ES Friday 11-7-14

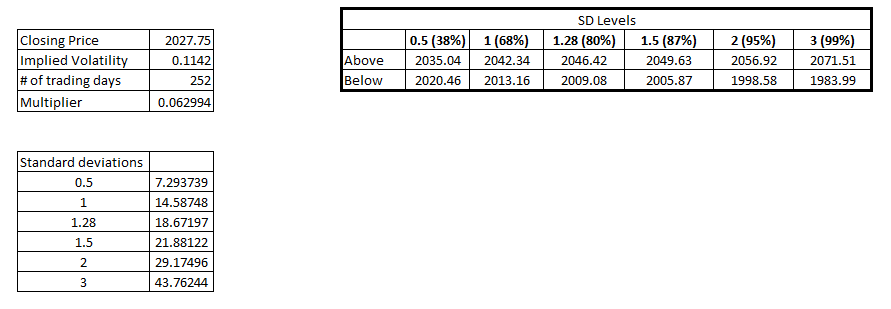

i was trying to use the 4:15 close. Maybe I should be using the 4 pm close instead? Regardless, my close was off

If I use the 4 pm close number that you provided, I get the same as Bruce..

Also I have 2026.25 as my 4pm close...

All good enough to get us some approx bands

If I use the 4 pm close number that you provided, I get the same as Bruce..

Also I have 2026.25 as my 4pm close...

All good enough to get us some approx bands

It gets confusing with these closes. Pivots can be based off 415 close or 4pm close as well. I believe Bruce uses 415 close for Pivots but that could have changed or I could be wrong with that...so do we need to be consistent in all of this...not sure what is best

I don't think there usually is much of a difference between a 4pm and 415pm close but you are right, we should be consistent regardless of what we pick.

I say we use the 4pm close as I think that is the more "official" close.

Use it for all calculations? (pivots, volatility, etc?)

Maybe you or Bruce have some experience that says use one over another?

I say we use the 4pm close as I think that is the more "official" close.

Use it for all calculations? (pivots, volatility, etc?)

Maybe you or Bruce have some experience that says use one over another?

Or anyone else reading this for that matter. Thoughts?

my understanding is the algo's use 4pm as close but that is just what I read. We want to be on the right side of that. Usually you are right there is not much of a difference and we are just trying to find areas and have it confirmed by price action anyway. Bruce can probably tell us more...

4:00 close represents the conclusion of equity money managers day in the market. They are the people that really control the longer trends in the market.

Thanks Paul. I have always been curious, what happens between 4 and 4:15? They call it settlement but I am not very clear on what that means. Can you shed some light on it?

http://www.cmegroup.com/market-data/files/cme-group-settlement-procedures.pdf

Settlement prices are manufactured. as explained in the pdf cited above.

if you are taking your close for the day from a daily price bar on your charting software, then you are probably getting the CME settlement price for the close of the bar.

most of the time the settelement does not vasry greatly from the last trade of the RTH, but at the end of a calendar month the variance can be multiple points 4, 5, 6 pts difference from last trade of RTH vs CME generated settlement. I know Dalton-ites have some hocus pocus about using the settlement price in stead of last trade) to determine overnight inventory, but I can tell I don't even look at settlement.

you can run an intraday chart comprised of a single 405 minute bar and the close of that bar will be the last trade of the day for the ES

you can just look at a 5minute bar chart and take the price for the bar concluding at 4:00pm to get the equivalent of the 4:00 PM CA$H close.

I did studies years ago on gap fills and I can tell you (although I cannot remember the exact figures and I have lost them long ago (somewhere in one of my computers but I am not looking for them) the gap players will trade off the last trade NOT the settlement (more often than not)... if looking for a a gap fill, conservative would be the closer of the 4:15 last trade price or the 4:00 C

Settlement prices are manufactured. as explained in the pdf cited above.

if you are taking your close for the day from a daily price bar on your charting software, then you are probably getting the CME settlement price for the close of the bar.

most of the time the settelement does not vasry greatly from the last trade of the RTH, but at the end of a calendar month the variance can be multiple points 4, 5, 6 pts difference from last trade of RTH vs CME generated settlement. I know Dalton-ites have some hocus pocus about using the settlement price in stead of last trade) to determine overnight inventory, but I can tell I don't even look at settlement.

you can run an intraday chart comprised of a single 405 minute bar and the close of that bar will be the last trade of the day for the ES

you can just look at a 5minute bar chart and take the price for the bar concluding at 4:00pm to get the equivalent of the 4:00 PM CA$H close.

I did studies years ago on gap fills and I can tell you (although I cannot remember the exact figures and I have lost them long ago (somewhere in one of my computers but I am not looking for them) the gap players will trade off the last trade NOT the settlement (more often than not)... if looking for a a gap fill, conservative would be the closer of the 4:15 last trade price or the 4:00 C

well,,,no question that using the 4:15 close was a better band so far today...perhaps it best to make a band of the bands and treat it like a zone...so for today you would have been watching 2019.25 ( the 4 pm close ) and 20.50 ( the 4:15 close)...that would be the band based on those closes.....I really don't know.....that was also a failed break of the IB low too...I like the 4;15 close for the pivots but in general I like the 4pm close for the bands.......something you'd really have to watch over time.......

in my brief study of the bands that I watch they would still have to print 2019.25 or 33.75 today.......just pointing that out and not taking any trades in RTH

in my brief study of the bands that I watch they would still have to print 2019.25 or 33.75 today.......just pointing that out and not taking any trades in RTH

gonna try a small short off 30.50 for single at 90 minute break out.....trade on both sides of Ib I'm hoping is a plus for this...33.75 is still above to be concerned about

that was only trade for me in RTH today...and LVn at 27.25 is next target but will exit last at 27.50 if it prints...otherwise runners will stop at B. even....hope all habve a great weekend

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.