ES Monday 10-6-14

Gonna kick off with this video and will add a second one to this post in a minute

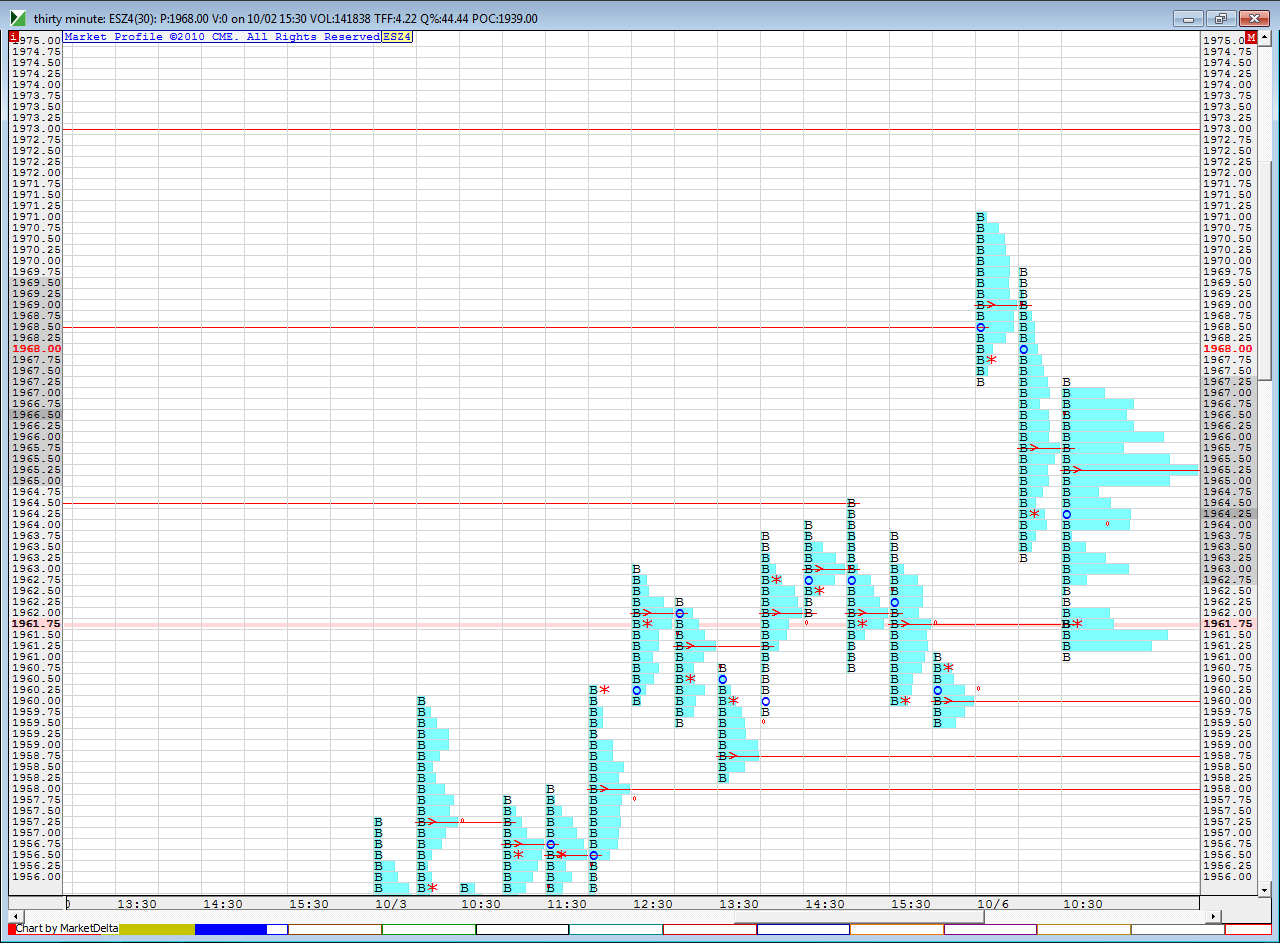

here is more ramble and I also forgot to mention that fridays gap and go rally was on lower volume than the previous day...u can see that on my SPX chart that I posted on the first video....so I am building my case for the short fades in early trade today

here is more ramble and I also forgot to mention that fridays gap and go rally was on lower volume than the previous day...u can see that on my SPX chart that I posted on the first video....so I am building my case for the short fades in early trade today

Originally posted by BruceM

revising next target to 65.50...just slightly above O/N midpoint....

Nice, you're done for today.

Gapclosed, and I'm trying to hold for that prominent POC at1960.00.

not yet , I'd really like that 62 but am now bothered by the single prints they are leaving behind on the 30 minute breakdown....those fill in a lot....the question is when will they fill them in ? they only stay unfilled about 7% of the time.....ideal would let them print down into my 62 and your 60 number and then go back for them...

Originally posted by Aladdin

Originally posted by BruceM

revising next target to 65.50...just slightly above O/N midpoint....

Nice, you're done for today.

Seems to me like just a gapclose.

Out at 1964.25

That is it for me for today.

Thanks Bruce for your videos.

Out at 1964.25

That is it for me for today.

Thanks Bruce for your videos.

no problem aladin and thanks for keeping the threads started......and please start us up any day......

Originally posted by Aladdin

Seems to me like just a gapclose.

Out at 1964.25

That is it for me for today.

Thanks Bruce for your videos.

we have a matching low at the IB low.....that also is not the greatest way to put in a low....LOL...lots of conflicts for me to hold this last runner and here they are trying to fill in the 30 minute low...........think of how crazy , stupid and difficult things can get....I was only 1.25 pts away from target and now price has moved up 4 points from that low....so the risk to reward gets so far out of whack sometimes with all the noise in the ES.....I think it is a very difficult market to trade unless you can peel off contracts along the way...

the only good thing now is that the test of the 30 minute low seems to have held...we certainly don't want to see a 30 minute close back above there again....value is building higher on the day even if we have an open and drive down.....I trust none of it !!

the only good thing now is that the test of the 30 minute low seems to have held...we certainly don't want to see a 30 minute close back above there again....value is building higher on the day even if we have an open and drive down.....I trust none of it !!

still one time framing down....funny how we justify holding a position sometimes....but sure wish they could get back under fridays highs and value area high

that's me flat at 61.75 ...good luck if you play from here...they are right on time again....It's almost 90 minutes of trade up...the best window to trade in for a fader IMHO

here is how my 30 minute chart looks against part of friday......u can see that volume is building today at the 65 - 65.50 area...something to keep in mind as we go forward if you are trading and they come back to that later

and good odds they will come back up to test the IB low....so if you really feel like trading ( which I don't ) then I would try from the 60 and also try down at 57.75 - 58.75 ( the better spot) to get back to IB low...if you take the 57.75 - 58.75 then I'd use 61 as a first target just in case.....

and another way to look at it is this...today we are one time framing down and all areas that were once single prints have been filled in...except we haven't tested officially the 120 minute low which was right near the 90 minute low

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.