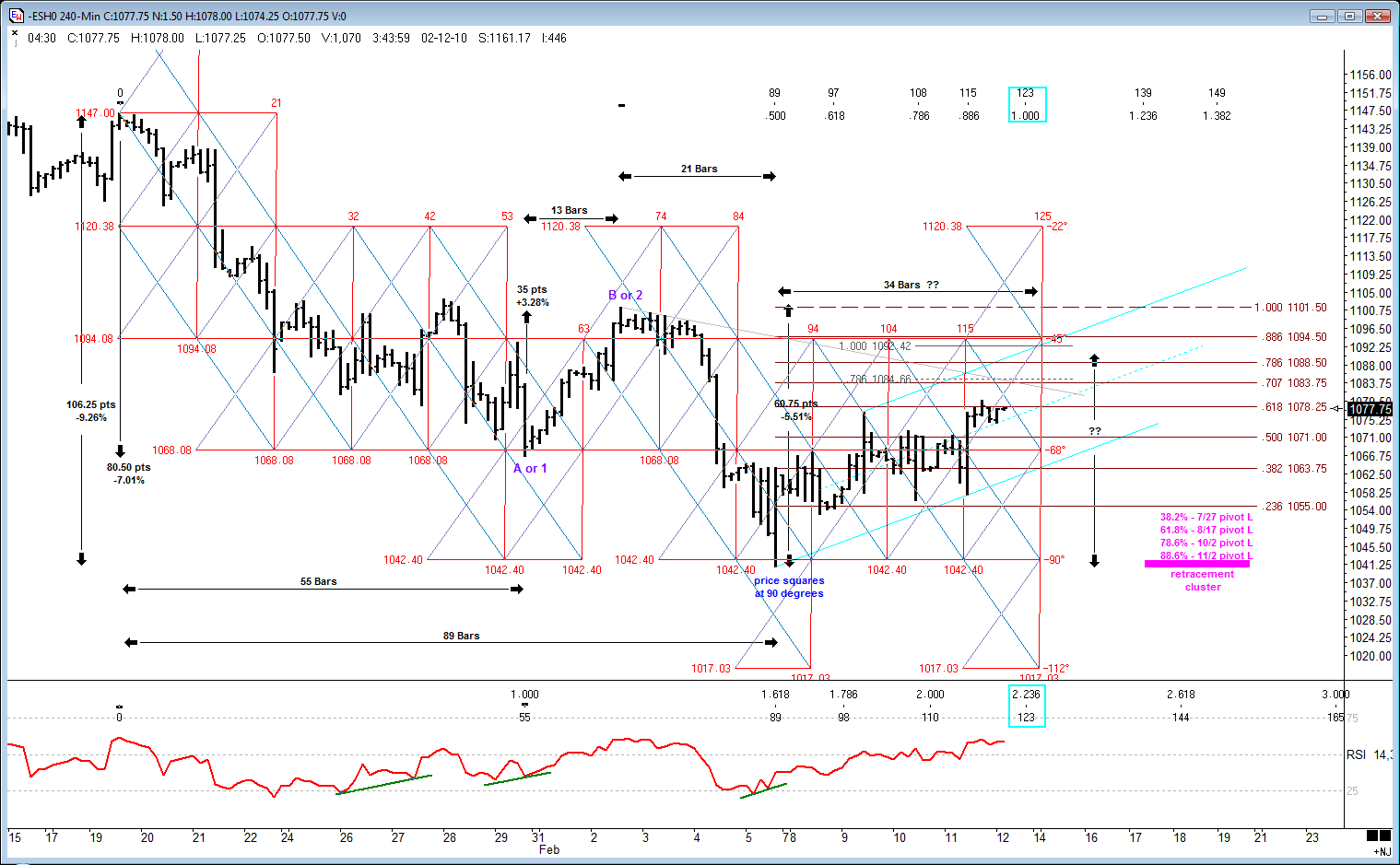

ES 2-12-10

There is some potential timing that hits late in the day. This would coincide with a Fibo 34 count off the 40.75 L, as well as, an end of square (EOS). Koolio has a cycle hiting the same time.

My key numbers come in at the 83-85 level with another grouping in the low to mid 90's, which is basically the top of square or 45 degrees. I'm guessing we don't see the 90's print, but you never know.

Something to watch tomorrow afternoon - should we be trading higher at that point.

Edit: BTW the 123 is a Lucas number for those that care.

My key numbers come in at the 83-85 level with another grouping in the low to mid 90's, which is basically the top of square or 45 degrees. I'm guessing we don't see the 90's print, but you never know.

Something to watch tomorrow afternoon - should we be trading higher at that point.

Edit: BTW the 123 is a Lucas number for those that care.

Nice Work VO !

KB - Thanks again for sharing your Kool's Tool's technique with us. I have been using the price projections to help me trade crude oil and I am constantly amazed at how often it hits the mark in spite of my sceptism given the "market sentiment" at the time.

Today I have used 5 set-ups and 4 of them hit or exceeded the target and the miss was off by 16 cents after having moved 65 cents of the 81 cents that was projected.

Here is what I worked with today:

7420-7396 projected 7357 ... exceeded

7309-7340 projected 7390 ... missed ("only" got to 7374)

7374-7349 projected 7309 ... exceeded

7372-7350 projected 7315 (basically a reprojection of the prior target from an added set-up) ... exceeded

7350-7326 projected 7287 ... hit 7288 but I call it a hit because I round the numbers.

It seems that one has to be very aware of the primary trend because the misses seem to occur when the projection is bucking the trend.

As I use the tool more, the more confidence I get in it and it is helping me vastly improve my trading discipline. I tend to get crushed when I ignore what it is indicating that I should do. I think it might help if I also implemented the time projections but I am trying to digest, trust and act on this much up to now.

Again, many thanks!

Today I have used 5 set-ups and 4 of them hit or exceeded the target and the miss was off by 16 cents after having moved 65 cents of the 81 cents that was projected.

Here is what I worked with today:

7420-7396 projected 7357 ... exceeded

7309-7340 projected 7390 ... missed ("only" got to 7374)

7374-7349 projected 7309 ... exceeded

7372-7350 projected 7315 (basically a reprojection of the prior target from an added set-up) ... exceeded

7350-7326 projected 7287 ... hit 7288 but I call it a hit because I round the numbers.

It seems that one has to be very aware of the primary trend because the misses seem to occur when the projection is bucking the trend.

As I use the tool more, the more confidence I get in it and it is helping me vastly improve my trading discipline. I tend to get crushed when I ignore what it is indicating that I should do. I think it might help if I also implemented the time projections but I am trying to digest, trust and act on this much up to now.

Again, many thanks!

Successful crude scalp from this morning. Price into support with divergence. #1 is where I thought I had missed the trade. #2 was entry. I had my sell order in a few ticks below the fib ma (34).

Only had 1 contract on since it was counter trend, but it doesn't take to many of this small trades to add up.

Only had 1 contract on since it was counter trend, but it doesn't take to many of this small trades to add up.

Addendum to my previous post ...

The CL LOD on an extremely bearish EIA crude inventory report was 7266. The impulse off of it was a jump to 7316 which projected 7397. I thought this must be impossible but the CL bounced to 7386 in spite of my doubt. I figured this resulted in an 11 cent miss.

Off of the 7386 we retraced to 7354. This projected 7302. We got to 7311 and the market reversed (a miss of 9 cents off of a move of 75 cents). It did not take out 7266 so the 7397 projection was still valid. The CL just hit 7398 resulting in a hit off of 7266.

AMAZING ....

The CL LOD on an extremely bearish EIA crude inventory report was 7266. The impulse off of it was a jump to 7316 which projected 7397. I thought this must be impossible but the CL bounced to 7386 in spite of my doubt. I figured this resulted in an 11 cent miss.

Off of the 7386 we retraced to 7354. This projected 7302. We got to 7311 and the market reversed (a miss of 9 cents off of a move of 75 cents). It did not take out 7266 so the 7397 projection was still valid. The CL just hit 7398 resulting in a hit off of 7266.

AMAZING ....

PWD. what time frame were you looking at with respect to those projections in your 10:57 post? Many thanks. einstein

Originally posted by einstein

PWD. what time frame were you looking at with respect to those projections in your 10:57 post? Many thanks. einstein

I use 1, 3 and 5 minute charts and just watch for the first meaningful retrace off of a significant move. If you use the price levels I posted and plot them against a chart of today's trading during the NYMEX pit session you should be able to see what I saw. I posted the price swings in the order of when I saw them.

One thing that KB always mentioned is that if the price projection is not hit or is exceeded that "something else is going on." I find that that is really important to watch for. If the projection is exceeded a different price swing (longer time frame) probably would have nailed it. If the projection is not reached it seems to imply a trend that is dangerous to buck.

I hope this is helpful.

An enjoyable extended weekend to all.

PWD: Re: your post of 2/12 18:41:58 - would you please kindly enlarge on your statement "If the projection is not reached it seems to imply a trend that is dangerous to buck." Thank you. Gary

Originally posted by smithgar

PWD: Re: your post of 2/12 18:41:58 - would you please kindly enlarge on your statement "If the projection is not reached it seems to imply a trend that is dangerous to buck." Thank you. Gary

It is just seems that if a projection is fallen short of and then negated that the market is saying a trend is in play that would be unwise to stubbornly keep countering (like I try to do too often, to the detriment of my account equity).

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.