62% 1022.00

HIGH 1013.75

62% 1008.50

50% 1007.00

38% 1005.50

LOW 1000.25

62% 992.00

100% 986.75

162% 978.50

262% 965.00

425% 943.00

If the day is a downslash then you subtract 6

and if its a flat direction then you add 12.75

For upslash, downslash and flat I am looking at the chart before opening. Though this is too late for your question, I hope you find it interesting.

This week I took off to recharge my batteries, so I woke up late and the move had already been to the high of 1027.

One thing I noticed was that if, at open, I realized the day would be an "upslash" day that is the low was at the open or close to it, then if one adjusts the Fib numbers by +6, you get 1027.25 at 100% {versus 1027 which was the actual high}.

I computed the +6 by:

12.75-6.75 where,

12.75 = Yest Mid- Today's open {i.e Yest Mid=1001.00, Open=1013.75}

6.75 = 1/2 yesterday's range

Yesterday's numbers before adjustment were:

(see http://www.mypivots.com/dn/?symbol=189)

Fibonacci Retracements and Extensions

425% 1065.25

262% 1043.00

162% 1029.50

100% 1021.25

62% 1016.00

HIGH 1007.75

62% 1002.50

50% 1001.00

38% 999.50

LOW 994.25

62% 986.00

100% 980.75

162% 972.50

262% 959.00

425% 937.00

-----

After adjustment of +6:

Fibonacci Retracements and Extensions

425% 1071.25

262% 1049.00

162% 1035.50

100% 1027.25

62% 1022.00

HIGH 1013.75

62% 1008.50

50% 1007.00

38% 1005.50

LOW 1000.25

62% 992.00

100% 986.75

162% 978.50

262% 965.00

425% 943.00

If the day is a downslash then you subtract 6

and if its a flat direction then you add 12.75

For upslash, downslash and flat I am looking at the chart before opening. Though this is too late for your question, I hope you find it interesting.

Just bought some SPY 103 sep puts @ 2.34 ES @ 1034, although am long the ES at the moment looking for 1035.25 with a stop @ 1030.25. I do believe we will put a high for the week in sometime today.

quote:

Originally posted by CharterJoe

Just bought some SPY 103 sep puts @ 2.34 ES @ 1034,

Sold 1/2 of those @ +0.40 Holding the rest for +0.80

Sold the rest @ 2.80 a nice move on those options no need to hold overnight for an extra 20 cent...plus 30min RSI already below 50. got 47 min might buy some calls before the close.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.