Collective2 - Six Sigma Trading

Original title for this thread: Zero losses year to date - eminis

Our trade system has produced only positive trades year to date with an estimated 14% return. Data guaranteed.

sixsigmatrading.com (site currently not available)

Our trade system has produced only positive trades year to date with an estimated 14% return. Data guaranteed.

sixsigmatrading.com (site currently not available)

sst- I think the basic question I see with what you have outlined in this thread is on the risk side of the system. From your comments, I am still a bit unclear as to if the system actually uses a hard stop loss order in the market when the position is open.

Does the system specify a hard stop loss price at the same time the initial position entry signal is sent out ? Or does the system keep the position open until an exit signal is sent out ?

Does the system specify a hard stop loss price at the same time the initial position entry signal is sent out ? Or does the system keep the position open until an exit signal is sent out ?

the acid test is does it work in all mkt conditions. up down sideways and then does it work across asset classes, stks, bonds, commodities

To continue alleyb's comment...

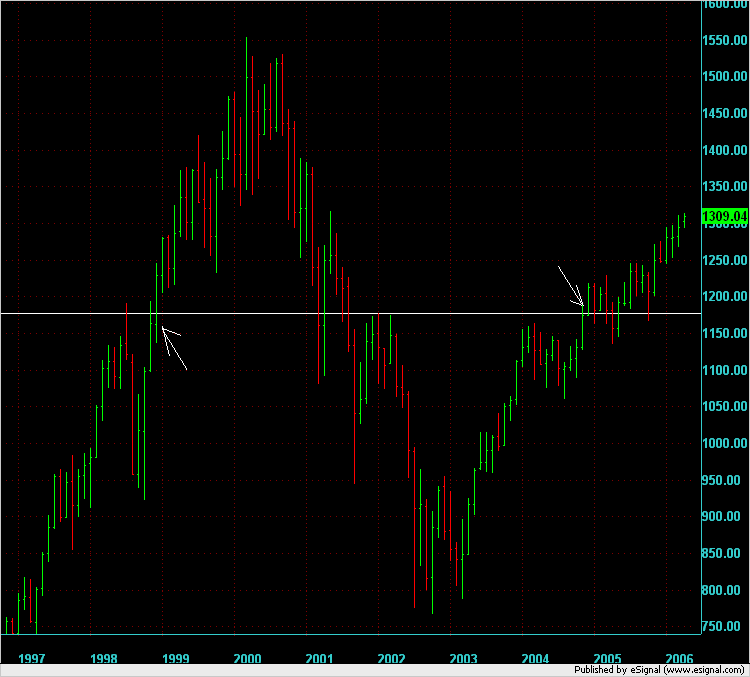

In recent history (over the last few years) we have a fantastic set of data to test new trade ideas because we have had a radical bull and bear market and if you choose your start and end date carefully then you can run a back test across a trading strategy that incorporates those market types and yet ends up at the same price. This time frame also includes a price shock (911). Here is a chart showing the monthly S&P500 and a couple of crudely drawn arrows showing possible start and end dates for strategy testing.

In recent history (over the last few years) we have a fantastic set of data to test new trade ideas because we have had a radical bull and bear market and if you choose your start and end date carefully then you can run a back test across a trading strategy that incorporates those market types and yet ends up at the same price. This time frame also includes a price shock (911). Here is a chart showing the monthly S&P500 and a couple of crudely drawn arrows showing possible start and end dates for strategy testing.

quote:

Originally posted by sst

Our trade system has produced only positive trades year to date with an estimated 14% return. Data guaranteed.

www.sixsigmatrading.com

I hit your link and your site was disabled...Please advise

Perhaps they were fraudulent and shut down by the CFTC or other body...

What I find, is that anybody with a genuine system or genuine interest for the consumer will continue to answer all reasonable questions in a forum to exhaustion. The originator of this topic (sst) appears to have given up fairly early on indicating a decline in interest in promoting his product or a fear of being exposed etc.

I believe in giving everybody a fair chance and you will notice that a number of topics in this forum dwindle out as the originator stops posting because we (not just me - there are some excellent pertinent questions from others) ask questions which expose flaws and weaknesses in new trading systems that have not been fully thought out or tested.

I hope that these people go off and work on the weaknesses in their systems and it helps them produce better systems but we rarely hear back from them so it's hard to tell.

What I find, is that anybody with a genuine system or genuine interest for the consumer will continue to answer all reasonable questions in a forum to exhaustion. The originator of this topic (sst) appears to have given up fairly early on indicating a decline in interest in promoting his product or a fear of being exposed etc.

I believe in giving everybody a fair chance and you will notice that a number of topics in this forum dwindle out as the originator stops posting because we (not just me - there are some excellent pertinent questions from others) ask questions which expose flaws and weaknesses in new trading systems that have not been fully thought out or tested.

I hope that these people go off and work on the weaknesses in their systems and it helps them produce better systems but we rarely hear back from them so it's hard to tell.

In fact, until they have exhaustively answered all reasonable questions in a public forum such as this I would not even take up a free trial subscription from a vendor of a service such as this. It is just a waste of time until they shown a genuine understand of the system that they have "developed."

I haven't given up on the system. Simply have not been back here in the last few weeks while I took care of some things. Took the web site down as I decided to take the audited approach to verify system results.

Go to www.collective2.com

and look up "Six Sigma Trading"

I still claim zero losses year to date.

Go to www.collective2.com

and look up "Six Sigma Trading"

I still claim zero losses year to date.

I tried a few different variations of "Sigma Six Trading" on the Collective2 site but could not find your system. After trying for about 10 minutes the Collective2 site crashed and so I've given up for the time being.

Do you not have a direct link to your system on Collective2 for us?

Do you not have a direct link to your system on Collective2 for us?

Found it now - the search problem must have been related to the problem that Collective2 was having as the Sigma search found your system when the Collective2 site came back up.

Your system is looking good on Collective2. It shows that 5 trades have been executed but you can only see the details of 2 of those trades with a worst case draw down of 1.5%

I see that of the 2 trades shown that they had 4.25 and 4.75 points draw down. Is this right? It also looks like you have 1 entry, 1 stop and 1 target - which I like - adds to the simplicity of the system.

I still can't see what the stop on each of these trades was. What was it?

Your system is looking good on Collective2. It shows that 5 trades have been executed but you can only see the details of 2 of those trades with a worst case draw down of 1.5%

I see that of the 2 trades shown that they had 4.25 and 4.75 points draw down. Is this right? It also looks like you have 1 entry, 1 stop and 1 target - which I like - adds to the simplicity of the system.

I still can't see what the stop on each of these trades was. What was it?

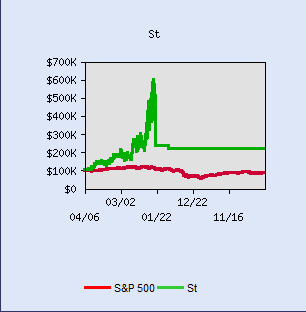

Still no losses year to date. 100% successful trade set ups taken. System is audited at www.collective2.com (under Six Sigma Trading) since April for public perusal. 38% gain from April to now.

http://www.collective2.com/cgi-perl/systems.mpl?want=publicdetails&systemid=19460736&session=83992322842674888254613355654842773

http://www.collective2.com/cgi-perl/systems.mpl?want=publicdetails&systemid=19460736&session=83992322842674888254613355654842773

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.