Some charts from the last two days

I got some positive feedback on the post I made showing some comments I made in my forum, so I thought I'd just follow up on that a bit. I do think, to some extent, it's not going to be of a lot of use, but I think it will serve some purpose, so I spent some time putting this together. If you like trader talk and want to gain some new insights, this is for you. I’m doing it to make a contribution, and to provide some clarity. I’d hate to think anyone would put me down for that.

Let me explain a bit about what I do in my forum, and why I do it that way. Understand my goal here is to satisfy people's curiosity as to what I do, what my approach is like, and so on. It is not a methodology well-suited to anyone I have seen post at MyPivots, but I am still curious myself about other trader's methods, even if I would never trade them. I like to learn as much as I can about the market, regardless. I never know when something I pick up might be useful. Maybe others feel the same way.

So, I am a big proponent of the concept of give a man a fish, he eats for a day, teach him to fish, and he eats for a lifetime. But, I am a very peculiar type of teacher. So, I have found, it is best for me to find people who want to learn from me that line up well with my style, and my methodological approach. One of my main goals as I developed my trading skills was to not only develop something that I thought would be robust in all market conditions, on all liquid issues, on all timeframes, over long periods of time, and varying market conditions, but also to 'figure out' the market. I don't mean that, at all, in the way most use the term. I mean it in that I understand as much as possible about why things were happening. That was just my naturally curious mind. I didn't want just some techniques to make some money and then done for the day, I wanted to 'understand the universe', understand the order, and where it came from.

On my journey I have found a tiny handful that wanted to go on a similar journey, a quest to understand this thing, not just trade it. I needed a private room for that. It was easiest to open it to those interested, which were book set buyers and mentor students. People who would have a vested interest in keeping the proprietary material to themselves. The idea, though, was for this to be a place where people that have already decided this is the style for them can help each other, contribute, and I can try to help them, all at zero cost.

If someone could demonstrate to me that they are using this methodology and that they can contribute I would surely consider them for the forum. I have hundreds of free commentary on my site and free articles, and this material covers the vast majority of what is in the books. This is all free. So if someone studied that and approached me, like I said, they would surely be considered. Hence, one could be in my forum without ever having spent a penny with me, and I’d be fine with that (just don’t tell me you learned my work by stealing my pirated material and want to be welcomed into the forum, I have had this happen multiple times). Anyway, this should have been done on my own server, with my own forum software, but I simply couldn't figure it out, and I have tried multiple times. Enter Guy, and that's how I wound up here.

Now this background is important to understand the upcoming charts. In most forum trading threads a fairly simple and straightforward technique is applied, and the better traders have really mastered it. The KISS principle is applicable. Trade sequences can be shown, with entry and exit, and this provides value. This would not, though, be very helpful with my methodology. I have a methodology that requires a lot of thinking, assessing, and applying higher-level thinking skills. It is the exact opposite of the KISS approach.

Everyone knows how I am overly wordy and always write 10X what anyone else would to make the same point. I suppose finding an overly complex trading methodology appealed to me in the same way. I guess I like to make things harder than they need be. But my goal was to understand market action, not just find a trading technique. The few followers in my forum are trying to learn my approach. My style of teaching is what in my teaching days was called ‘guided discovery’. I salt clues out there, try to point them in the right direction, try to get them to think in a manner that will advance their understanding of the methodology and the approach. I use a lot of humor (a style most don’t get or don’t like, but those that do absolutely love it), and some sarcasm. I try to keep it fun. I also run the forum more like a chat room a lot of the time, posting endlessly bell to bell and after.

I used to hang around in a few chat rooms long ago, and enjoyed it. I tried it more recently and found I could no longer concentrate (I guess as we get older…?) at all. So, running the forum like a chat room allows me to post as I see fit, but not see it flashing when someone else does something. This way, if I need to focus, I can. When I want to post, I can.

Now, one assumption I have is that people that are in there know the basics. I do not have to explain in any way what an area is. If people in there didn’t know that the dip on the open this AM was a setup, well, then they are in over their heads. But they can ask questions about the setup, about what entry trigger I liked, aspects of the setup, which lines, and so on, if they are confused. That’s one of the functions of the forum.

So, if I were to post all this anywhere but my forum it would be essentially useless. It is designed for people who have studied it for years. This is not a ‘beginner’ forum, it’s for people who have the basics of a complex methodology already down. There is no way I can post in essentially real time and explain what the setup is, how to do it, chart it and post it, and do what I need to do for myself. But if everyone is basically following the approach and I say then watch what price does here for a clue, watch the reaction off this, see if it comes back in to here and reacts, or does respect the area, and here’s what my experience says that may indicate, well, I can do that, and people can get the feel for what is unfolding. I frequently do this tick by tick in the market.

As I have explained many times, this approach is vastly different than usual daytrading approaches, and anything here at MyPivots. It’s a trend following methodology, although in the forum I mostly discuss intraday swing trades in the ES. That is, I try to find a swing move and stay with it until it ends, and let the market tell me it’s over. Many of the moves are 8-10 points, and when the volatility is higher 20 and 30 is not uncommon. I use no profit targets; the phrase is not even in my ‘Trading Plan’. I have areas I watch, but a trade doesn’t come off if they are reached, the market tells the trader when it’s time.

I understand this is not an approach that anyone in here is interested in. I am merely trying to develop some context for my charts. When you read the comments you can see them in the light of why I am posting them. These are selected comments. There are many humorous ones I won’t show you (for example, when the ES starts to sell off an area and looks ready to really dump, I love to yell out ‘Die, pig, die!, since I often refer to the market as a bloated pig, or oinker).

I do a lot of reading of the action. There is a little of that in these charts, but not much. I do endless comments on many of the little wiggles it does, and what I think they mean. As I have advanced my craft I have come to the conclusion, which I do not mean literally, but very close: ’There is no noise’. I am trying to teach people this reading skill, what in the old days they might call tape reading, or ticker sense. If I posted all those comments without you having followed me extensively in the forum they’d sound like ‘noise’, they’d make no sense. But that is a critical part of what I am trying to teach.

In my methodology, a trend following methodology, things like entry triggers, management, ‘context’, reading the action, they are all as important, if not more important, than the setups. Calling market turns, which I think I have adequately demonstrated, actually isn’t that important, compared to say most daytrading methodologies. As I have said, it accounts for maybe 10%-20% of the plan, at the most. Anyone who takes this approach would soon see that.

An interesting aside: this methodology tends to perform very well on strong trending days, as it would call for just staying with the trend until it turns. This is the exact opposite of most daytrading methods, which use a more static support and resistance, and do well when the market bounces between them. Sort of like comparing an oscillator system and a moving average system. With good market reading skills, though, if one can see the kind of day it is, or what phase it is in at the current moment, it is easy to adapt, and just focus on a lower timeframe trend from the static support to resistance, for example. It’s built to handle that.

So, here are some posts from the Fed day yesterday, and from today. I chose them to show some of what I am trying to point out to my readers to guide them. If I say I think something may be headed for an area and they have a completely different area they can redo their work, or ask me what the basic things are for that area. If I am giving overhead levels (at any given time I generally only post levels on one side) and they are lining up a short right now, they can ask what my reasoning is. That’s how this is designed. To guide people to discovering for themselves what the methodology implies and how it would be applied from my point of view. If you look at the comments below (and the ones I posted without charts before) in that light, it makes more sense.

If you were trying to advance your skill in price action reading and had some handle on that, then a series I could do on a chart with those comments might make that more clear. Some of that, though, is best experienced in ‘real time’, as I watch say 13-tick charts and may comment on a little swing move it did, and what I think that means, and you just can’t get a feel for that unless you read the comment and look right at your chart. I am trying to do that constantly. Setups are good, but I assume essentially all of my readers already understand that. I just try to comment, then, on anything that is unique, different, or relevant to that setup.

Again, I understand that none of this is interesting to a lot of the readers. But some may be more like me and if they read this and look it over they may say ‘Yeah, that was cool, Jim’s right, that’s not for me, but it’s a whole lot clearer what he is doing in his forum and how he teaches. That’s good to understand.’

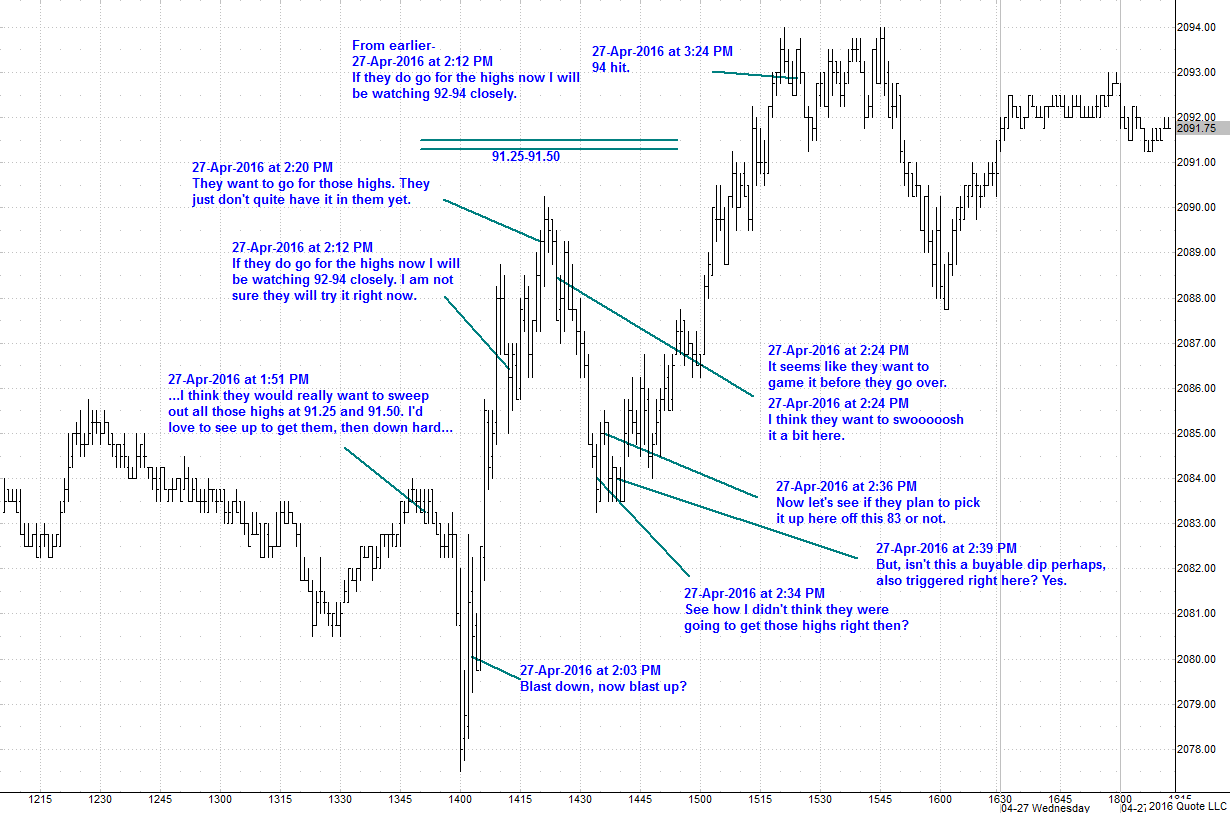

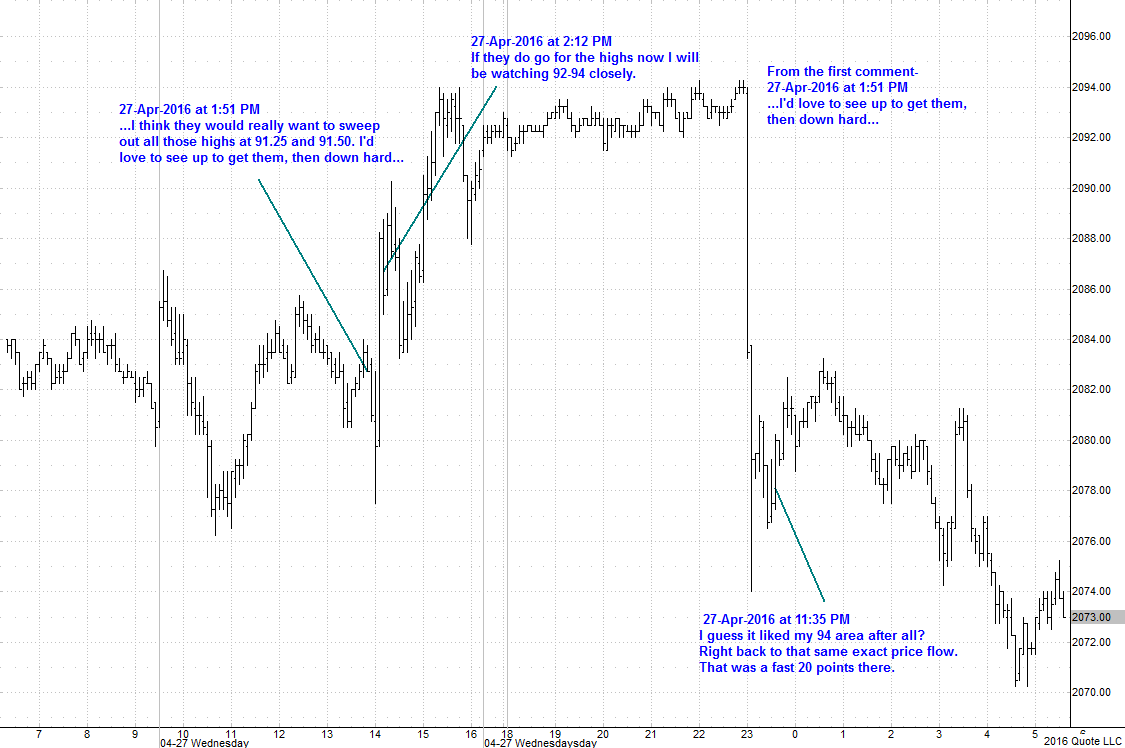

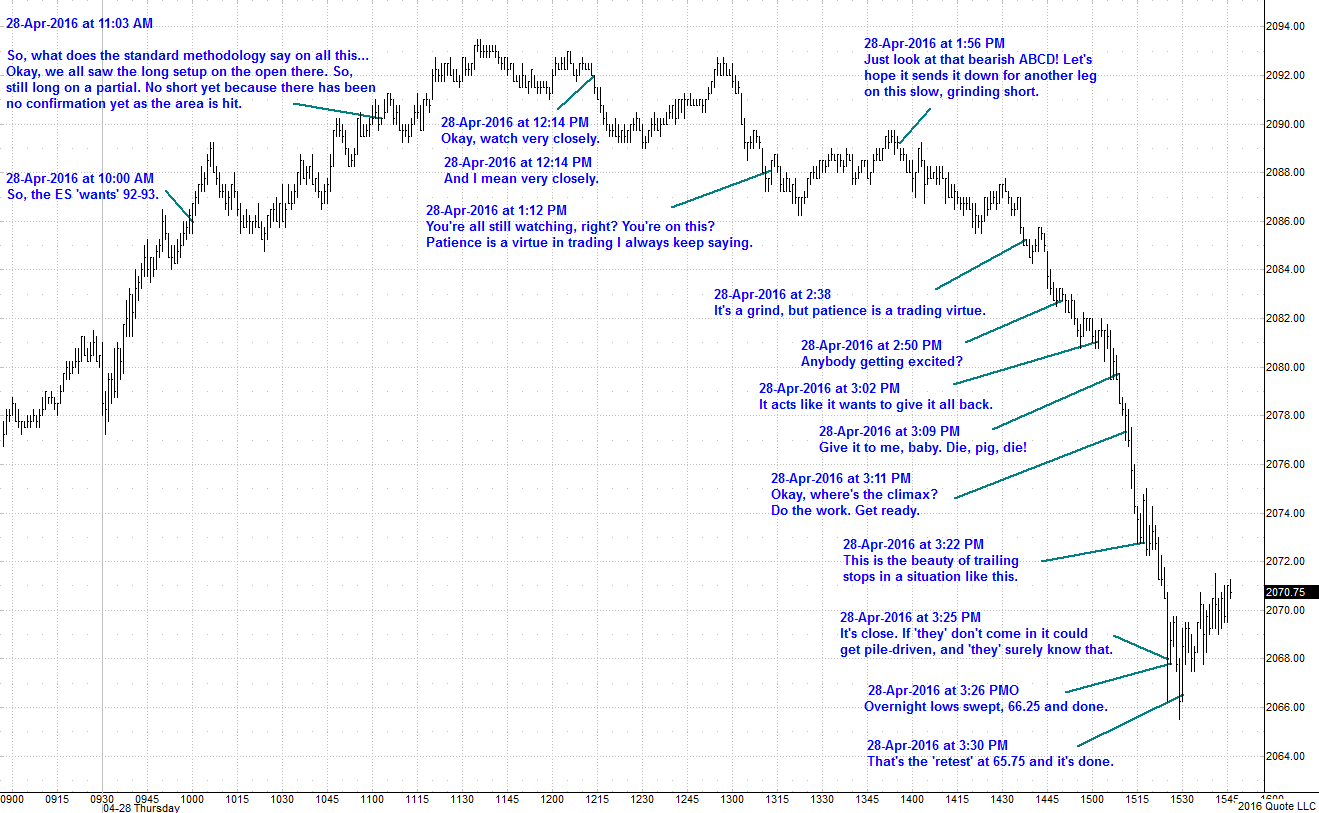

So, here are three charts with some of my comments on them. There are no workups on the charts, just the comments and a line showing when they were posted. I got the lines to show the post times as accurate as I could. Those that are interested can go to their own charts and look at the time stamps. Now, look at them from the perspective of what we just covered…

I started to work on this while I was posting and following the drop (I’m very good at multi-tasking). When I discussed above the concept of the intraday swing play with trailing stops and such, and 20 and 30 point moves, I didn’t expect one was going to unfold as I was working on this. The really interesting part is with the market moving the way it does and using an approach like this (not necessarily mine, but a trend following intraday swing approach) I do not find this all that unusual.

I hope everyone enjoyed this. Mostly what I want people to see is the ‘flow’ of the market when you look at it this way. It moves, the trader moves with it. Just like ballroom dancing.

From Bruce Lee:

“When my opponent expands, I contract. When he contracts, I expand. And when there is an opportunity, I don’t hit (he holds up a fist), it hits all by itself.”

Most may find all this hokey, but it’s how I see the market, and I think it helps me.

Charts created on QCharts, courtesy eSignal

Let me explain a bit about what I do in my forum, and why I do it that way. Understand my goal here is to satisfy people's curiosity as to what I do, what my approach is like, and so on. It is not a methodology well-suited to anyone I have seen post at MyPivots, but I am still curious myself about other trader's methods, even if I would never trade them. I like to learn as much as I can about the market, regardless. I never know when something I pick up might be useful. Maybe others feel the same way.

So, I am a big proponent of the concept of give a man a fish, he eats for a day, teach him to fish, and he eats for a lifetime. But, I am a very peculiar type of teacher. So, I have found, it is best for me to find people who want to learn from me that line up well with my style, and my methodological approach. One of my main goals as I developed my trading skills was to not only develop something that I thought would be robust in all market conditions, on all liquid issues, on all timeframes, over long periods of time, and varying market conditions, but also to 'figure out' the market. I don't mean that, at all, in the way most use the term. I mean it in that I understand as much as possible about why things were happening. That was just my naturally curious mind. I didn't want just some techniques to make some money and then done for the day, I wanted to 'understand the universe', understand the order, and where it came from.

On my journey I have found a tiny handful that wanted to go on a similar journey, a quest to understand this thing, not just trade it. I needed a private room for that. It was easiest to open it to those interested, which were book set buyers and mentor students. People who would have a vested interest in keeping the proprietary material to themselves. The idea, though, was for this to be a place where people that have already decided this is the style for them can help each other, contribute, and I can try to help them, all at zero cost.

If someone could demonstrate to me that they are using this methodology and that they can contribute I would surely consider them for the forum. I have hundreds of free commentary on my site and free articles, and this material covers the vast majority of what is in the books. This is all free. So if someone studied that and approached me, like I said, they would surely be considered. Hence, one could be in my forum without ever having spent a penny with me, and I’d be fine with that (just don’t tell me you learned my work by stealing my pirated material and want to be welcomed into the forum, I have had this happen multiple times). Anyway, this should have been done on my own server, with my own forum software, but I simply couldn't figure it out, and I have tried multiple times. Enter Guy, and that's how I wound up here.

Now this background is important to understand the upcoming charts. In most forum trading threads a fairly simple and straightforward technique is applied, and the better traders have really mastered it. The KISS principle is applicable. Trade sequences can be shown, with entry and exit, and this provides value. This would not, though, be very helpful with my methodology. I have a methodology that requires a lot of thinking, assessing, and applying higher-level thinking skills. It is the exact opposite of the KISS approach.

Everyone knows how I am overly wordy and always write 10X what anyone else would to make the same point. I suppose finding an overly complex trading methodology appealed to me in the same way. I guess I like to make things harder than they need be. But my goal was to understand market action, not just find a trading technique. The few followers in my forum are trying to learn my approach. My style of teaching is what in my teaching days was called ‘guided discovery’. I salt clues out there, try to point them in the right direction, try to get them to think in a manner that will advance their understanding of the methodology and the approach. I use a lot of humor (a style most don’t get or don’t like, but those that do absolutely love it), and some sarcasm. I try to keep it fun. I also run the forum more like a chat room a lot of the time, posting endlessly bell to bell and after.

I used to hang around in a few chat rooms long ago, and enjoyed it. I tried it more recently and found I could no longer concentrate (I guess as we get older…?) at all. So, running the forum like a chat room allows me to post as I see fit, but not see it flashing when someone else does something. This way, if I need to focus, I can. When I want to post, I can.

Now, one assumption I have is that people that are in there know the basics. I do not have to explain in any way what an area is. If people in there didn’t know that the dip on the open this AM was a setup, well, then they are in over their heads. But they can ask questions about the setup, about what entry trigger I liked, aspects of the setup, which lines, and so on, if they are confused. That’s one of the functions of the forum.

So, if I were to post all this anywhere but my forum it would be essentially useless. It is designed for people who have studied it for years. This is not a ‘beginner’ forum, it’s for people who have the basics of a complex methodology already down. There is no way I can post in essentially real time and explain what the setup is, how to do it, chart it and post it, and do what I need to do for myself. But if everyone is basically following the approach and I say then watch what price does here for a clue, watch the reaction off this, see if it comes back in to here and reacts, or does respect the area, and here’s what my experience says that may indicate, well, I can do that, and people can get the feel for what is unfolding. I frequently do this tick by tick in the market.

As I have explained many times, this approach is vastly different than usual daytrading approaches, and anything here at MyPivots. It’s a trend following methodology, although in the forum I mostly discuss intraday swing trades in the ES. That is, I try to find a swing move and stay with it until it ends, and let the market tell me it’s over. Many of the moves are 8-10 points, and when the volatility is higher 20 and 30 is not uncommon. I use no profit targets; the phrase is not even in my ‘Trading Plan’. I have areas I watch, but a trade doesn’t come off if they are reached, the market tells the trader when it’s time.

I understand this is not an approach that anyone in here is interested in. I am merely trying to develop some context for my charts. When you read the comments you can see them in the light of why I am posting them. These are selected comments. There are many humorous ones I won’t show you (for example, when the ES starts to sell off an area and looks ready to really dump, I love to yell out ‘Die, pig, die!, since I often refer to the market as a bloated pig, or oinker).

I do a lot of reading of the action. There is a little of that in these charts, but not much. I do endless comments on many of the little wiggles it does, and what I think they mean. As I have advanced my craft I have come to the conclusion, which I do not mean literally, but very close: ’There is no noise’. I am trying to teach people this reading skill, what in the old days they might call tape reading, or ticker sense. If I posted all those comments without you having followed me extensively in the forum they’d sound like ‘noise’, they’d make no sense. But that is a critical part of what I am trying to teach.

In my methodology, a trend following methodology, things like entry triggers, management, ‘context’, reading the action, they are all as important, if not more important, than the setups. Calling market turns, which I think I have adequately demonstrated, actually isn’t that important, compared to say most daytrading methodologies. As I have said, it accounts for maybe 10%-20% of the plan, at the most. Anyone who takes this approach would soon see that.

An interesting aside: this methodology tends to perform very well on strong trending days, as it would call for just staying with the trend until it turns. This is the exact opposite of most daytrading methods, which use a more static support and resistance, and do well when the market bounces between them. Sort of like comparing an oscillator system and a moving average system. With good market reading skills, though, if one can see the kind of day it is, or what phase it is in at the current moment, it is easy to adapt, and just focus on a lower timeframe trend from the static support to resistance, for example. It’s built to handle that.

So, here are some posts from the Fed day yesterday, and from today. I chose them to show some of what I am trying to point out to my readers to guide them. If I say I think something may be headed for an area and they have a completely different area they can redo their work, or ask me what the basic things are for that area. If I am giving overhead levels (at any given time I generally only post levels on one side) and they are lining up a short right now, they can ask what my reasoning is. That’s how this is designed. To guide people to discovering for themselves what the methodology implies and how it would be applied from my point of view. If you look at the comments below (and the ones I posted without charts before) in that light, it makes more sense.

If you were trying to advance your skill in price action reading and had some handle on that, then a series I could do on a chart with those comments might make that more clear. Some of that, though, is best experienced in ‘real time’, as I watch say 13-tick charts and may comment on a little swing move it did, and what I think that means, and you just can’t get a feel for that unless you read the comment and look right at your chart. I am trying to do that constantly. Setups are good, but I assume essentially all of my readers already understand that. I just try to comment, then, on anything that is unique, different, or relevant to that setup.

Again, I understand that none of this is interesting to a lot of the readers. But some may be more like me and if they read this and look it over they may say ‘Yeah, that was cool, Jim’s right, that’s not for me, but it’s a whole lot clearer what he is doing in his forum and how he teaches. That’s good to understand.’

So, here are three charts with some of my comments on them. There are no workups on the charts, just the comments and a line showing when they were posted. I got the lines to show the post times as accurate as I could. Those that are interested can go to their own charts and look at the time stamps. Now, look at them from the perspective of what we just covered…

I started to work on this while I was posting and following the drop (I’m very good at multi-tasking). When I discussed above the concept of the intraday swing play with trailing stops and such, and 20 and 30 point moves, I didn’t expect one was going to unfold as I was working on this. The really interesting part is with the market moving the way it does and using an approach like this (not necessarily mine, but a trend following intraday swing approach) I do not find this all that unusual.

I hope everyone enjoyed this. Mostly what I want people to see is the ‘flow’ of the market when you look at it this way. It moves, the trader moves with it. Just like ballroom dancing.

From Bruce Lee:

“When my opponent expands, I contract. When he contracts, I expand. And when there is an opportunity, I don’t hit (he holds up a fist), it hits all by itself.”

Most may find all this hokey, but it’s how I see the market, and I think it helps me.

Charts created on QCharts, courtesy eSignal

Let me describe a bit on something that some maybe are wondering about. One approach for trailing stops is to use an automated trailing stop. I like Ninja, and it is very easy to do on that platform. Once you have assessed your layout, you know the 'context' and timeframe of your play, you can set a trailing stop to just follow it down. I prefer a much more refined approach where I would mechanically do basically the same thing. Most platforms have screen based trading nowadays. On Ninja I might have a chart and I set up the 'Chart trader'.

So, I prefer to just move my stop line down with the price action. I do work all along as the action unfolds. In today's action it kept following the basic techniques for the pullbacks. Once it starts to come in (or rip, in the case of a downtrend like this afternoon) I do my workup, and I can set my stop just outside of that. Click and it's there. I can simulate that as it is moving, just clicking here and there to keep it close to that far away. Once a play like this gets going there is little to do. This play was almost four hours from the peak, and over three hours from entry to ext, by the methodology. So, other than a few clicks here and there and doing work I have done so many thousands of times I could almost literally do it in my sleep, I have a lot of time on my hands where I have to keep watching, but would go nuts if I had to just watch and do nothing else*.

Now, could one just set the trail and walk away, and come back later and see how it played out? Sure, I guess, but I can't imagine any professional full-time trader taking that approach. You'd want to see what is developing, see how you could refine the management, and to use a phrase from Reminiscences of a Stock Operator be Johnny-on-the-spot if anything goes wrong technologically, broker, or exchange-wise. Sure, I am not opposed to using this technique for overnight trends, as long as one understands the extra risks. But if one can be there, why wouldn't you?

*This may beg the question for some, isn't there something else you can do while you watch a play unfold for so long? Yes, my own personal style would be to play many of the legs as additional, separate plays. Once a bigger move is under way I could look to buy the dips or sell the rips at my areas along the way while the other play runs. Let's say I was trading five contracts on the main play (I am choosing a size that I think most in here could relate to, as opposed to more of a hedge fund size). Then I could buy say two or three on a dip, then sell them off when that leg is done, getting back to five. I could then repeat this as indicated. That allows one to take advantage of additional opportunities while running a play. Many platforms are good for this, but Ninja with screen based Chart trader is really easy to execute. (I don't work for Ninja in any way. I have used J-trader, Strategy Runner, Button Trader (totally different but awesome in its own way), and many others, all of them with merits).

So, I prefer to just move my stop line down with the price action. I do work all along as the action unfolds. In today's action it kept following the basic techniques for the pullbacks. Once it starts to come in (or rip, in the case of a downtrend like this afternoon) I do my workup, and I can set my stop just outside of that. Click and it's there. I can simulate that as it is moving, just clicking here and there to keep it close to that far away. Once a play like this gets going there is little to do. This play was almost four hours from the peak, and over three hours from entry to ext, by the methodology. So, other than a few clicks here and there and doing work I have done so many thousands of times I could almost literally do it in my sleep, I have a lot of time on my hands where I have to keep watching, but would go nuts if I had to just watch and do nothing else*.

Now, could one just set the trail and walk away, and come back later and see how it played out? Sure, I guess, but I can't imagine any professional full-time trader taking that approach. You'd want to see what is developing, see how you could refine the management, and to use a phrase from Reminiscences of a Stock Operator be Johnny-on-the-spot if anything goes wrong technologically, broker, or exchange-wise. Sure, I am not opposed to using this technique for overnight trends, as long as one understands the extra risks. But if one can be there, why wouldn't you?

*This may beg the question for some, isn't there something else you can do while you watch a play unfold for so long? Yes, my own personal style would be to play many of the legs as additional, separate plays. Once a bigger move is under way I could look to buy the dips or sell the rips at my areas along the way while the other play runs. Let's say I was trading five contracts on the main play (I am choosing a size that I think most in here could relate to, as opposed to more of a hedge fund size). Then I could buy say two or three on a dip, then sell them off when that leg is done, getting back to five. I could then repeat this as indicated. That allows one to take advantage of additional opportunities while running a play. Many platforms are good for this, but Ninja with screen based Chart trader is really easy to execute. (I don't work for Ninja in any way. I have used J-trader, Strategy Runner, Button Trader (totally different but awesome in its own way), and many others, all of them with merits).

I was thinking on something else that further clarifies some of what I try to do in the forum. I was pondering how what I do differs from approaches I see in general. My goal in my forum is education. I am trying to help people learn this methodology. Many forums, both paid and free, are producing, and are judged on, making market calls. Market calls are a big part of their methodologies. Here’s the very serious concern I had.

What would likely happen if I ran a forum with the sole goal of helping people learn my methodology, and in doing so I mostly pointed to setups right before the happened, talked about the entry trigger, announced it as it happened, then discussed management, when parts would be taken off as that happened, and so on? In my experience when I have seen this done people don’t spend the hard work and time learning, they just piggyback. They just trade off the calls, and that’s it.

Now, maybe this happens less (I personally doubt it) with a methodology that is fairly simple to explain and understand. With a very complex methodology that can take five years of full-time work just to have a shot at basic competency, the temptation to just piggyback instead of pay the immense dues would be too great. Regardless, it was my decision as to the best way to address this.

I decided to really do a lot of the ‘guided discovery’, giving clues and hints and making people think on their own instead of me telling them what I think. Sure, I discuss areas in advance, but I try to do it in such a manner that makes any attempt to piggy back anything I say very difficult. If I had any hint that anyone in there was even thinking of trying that I’d take them aside and give them a good reaming. That’s not what the forum is all about. So far I have had no hint of that.

Let’s look briefly at a little interchange that happened with someone today that is just starting to learn how I do the forum. The open was setting up a nice bearish play. Anyone who knows my methodology would see this, so we have to assume that’s straightforward for anyone who has been in the forum for awhile.

29-Apr-2016 at 9:33 AM

Okay, time to see if these buyers are for real.

No, wait, isn’t the setup forming for a short? That completed at 9:35 AM.

29-Apr-2016 at 9:46 AM

Looking pretty weak.

29-Apr-2016 at 10:08 AM

…Go back and look at my teasing comment right off the open. What was I trying to get people to think about? What is an EXP ABCD? Basically, especially with the action right before the open, a double stop sweep. Just as they made it look like the buyers were ready to launch the pattern kicks in.

Reader:

29-Apr-2016 at 10:19 AM

I thought your comment about the buyers was interesting. So you actually want us to think : )

29-Apr-2016 at 10:27 AM

Yes. My sarcasm (it wasn't really sarcasm in this case per se) has tripped up many, many overseas readers over the years where English is not their primary language. I have toned it way down, but my style would be to use it quite a bit. If you read the latest posts I made in the public KT area I describe a bit of my 'guided discovery' concept again there. My mission is to get people to develop critical thinking skills for themselves. I am always thinking of the bigger picture. As I have said many times, I teach how I teach, and it is not suited for probably most. But for those that it is suited for, I think it can lead to some deep skills.

What would likely happen if I ran a forum with the sole goal of helping people learn my methodology, and in doing so I mostly pointed to setups right before the happened, talked about the entry trigger, announced it as it happened, then discussed management, when parts would be taken off as that happened, and so on? In my experience when I have seen this done people don’t spend the hard work and time learning, they just piggyback. They just trade off the calls, and that’s it.

Now, maybe this happens less (I personally doubt it) with a methodology that is fairly simple to explain and understand. With a very complex methodology that can take five years of full-time work just to have a shot at basic competency, the temptation to just piggyback instead of pay the immense dues would be too great. Regardless, it was my decision as to the best way to address this.

I decided to really do a lot of the ‘guided discovery’, giving clues and hints and making people think on their own instead of me telling them what I think. Sure, I discuss areas in advance, but I try to do it in such a manner that makes any attempt to piggy back anything I say very difficult. If I had any hint that anyone in there was even thinking of trying that I’d take them aside and give them a good reaming. That’s not what the forum is all about. So far I have had no hint of that.

Let’s look briefly at a little interchange that happened with someone today that is just starting to learn how I do the forum. The open was setting up a nice bearish play. Anyone who knows my methodology would see this, so we have to assume that’s straightforward for anyone who has been in the forum for awhile.

29-Apr-2016 at 9:33 AM

Okay, time to see if these buyers are for real.

No, wait, isn’t the setup forming for a short? That completed at 9:35 AM.

29-Apr-2016 at 9:46 AM

Looking pretty weak.

29-Apr-2016 at 10:08 AM

…Go back and look at my teasing comment right off the open. What was I trying to get people to think about? What is an EXP ABCD? Basically, especially with the action right before the open, a double stop sweep. Just as they made it look like the buyers were ready to launch the pattern kicks in.

Reader:

29-Apr-2016 at 10:19 AM

I thought your comment about the buyers was interesting. So you actually want us to think : )

29-Apr-2016 at 10:27 AM

Yes. My sarcasm (it wasn't really sarcasm in this case per se) has tripped up many, many overseas readers over the years where English is not their primary language. I have toned it way down, but my style would be to use it quite a bit. If you read the latest posts I made in the public KT area I describe a bit of my 'guided discovery' concept again there. My mission is to get people to develop critical thinking skills for themselves. I am always thinking of the bigger picture. As I have said many times, I teach how I teach, and it is not suited for probably most. But for those that it is suited for, I think it can lead to some deep skills.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.