ES Tuesday 24/Jan/2012

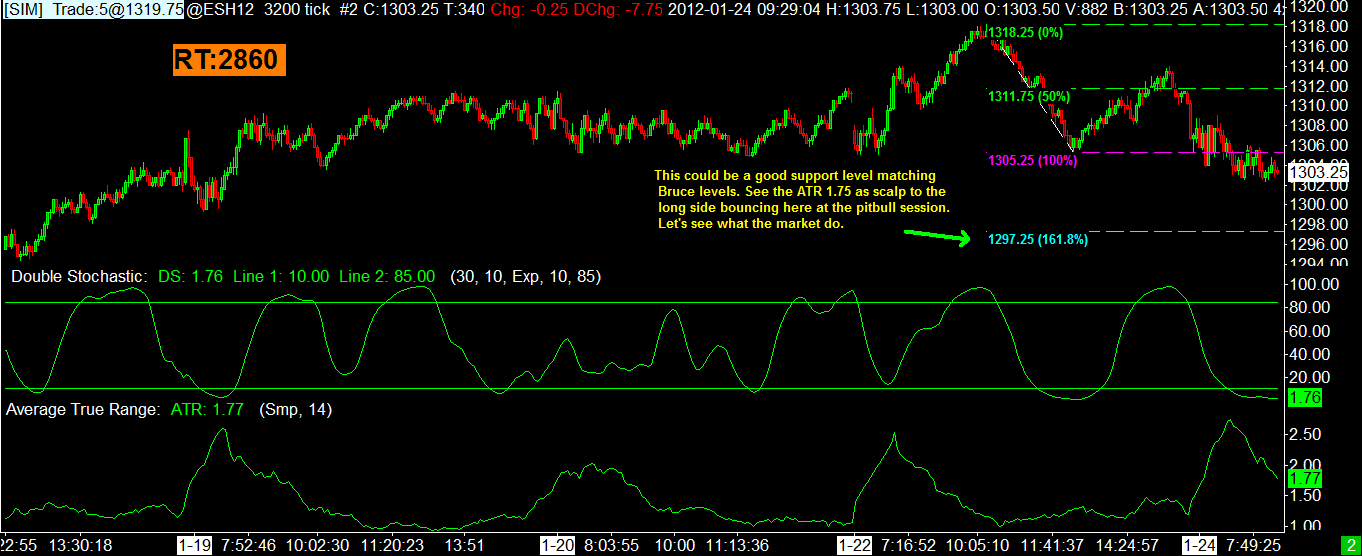

all levels still apply from yesterday with emphasis on the 02 - 04 due to overnight low.......1307.25 and then the 1311 - 1314 zone...lots of confluence in there

yesterday they ran the first 30 minute up with no pauses...they won't do that again today.......lets see what the pitbull brings us

yesterday they ran the first 30 minute up with no pauses...they won't do that again today.......lets see what the pitbull brings us

if they roll it down then my next key zone is down in the 95 - 98 area to look for changes in the delta

Bruce,

I know you talk a lot about trips, what to you make about the trips at the initial balance high? are these usually a fade when they break or go with?

I know you talk a lot about trips, what to you make about the trips at the initial balance high? are these usually a fade when they break or go with?

Hi Horse..

unfortunately in this low Volume slop we are seeing too many triples and multiple stops....In general I trade for triples to be run out and try to position ahead of the break so I can take profits when we get close to them. I also don't like triples when they form NEAR the low or highs.

Like most things in trading they work better in context and this includes triples. Today saw the Overnight the low broken into our key low volume zone so the pitbull traders bought the open on the way back up. They couldn't even push the market 2.5 points below the open and we know they will push a plus or minus 4 number each day...even in this low range garbage.

So given the fact that we were holding above the open and yesterdays RTH lows seemed to make sense to try and trade for those triples to break and trade up to hit a plus 4 number. This is all in hindsight and this volume/range is dreadful.

I usually like to fade off of numbers that are generated from the previous day or days as it gives more people time to find them. Developing numbers are not as important to me. Triples inside a days range are better targets in normal volatility. We had the 1308 number so I was using that with limited results today but you can see how that number has been a problem for buyers and sellers.

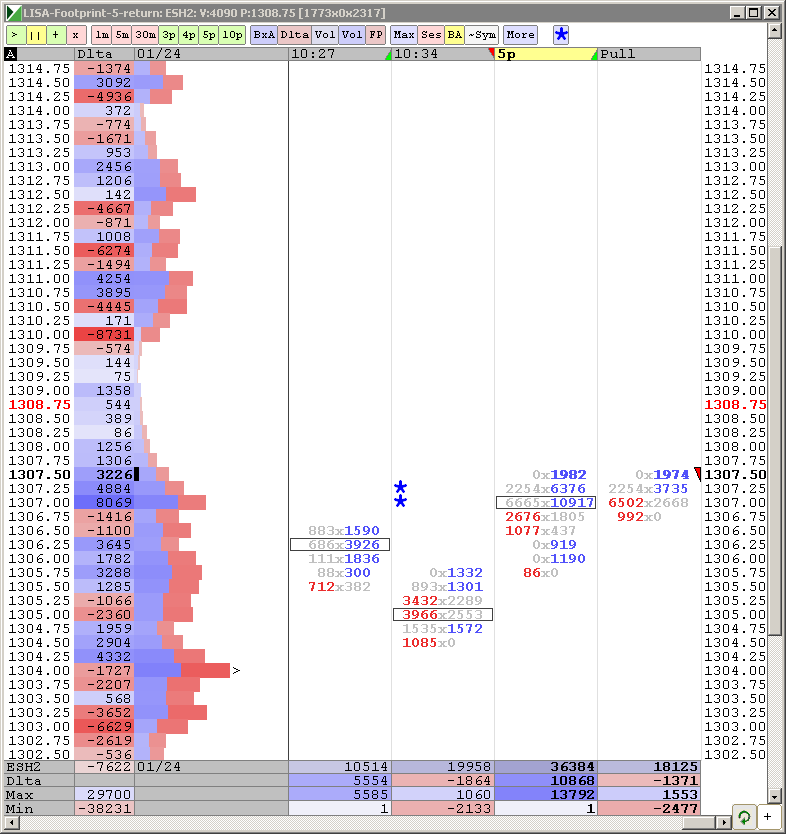

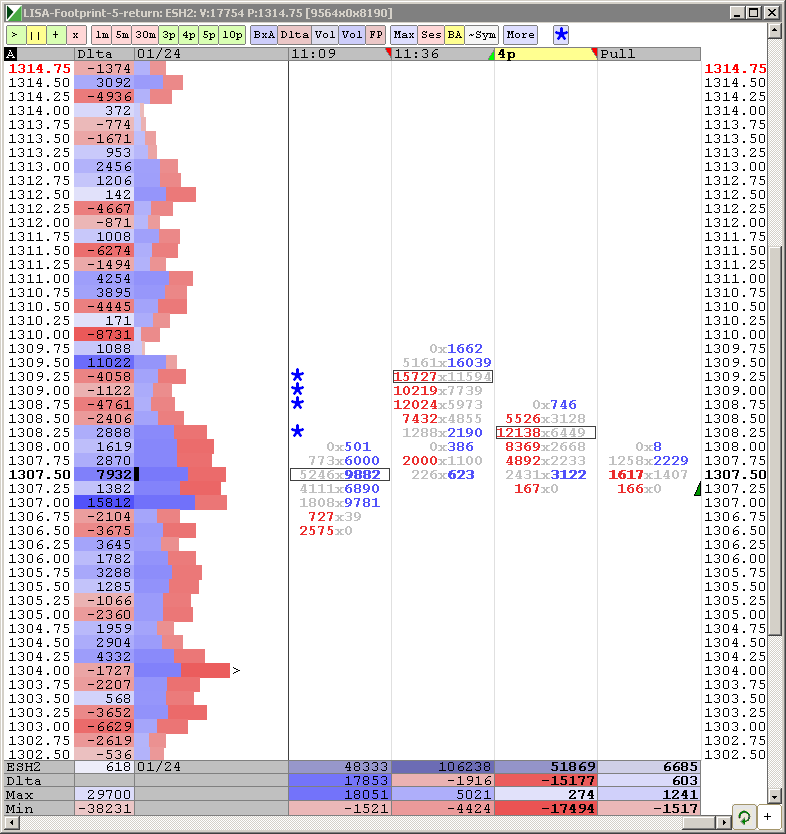

Currently value is developing lower than yesterday and the PVP is at 1307.75...real close to that 1308...hard to trade around those nodes for me...I prefer to see those broken and then the market runs out of gas and comes back for the retest....but once again I think this is hard trading cause there is little volume.

all the volume spikes are forming at the 05 - 06 number today..that is what buyers are trying to defend

unfortunately in this low Volume slop we are seeing too many triples and multiple stops....In general I trade for triples to be run out and try to position ahead of the break so I can take profits when we get close to them. I also don't like triples when they form NEAR the low or highs.

Like most things in trading they work better in context and this includes triples. Today saw the Overnight the low broken into our key low volume zone so the pitbull traders bought the open on the way back up. They couldn't even push the market 2.5 points below the open and we know they will push a plus or minus 4 number each day...even in this low range garbage.

So given the fact that we were holding above the open and yesterdays RTH lows seemed to make sense to try and trade for those triples to break and trade up to hit a plus 4 number. This is all in hindsight and this volume/range is dreadful.

I usually like to fade off of numbers that are generated from the previous day or days as it gives more people time to find them. Developing numbers are not as important to me. Triples inside a days range are better targets in normal volatility. We had the 1308 number so I was using that with limited results today but you can see how that number has been a problem for buyers and sellers.

Currently value is developing lower than yesterday and the PVP is at 1307.75...real close to that 1308...hard to trade around those nodes for me...I prefer to see those broken and then the market runs out of gas and comes back for the retest....but once again I think this is hard trading cause there is little volume.

all the volume spikes are forming at the 05 - 06 number today..that is what buyers are trying to defend

Originally posted by horse43

Bruce,

I know you talk a lot about trips, what to you make about the trips at the initial balance high? are these usually a fade when they break or go with?

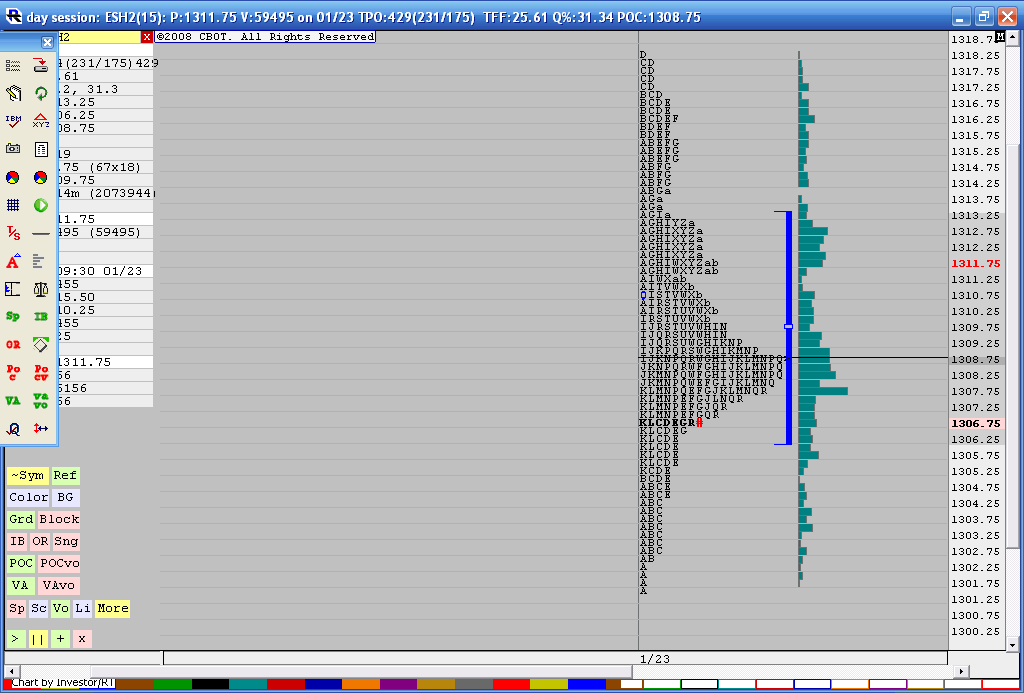

a look at monday and tuesday combined....hard to trade when we aren't at extremes...look at all the time and volume at the 1308 area...stay away!!!

Thanks for taking the time to post the information Bruce!

Much appreciated.

Much appreciated.

bruce, why did the pitbull traders buy the open? we did not trade down to -2.5 to activate the long at the open trade right? is it because we took the o/n lows out in the move down? thanks

Originally posted by BruceM

Hi Horse..

unfortunately in this low Volume slop we are seeing too many triples and multiple stops....In general I trade for triples to be run out and try to position ahead of the break so I can take profits when we get close to them. I also don't like triples when they form NEAR the low or highs.

Like most things in trading they work better in context and this includes triples. Today saw the Overnight the low broken into our key low volume zone so the pitbull traders bought the open on the way back up. They couldn't even push the market 2.5 points below the open and we know they will push a plus or minus 4 number each day...even in this low range garbage.

So given the fact that we were holding above the open and yesterdays RTH lows seemed to make sense to try and trade for those triples to break and trade up to hit a plus 4 number. This is all in hindsight and this volume/range is dreadful.

I usually like to fade off of numbers that are generated from the previous day or days as it gives more people time to find them. Developing numbers are not as important to me. Triples inside a days range are better targets in normal volatility. We had the 1308 number so I was using that with limited results today but you can see how that number has been a problem for buyers and sellers.

Currently value is developing lower than yesterday and the PVP is at 1307.75...real close to that 1308...hard to trade around those nodes for me...I prefer to see those broken and then the market runs out of gas and comes back for the retest....but once again I think this is hard trading cause there is little volume.

all the volume spikes are forming at the 05 - 06 number today..that is what buyers are trying to defendOriginally posted by horse43

Bruce,

I know you talk a lot about trips, what to you make about the trips at the initial balance high? are these usually a fade when they break or go with?

correct Nick...the pitbull traders have to wait for at LEAST one of three things to happen.

1)We break an O/N low or high

2)We break the computer session ( 7:30- 9:15 ) low or high

3) We go 2.5 points above or below the Opening range (modified to just use the open print)

1)We break an O/N low or high

2)We break the computer session ( 7:30- 9:15 ) low or high

3) We go 2.5 points above or below the Opening range (modified to just use the open print)

Originally posted by NickP

bruce, why did the pitbull traders buy the open? we did not trade down to -2.5 to activate the long at the open trade right? is it because we took the o/n lows out in the move down? thanks

Originally posted by BruceM

Hi Horse..

unfortunately in this low Volume slop we are seeing too many triples and multiple stops....In general I trade for triples to be run out and try to position ahead of the break so I can take profits when we get close to them. I also don't like triples when they form NEAR the low or highs.

Like most things in trading they work better in context and this includes triples. Today saw the Overnight the low broken into our key low volume zone so the pitbull traders bought the open on the way back up. They couldn't even push the market 2.5 points below the open and we know they will push a plus or minus 4 number each day...even in this low range garbage.

So given the fact that we were holding above the open and yesterdays RTH lows seemed to make sense to try and trade for those triples to break and trade up to hit a plus 4 number. This is all in hindsight and this volume/range is dreadful.

I usually like to fade off of numbers that are generated from the previous day or days as it gives more people time to find them. Developing numbers are not as important to me. Triples inside a days range are better targets in normal volatility. We had the 1308 number so I was using that with limited results today but you can see how that number has been a problem for buyers and sellers.

Currently value is developing lower than yesterday and the PVP is at 1307.75...real close to that 1308...hard to trade around those nodes for me...I prefer to see those broken and then the market runs out of gas and comes back for the retest....but once again I think this is hard trading cause there is little volume.

all the volume spikes are forming at the 05 - 06 number today..that is what buyers are trying to defendOriginally posted by horse43

Bruce,

I know you talk a lot about trips, what to you make about the trips at the initial balance high? are these usually a fade when they break or go with?

just like the daily open defines the theme for the day so does the weekly open define it for the week.....look at the weekly open of 1310.75.....so cool!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.