slate pile 6941

warning.. there is no holy grail... all trade setups have failures..

'' before you add a setup to your trading, know that setup so well that you will be willing to risk your family's financial well being on that setup alone to the exclusion of all others..short of that... don't trade it'' joed

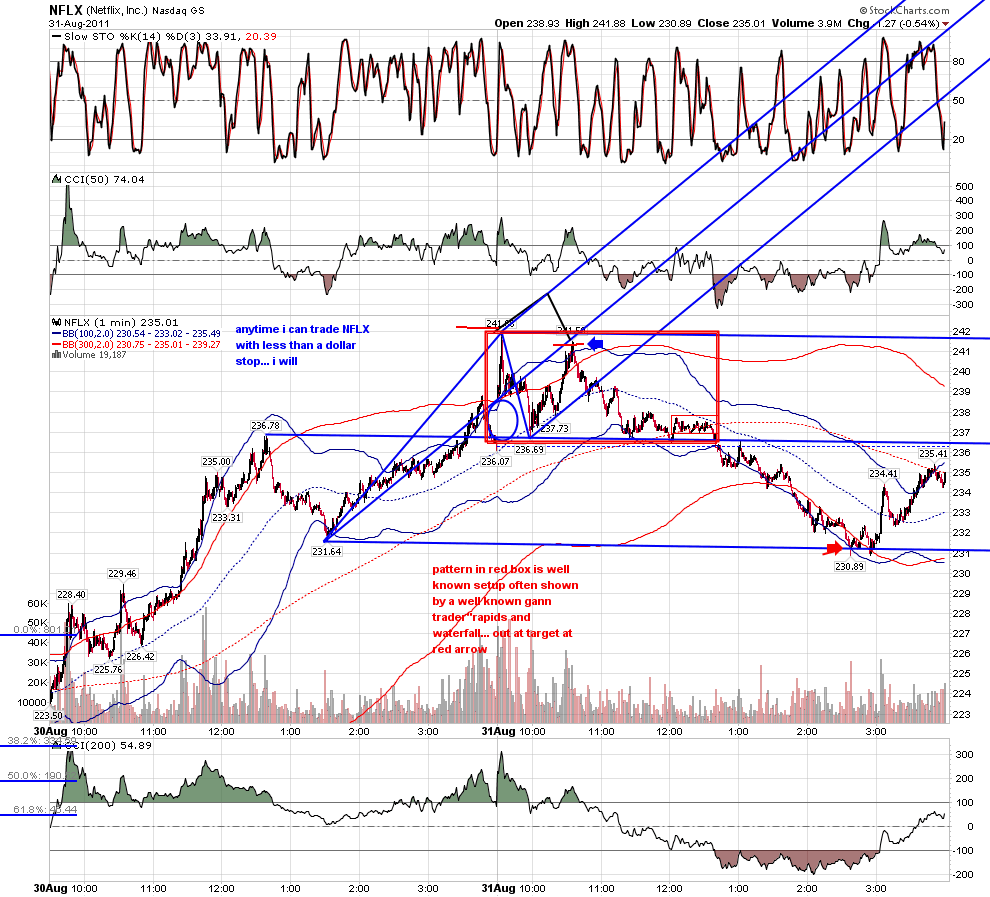

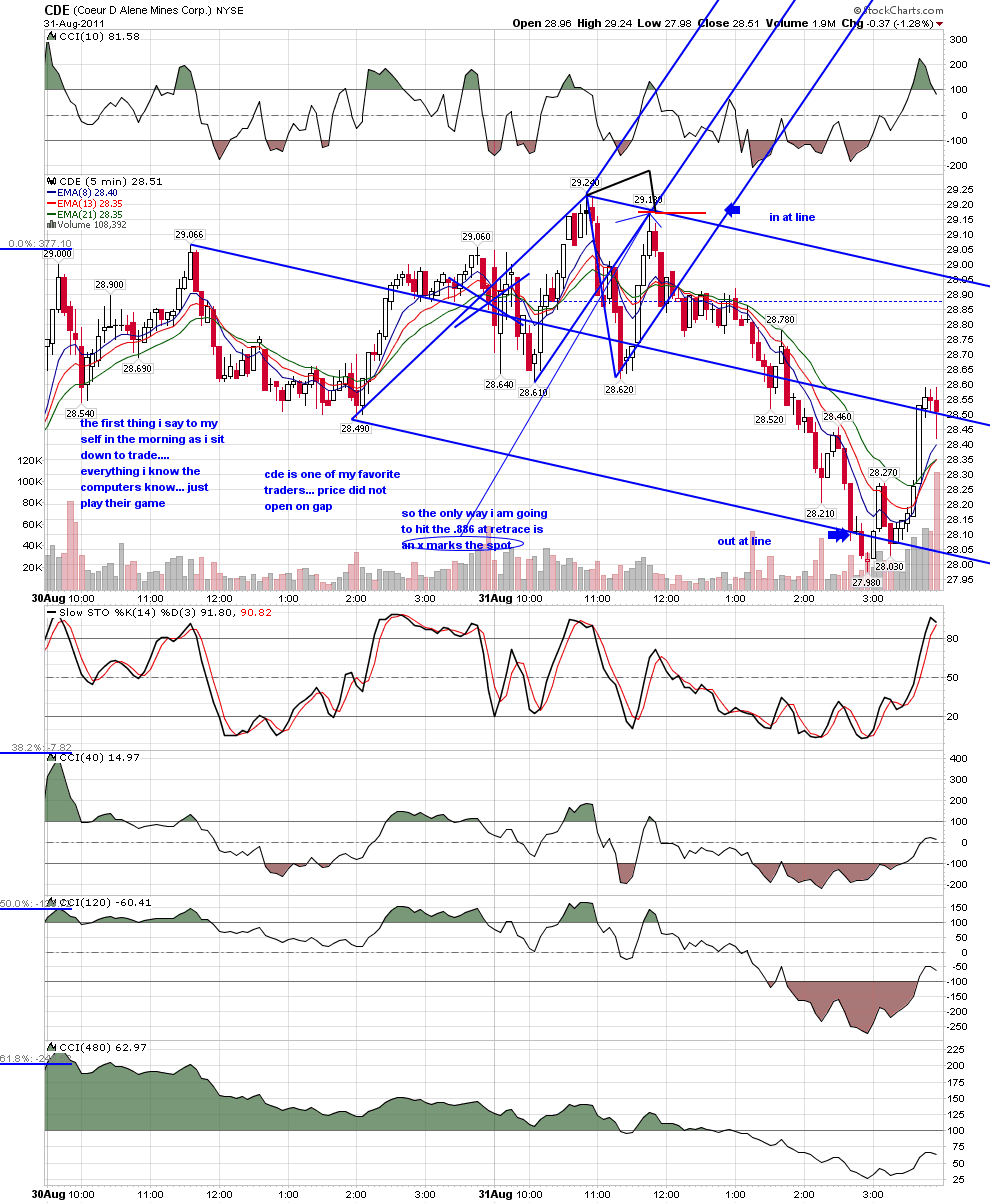

trading this setup requires 4 things .. a mastery of medianlines, a mastery of fib, a setup that allows you to do a constant scan of a set group of traders...then collecting at least 1000 examples of the setup you have found on your own...thus making it your own.

the setup is the [email protected] have been showing it relentlessly at the kane forum for the last 4.5 years.

'' before you add a setup to your trading, know that setup so well that you will be willing to risk your family's financial well being on that setup alone to the exclusion of all others..short of that... don't trade it'' joed

trading this setup requires 4 things .. a mastery of medianlines, a mastery of fib, a setup that allows you to do a constant scan of a set group of traders...then collecting at least 1000 examples of the setup you have found on your own...thus making it your own.

the setup is the [email protected] have been showing it relentlessly at the kane forum for the last 4.5 years.

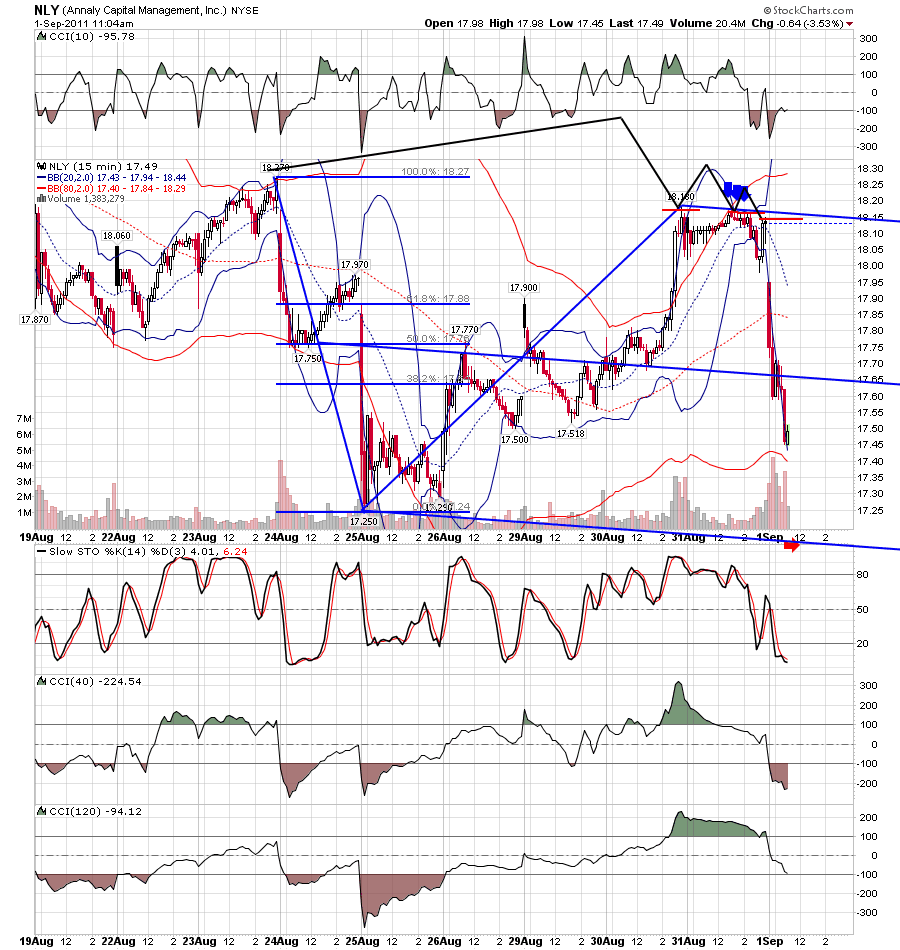

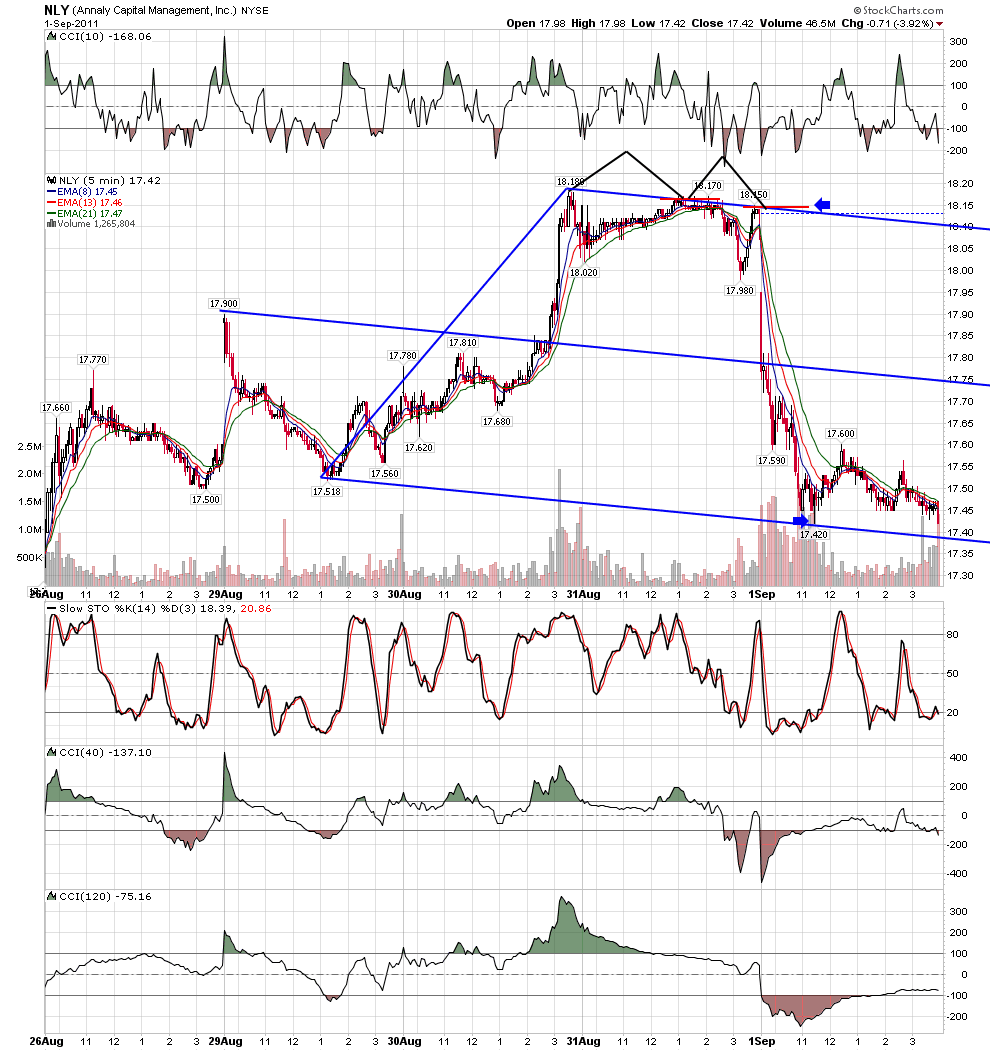

it is important to remember that in and by itself the .886 is powerful. back to back to back .886's at the geometry signaled the computers meant to do NLY harm..

Hey roofer......nice charts.....

NLY is a long term holding of mine so I'm not to pleased today with the 4% drop.......yuk!

Hey do you think this green channel is valid for the S&P.

Thx

NLY is a long term holding of mine so I'm not to pleased today with the 4% drop.......yuk!

Hey do you think this green channel is valid for the S&P.

Thx

i am here to do my final public post in my lifetime, with eventually hundreds of examples and details,of what i do...that is all.

do you ever wonder why your life took the EXACT path it did?i know there is no way.. ABSOLUTELY NO WAY... i would have ever figured out what the computers were doing if certain events had not happened in a specific sequence...

i do not not remember how i stumbled upon the medianline work of the trader tim morge back in 2001-2 when he was trading from home in chicago.during that time he was doing a 6-8 page summary 3-4 times a week explaining the details of his use of his tools the previous day...traders from that time were stunned into silence by the clarity and clarity of purpose of those writings. i believe to this day that if those writings had been edited and put together in book form they would be the definitive book on medianlines. no writings since that time have added anything to the notes i kept back then....in particular , he pounded the table for the importance of gap medianline sets, sets anchored in a specific way in gaps left behind.it gave me a much different view of the possibilities of gaps and freed me up to consider that gaps were being used by skilled traders in many ways not traditionally taught...it led to the thought one morning that perhaps skilled fib traders were measuring fib from the middle of gaps and after a few months of scanning i saw that to be true and have shown it as ''gapfib'' since 2003... end part

i do not not remember how i stumbled upon the medianline work of the trader tim morge back in 2001-2 when he was trading from home in chicago.during that time he was doing a 6-8 page summary 3-4 times a week explaining the details of his use of his tools the previous day...traders from that time were stunned into silence by the clarity and clarity of purpose of those writings. i believe to this day that if those writings had been edited and put together in book form they would be the definitive book on medianlines. no writings since that time have added anything to the notes i kept back then....in particular , he pounded the table for the importance of gap medianline sets, sets anchored in a specific way in gaps left behind.it gave me a much different view of the possibilities of gaps and freed me up to consider that gaps were being used by skilled traders in many ways not traditionally taught...it led to the thought one morning that perhaps skilled fib traders were measuring fib from the middle of gaps and after a few months of scanning i saw that to be true and have shown it as ''gapfib'' since 2003... end part

But what do you think about the ES chart?

And I think we all have exactly the life we want....if we wanted something else we would change it right?

And I think we all have exactly the life we want....if we wanted something else we would change it right?

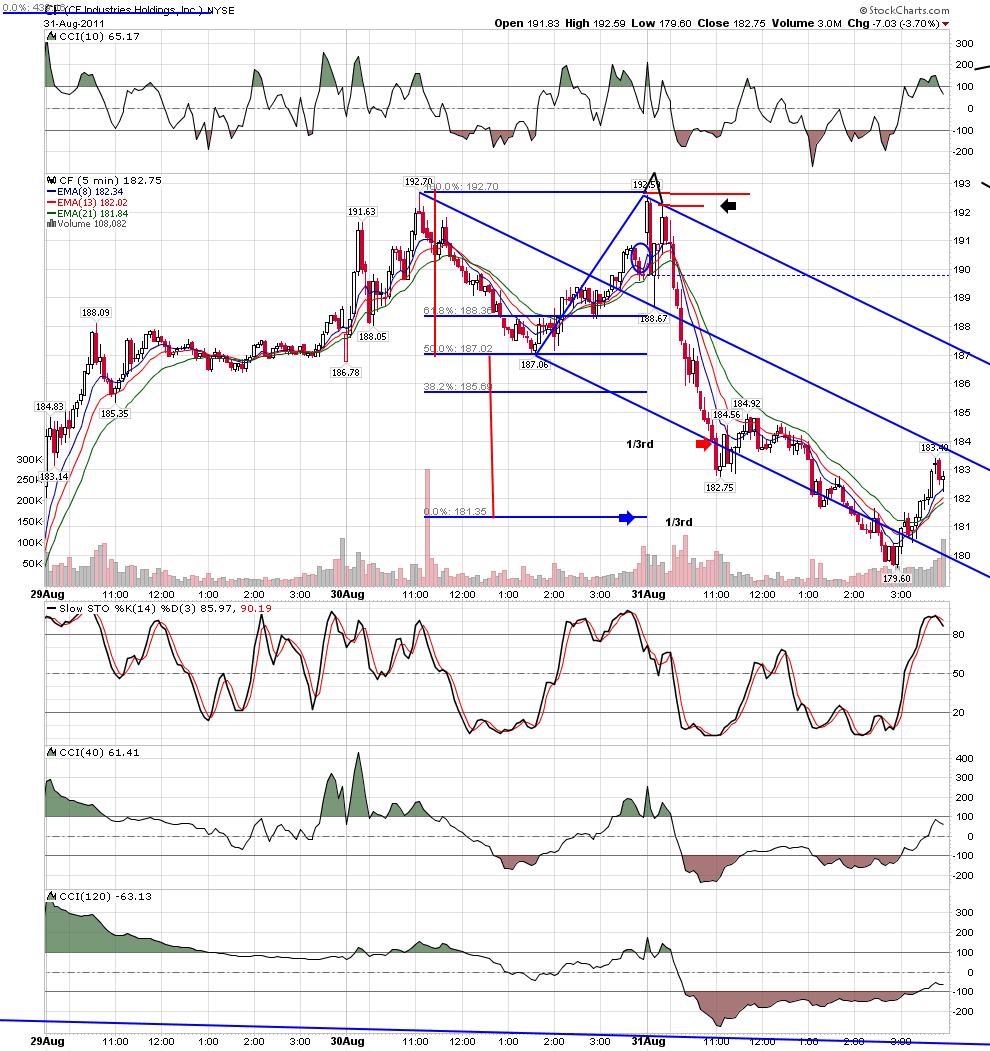

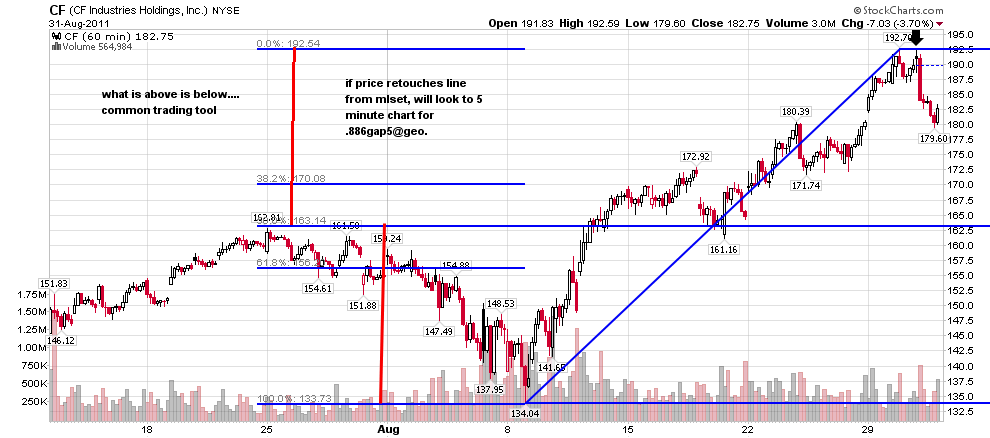

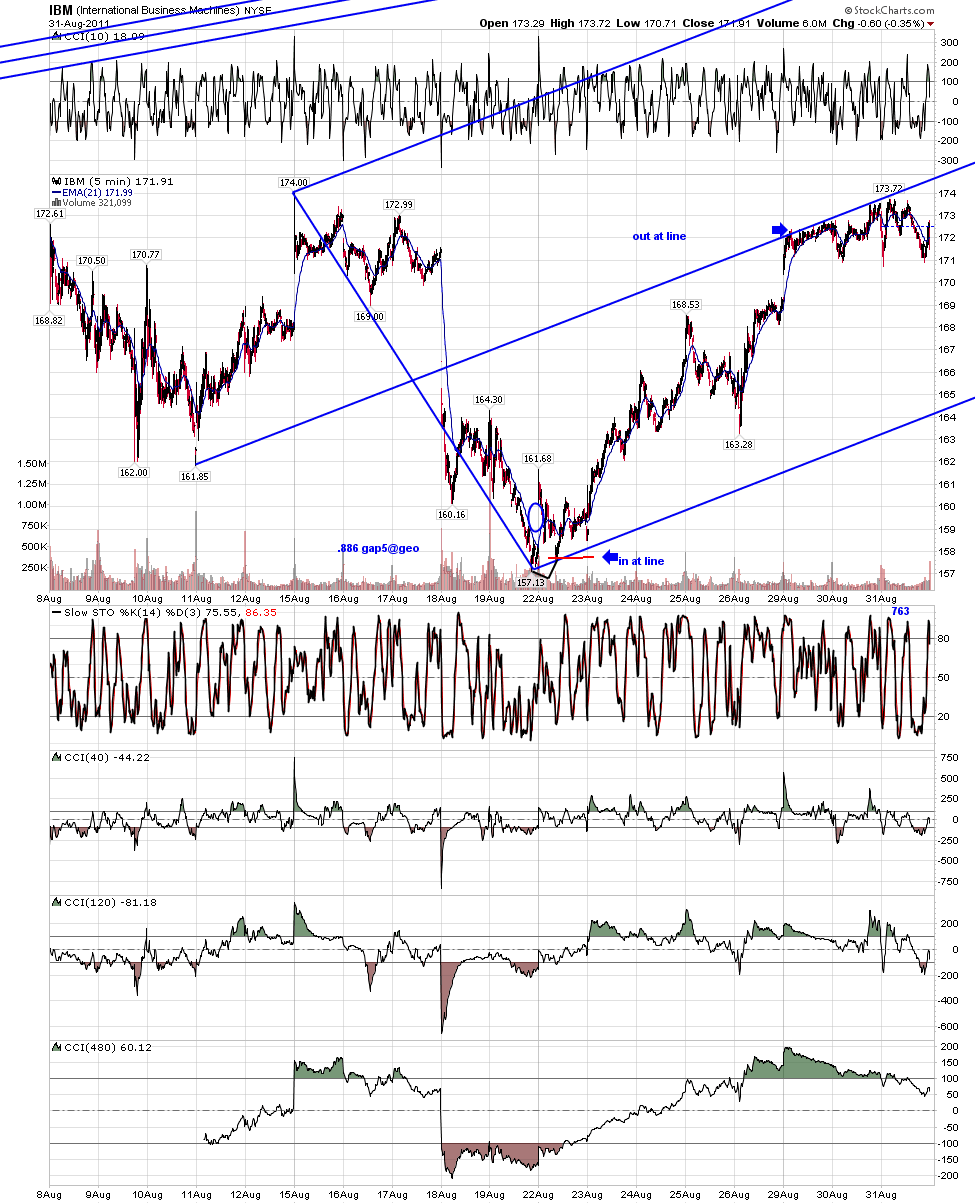

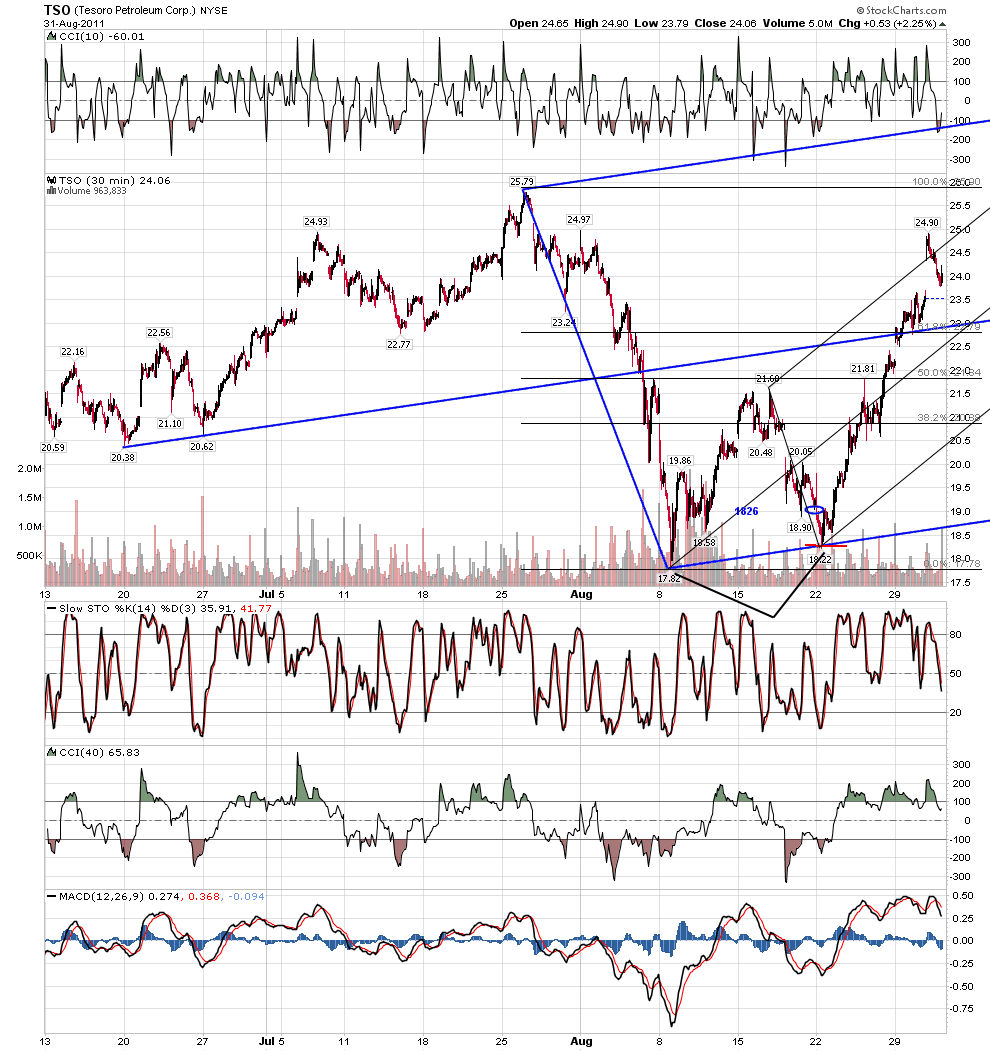

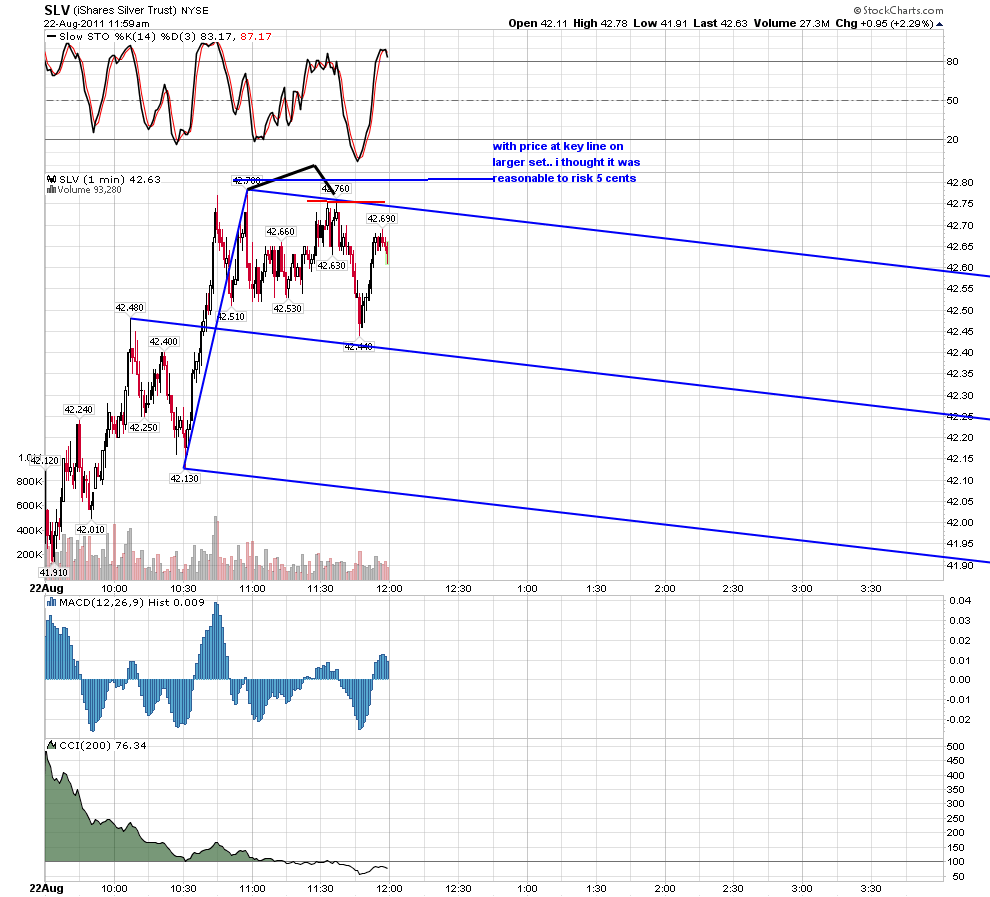

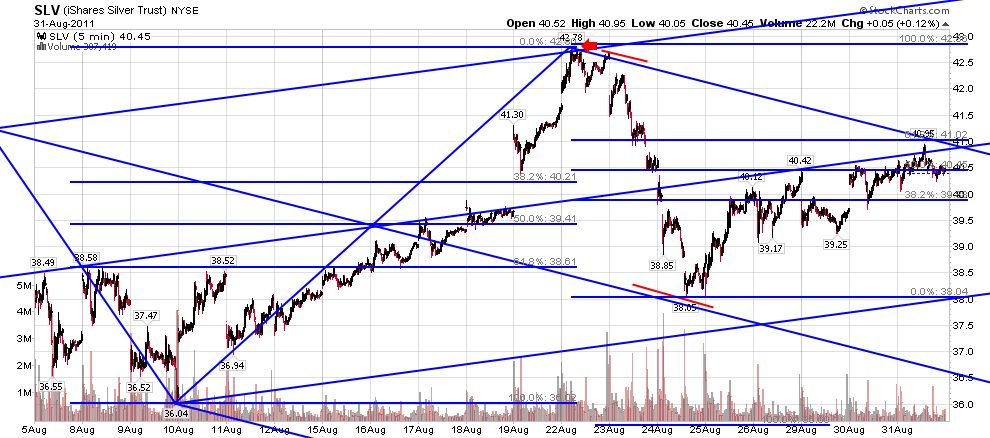

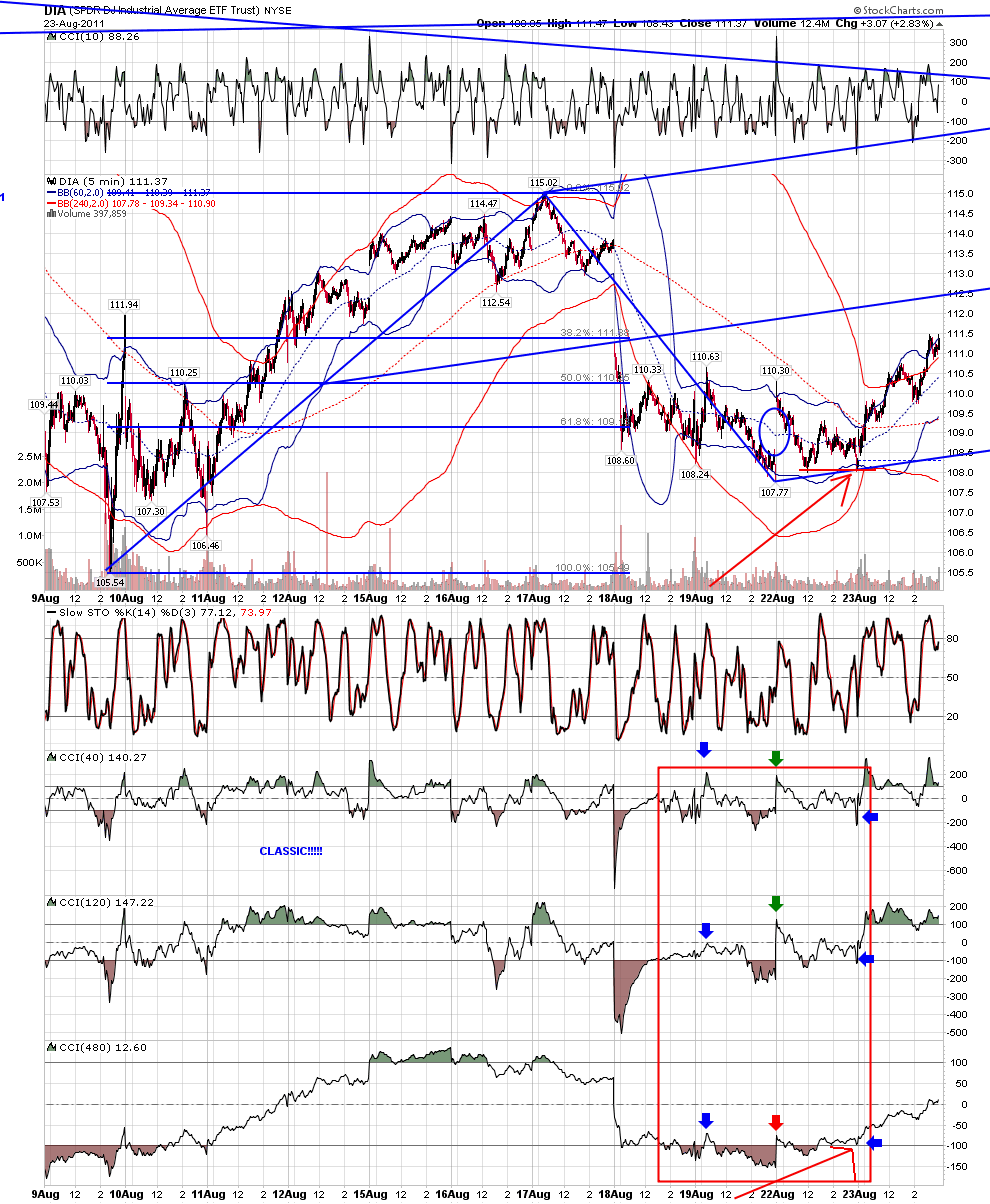

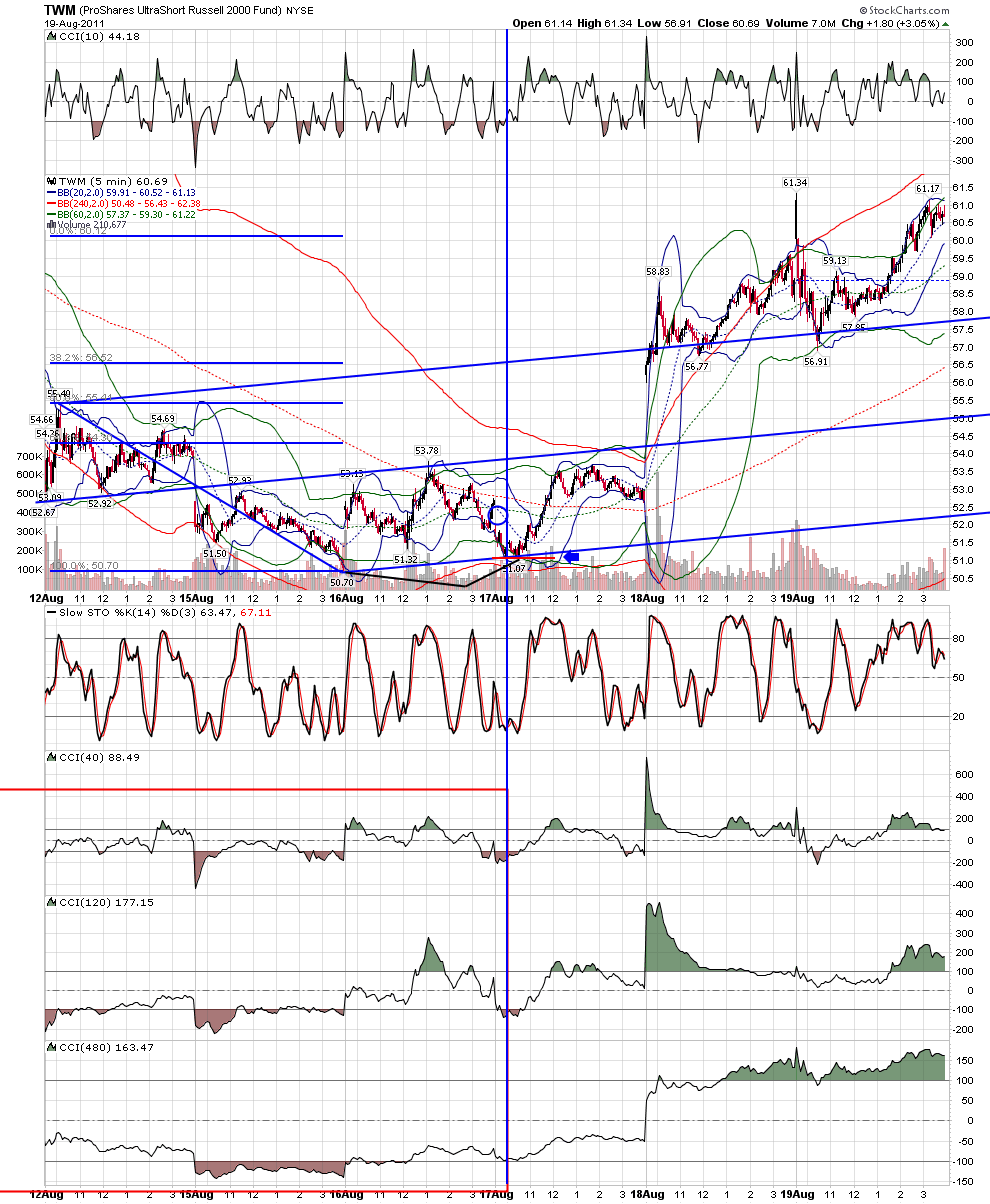

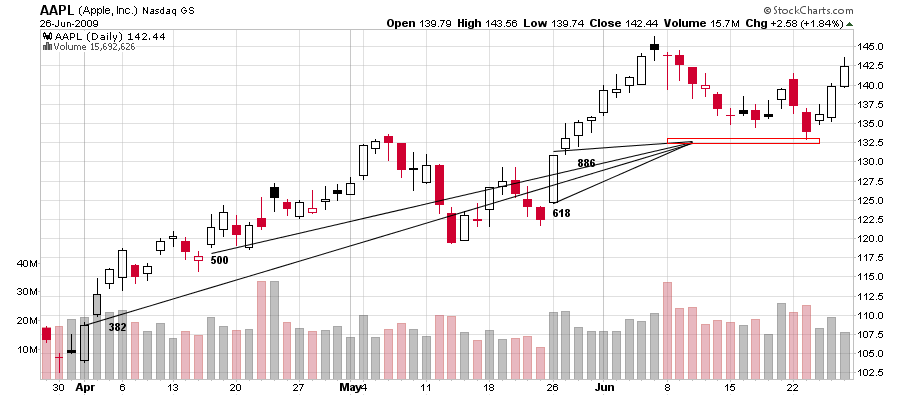

this should suffice for gap fib....the computers and skilled traders do not forget gaps left behind and look to trade fib confluences based on measuring from the middle of those gaps...

Hi Roofer, I posted the following Q at Pugs, apologies, you were right, should have posted here instead:

"Hello Slater, thanks for showing your work and I hope you recover well and quickly. I have been looking at your chart examples and I have a couple of questions, if you don't mind: how much margin of error do you give the .886 retrace? To see if I have understood the setup correctly, it looks to me that GDX just presented a set up when it touched the .886 retrace after a gap up, move down and now retrace. However by my calculations the .886 number is 63.425 and so far GDX has hit 63.57. Do you simply short at this number (with sell limit) and then place your stop above the previous high?

Was I correct in noting the set up in GDX?

Thank you. I have lots more questions but I think I’ll keep it simple for now."

Note: With today's action in GDX it looks like the trading setup has failed, IF it was a valid one to begin with according to your rules. HOwever I would still like to know what your margin of error is for the .886 retrace (for stops), do you just place above the highs or do you have a much tighter stop? This is for sizing my positions.

THanks again for showing your work.

"Hello Slater, thanks for showing your work and I hope you recover well and quickly. I have been looking at your chart examples and I have a couple of questions, if you don't mind: how much margin of error do you give the .886 retrace? To see if I have understood the setup correctly, it looks to me that GDX just presented a set up when it touched the .886 retrace after a gap up, move down and now retrace. However by my calculations the .886 number is 63.425 and so far GDX has hit 63.57. Do you simply short at this number (with sell limit) and then place your stop above the previous high?

Was I correct in noting the set up in GDX?

Thank you. I have lots more questions but I think I’ll keep it simple for now."

Note: With today's action in GDX it looks like the trading setup has failed, IF it was a valid one to begin with according to your rules. HOwever I would still like to know what your margin of error is for the .886 retrace (for stops), do you just place above the highs or do you have a much tighter stop? This is for sizing my positions.

THanks again for showing your work.

W-the trade was not present. if price gaps on the open it must hold that gap for the first 5 minute bar so that the first 5 minute bar of the day does not overlap last bar of previous day.... the genius of what the computers are doing is using a gap on time frame that most traders do not consider important to set up trade.on the day you mentioned, the gap did not hold... i am going to show many examples...

Hi all!

I can't get this thread to scroll down properly??

Hmm...

What was that near 50% retrace again? Was it 48.1%

Can a moderator fix this thread, or am I doing it wrong?

peace

r247

I can't get this thread to scroll down properly??

Hmm...

What was that near 50% retrace again? Was it 48.1%

Can a moderator fix this thread, or am I doing it wrong?

peace

r247

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.