Foliage's E-Mini NQ100 trading system

http://www.collective2.com/cgi-perl/systems.mpl?session=1806120558510333256636390093&want=publicdetails&systemid=17894465&fromoutside=1&donealready=1

C2 rank list:

http://www.collective2.com/cgi-perl/newsearch.mpl?want=all&session=47585529117521092135066799110662783

This is a computer auto trade system.

This system only trades Emini NQ100.

Buy or short after market open(around 9:30AM EST)

Sell or cover before market close(around 16:00PM EST)

Backtest from Mar. 10th, 1999 to Jan. 19th, 2006.

Capital increase percentage based on average NQ price.

On yearly1 chart:

Red line shows the trades on C2 from 01/20/2006 to 02/06/2006

I trade 40 contracts every time, assume average NQ price is

$1700, profit $52000, capital = 1700 * 40 = 68000

Capital increasement = 52000/ 68000 = 76%

On the following chart, it is about 83% because I use average NQ

price is $1565.5 from 2005 -01-01 to present

Lost trades:(My fucntion get_last_quote() has a small bug,

there are three days can not go to C2 although my system

send a signal. I keep narrowing the line range for this bug)

long 40 @NQH6 1693 2006-01-24 09:31 sell 1696.5 2006-01-24 15:58

short 40 @NQH6 1719 2006-02-02 09:31 sell 1695 2006-02-02 15:58

long 40 @NQH6 1675 2006-02-08 09:31 sell 1680 2006-02-08 15:58

There is one thing I need to mention here:

If I do not set up stop loss limit, I can earn more 20% percent every

year. But I use stop loss limit in case some thing like 911 happens

during my trading time.

If you can want to earn more, you may increase the stop loss range

several points than mine. I will public my stop loss limit for every

trade on C2.

C2 rank list:

http://www.collective2.com/cgi-perl/newsearch.mpl?want=all&session=47585529117521092135066799110662783

This is a computer auto trade system.

This system only trades Emini NQ100.

Buy or short after market open(around 9:30AM EST)

Sell or cover before market close(around 16:00PM EST)

Backtest from Mar. 10th, 1999 to Jan. 19th, 2006.

Capital increase percentage based on average NQ price.

On yearly1 chart:

Red line shows the trades on C2 from 01/20/2006 to 02/06/2006

I trade 40 contracts every time, assume average NQ price is

$1700, profit $52000, capital = 1700 * 40 = 68000

Capital increasement = 52000/ 68000 = 76%

On the following chart, it is about 83% because I use average NQ

price is $1565.5 from 2005 -01-01 to present

Lost trades:(My fucntion get_last_quote() has a small bug,

there are three days can not go to C2 although my system

send a signal. I keep narrowing the line range for this bug)

long 40 @NQH6 1693 2006-01-24 09:31 sell 1696.5 2006-01-24 15:58

short 40 @NQH6 1719 2006-02-02 09:31 sell 1695 2006-02-02 15:58

long 40 @NQH6 1675 2006-02-08 09:31 sell 1680 2006-02-08 15:58

There is one thing I need to mention here:

If I do not set up stop loss limit, I can earn more 20% percent every

year. But I use stop loss limit in case some thing like 911 happens

during my trading time.

If you can want to earn more, you may increase the stop loss range

several points than mine. I will public my stop loss limit for every

trade on C2.

A short signaled this morning at the open at 1654.5 which was stopped out at 14:43 at 1679.0 for a loss of 24.5 NQ points

Note that this system is still trading the March contract (H6) which rolled over last week. This is (in my opinion) a flaw in the system which should now be trading the June (M6) contract.

Cumulative P/L to date:

-74.5 NQ points (over 6 trades)

Note that this system is still trading the March contract (H6) which rolled over last week. This is (in my opinion) a flaw in the system which should now be trading the June (M6) contract.

Cumulative P/L to date:

-74.5 NQ points (over 6 trades)

A short signaled this morning at the open at 1700 close out at the end of the day at 15:58 at 1681.0 for a loss of 19.0 NQ points

Still trading the March contract (H6) so who knows how much slippage those trades would have experienced or how bad the spread was - this is ludicruous trading the March 1 day before expiry.

Cumulative P/L to date:

-93.5 NQ points (over 7 trades)

Still trading the March contract (H6) so who knows how much slippage those trades would have experienced or how bad the spread was - this is ludicruous trading the March 1 day before expiry.

Cumulative P/L to date:

-93.5 NQ points (over 7 trades)

Looks like this strategy was a bust. Just looked at Collective2 and I see that the last 3 trades taken on this system were marked with Drawdown & Risk levels set at Extreme which is the highest level they rank it at.

I'm guessing that the system was taking Extreme Risks to try and recover and as is usually the case in these circumstances it blew out. This is like continuously averaging in or doubling down until you get stopped out and your account is frozen.

I'm guessing that the system was taking Extreme Risks to try and recover and as is usually the case in these circumstances it blew out. This is like continuously averaging in or doubling down until you get stopped out and your account is frozen.

I've just found this on the Collective2 site about the losing trade that I was complaining about that wasn't recorded.

Unfortunately this doesn't fly.

You can't just go back and say that a trade shouldn't be recorded because it was a mistake. If that had been a fat profit I have no doubt that it would have remained in the results table. Explain that...

It also indicates that the Collective2 software still needs work done on it before it can be trusted. Remember that a system that has been verified by Collective2 has used their software in the past (the version with bugs) and they don't re-run the results so the history in those results have been generated with buggy software. So those results could be showing fat profits as a result of errors in the software that shouldn't be there - i.e. the profits shouldn't be there.

Busting a trade because it had 0 contracts/size and saying that it couldn't have been acted on in the real world is nonsensical. The real world does many things that don't make sense like fat-fingers.

I have seen an accounting system generate negative valued checks when a customers owes a company money. I've also seen those checks mailed out to the customers with the negative/minus sign in front of the amount. And to cap it all, I've seen the bank accept these checks and deposit those amount as positive amounts into the customer's private account. This is what happens in the real world.

quote:

...On March 3, the system owner for this system was running API programming tests using this system, even though he had many subscribers to this system. His method of testing his programs was to issue an order for a quantity of zero contracts. Alas, Collective2 has not been programmed to handle quantity=0 orders, so it simply assumed the closing order was meant to close an entire position. Thus, C2 filled his order at the price he specified (1709.13), creating a large loss.

The owner of the system complained to me that he had not intended that any order actually get placed. Clearly this is a "gray area." The owner -- while perhaps using bad judgement (testing his software using a live trading account that many people have subscribed to) -- clearly did not intend for any order to be placed.

Intentions don't always matter. If the poor judgement had resulted in a real-life trade by an autotrading subscriber, then the trade would have stayed. However, I checked the C2 autotrading database and I discovered that no one autotrading this system actually filled the erroneous order in a real-life account. So I erased the erroneous trade from the record and ruled it a busted trade...

Unfortunately this doesn't fly.

You can't just go back and say that a trade shouldn't be recorded because it was a mistake. If that had been a fat profit I have no doubt that it would have remained in the results table. Explain that...

It also indicates that the Collective2 software still needs work done on it before it can be trusted. Remember that a system that has been verified by Collective2 has used their software in the past (the version with bugs) and they don't re-run the results so the history in those results have been generated with buggy software. So those results could be showing fat profits as a result of errors in the software that shouldn't be there - i.e. the profits shouldn't be there.

Busting a trade because it had 0 contracts/size and saying that it couldn't have been acted on in the real world is nonsensical. The real world does many things that don't make sense like fat-fingers.

I have seen an accounting system generate negative valued checks when a customers owes a company money. I've also seen those checks mailed out to the customers with the negative/minus sign in front of the amount. And to cap it all, I've seen the bank accept these checks and deposit those amount as positive amounts into the customer's private account. This is what happens in the real world.

I noticed that there was another trade today but I'm not going to track this system any longer. It does not appear to be viable.

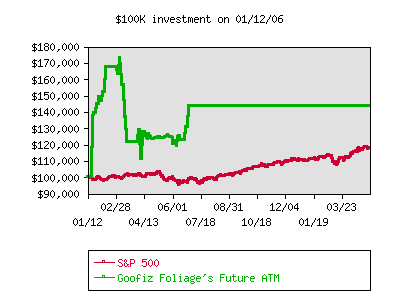

My last comment on this trading system was made on 04/05/2006 and the last trade that was opened/closed on the system was 06/23/2006 - about 10 weeks later. The system lost more money after my last post but subsequently recovered some. There does not appear to be a reason given for the system no longer being active.

Here is the equity curve of the system.

Here is the equity curve of the system.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.