ES Short Term Trading 8-2-2010

Range Based S/R for Monday August 2.

R1 = 1108.50

S1 = 1078.50

R2 = 1113.50

S2 = 1073.50

Steenbarger Pivot = 1095.875

R1 = 1108.50

S1 = 1078.50

R2 = 1113.50

S2 = 1073.50

Steenbarger Pivot = 1095.875

Great question Bruce. I'm sure Kool will have a great answer.

My thoughts on the subject is we should use at least 3 different time frames. As for which ones I think it becomes an experience thing.

The greatest moves will come when all three time frames line up in the same direction or point in the same direction.

My thoughts on the subject is we should use at least 3 different time frames. As for which ones I think it becomes an experience thing.

The greatest moves will come when all three time frames line up in the same direction or point in the same direction.

Originally posted by BruceM

Hey Kool...how do u determine which time frame to use ? I see some use the one minute, the 5 minute...the key 15 minute, the 30 minute and you just posted the 120 minute....

The question is really this : How do we decide what time frame to use so we don't have too many levels to look at ? What should MOST use who want to try and hold for longer term moves ? My eternal quest..! !

my plan now is to short above O/N high in the RTH session if it gets up there and early on or if 15.50 prints in O/N session.....the last time I shorted a big gap up and we had reports at 10, it became a very challenging day. To put it mildly...so I will not be as agressive on initial shorts today and I will be giving up some potential profits ( if correct)to limit risk early on

Peak O/N volume is 11.75

Peak O/N volume is 11.75

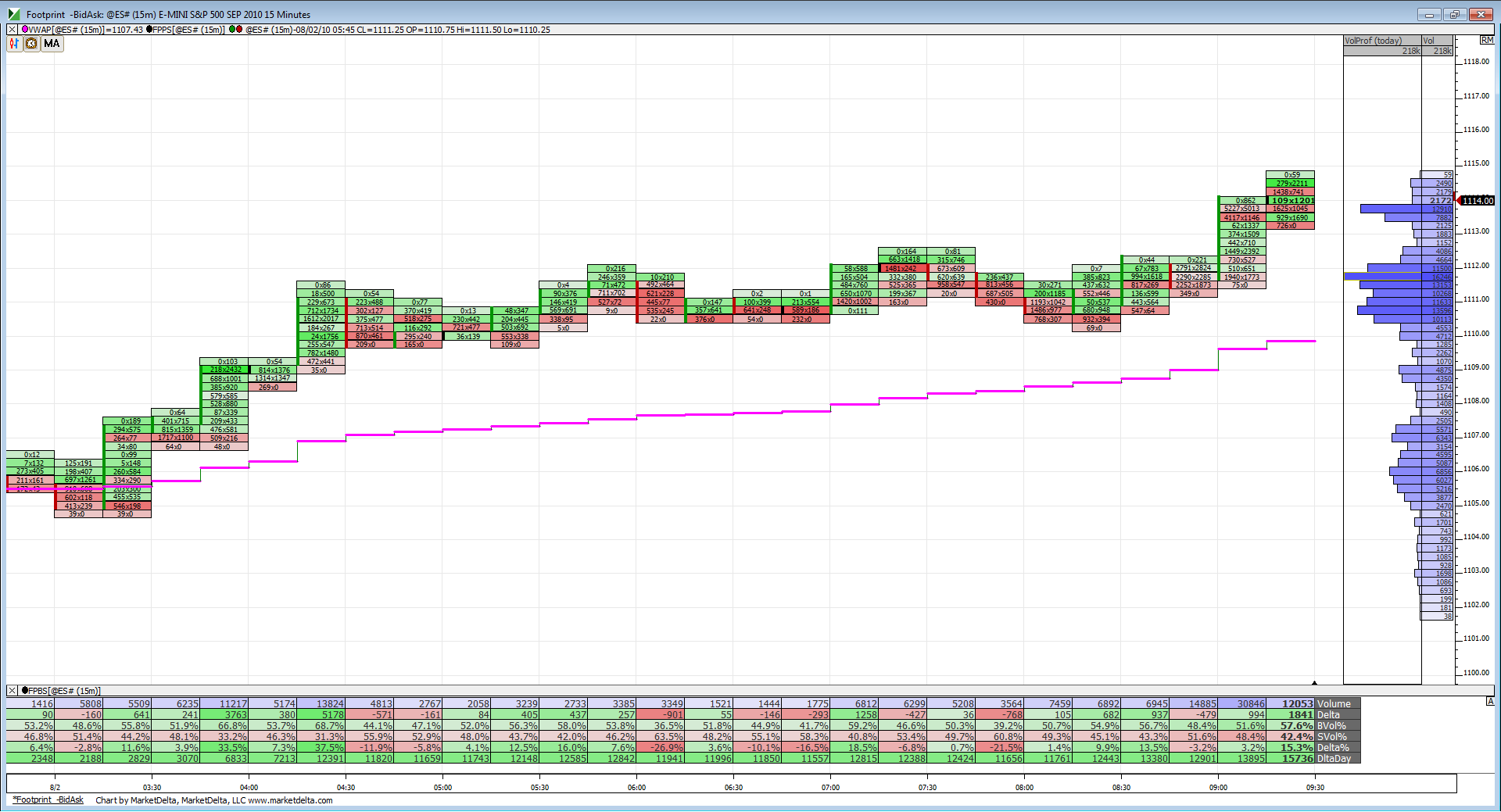

We can see prices breaking away from VWAP early in the morning and as Bruce pointed out volume is building in this upper range.

I may be early but on the 15 print short..I feel I will be able to trade out with the 15 - 18 zone up here

first low volume area is now 12.75...so that is first target and not much ammo for other targets if we just sell off in ON

Originally posted by BruceM.. Good question, Bruce!.. i mostly use the 5 min and one min charts for trading with only an occasional glance at the 30 min for perspective... In my work, with fib extentions, most charts are going to give the same levels , its just the smaller charts sometimes give a shorter timeframe move, because of a little pullback (therefore a smaller initial move)that may not be evident on the larger charts... As ive traded with you for over 2 years, i know your trading style well! I would suggest the 5 min and 13 (or 15) min for trades you most go after... As far as the 120 min i used, that was just to eliminate any small pullbacks, or 'noise' if you will. Hope this helps clarify it a little bit.

Hey Kool...how do u determine which time frame to use ? I see some use the one minute, the 5 minute...the key 15 minute, the 30 minute and you just posted the 120 minute....

The question is really this : How do we decide what time frame to use so we don't have too many levels to look at ? What should MOST use who want to try and hold for longer term moves ? My eternal quest..! !

longs would like that HV zone to hold and get new highs...us shorts want to bust it and try for 1108....

so the zones I'm watching are the 08 - 10 and that 15.50 - 18.....don't like buys....so still prefer shorts at higher end of range.....that's why the 15 shorts were placed...I missed adding on the 15.50 print

$ticks not showing any extremes on buying...only a plus 650 so far...not much for a big gap up

$ticks not showing any extremes on buying...only a plus 650 so far...not much for a big gap up

VWAP is holding for now.

Originally posted by BruceM

so the zones I'm watching are the 08 - 10 and that 15.50 - 18.....don't like buys....so still prefer shorts at higher end of range.....that's why the 15 shorts were placed...I missed adding on the 15.50 print

$ticks not showing any extremes on buying...only a plus 650 so far...not much for a big gap up

you freakin asshole.. if you follow my work at all i explain it as i go.. i basically call turns all day long ..in advance not after the fact! and have for 2 years. The gross misinterpetation of my work is areflection of your jealousy and /or ignorance. Its because of idiot replies like this that im thru with mypivots!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.