The TICK Trade

[Originally posted by myptofvu. Moved to here by day trading.]

Here is a trade I call the TICK trade. As far as I'm aware I invented it so I shouldn't be stepping on anyones toes by sharing it.

It was designed to scalp the market during sideways action also known as, (give me something to do when I was bored).

The idea is to take small swings in the futures market based upon small swings in the stock market.

It uses a 1min ES chart and a NYSE TICK chart (not to be confused with a contracts traded tick chart)

The trade is very reliable probably 90% or better and very safe due to a 3/4 pt stop.

The problem is that the setup can occur only rarely sometimes.

Here is a trade I call the TICK trade. As far as I'm aware I invented it so I shouldn't be stepping on anyones toes by sharing it.

It was designed to scalp the market during sideways action also known as, (give me something to do when I was bored).

The idea is to take small swings in the futures market based upon small swings in the stock market.

It uses a 1min ES chart and a NYSE TICK chart (not to be confused with a contracts traded tick chart)

The trade is very reliable probably 90% or better and very safe due to a 3/4 pt stop.

The problem is that the setup can occur only rarely sometimes.

Thanks for posting this myptofvu!

Some questions:

What is "significant" in a significant spike on the tick chart? 400? 600? 800? Or does it depend on the day type? I know that sometimes the NYSE TICK is bouncing all over the place and at other times it is docile.

Also, I assume that your charts are in the Pacific Time Zone right?

Some questions:

What is "significant" in a significant spike on the tick chart? 400? 600? 800? Or does it depend on the day type? I know that sometimes the NYSE TICK is bouncing all over the place and at other times it is docile.

Also, I assume that your charts are in the Pacific Time Zone right?

Day Trading

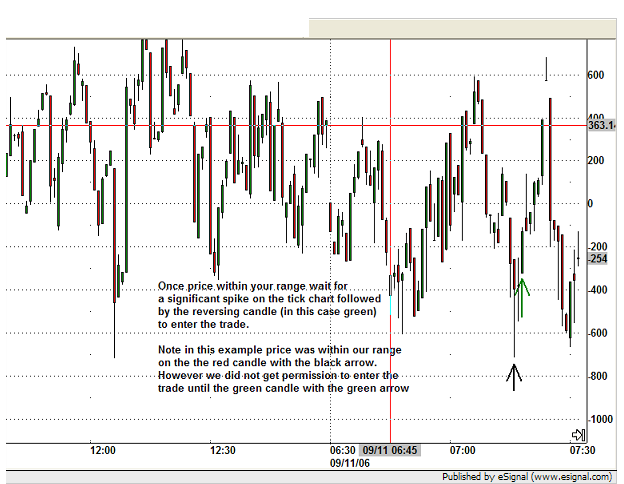

Significant is in relation to how it had been moving (you are right it can be volatile or stagnant), there is no number to relate it to. The best way I found to describe it was by calling it a spike like you might refer to a volume bar as a spike.

At that time I believe it was Pacific time.

You can disregard any indicators you see on the chart(s) they don't apply. Only the price setup from the ES chart and the entry from the TICK chart apply.

Significant is in relation to how it had been moving (you are right it can be volatile or stagnant), there is no number to relate it to. The best way I found to describe it was by calling it a spike like you might refer to a volume bar as a spike.

At that time I believe it was Pacific time.

You can disregard any indicators you see on the chart(s) they don't apply. Only the price setup from the ES chart and the entry from the TICK chart apply.

Thanks!

So the first thing you do is calculate the stop which is 1 tick below the low (assuming a long setup here) and then you wait for the price to trade into the 3 tick area above the stop and wait for a TICK spike to enter the trade. Sounds fairly simple. The target is also 3 ticks.

It works 90% of the time you say? That's not a bad risk/return. It also sounds like a perfect setup to automate or semi automate.

So the first thing you do is calculate the stop which is 1 tick below the low (assuming a long setup here) and then you wait for the price to trade into the 3 tick area above the stop and wait for a TICK spike to enter the trade. Sounds fairly simple. The target is also 3 ticks.

It works 90% of the time you say? That's not a bad risk/return. It also sounds like a perfect setup to automate or semi automate.

You understand it pretty well. The only correction I would make is that the first thing is to have what I call the N setup or A B C confirmed and then wait for the TICK to give you permission to enter the trade.

The stop is always 3 ticks but the profit target is determined by the range of the N formation. If the channel is 3 points then your target would be 1 point. The target is always 1/3 of the channel.

The stop is always 3 ticks but the profit target is determined by the range of the N formation. If the channel is 3 points then your target would be 1 point. The target is always 1/3 of the channel.

Thanks for the clarification. I missed the part about the target.

How often do you see this setup? (You say that it is rare.) I am guessing that you don't look for the setup if you're already in a trade? Or do you? Say, for example, you were short from point B on a different setup, would you then use point C as a target instead of an entry?

How often do you see this setup? (You say that it is rare.) I am guessing that you don't look for the setup if you're already in a trade? Or do you? Say, for example, you were short from point B on a different setup, would you then use point C as a target instead of an entry?

quote:

Originally posted by day trading

Thanks for the clarification. I missed the part about the target.

How often do you see this setup? (You say that it is rare.) I am guessing that you don't look for the setup if you're already in a trade? Or do you? Say, for example, you were short from point B on a different setup, would you then use point C as a target instead of an entry?

I've seen it as many as 6 times in a day and as few as 1 per week. No I don't look for it if I'm already in a trade it was used mostly during lunch hour and other slow periods. Due to its nature I would probably not use this trade to validate or invalidate any other trade I was in.

I mentioned before that I don't highly recomend this trade and that is for several reasons other than just its scarcity. For it to be highly effective you must follow the disciplines of the trade for example: this pattern develops in a consolodation period in which there will be a breakout. Therefore you need to resign yourself to taking advantage of this trade only once no more than twice per occurence. Also, this pattern often develops in conjunction with a support or resistance area such as a pivot level. If you are a S&R trader there may be better trades that you would take for higher profit targets. If there is no conflict with your trade then you can give it a try.

Thanks for the notes!

hey this is good stuff...thanks for that posting....

Bruce

Bruce

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.