ES Monday 8-31-15

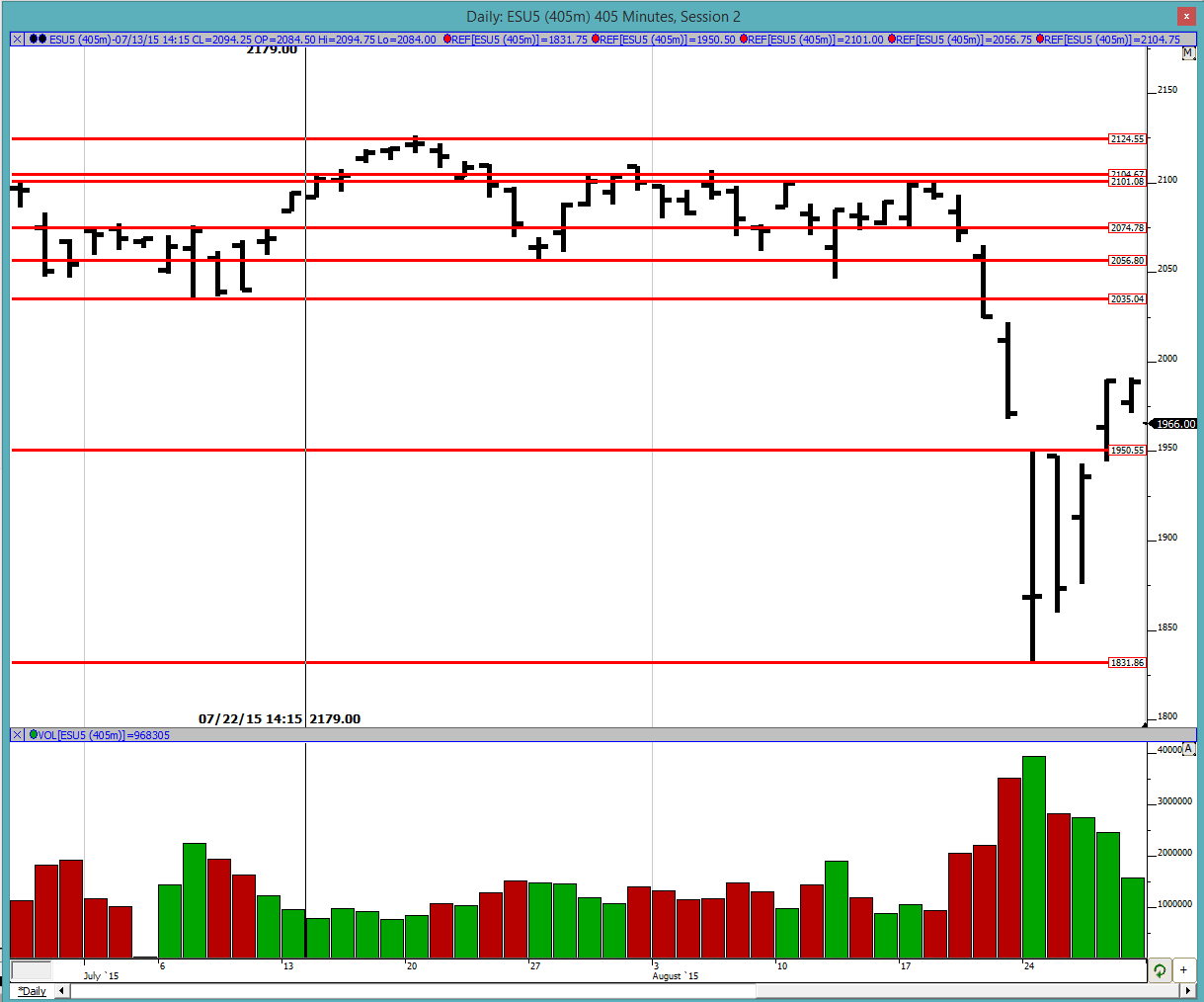

Good evening to all. Friday was a balancing day and it was almost inside Thursday's range. Friday's high is only 3 ticks higher than that of Thursday's. I am continuing to have 1950.5 on my radar as that was the previous balance area high and I think it would be prudent to watch if the market slips back into it or if we continue chewing away at 8/21's range and get into that of 8/20.

Greenies: 1894, 1964.25, 1982.25, 1995, 2014.25, 2053.25, 2077.75

Profile:

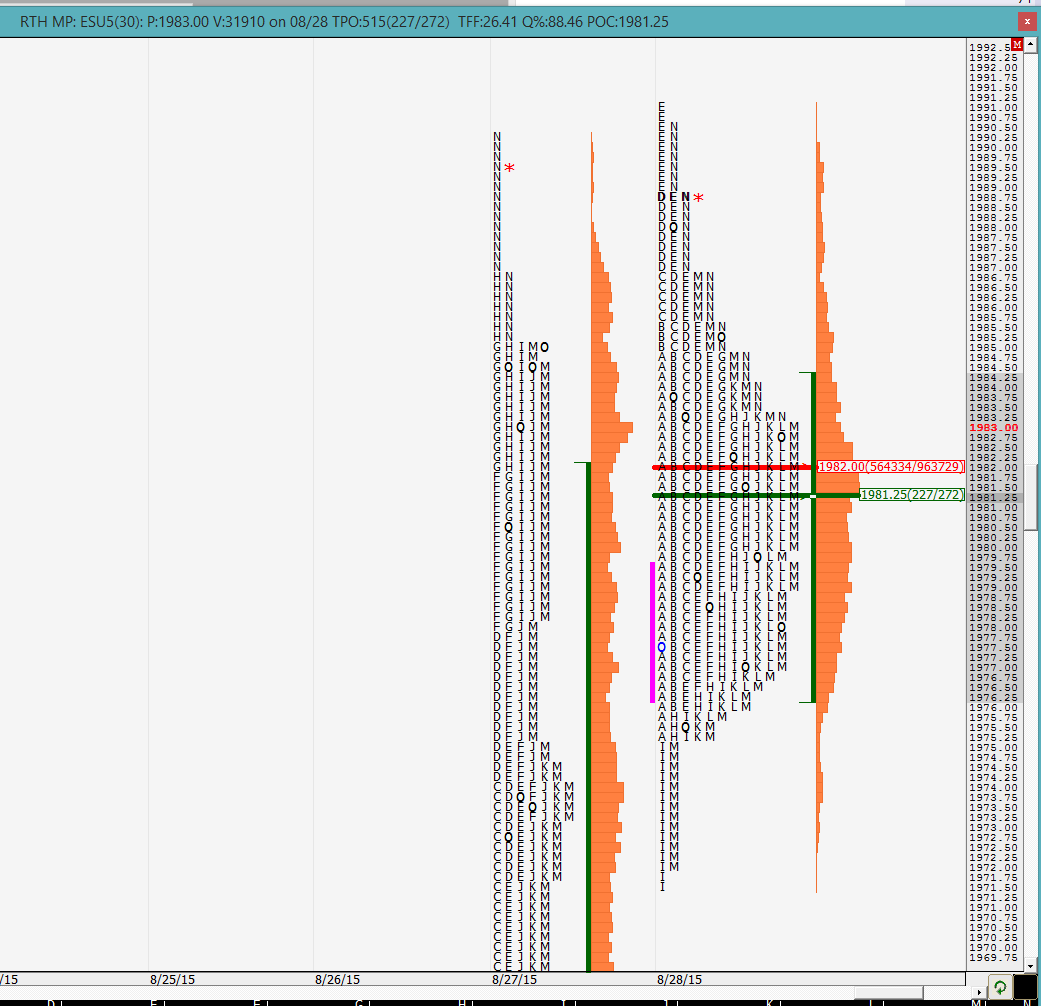

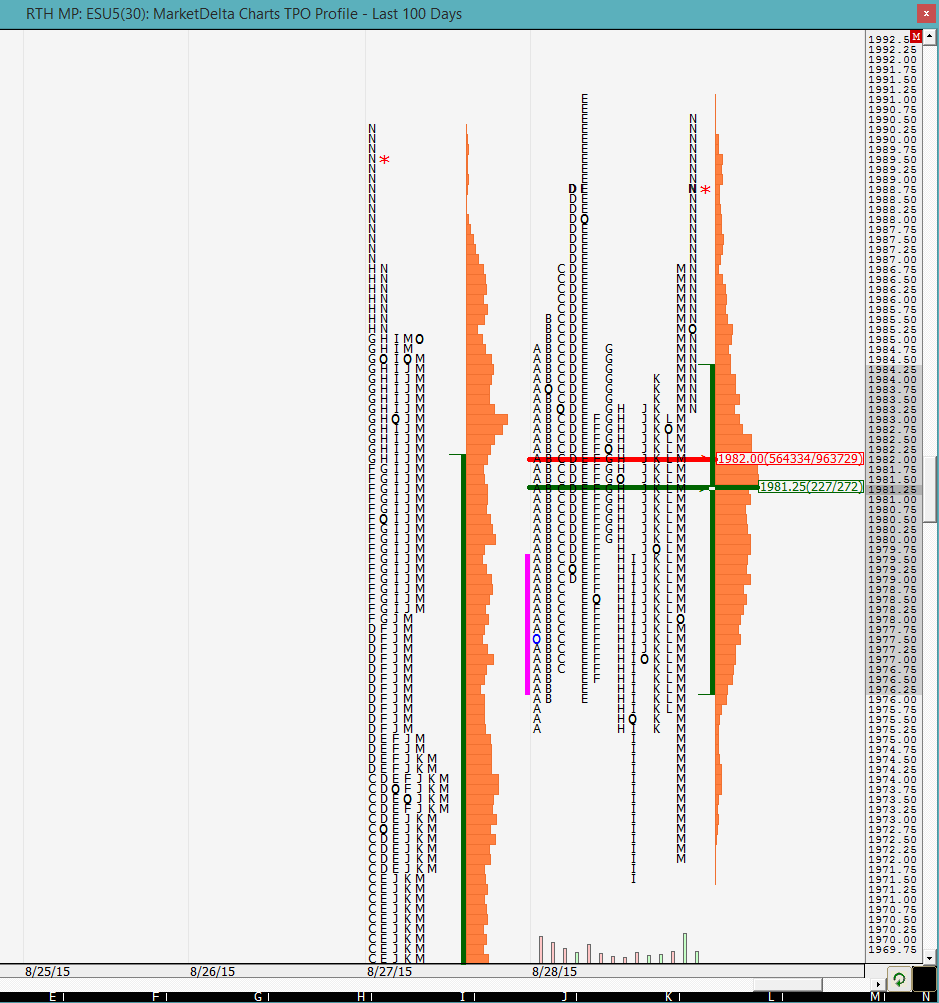

We can see that on Friday we had a very prominent POC (1981.25) and a VPOC that was close by it (1982). As mentioned earlier, Friday was a very balancing day with the prices coming back to 1981/1982 all day long and failing to break away with much conviction from there. We closed at 1988.75, which is a little far away from the VPOC so that is again interesting to me. On Monday we shall see whether we open inside Friday's range and manage to breakout or if we open outside it and try coming back into it. As we know by now, a prominent POC usually gets visited almost always with the question being on the "when". We shall see how the market reacts around this value as it can become strong support/resistance.

The split profile shows how the market tried breaking away in both directions but failed to do so and ended up creating a prominent POC.

One final note that last week's VPOC was at 1982 and the volume based VAL was 1904.5. We shall see how the O/N plays out and come up with a game plan in the morning. As of right now we are outside Friday's range with the gap down. See you in the morning.

Greenies: 1894, 1964.25, 1982.25, 1995, 2014.25, 2053.25, 2077.75

Profile:

We can see that on Friday we had a very prominent POC (1981.25) and a VPOC that was close by it (1982). As mentioned earlier, Friday was a very balancing day with the prices coming back to 1981/1982 all day long and failing to break away with much conviction from there. We closed at 1988.75, which is a little far away from the VPOC so that is again interesting to me. On Monday we shall see whether we open inside Friday's range and manage to breakout or if we open outside it and try coming back into it. As we know by now, a prominent POC usually gets visited almost always with the question being on the "when". We shall see how the market reacts around this value as it can become strong support/resistance.

The split profile shows how the market tried breaking away in both directions but failed to do so and ended up creating a prominent POC.

One final note that last week's VPOC was at 1982 and the volume based VAL was 1904.5. We shall see how the O/N plays out and come up with a game plan in the morning. As of right now we are outside Friday's range with the gap down. See you in the morning.

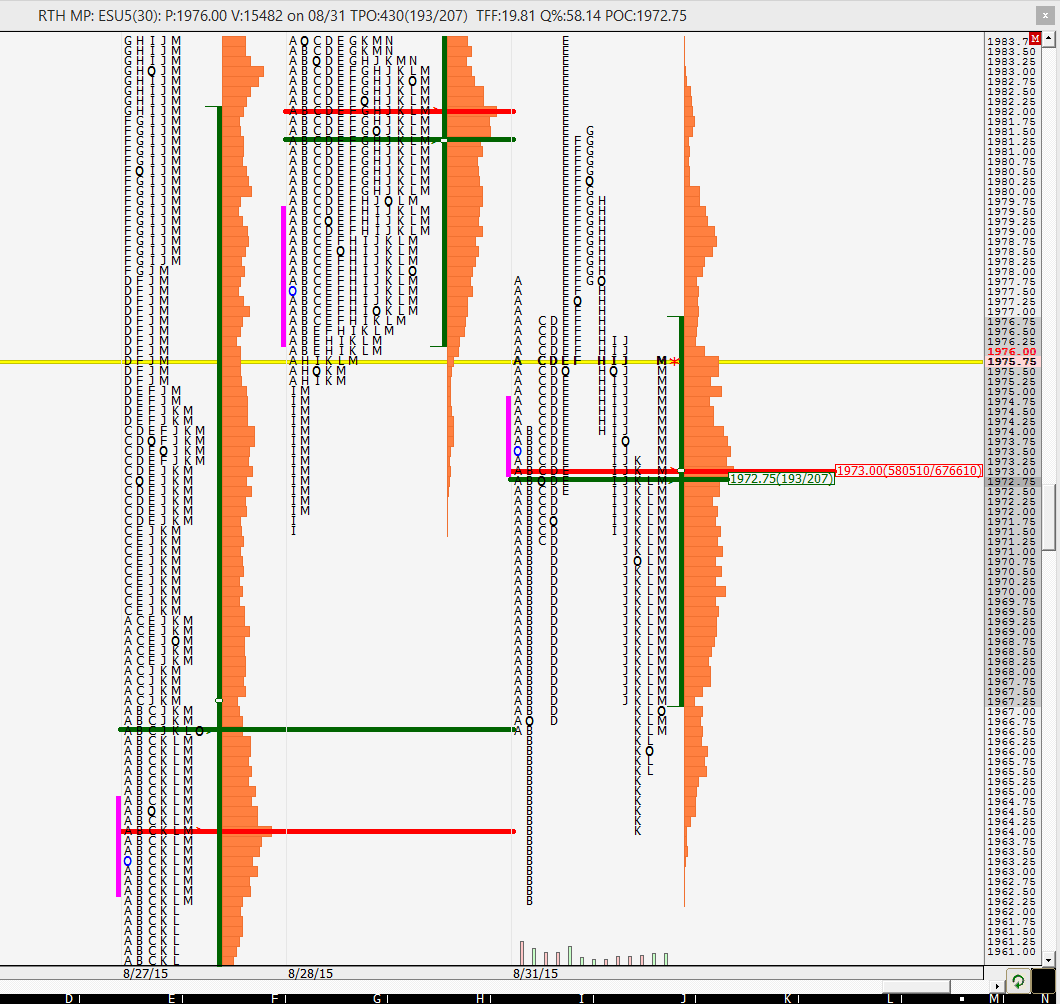

well, that did not take a lot of time to get to 1982 now, did it? :)

Both 1964 and 1982 were great calls !

current VPOC is 1973. we could snap back to it by the end of the day making it another balancing day

ding ding ding!!

astute observation !

Originally posted by jimk

astute observation !

jimk, the reason was that L period low could not take out the K period low, which in turn had not been able to take out the B period low (current low of the day). the sellers were not getting paid and as we are getting close to the end of the RTH session, they were bound to throw in the towel and drive the market back up, which is precisely what ended up happening.

I tried several shorts today >2070 but never took my profits in the 64-66 area. Every time I thought the market was goin lower. Ended up with small profits overall. Have a feeling that this market will have a hard time surpassing 1990-2000. Great calls again today ! Many thx.

see the price action and play it accordingly. try to not have too many convictions of what the market should do. it rarely does what it "should" do! have a good evening

Thank you. The same to you :)

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.