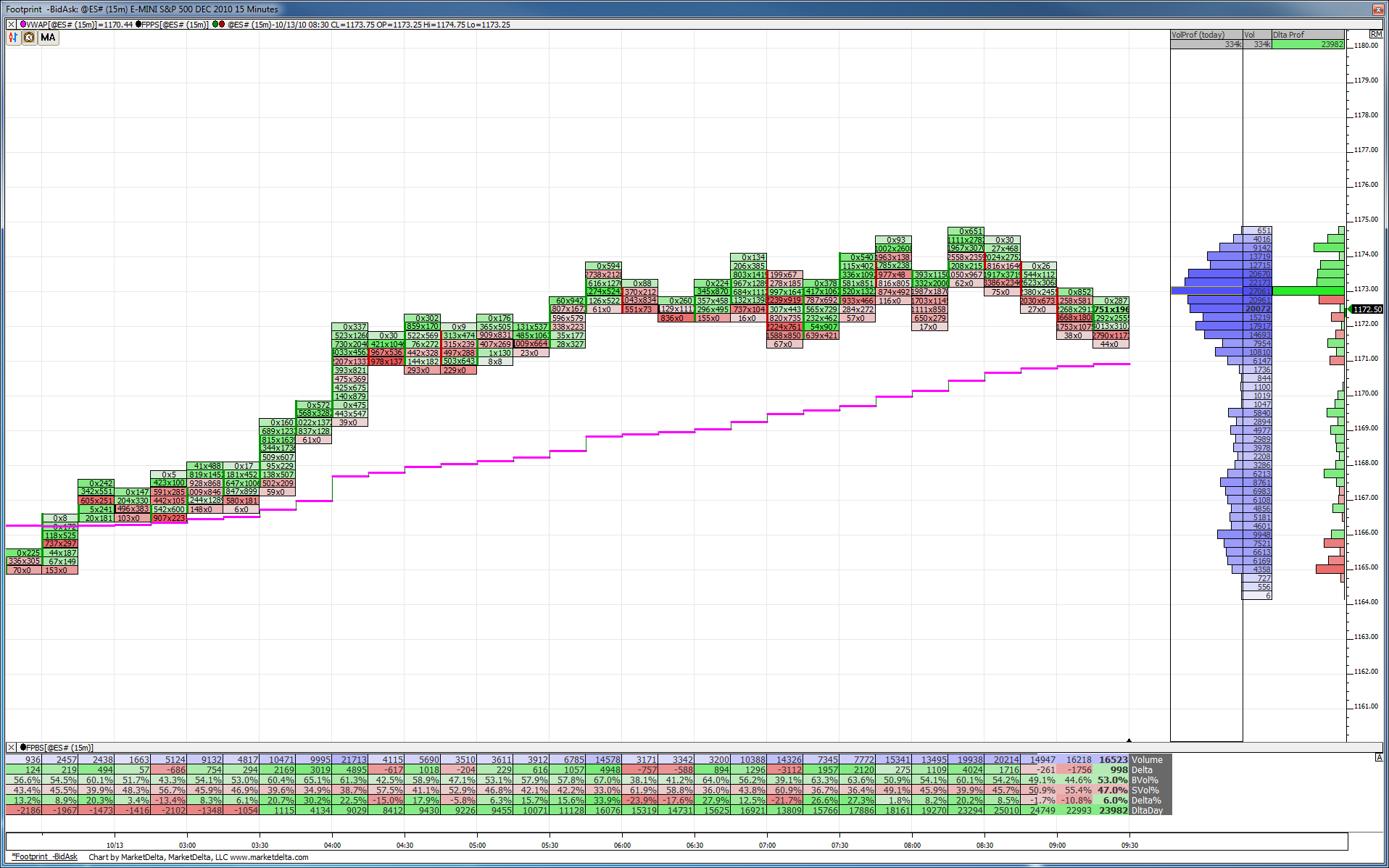

ES short term trading 10-13-10

starting small O/N shorts at 74 with 70 being target....YD was an up OUTSIDE bar into overbought conditions....I just don't like those..

Pauls extension hit down yesterday and now it has hit the upside...so we need to be careful up here

8:30 reports could try for a number in my notes at 81 area...so caution is advised.....no reports at 10 today so that usually helps our fading mentality

Pauls extension hit down yesterday and now it has hit the upside...so we need to be careful up here

8:30 reports could try for a number in my notes at 81 area...so caution is advised.....no reports at 10 today so that usually helps our fading mentality

we also have a RAT at 75 area and look where plus 5 comes in off YD RTH high...I always like that plus 2.5 - 5 point range above/below highs and lows...they like to run stops...that has been a good zone for years

Air pocket in O/N BEGINS at 70.75... !

Air pocket in O/N BEGINS at 70.75... !

Bruce

I have to point out something about viewing Monday RTH extensions.

Yesterday RTH, low print was beyond (below) the 618 extension down (1153.25) of Monday's RTH range, expected full extension (meaning print 1150.50) BUT, the full extension (1150.50) was not printed.

I can't say whether it will be printed or not, but I can say that I consider the observation signal extinguished if price moves above the H of Monday.

When I studied this phenomenon, I noticed that if price hits a 618 extension, retrace or bounce has to be limited.

Here is an example, say price moved up to print 618 above the Monday High but then price retraced, expectations for a full extension can be graded based on retracement level hit

For a move higher that prints 618 up, but not 1.00 and then starts to retrace:

"OK/good" if price retraced and found support at Monday's High

"getting shaky" if price retraced to 50% of Monday's RTH range

"Probably a failed signal" if price retraced and printed under Monday's Low.

Just the opposite for down, (and I'll use Tuesday's PA to illustrate grades for the possibility of printing at the full extension)

price printed 618 extension down (1153.25) of Monday's range and then rebounded (without going the full 1.00 extension) then

On the rebound, (Tue) Price pushed up through Monday's Low (57.75) and actually established a base (not good for expectations of a full extension down because Monday's Low (once exceeded, was clearly acting like support)

After support was established above MOnday's Low, Price kept bouncing its head against Monday's 50% (1161.50), but then, with FOMC minutes, Px broke through that, fell back and 61.50 became another line of support.

Then look what happened later Tuesday Afternoon, Px broke up through Monday's H (1165.00) and then came back to it and 1165.00 acted like support.

That's got to be considered a failed signal.

Now for today, possibility for an RTH print at 618 extension up (1169.50) would tilt odds for a full extension and a print 1172.25.

Oncw RTH opens, even just a test of O/N H (1174.75) would satisfy expectation for 618 pint tilt odds for 1.00 print.

I have to point out something about viewing Monday RTH extensions.

Yesterday RTH, low print was beyond (below) the 618 extension down (1153.25) of Monday's RTH range, expected full extension (meaning print 1150.50) BUT, the full extension (1150.50) was not printed.

I can't say whether it will be printed or not, but I can say that I consider the observation signal extinguished if price moves above the H of Monday.

When I studied this phenomenon, I noticed that if price hits a 618 extension, retrace or bounce has to be limited.

Here is an example, say price moved up to print 618 above the Monday High but then price retraced, expectations for a full extension can be graded based on retracement level hit

For a move higher that prints 618 up, but not 1.00 and then starts to retrace:

"OK/good" if price retraced and found support at Monday's High

"getting shaky" if price retraced to 50% of Monday's RTH range

"Probably a failed signal" if price retraced and printed under Monday's Low.

Just the opposite for down, (and I'll use Tuesday's PA to illustrate grades for the possibility of printing at the full extension)

price printed 618 extension down (1153.25) of Monday's range and then rebounded (without going the full 1.00 extension) then

On the rebound, (Tue) Price pushed up through Monday's Low (57.75) and actually established a base (not good for expectations of a full extension down because Monday's Low (once exceeded, was clearly acting like support)

After support was established above MOnday's Low, Price kept bouncing its head against Monday's 50% (1161.50), but then, with FOMC minutes, Px broke through that, fell back and 61.50 became another line of support.

Then look what happened later Tuesday Afternoon, Px broke up through Monday's H (1165.00) and then came back to it and 1165.00 acted like support.

That's got to be considered a failed signal.

Now for today, possibility for an RTH print at 618 extension up (1169.50) would tilt odds for a full extension and a print 1172.25.

Oncw RTH opens, even just a test of O/N H (1174.75) would satisfy expectation for 618 pint tilt odds for 1.00 print.

74 should be a real headbanger

based on RTH only, Weekly R1 and Monthly R1 both have 74 handle.

This is OpEx week and the "powers that be" have already sucked all the premium out of the puts, maybe they will target calls today (lower prices)

based on RTH only, Weekly R1 and Monthly R1 both have 74 handle.

This is OpEx week and the "powers that be" have already sucked all the premium out of the puts, maybe they will target calls today (lower prices)

have to watch PA at test of yesterday's H (1169.00), if that can't support, then reversal of pattern seen yesterday could unfold,

if 69 breaks, test 65, if 65 breaks, test 61

for a failure, a pattern I would look for on a day like this (if it is to be a move lower in profit-taking) would be a swing failure H (H lower than or = 24hr H or just 1 or 2 tics higher)

if 69 breaks, test 65, if 65 breaks, test 61

for a failure, a pattern I would look for on a day like this (if it is to be a move lower in profit-taking) would be a swing failure H (H lower than or = 24hr H or just 1 or 2 tics higher)

takin the short again at 73.50...

added at 75 print.. a rat during Opt ex

that was a top 5 with Tick divergence...!

a failed hour breakout will try and get to the hour midrange....so near 72! If this is to work...I'm not convinced that this fade will work yet....my plan is to monitor what happens at 2.5 points above the 75 number if it prints to add on

small range in first 60 minutes is my biggest concern on this fade...

I have the 75.25, the 77.75 ...looking for air fill and retest of hour high area

I have the 75.25, the 77.75 ...looking for air fill and retest of hour high area

Originally posted by BruceMBruce... why did you have 81 as key #? 60 min breakout tgt?

81 is key number and trips below

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.