ES Thursday 4-2-15

impressive drive out of YD's VA and range. Did not even hesitate at YD high. Congratulations to those who took the breakout. I just had a small fade to look back into value

the corollary held true today. we looked outside value, came back into value, failed and drove back out of value. that was a good setup for a breakout. need to take advantage of such moves because they can tend to be explosive like it is today

30 min VPOC @ 51.75 but there are a lot of HVNs scattered in the way. On the other hand we also have a lot of singles. Conflicting data here but the profile looks really stretched

the current high is at Tuesday's LVN of 64.5/64.75. Would have been a good place to start a short. I was a little nervous to take it so let it pass. There will be other opportunities.

seems like folks have already taken off for the long weekend. hope everyone has a good one and see you all on Monday.

P.S: Now I know how Bruce feels some days when he mentions feeling like he is talking to himself. lol

P.S: Now I know how Bruce feels some days when he mentions feeling like he is talking to himself. lol

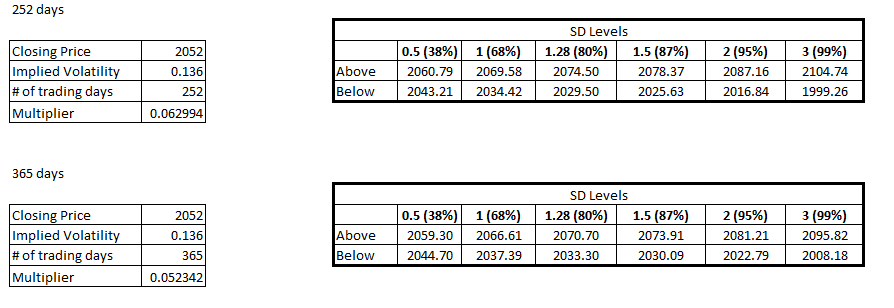

If i am not wrong the calculations seem to be. the resistant levels calculated

are lesser than the PP. Or please guide me accordingly and oblige.

Thanks.

Originally posted by tarspark

If i am not wrong the calculations seem to be. the resistant levels calculated

are lesser than the PP. Or please guide me accordingly and oblige.

You're using the Camarilla Pivots. If you look at the formula that's used for the R and S numbers it "pivots off" the Closing price and calculates the R and S numbers based on fractions of the range above and below it. So technically you would using the Closing price as the Pivot Point in this case.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.