Housing: Building Up to a Boom?

From the CME:

Full Article: http://www.cmegroup.com/education/featured-reports/housing-building-up-to-a-boom.html

Executive Summary

- Pent-up consumer demand in a steadily improving economy and a dramatic decline in inventories of new and existing homes are among eight key reasons why the U.S. housing sector could be at the cusp of a lift-off in the aftermath of the Great Recession.

- Home prices, except in a few locations, remain significantly below their peaks of 2006, while mortgage rates are historically low.

- The Federal Reserve likely raising short-term interest rates this year is not expected to have any significant impact on home-buying.

Full Article: http://www.cmegroup.com/education/featured-reports/housing-building-up-to-a-boom.html

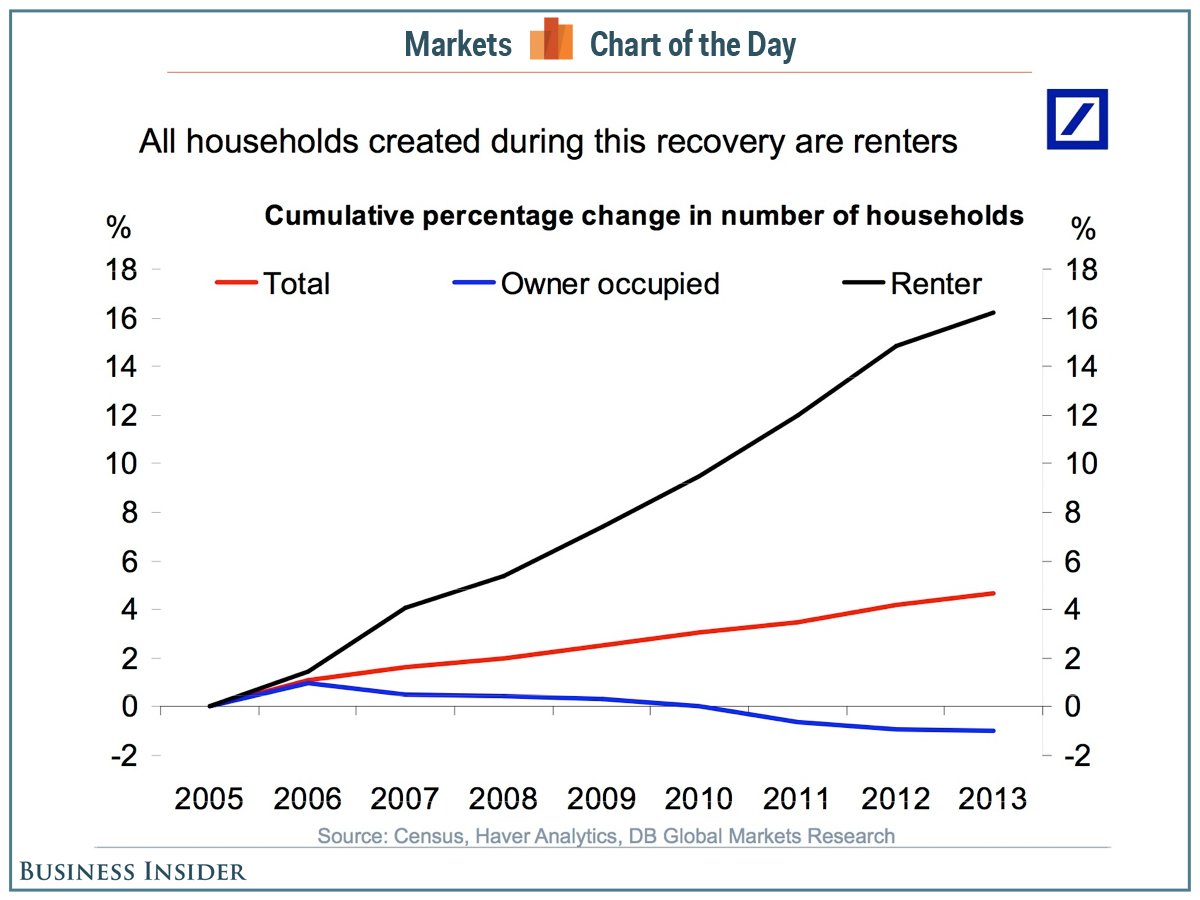

And lets not let the fact that no one can afford to buy a home stand in the way of our euphoric predictions.

that is something i agree with it. if we assume the average household income is 100k (which it definitely is not, is much lower than that), then the average house should cost ~300k. but over here, 300k barely gets you anything. i have no idea how people afford the houses unless they are very wealthy or are leveraging way more than 3x their income

I think you have to break it down into averages per area to more accurately assess affordability.

I think the big difference this time around will be that mortgages are going to be way more difficult to get.

I think the big difference this time around will be that mortgages are going to be way more difficult to get.

i hope they are continue to be more difficult to get. i have already started seeing "articles" about buying houses with 2%-5% down so i wonder if people are already starting to forget the mess we have been through

Look at the hoops people have to go through to get a home today. Back in 2005 I had a friend who bought a 389,000 house in a lake dwelling community. He made like barely 40k a year, and his wife never had a job. But because of "creative" lending he got an interest only loan for the first 3 months and then a subprime mortgage. He put no money down, and actually I think he got like 105% financing. His payments where like 1k, 1k, 1k, 2.4k, 3k 3.6k...... default. If there is a housing boom it will be after this generation, because I hope were not that stupid that fast again. Hoping for a housing boom is like hoping tulips or .com stocks will deify gravity again.

Originally posted by CharterJoe

...in 2005 I had a friend who bought a 389,000 house in a lake dwelling community. He made like barely 40k a year, and his wife never had a job. But because of "creative" lending he got an interest only loan for the first 3 months and then a subprime mortgage. He put no money down, and actually I think he got like 105% financing. His payments where like 1k, 1k, 1k, 2.4k, 3k 3.6k...... default...

This was my favorite story of that time:

“Despite making only $14,000 a year, strawberry picker Alberto Ramirez managed to buy his own slice of the American Dream. But his Hollister home came with a hefty price tag, $720,000. A year and a half later, Ramirez has defaulted on his loan, and he’s hoping to sell the house before it’s repossessed.”

“So how did Ramirez, with an annual income of just $14,000, purchase a $720,000 home without any money down? He had help, for one thing. Although Alberto Ramirez was the only one to sign the purchase agreement and the only one named on the loan documents, he actually bought the house with his wife Rosa Ramirez, as well as their friends Jesus Martinez and his wife.”

“However, even in a good month, the Ramirezes and Martinezes together don’t earn much more than a combined $6,500, and their official monthly payments were around $5,200.”

“The Ramirezes said Rancho Grande real estate agent Maria Avila promised they could refinance their home in three to six months to an affordable rate; until then, Rosa Ramirez said, Avila said she would pay for whatever they couldn’t afford.”

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.